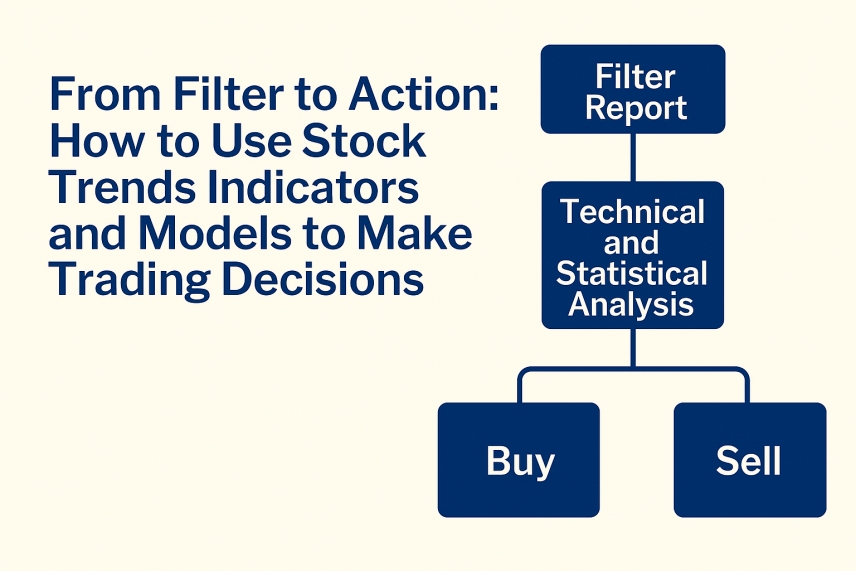

At Stock Trends, our mission is to help investors navigate market cycles by combining our proprietary indicator framework with disciplined interpretation of sector and stock-level signals. In the trading week ended August 8, 2025, our Stock Trends Inference Model (ST-IM) and trend distribution analysis pointed clearly toward two sectors with particularly attractive bullish setups: Consumer Discretionary in the Early Breakout stage, and Healthcare in Established Bullish Trends.

This week’s Stock Trends indicators spotlight a two‑track opportunity: early breakouts in Consumer Discretionary and established bullish trends in Healthcare. Using our trend regime, trend age, RSI outperformance, and volume context—augmented by ST‑IM and our epoch research—we highlight how the framework guided us to Fly‑E Group and MEDIROM on the breakout side, and to OptimizeRx, Adaptive Biotechnologies, ABVC BioPharma, and Eupraxia Pharmaceuticals among enduring leaders.

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!