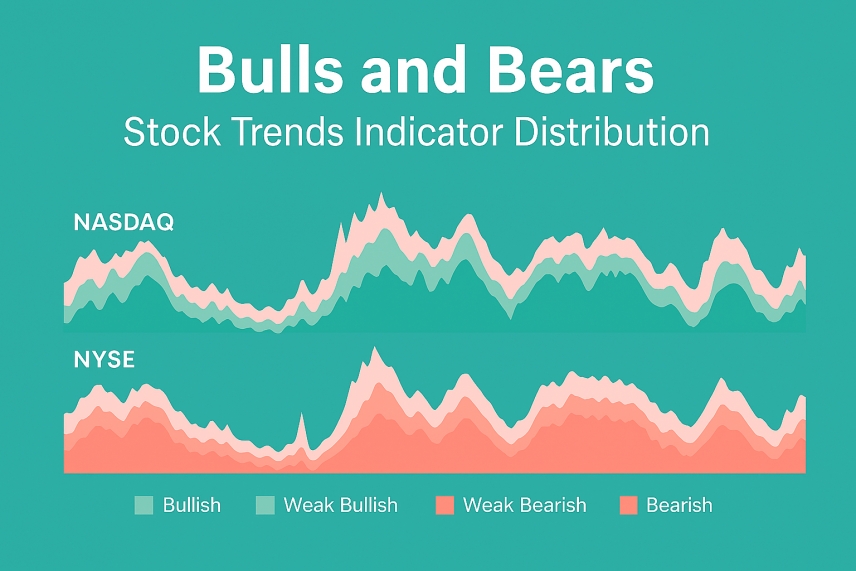

For decades, the Stock Trends framework has rested on a foundational analytical question: Can we infer future return tendencies from recurring patterns of trend, momentum, and trading activity?

In 2014, we formalized this question through the Stock Trends Inference Model (ST-IM), built on two basic premises:

- Market conditions are non-specific to a particular security.

- Market responses to these conditions are specific.

Those ideas remain central to Stock Trends today. But the investing world has changed. Academic research into momentum, trend-following, and behavioural finance has deepened; markets have experienced extreme macro cycles; and our own analytical tools have evolved dramatically.

A decade later, it is time to revisit the original assumptions, test them against modern evidence, and expand their meaning for today’s Stock Trends users.

I very much like the systematic approach to analyzing stock data, it fits my approach.

I very much like the systematic approach to analyzing stock data, it fits my approach.