Dow Jones Industrials Bullish CrossoverCurrent Strategy SummaryBuys: 1 Sells: 0 Performance2026 ytd: +4.8% |

| Current Portfolio Report | Portfolio History Report |

| (subscribers only - Login ID and password required) |

The Stock Trends Bullish Crossover (![]() ) and Bearish Crossover (

) and Bearish Crossover (![]() ) are key signals that a long-term price trend has changed, but for many investors these moving average indicators appear to be too lagging current market prices to generate trading success. Indeed, the premise of trend analysis is that moving average market timing buy signals forgo early price movement in order to definitively categorize a new price trend, and that trade exit markers provided by moving averages are well behind price action trade exits – a dual handicap that some investors would find intolerable.

) are key signals that a long-term price trend has changed, but for many investors these moving average indicators appear to be too lagging current market prices to generate trading success. Indeed, the premise of trend analysis is that moving average market timing buy signals forgo early price movement in order to definitively categorize a new price trend, and that trade exit markers provided by moving averages are well behind price action trade exits – a dual handicap that some investors would find intolerable.

However, the best way to challenge these misgivings is to produce a trading record that substantiates an ongoing trading plan employing moving average crossovers as both buy and sell signals. Long-term investment returns achieved when using the Stock Trends Bullish and Bearish Crossovers indicators (![]() and

and ![]() ) will surprise skeptics.

) will surprise skeptics.

|

The Dow Jones Industrials Bullish Crossover Portfolio trading strategy:

|

|---|

|

BUY a component stock of the Dow Jones Industrials index when:

tagged with a “Bullish Crossover” indicator

|

|

SELL a stock when:

tagged with a “Bearish Crossover” indicator

|

An example of this trading strategy at work

|

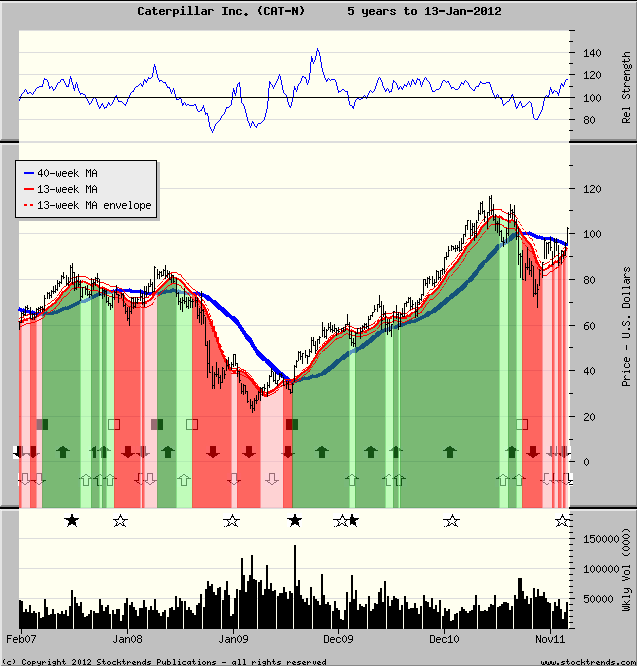

The following Stock Trends chart shows the changing trend indicators over the 5-year period from early 2007 for Caterpillar Inc. (CAT-N). It depicts three Stock Trends Bullish trend categories - all introduced by a Bullish Crossover indicator ( |

|

|

The money management rules for the portfolio are as follows:

Exposure to each position is limited to $10,000. Although the average number of positions held since 1981 is 18, the strategy could potentially require holdings of all 30 stocks at one time. Conversely, the system will not hold many stocks at all in bearish markets. During bear markets of this trading record, the portfolio holdings fell to an average of 5 or 6, while the most active year (1997) the average number of stock held by the portfolio was 26.

Transaction costs are factored into the cost of purchases and the net proceeds of sales at 1% in and 1% out, or 2% commission on a round trip.

DJ Industrials Bullish Crossover Portfolio Performance -

1981 to 2021:

| Year | Avg Invested Capital ($) | Net Gain/(Loss) ($) | ST Portfolio (%)* | S&P 500 (%) | Difference (%) |

| Since inception | $179.747 | $1,077,399 | +14.6% | +9.1% | +5.5% |

| 2021 | 232,453 | 49,189 | 21.1 | 26.9 | -5.8 |

| 2020 | 149,057 | -9,338 | -6.3 | 14.3 | -20.6 |

| 2019 | 182,830 | 24,902 | 13.6 | 30.3 | -16.7 |

| 2018 | 203,774 | -9,622 | -4.7 | -7.0 | 2.3 |

| 2017 | 226,226 | 62,730 | 27.8 | 19.4 | 8.4 |

| 2016 | 195,472 | 12,597 | 6.4 | 9.5 | -3.1 |

| 2015 | 150,566 | -7,071 | -4.7 | -1.3 | -3.4 |

| 2014 | 233,774 | 31,029 | 13.3 | 13.4 | -0.1 |

| 2013 | 245,472 | 67,056 | 27.3 | 31.3 | -4.0 |

| 2012 | 219,811 | 9,903 | 4.5 | 11.5 | -7.0 |

| 2011 | 191,509 | -16,287 | -8.5 | 0.0 | -8.5 |

| 2010 | 205,283 | 11,673 | 5.7 | 12.8 | -7.1 |

| 2009 | 134,340 | 59,490 | 45.4 | 29.1 | 16.3 |

| 2008 | 67,547 | -40,835 | -59.3 | -41.0 | -18.3 |

| 2007 | 230,189 | 28,957 | 12.5 | 4.2 | 8.3 |

| 2006 | 203,585 | 23,574 | 11.7 | 13.6 | -1.9 |

| 2005 | 156,038 | -11,506 | -7.4 | 3.0 | -10.4 |

| 2004 | 199,811 | 3,099 | 1.6 | 10.4 | -8.8 |

| 2003 | 185,283 | 41,862 | 22.7 | 25.2 | -2.5 |

| 2002 | 95,660 | -34,992 | -36.3 | -24.6 | -11.7 |

| 2001 | 107,925 | -36,875 | -34.1 | -12.1 | -22.0 |

| 2000 | 129,245 | -75,064 | -58.1 | -10.1 | -48.0 |

| 1999 | 216,226 | 140,505 | 64.5 | 19.5 | 45.0 |

| 1998 | 195,283 | 115,399 | 59.1 | 31.0 | 28.1 |

| 1997 | 257,925 | 88,549 | 34.2 | 23.7 | 10.5 |

| 1996 | 239,245 | 103,473 | 43.4 | 22.9 | 20.5 |

| 1995 | 243,019 | 107,789 | 44.3 | 34.1 | 10.2 |

| 1994 | 159,057 | -147 | -0.1 | -1.5 | 1.4 |

| 1993 | 166,981 | 5,114 | 3.1 | 7.1 | -4.0 |

| 1992 | 183,396 | 9,184 | 5.0 | 8.2 | -3.2 |

| 1991 | 186,415 | 71,615 | 38.2 | 23.7 | 14.5 |

| 1990 | 153,019 | -2,212 | -1.4 | -7.0 | 5.6 |

| 1989 | 238,868 | 101,415 | 42.4 | 27.3 | 15.1 |

| 1988 | 120,755 | -3,917 | -3.3 | 12.4 | -15.7 |

| 1987 | 200,377 | -5,475 | -2.7 | 2.1 | -4.8 |

| 1986 | 199,245 | 62,940 | 31.4 | 17.8 | 13.6 |

| 1985 | 180,755 | 44,764 | 24.9 | 26.1 | -1.2 |

| 1984 | 102,264 | -29,285 | -29.0 | 0.8 | -29.8 |

| 1983 | 191,132 | 47,492 | 24.7 | 17.3 | 7.4 |

| 1982 | 133,962 | 48,723 | 36.8 | 14.8 | 22.0 |

| 1981 | 53,585 | -4,535 | -8.5 | -10.1 | 1.6 |

* ST portfolio annual returns are based on average invested capital for the year.

|

Trading Statistics | |

|---|---|

| Total # of positions taken: | 846 |

| # of winning positions (winning %): | 381 (45%) |

| Average gain(%) per winning position: | 42% |

| Average loss(%) per losing position: | 11% |

| Profit factor**: | 3.1 |

| Maximum gain(%) on a position: | 570% |

| Maximum loss(%): | -45% |

| Annualized return on average invested capital: | 14% |

| Average invested capital: | $179.747 |

| Average # of positions held: | 18 |

| Average # of weeks invested in each position: | 45 |

|

* trading stats compiled at December 31, 2021 **Profit Factor = (% of winning trades X average $ gains on winning trades) / ABSOLUTE VALUE[(% of losing trades X average $ losses on losing trades)] |

|