The Stock Trends Inference Model (ST‑IM) complements the core Stock Trends indicator by examining a security’s Trend Profile—the distribution of past returns of a trend and momentum characteristic relative to its standard deviation—to calculate a probability that the stock will continue to outperform over the next 4-weeks/13-weeks/40-weeks. Stocks with ST‑IM probabilities above 55 % (on the lowest end of the interval) qualify for the ST‑IM Select stocks of the week report. By focusing on names that exhibit both price momentum and statistically favorable return distributions, ST-IM helps investors identify timely rotations that might otherwise be overlooked.

Unlike the broader Top Trending or Bullish Crossovers lists, the ST‑IM Select stocks of the week report is a statistically evaluated inference model report listing only stocks meeting the probability and liquidity thresholds that are specified. Below we highlight a handful of interesting names from both the NYSE and NASDAQ ST‑IM Select stocks reports of August 1, 2025, illustrating how the filter guides investors toward sector rotations.

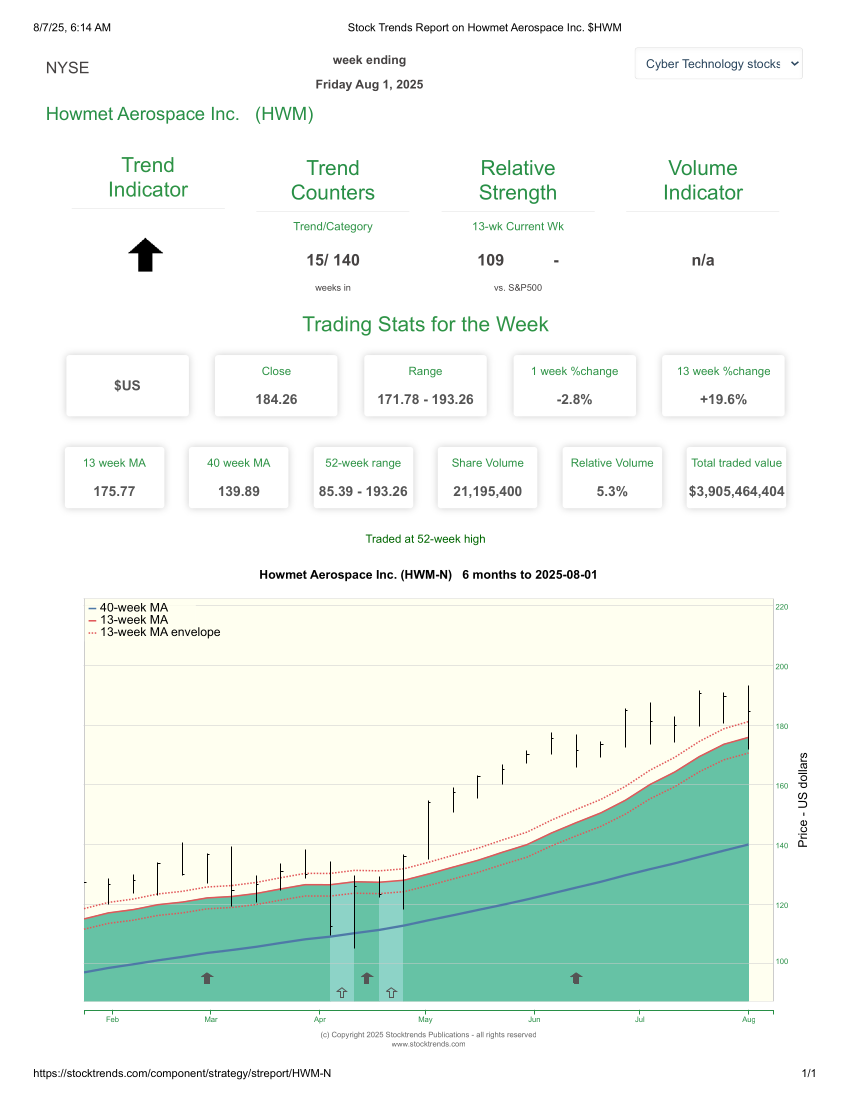

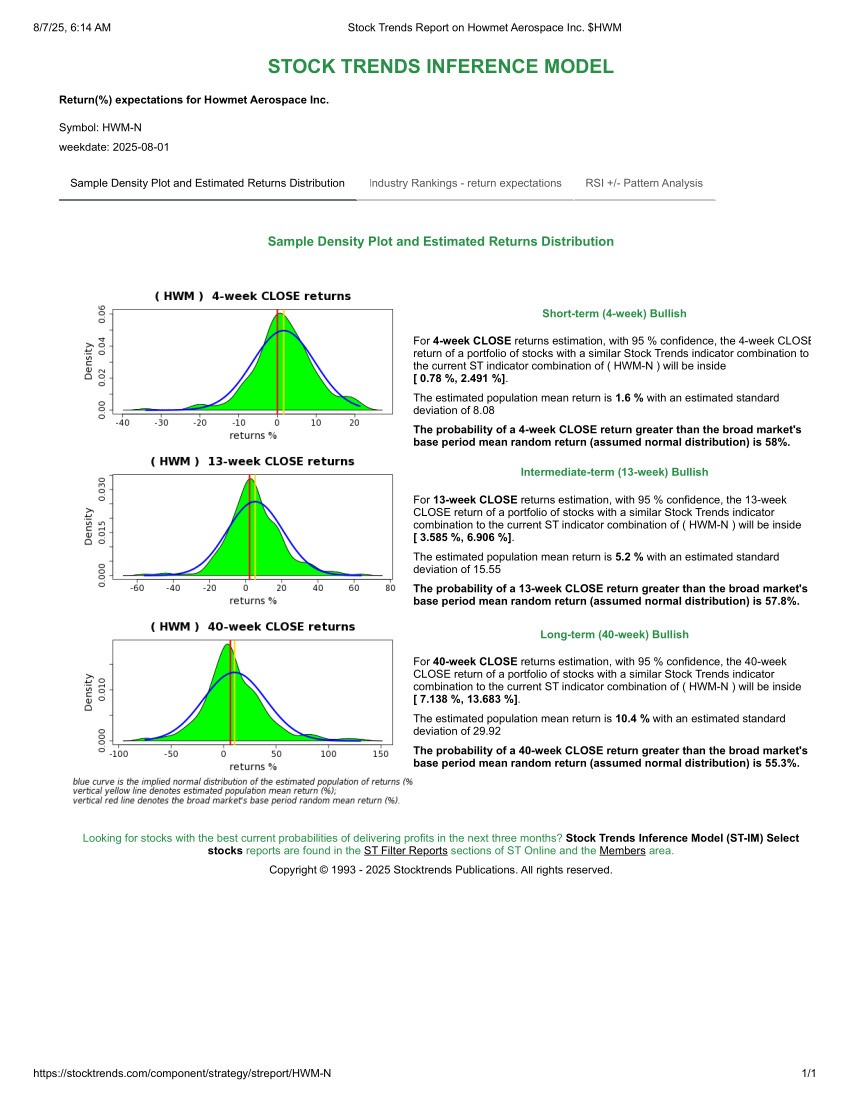

Howmet Aerospace – A strong flight path

Howmet Aerospace (HWM) manufactures advanced jet‑engine components and maintains a strongly Bullish Stock Trends indicator (![]() ) with fifteen weeks in the current indicator. Its relative strength index (RSI) is 109, its 13‑week return is +19.6 %, and its volatility is modest. Fundamentally, Howmet posted US $2.05 billion in second‑quarter revenue and US $407 million in net income, up 53 % year‑over‑year. Adjusted EBITDA margin expanded to 28.7 % and free cash flow reached US $446 million. Management raised guidance and accelerated share repurchases, reinforcing the bullish technical signals.

) with fifteen weeks in the current indicator. Its relative strength index (RSI) is 109, its 13‑week return is +19.6 %, and its volatility is modest. Fundamentally, Howmet posted US $2.05 billion in second‑quarter revenue and US $407 million in net income, up 53 % year‑over‑year. Adjusted EBITDA margin expanded to 28.7 % and free cash flow reached US $446 million. Management raised guidance and accelerated share repurchases, reinforcing the bullish technical signals.

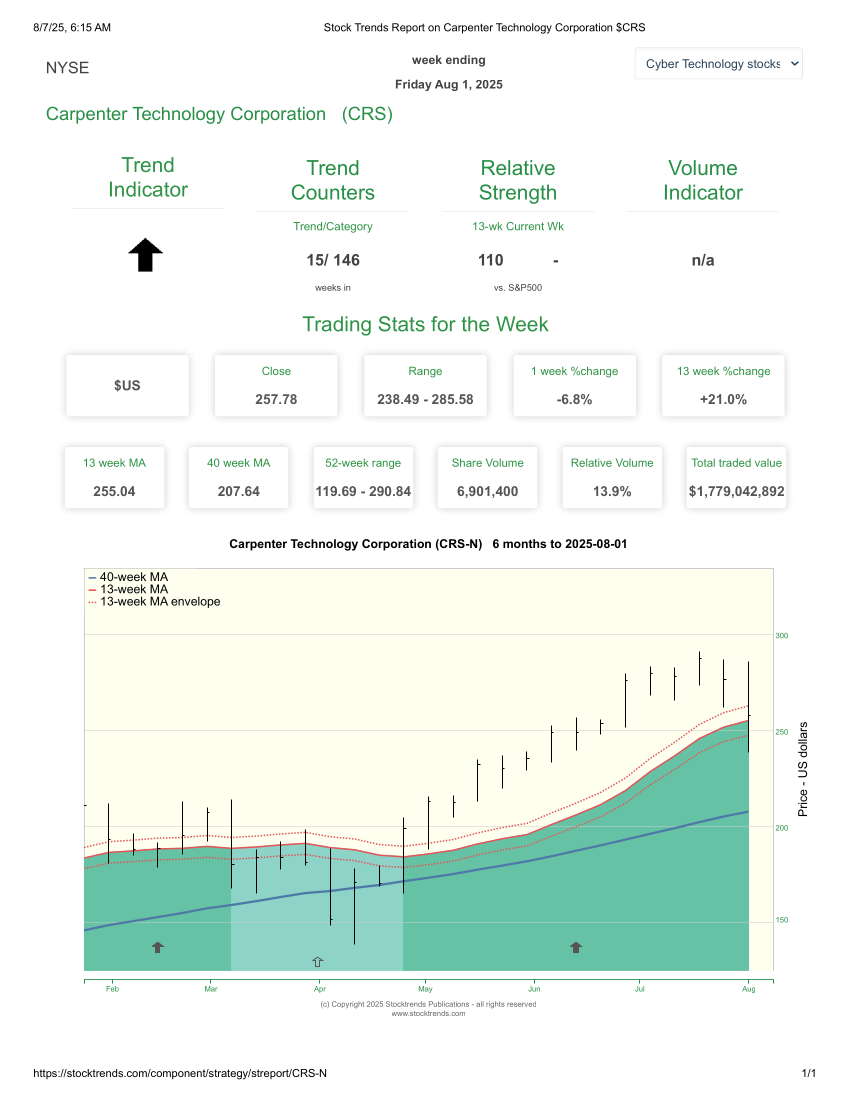

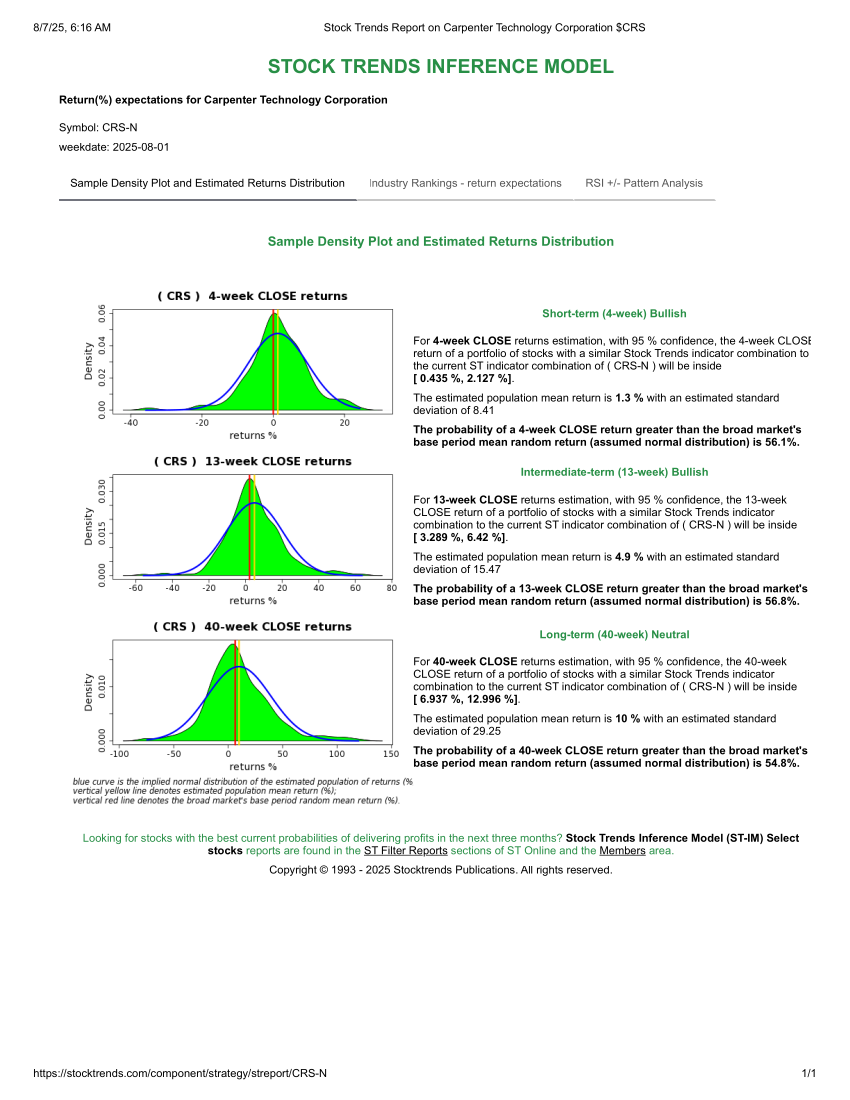

Carpenter Technology – Specialty metals momentum

Carpenter Technology (CRS) shares also carry a strongly Bullish (![]() ) indicator, with fifteen weeks in the current trend. CRS has an RSI of 110 and a 13‑week gain of +21 %. Volatility is low, contributing to a high ST‑IM score. The specialty alloys maker reported record operating income of US $118.9 million—a 70 % increase year‑over‑year—with margins improving to 28.3 %. Management raised its FY 2025 operating income and free‑cash‑flow guidance, aligning fundamentals with ST‑IM’s positive inference.

) indicator, with fifteen weeks in the current trend. CRS has an RSI of 110 and a 13‑week gain of +21 %. Volatility is low, contributing to a high ST‑IM score. The specialty alloys maker reported record operating income of US $118.9 million—a 70 % increase year‑over‑year—with margins improving to 28.3 %. Management raised its FY 2025 operating income and free‑cash‑flow guidance, aligning fundamentals with ST‑IM’s positive inference.

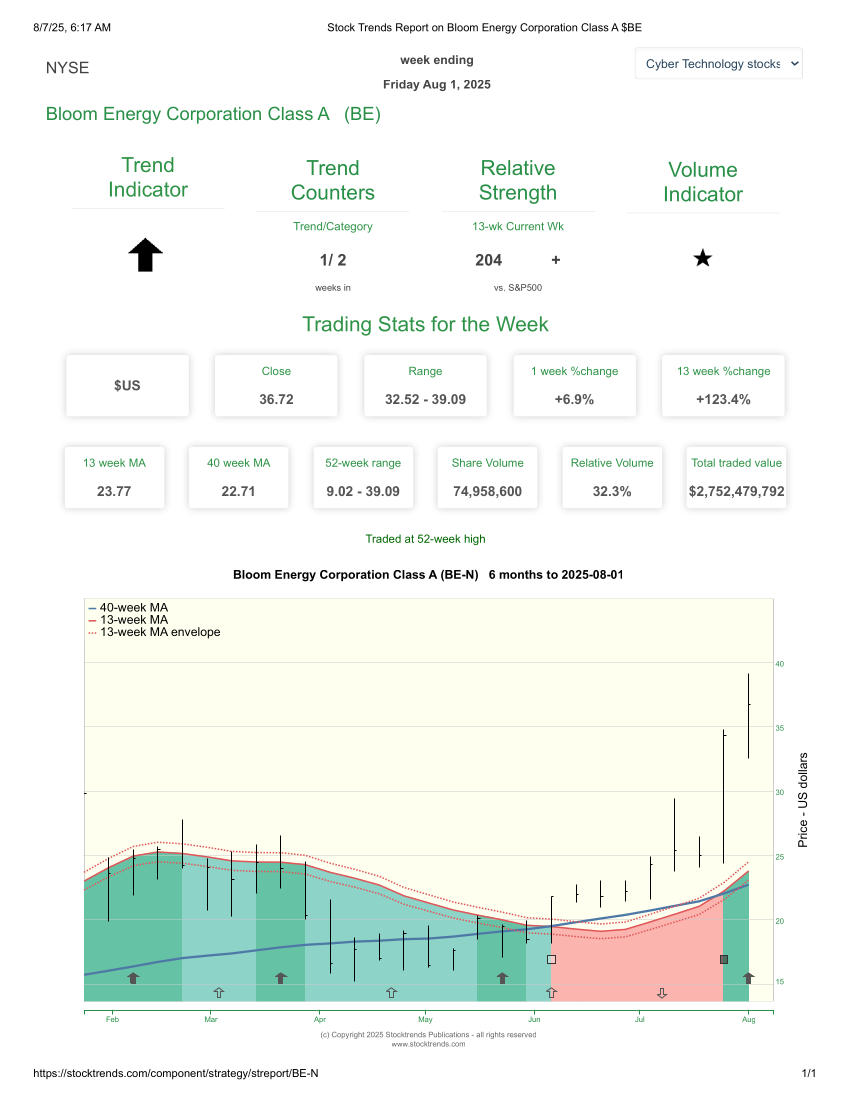

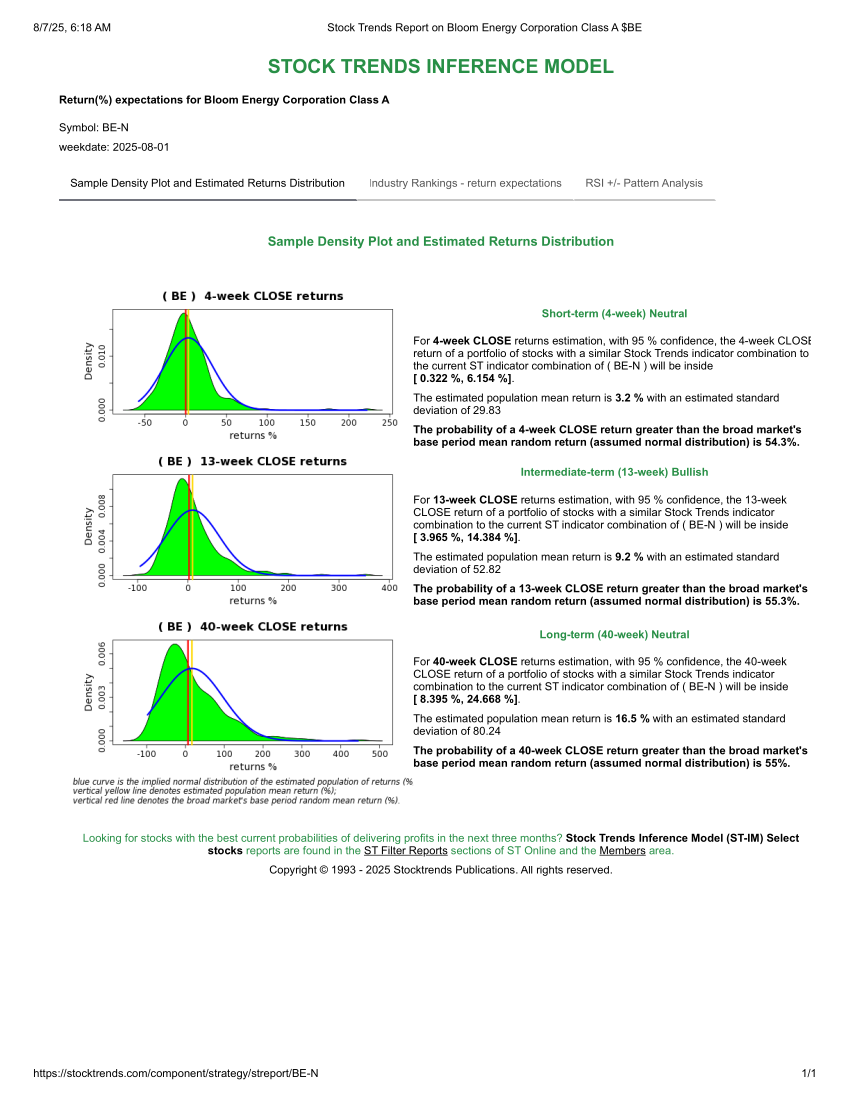

Bloom Energy – Hydrogen breakthrough

Bloom Energy (BE) is a fuel‑cell and hydrogen‑solutions provider. It holds a strongly Bullish (![]() ) indicator with one week in the current trend and two weeks in the broader trend. Its RSI is 204, the 13‑week return exceeds +123 %, and it is one of the few ST‑IM names with a positive weekly change. Bloom reported US $401.2 million in revenue for Q2 2025 (up 19.5 %) and adjusted EPS of US $0.10. Operating margin improved and full‑year revenue guidance was reaffirmed. Strong fundamentals and momentum justify the ST‑IM designation.

) indicator with one week in the current trend and two weeks in the broader trend. Its RSI is 204, the 13‑week return exceeds +123 %, and it is one of the few ST‑IM names with a positive weekly change. Bloom reported US $401.2 million in revenue for Q2 2025 (up 19.5 %) and adjusted EPS of US $0.10. Operating margin improved and full‑year revenue guidance was reaffirmed. Strong fundamentals and momentum justify the ST‑IM designation.

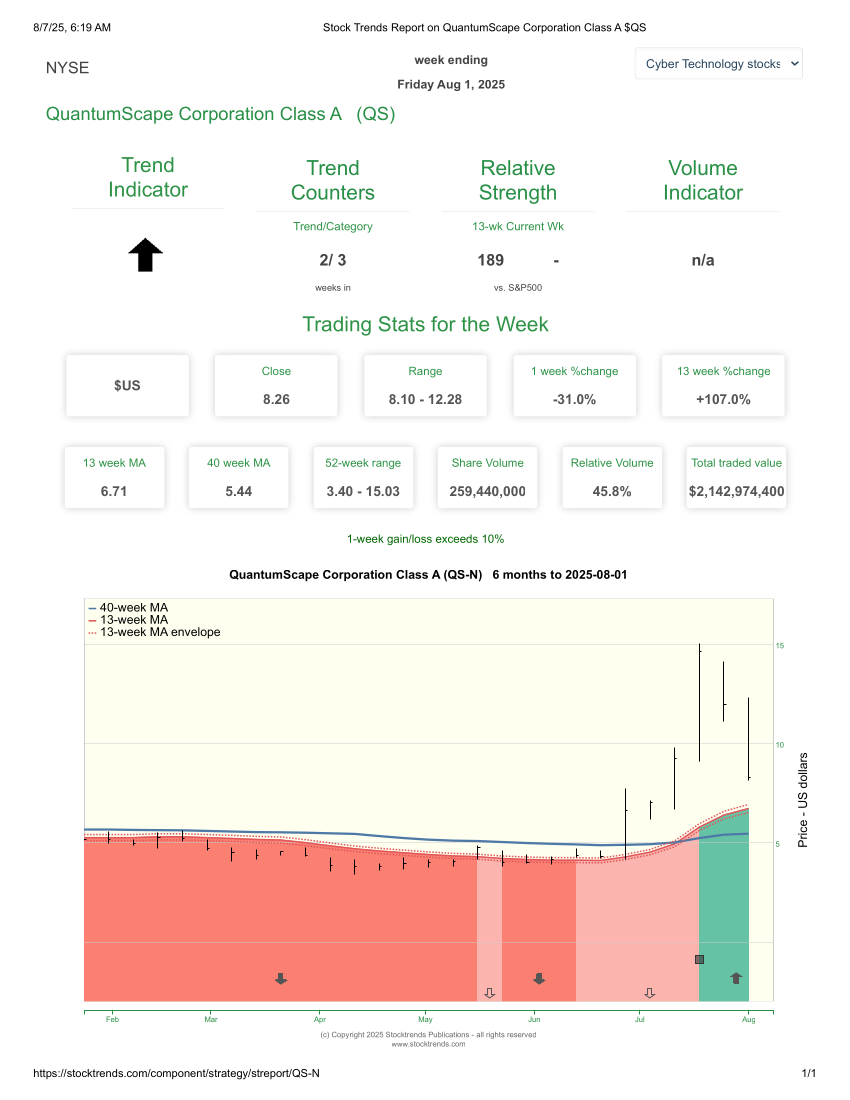

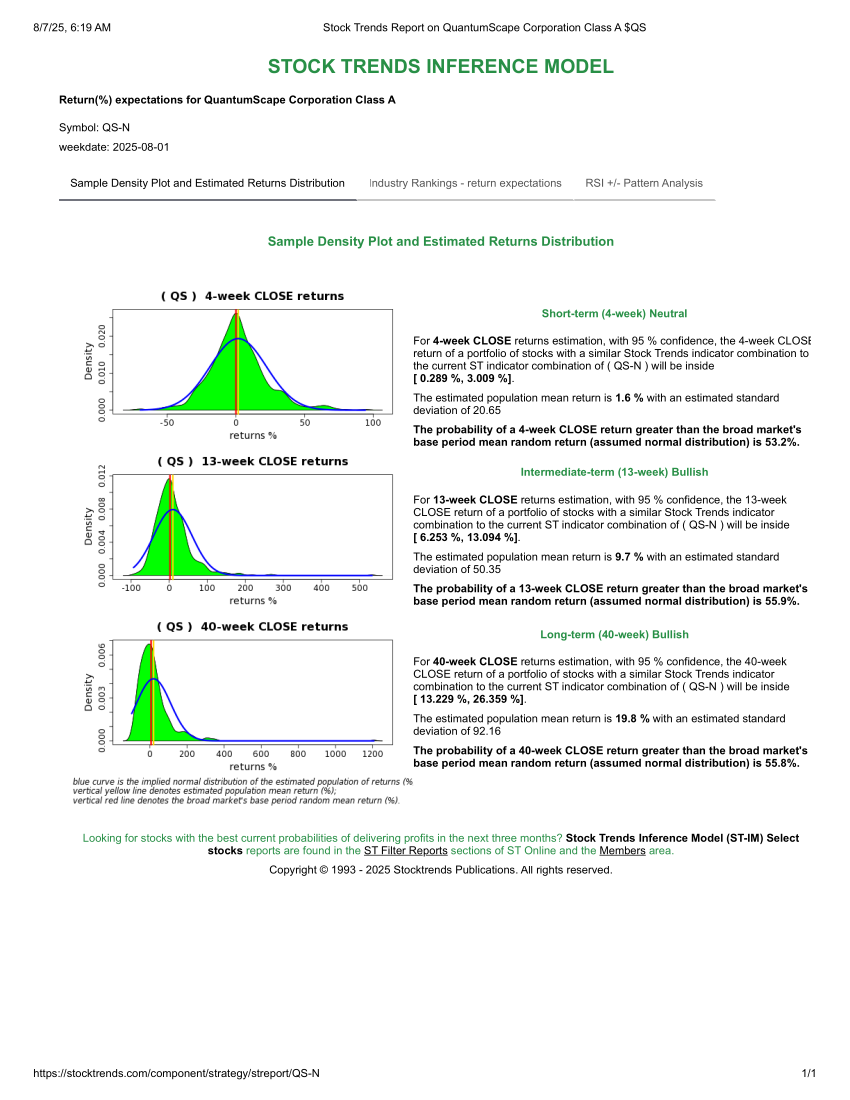

QuantumScape – High‑risk, high‑reward battery play

QuantumScape (QS), a developer of solid‑state batteries, is in a strongly Bullish (![]() ) phase but only two weeks into its current indicator. Its 13‑week return is +107 %, despite a 31 % pullback last week, and its high volatility still yields a notable ST‑IM above expected return probability over the intermediate and long-term ahead. Investor excitement waned temporarily when the company unveiled a new manufacturing process that could delay commercialization; yet, analysts still expect year-over-year EPS to improve by 28%. ST‑IM flags QS as a speculative but potentially rewarding rotation.

) phase but only two weeks into its current indicator. Its 13‑week return is +107 %, despite a 31 % pullback last week, and its high volatility still yields a notable ST‑IM above expected return probability over the intermediate and long-term ahead. Investor excitement waned temporarily when the company unveiled a new manufacturing process that could delay commercialization; yet, analysts still expect year-over-year EPS to improve by 28%. ST‑IM flags QS as a speculative but potentially rewarding rotation.

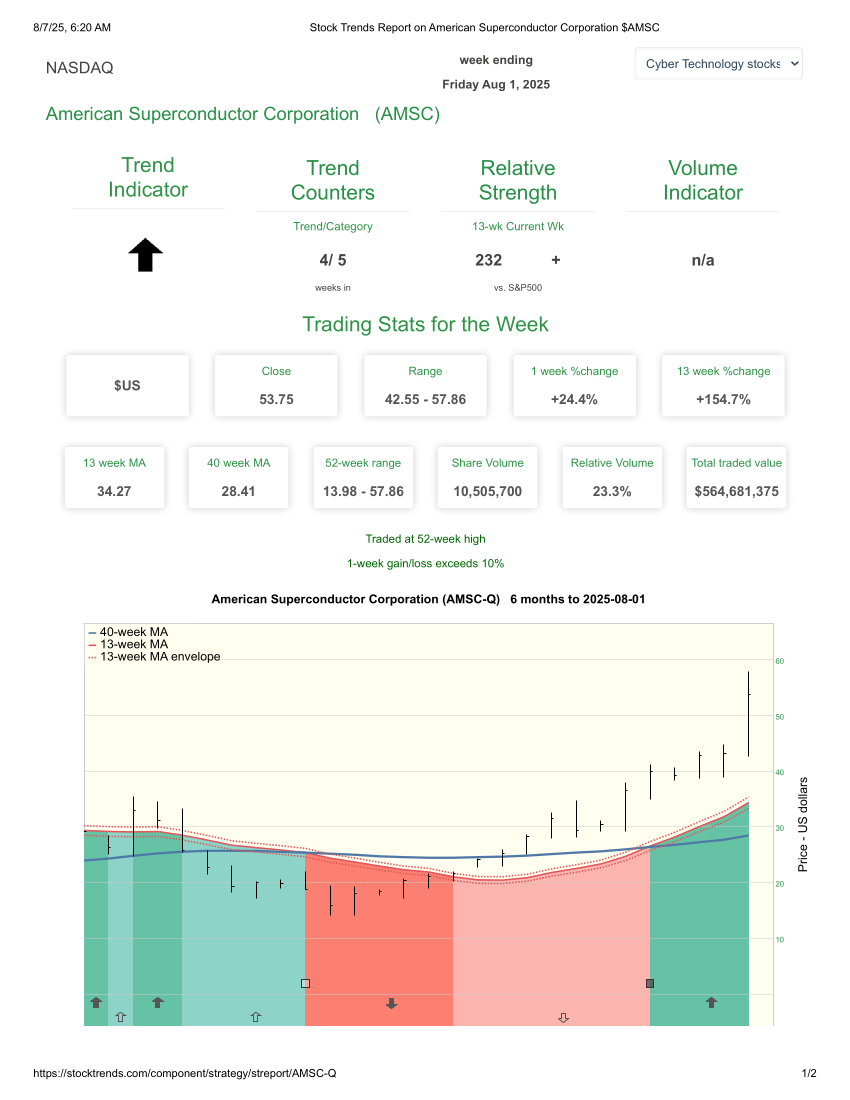

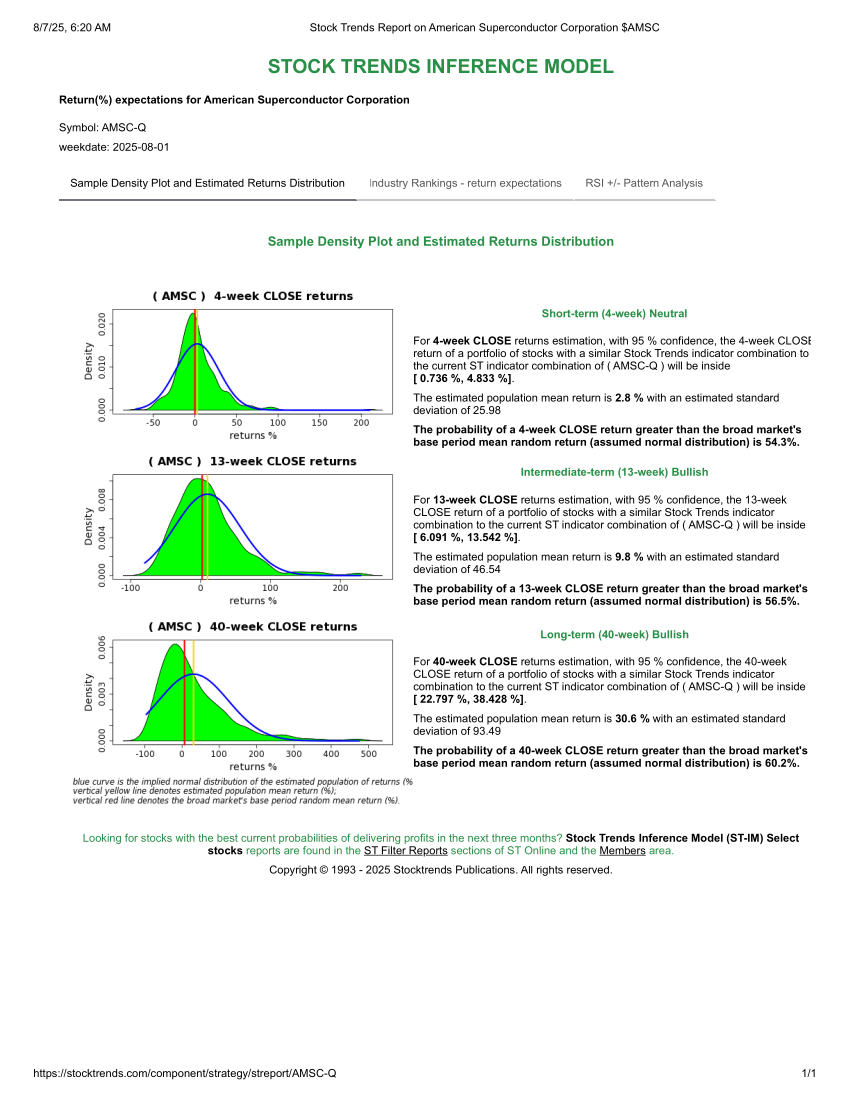

American Superconductor – renewable energy technology

American Superconductor (AMSC) features on the NASDAQ ST‑IM list and shows a strongly Bullish (![]() ) indicator with five weeks in the current bullish category. It boasts an RSI of 232 and a 13‑week gain of +154 %. In Q1 FY2025, AMSC’s revenue surged 80 % to US $72.4 million, net income reached **US $6.7 million**, and non‑GAAP net income was US $11.6 million. With margins above 30 % and guidance projecting continued profitability, ST‑IM highlights AMSC as a rotation into grid and power‑management technology.

) indicator with five weeks in the current bullish category. It boasts an RSI of 232 and a 13‑week gain of +154 %. In Q1 FY2025, AMSC’s revenue surged 80 % to US $72.4 million, net income reached **US $6.7 million**, and non‑GAAP net income was US $11.6 million. With margins above 30 % and guidance projecting continued profitability, ST‑IM highlights AMSC as a rotation into grid and power‑management technology.

Galectin Therapeutics – A biotech rotation

Galectin Therapeutics (GALT) stands out in the NASDAQ list. The biotechnology firm is developing belapectin, a galectin‑3 inhibitor for MASH cirrhosis and portal hypertension. In its March‑quarter update, Galectin reported a net loss of US $9.6 million, an improvement over the prior year, and highlighted significant reductions in liver stiffness and variceal incidence in its Phase‑3 NAVIGATE trial. The company secured a **US $10 million credit line** from chairman Richard Uihlein, extending funding through June 2026. ST‑IM flags GALT because the improving clinical data and financing boost the probability of outperformance, hinting at investor rotation into biotech.

Ramaco Resources – Rare earths meet met coal

Ramaco Resources (METC) is primarily a metallurgical‑coal producer but is evolving into a dual‑platform company by developing a rare‑earths and critical‑minerals operation. Ramaco is in a bullish trend despite a down week (-15.9%) and appears on the NYSE ST‑IM list. Q2 2025 results showed a net loss of **US $14 million** and adjusted EBITDA of **US $9 million**, but the company set a second consecutive production record. The Brook Mine in Wyoming contains heavy and medium rare earths—gallium, germanium and scandium—that are critical for defence, energy and advanced manufacturing. Management expects pilot production to begin in 2026, accelerating the timeline after a positive economic assessment. ST‑IM highlights METC as a rotation play on the emerging U.S. rare‑earth supply chain.

Summary table of featured ST‑IM Select names

| Symbol | ST indicator | Trend counters (current/major) | RSI | 1‑week change (%) | 13‑week change (%) | Comments |

|---|---|---|---|---|---|---|

| HWM | 15 / 140 | 109 | –2.8 | +19.6 | Record revenue & profit; guidance raised | |

| CRS | 15 / 146 | 110 | –6.8 | +21.0 | Record operating income & margins | |

| BE | 1 / 2 | 204 | +6.9 | +123.4 | Fuel‑cell revenue up 19.5 %, EPS beat | |

| QS | 2 / 3 | 189 | –31.0 | +107.0 | Solid‑state battery developer; high volatility | |

| AMSC | 4 / 5 | 232 | +24.4 | +154.7 | Revenue up 80 %; net income positive | |

| GALT | 2 / 3 | 239 | +25.4 | +162.6 | Phase‑3 trial success | |

| METC | 4 / 5 | 185 | -15.9 | +102.6 | Emerging rare‑earth producer; met coal & critical minerals |

Note: “Trend counters” show how many weeks a stock has been in its current indicator and how many weeks it has been in the broader bullish category.

Why ST‑IM matters for rotation

The ST‑IM Select stocks of the week report serves as a curated shortlist in the Stock Trends decision tree. After screening for positive trend indicators and high relative strength, investors use ST‑IM to focus on names whose return distributions are statistically positive. The diversity of this week’s picks—industrial aerospace, specialty metals, hydrogen technology, solid‑state batteries, grid hardware, biotech and critical minerals—illustrates how ST‑IM can direct investors toward sector rotations rather than concentrating risk in a single theme.

While technical indicators provide early signals, fundamental research is still essential. Stocks like Howmet and Carpenter are backed by record earnings; Bloom Energy and American Superconductor benefit from clean‑energy and grid‑modernisation trends; QuantumScape and Galectin offer high‑risk, high‑reward exposure to transformative technologies; and Ramaco Resources combines metallurgical coal cash flows with a strategic U.S. rare‑earth play. By monitoring ST‑IM Select and overlaying fundamental analysis, investors can position for timely rotations across market cycles.

Related items

- Stock Trends Mid-Quarter Review: How the Year-End 2025 Themes Are Performing in Q1 2026

- Stock Trends Year-End Analysis: Institutional Momentum, ST-IM Alpha, and the Road Into Q1 2026

- Understanding Our Assumptions — A Decade Later

- Trading Nvidia with the Stock Trends RSI +/– Pattern Analysis Model

- Navigating Market Turmoil in December 2025 – How Stock Trends Guides Investors

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!