For 25 years, I had the privilege to work in the global information technology industry, typically in marketing roles, enabling me to build on a passion for tech that began in my teens in the early 1970s with a simple Texas Instrument calculator, a basic Ford V-8 engine and a classic Pioneer stereo system.

Over the last five years, I’ve also had the privilege to speak confidentially every day with portfolio managers and equity analysts all over the world about the technology companies they own, cover or care about – and why. I won’t betray those confidences or those of my fellow consulting associates, but I will convey some firmly-held convictions in the months to come that will enable you, dear reader, to separate the wheat from the chaff, as my grandfather used to say.

I consider it to be a privilege to converse with you for the next several months (or at least until we feel we have adequately covered off the topic) about the best technology companies on the planet – and why. What I’m not going to do is recommend stock picks as I’m not licensed or qualified to do that. What I am going to do is share with you why some technology companies will be successful over the long term and, thus, are worth further investigation by you and/or your financial advisor. After all, good companies are typically good investments, too. Their business acumen is almost always reflected in their share price over the long-term.

When evaluating technology companies, there are four areas of research that I focus on intently:

- A company’s quarterly Management’s Discussion and Analysis (MD&A) document;

- A company’s quarterly financials;

- Independent industry research analysis of the company as opposed to equity market research, although equity research has considerable value, too; and

- The financial section of a daily newspaper, like the Wall Street Journal, the National Post’s Financial Post or the Globe and Mail’s Report On Business.

These important documents will reveal the following key facts:

- Strength and durability of technology product and service offerings;

- Quality of senior management team and board of directors;

- Key competitors and competitive environment, overall;

- Fiscal health, particularly recurring revenue stream, debt levels and available capital; and

- Latest industry, company and equity market news.

That all said, here are the three most important attributes of a great software company in the third decade of the 21st Century:

- Technologically-driven, customer-focused CEO who is materially invested in his or her company;

- Consistent top-line and bottom-line growth built on growing recurring revenue model, i.e., Software as a Service (SaaS) subscription model;

- Key products and services based on cloud-based technologies that have deep moats, i.e., industry-leading, long-legged addressable markets and extremely sticky, i.e., customers have to have them to operate their businesses efficiently, effectively and affordably.

In my view, there are four software companies that embody these attributes today and I expect they will do so for some time to come. In alphabetical order, they are:

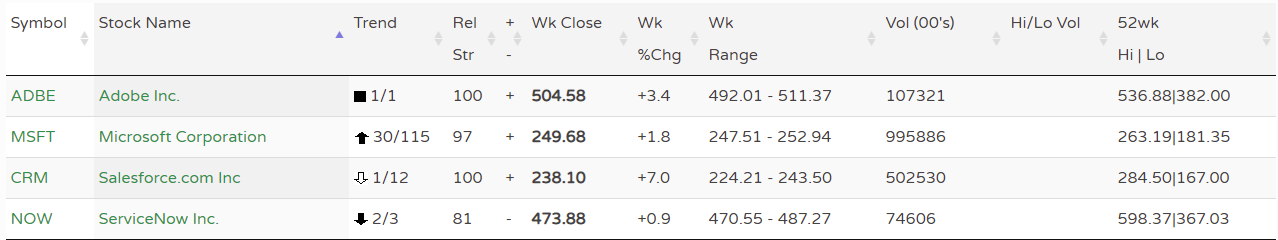

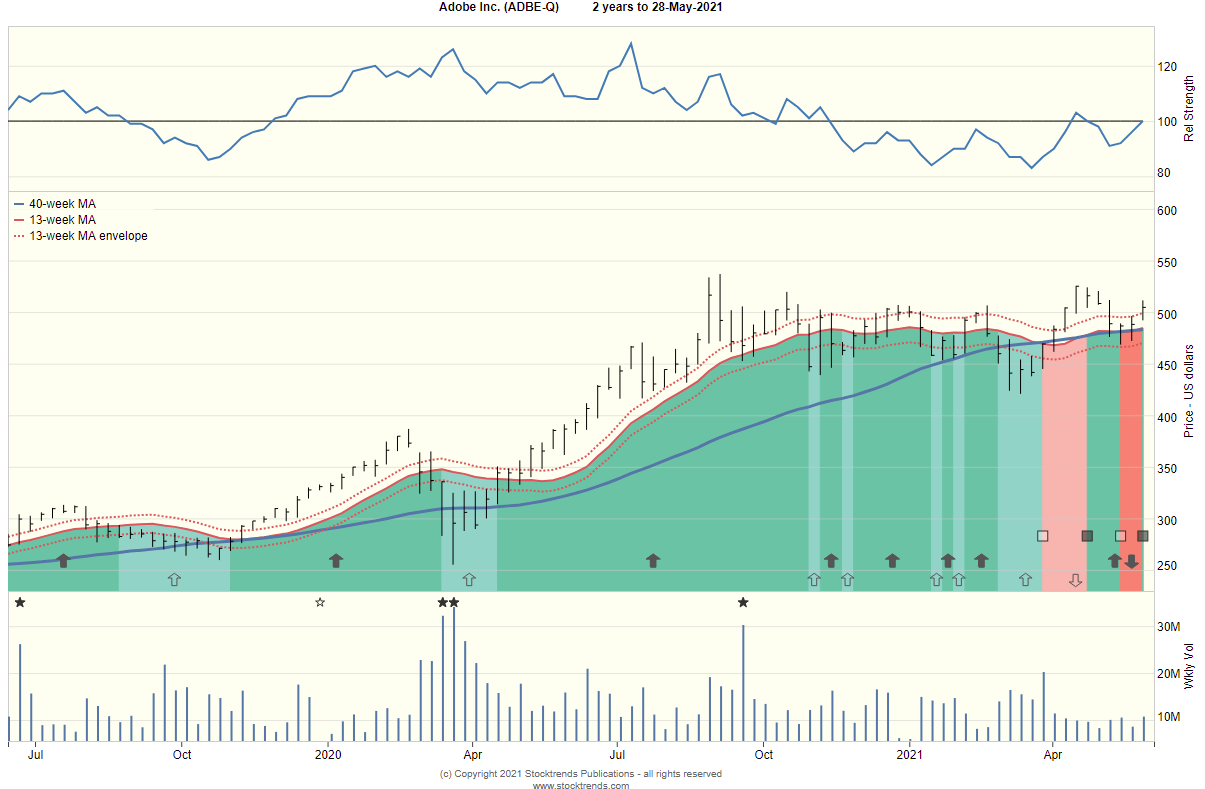

Adobe Inc. (ADBE)

Led by Shantanu Narayen since 2007, the company has historically developed software for content creation and publication, including animation, graphics, illustration, motion pictures, multimedia/video, photography and print. It has since expanded into digital marketing management software. Adobe has more than 12 million users worldwide. Flagship products include Photoshop image editing software, Adobe Illustrator vector-based illustration software, Adobe Acrobat Reader and the Portable Document Format (PDF), etc. Adobe had 2020 revenues of $12.8 billion.

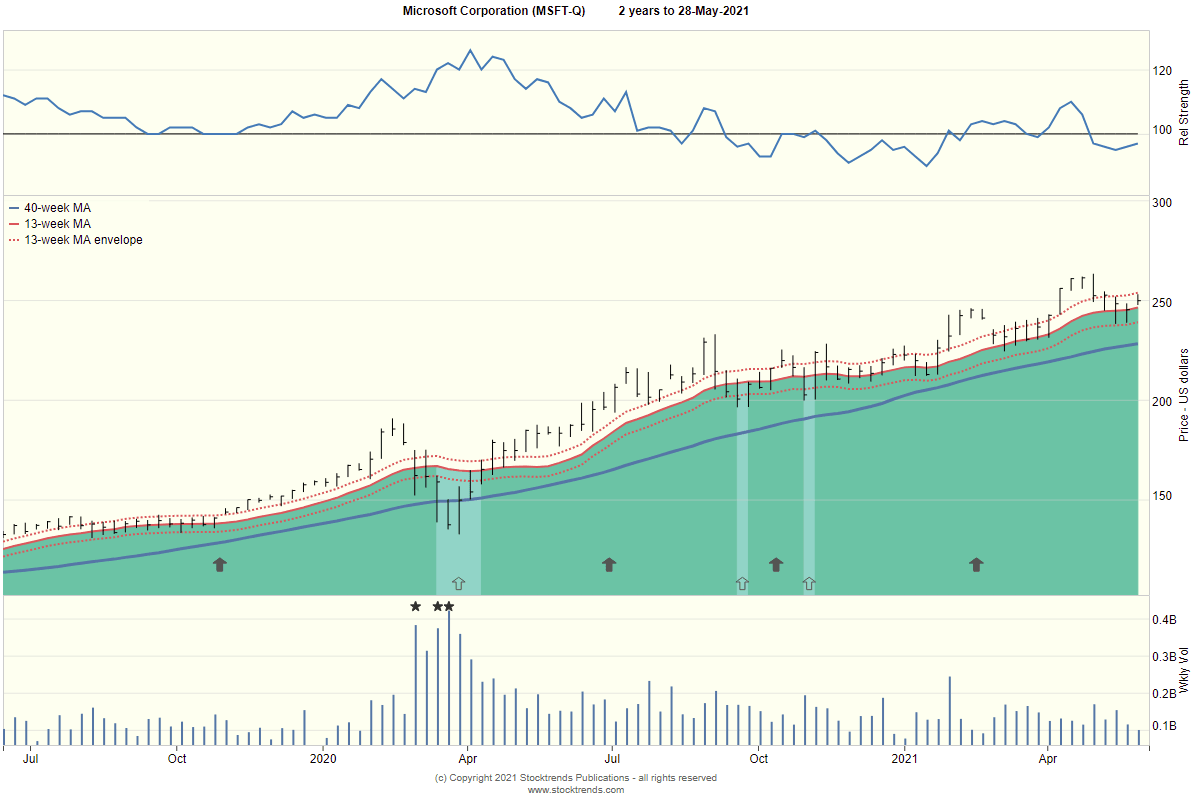

Microsoft Corp. (MSFT)

Led by the highly respected Satya Nadella since 2014, the company develops, licenses, manufactures sells and supports computer software, consumer electronics, personal computers and related services. Microsoft has over one billion users worldwide. Its best-known products are the Microsoft Windows line of operating systems, Microsoft Office suite and Internet Explorer and Edge web browsers. Microsoft had 2020 revenues of $143 billion.

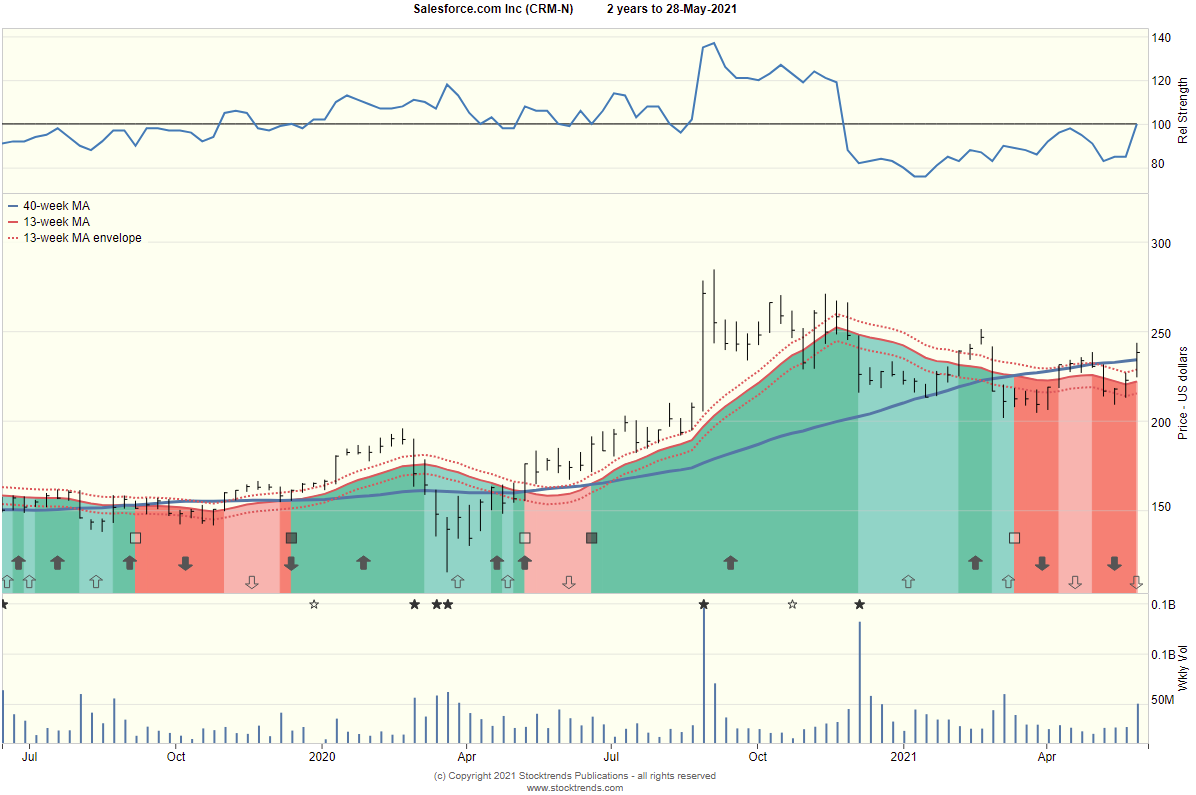

Salesforce.com Inc. (CRM)

Led by founder Marc Benioff since its establishment in 1999, the company provides customer relationship management (CRM) services and also provides a complementary suite of enterprise applications focused on analytics, automation, application development, customer service and marketing automation. Salesforce has more than 150,000 business customers worldwide. Salesforce had 2020 revenues of $17.1 billion.

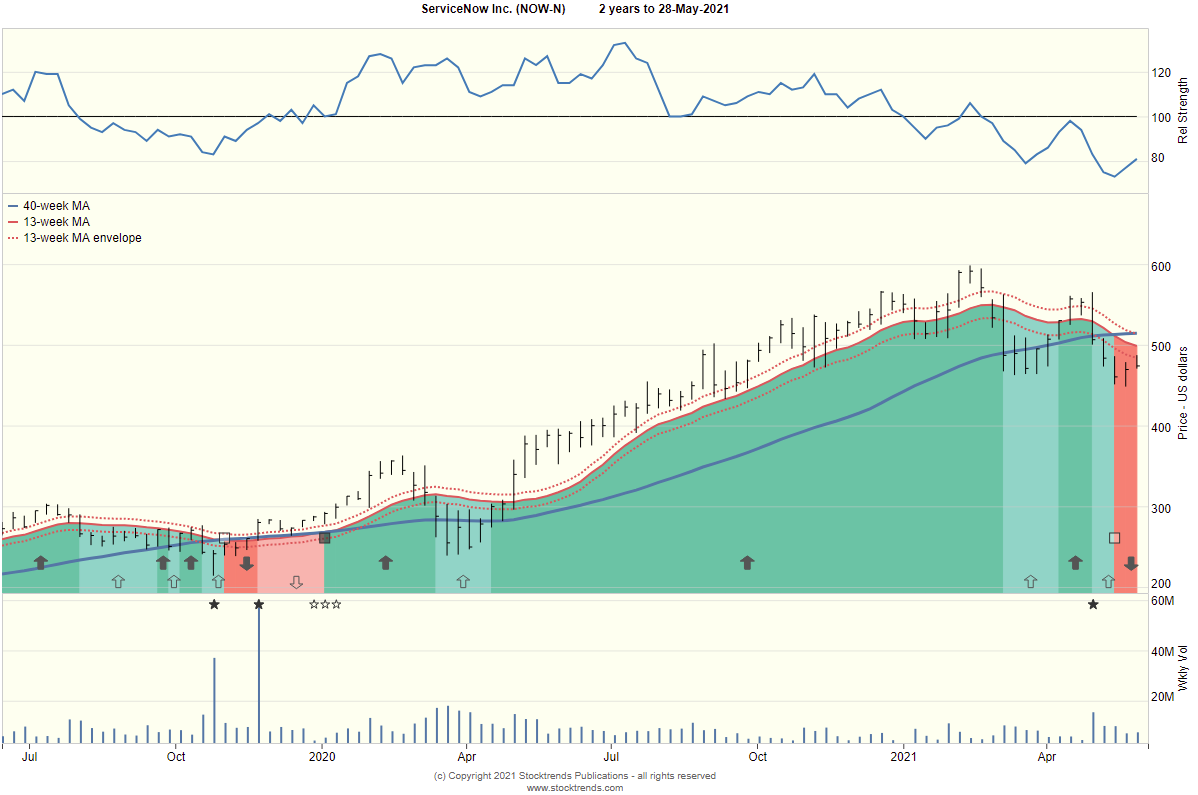

ServiceNow Inc. (NOW)

Led by Bill McDermott since 2019, the company has developed a cloud computing platform to help companies manage digital workflows for enterprise operations. It has more than 128,000 clients worldwide. ServiceNow had 2020 revenues of $3.4 billion.

In addition to possessing my key three attributes in abundance, these companies are regularly recognized for being great places to work, for attracting the best and the brightest in the global software sector and for having independent Boards of Directors who are committed to the kind of governance that ultimately respects shareholders.

There are a number of up-and-coming software firms out there that have the potential to join this group. I will identify them and discuss their attributes and challenges in detail in a future column.

Next month: global hardware sector

If there is a technology company that you would like John to focus on in-depth in a future column or if you have a general comment about the value of Technology Corner to you as an investor, please contact Stocktrends Publications.

Related items

- When the “Big Short” Turned Its Eye on Tech: Interpreting the Burry Shock Through Stock Trends Indicators

- From Banks to Bytes to Uranium: Strong Bulls Align with ST-IM Signals

- Technology Sector Split: Hardware & Chips vs. Software – A Deep Dive with Stock Trends

- Spotlight on Risk: Bullish Stocks Showing Signs of Weakness

- Cybersecurity Stocks in Focus: Bullish Signals from Stock Trends as Industry Fortunes Rise