Cybersecurity is now a pillar of the global digital economy. From securing AI workloads to defending Web3 infrastructure, companies that protect digital systems are essential players in the technology landscape. For investors, the cybersecurity sector is no longer speculative—it’s strategic.

This week’s Stock Trends indicator analysis affirms a decisive shift toward bullish momentum among leading cybersecurity names. Investors looking to align with the structural demand trends in AI, blockchain, and cloud computing are seeing validation through Stock Trends’ unique trend classification system.

Sector Leadership Confirmed by Stock Trends Indicators

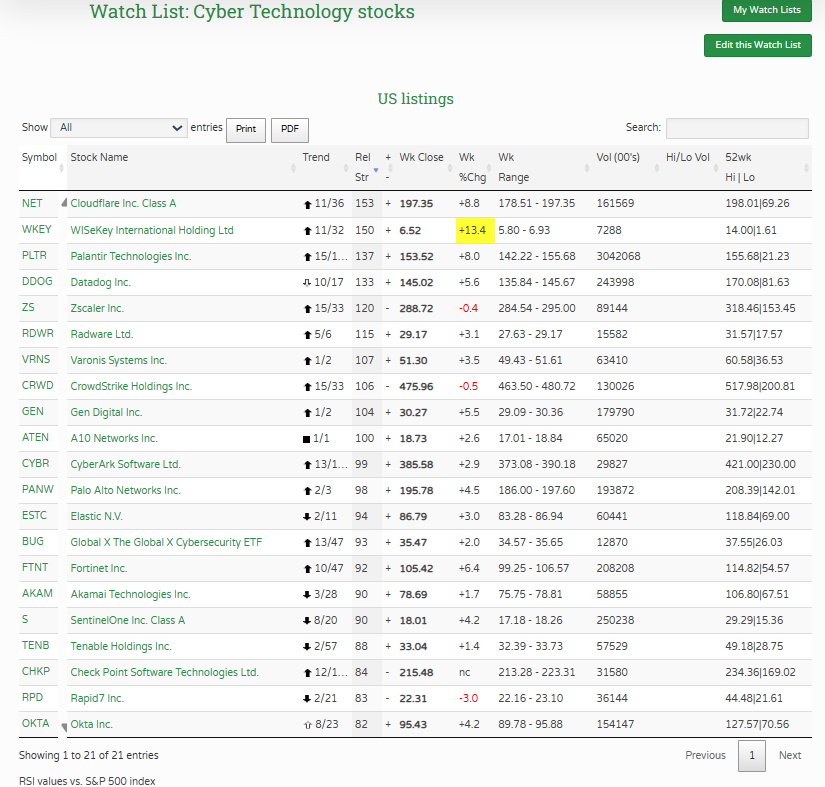

Among the cybersecurity stocks tracked by Stock Trends, the majority are currently classified within Bullish or Strong Bullish trend categories, with only a few still in longer-term Bearish positions. This distribution reflects both the strength of recent price action and the broader sector resilience in a volatile macro environment.

Strong Bullish Standouts

-

-

Trend: Strong Bullish (

)

) -

Price Change (Wk): -0.4%

-

RSI: 120

Despite a slight dip in price this week, Zscaler remains well above its 13-week moving average, confirming its strong position within the market’s short-term bullish channel.

-

-

-

Trend: Strong Bullish (

)

) -

Price Change (Wk): +13.4%

-

RSI: 150

The most notable gainer in the group, WISeKey’s sharp price rise and surging RSI reflect breakout momentum. Investors should be alert to further confirmation in volume or trend duration.

-

-

-

Trend: Strong Bullish (

)

) -

RSI: 106

A core cybersecurity holding, CrowdStrike maintains bullish alignment, supported by institutional inflows and strong quarterly results.

-

-

CyberArk (CYBR), Fortinet (FTNT), Gen Digital (GEN), Varonis (VRNS) all remain in confirmed Bullish trends with RSI values indicating continued strength.

Bullish Crossovers and New Opportunities

-

-

Trend: Bullish Crossover (

)

) -

Price Change (Wk): +2.6%

-

RSI: 100

This is the first week of a new Bullish trend for ATEN. For Stock Trends users, Bullish Crossovers are often considered ideal entry signals, as they mark the technical shift from bearish to bullish market structure.

-

Cautionary Trends

-

-

Trend: Weak Bullish (

), RSI: 82

), RSI: 82

Despite a price gain of 4.2%, OKTA’s classification as Weak Bullish flags a potential loss of upside momentum. Investors holding OKTA should monitor closely for a trend downgrade to Bearish.

-

-

Tenable (TENB), SentinelOne (S), Akamai (AKAM)

-

All remain in Strong Bearish (

) trends, despite modest price gains this week. These should be viewed with caution unless a crossover pattern emerges.

) trends, despite modest price gains this week. These should be viewed with caution unless a crossover pattern emerges.

-

ETF Exposure: BUG’s Bullish Context

The Global X Cybersecurity ETF (BUG) also continues to trade in a Strong Bullish trend. BUG offers diversified exposure to cybersecurity names, with top holdings in Zscaler, CrowdStrike, Palo Alto Networks, Fortinet, and Check Point—each of which is in a Bullish or Strong Bullish trend per Stock Trends data.

As of this week, BUG closed up 2.0%, with its RSI at 93 and holding well above its 13-week moving average. For investors preferring an ETF vehicle rather than individual equities, BUG provides trend-confirmed access to the sector’s strength.

The Broader Market Context: Cybersecurity in the Digital Arms Race

Recent market commentary supports the continued bullish case for cybersecurity:

-

AI and Cloud Growth:

Zscaler, Cloudflare, and CrowdStrike continue to grow through enterprise adoption of AI-powered security stacks. -

Web3 Integration:

Cloudflare leads in blockchain security infrastructure, while firms like SentinelOne and Palo Alto explore decentralized identity and smart contract monitoring. -

Cyber Budgets Resilient:

Gartner and Morgan Stanley project rising enterprise cyber budgets through 2026, even under tighter IT spending conditions. -

Geopolitical Tensions & Regulation:

Cybersecurity threats linked to critical infrastructure and regulatory shifts (e.g., SEC breach reporting mandates) are accelerating enterprise demand.

These macro tailwinds align with the Stock Trends market distribution data, which shows an expansion in Bullish classifications across the Technology sector—a shift that supports continued capital rotation into high-quality cybersecurity names.

What the Stock Trends Inference Model Reveals

The Stock Trends Inference Model provides 80% confidence intervals for expected returns over 4-week, 13-week, and 40-week horizons—giving users insight into both opportunity and risk.

Top 5 Cybersecurity Stocks by Expected 4-Week Return

| Symbol | Company | Trend | 4-Week Return (Mean) | CI Range (80%) | Std Dev | RSI |

|---|---|---|---|---|---|---|

| DDOG | Datadog | Weak Bearish ( |

2.60% | -1.15% → 6.35% | 26.80 | 133 |

| WKEY | WISeKey | Strong Bullish ( |

2.32% | 0.54% → 4.10% | 14.63 | 150 |

| NET | Cloudflare | Strong Bullish ( |

2.18% | -0.66% → 5.03% | 19.68 | 153 |

| OKTA | Okta | Weak Bullish ( |

2.09% | 0.39% → 3.78% | 13.53 | 82 |

| ZS | Zscaler | Strong Bullish ( |

1.77% | 1.10% → 2.43% | 11.18 | 120 |

Notably, Datadog, WISeKey, and Cloudflare all offer attractive short-term upside based on current trend and modeled expectations, even when volatility is considered.

Longer-Term Outlook (13-week and 40-week horizons)

-

WISeKey (WKEY) projects a 17.17% expected return over 40 weeks—with an upper bound of over 27% and standard deviation of 80.5.

-

Zscaler (ZS) also offers compelling mid- and long-term profiles: ~3.9% expected return at 13 weeks, and over 10.5% at 40 weeks, on relatively modest volatility.

-

Cloudflare (NET) and Datadog (DDOG) both show double-digit upside potential at 40 weeks, consistent with broader growth momentum in their operational metrics.

These model-based forecasts underscore how the best technical setups are backed by statistical return expectations—creating higher-confidence trade opportunities.

Trading with the Stock Trends Discipline

Stock Trends subscribers know that timing entries and exits with the trend classification system helps remove emotional bias from the trade process.

In the current environment:

-

Trade Entry Candidates:

Look to Bullish Crossover stocks like ATEN or Strong Bullish stocks like WKEY and ZS for new positions. These offer technical entry alignment and macro support. -

Hold Candidates:

Maintain exposure to PANW, CRWD, CYBR, GEN, and BUG while their indicators remain in Bullish zones and RSI levels stay above 90. -

Exit or Review Candidates:

OKTA and AKAM should be monitored for trend reversals or bearish reclassifications. Don’t let short-term price lifts distract from deteriorating indicator alignment. -

ETF Users:

For less active traders, BUG remains a trend-confirmed option for participation in the sector’s performance.

Cybersecurity as a Core Tech Strategy

The cybersecurity sector offers one of the strongest combinations of trend momentum and macro relevance in the current market. The Stock Trends classification of these names provides a clear roadmap for investors seeking to align their portfolios with this durable growth theme.

As the digital landscape expands and risk complexity grows, so too does the need for the companies that protect that ecosystem. Cybersecurity is not a temporary play—it’s a core allocation for a new digital economy.

Related items

- Stock Trends Mid-Quarter Review: How the Year-End 2025 Themes Are Performing in Q1 2026

- Stock Trends Year-End Analysis: Institutional Momentum, ST-IM Alpha, and the Road Into Q1 2026

- Understanding Our Assumptions — A Decade Later

- Trading Nvidia with the Stock Trends RSI +/– Pattern Analysis Model

- Navigating Market Turmoil in December 2025 – How Stock Trends Guides Investors

I am fascinated with your service and methodology - it is very impressive. [...] Over the years I have concluded that there are many ways to approach stock investing, but once one has chosen a path, one is better off sticking to it.

I am fascinated with your service and methodology - it is very impressive. [...] Over the years I have concluded that there are many ways to approach stock investing, but once one has chosen a path, one is better off sticking to it.