Stock Trends helps investors spot early opportunities by blending proprietary trend indicators with industry research. In the post‑pandemic travel boom, Lindblad Expeditions Holdings Inc. (LIND‑Q) has emerged from our NASDAQ screeners as a timely and quality investment idea. This article explains how our reports identified LIND‑Q and how current travel and cruise industry data underpin the thesis.

Stock Trends Weekly Reporter filters

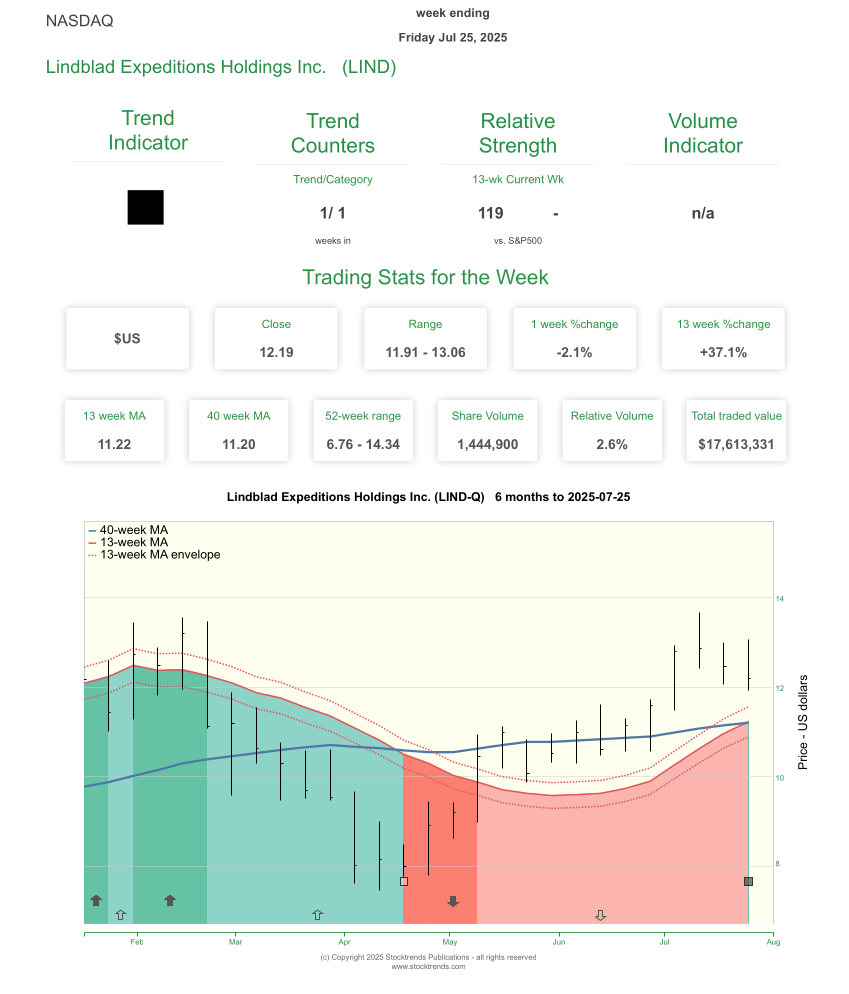

Our NASDAQ Bullish Crossover filter flags stocks whose 13‑week moving average has just crossed above the 40‑week average. The Stock Trends Inference Model analysis then refines those candidates by expected return and risk. On 25 July 2025 both reports highlighted LIND. We initiated a Stock Trends Nasdaq ST-IM Bullish Crossover model portfolio position, confirming that the stock met our quantitative criteria. The alignment between filter and portfolio tells subscribers that LIND deserves closer examination. A LIND position in the Nasdaq Bullish Crossover portfolio was not intiated because the trading record of the week did not trigger a high volume (![]() ) indicator nor outperform the S&P 500 index on the week (RSI +), two of the requirements needed for that broader Bullish Crossover portfolio strategy.

) indicator nor outperform the S&P 500 index on the week (RSI +), two of the requirements needed for that broader Bullish Crossover portfolio strategy.

Early momentum and strong relative strength

LIND’s Stock Trends Report shows a Bullish Crossover with a trend counter of 1/1, meaning this Bullish trend category is just beginning. The relative strength index (RSI) versus the S&P 500 is 119, indicating the stock has outperformed the market by roughly 19% over the past quarter. Trading statistics reveal a closing price of $12.19, weekly range $11.91–13.06 and a 37.1% gain over the last 13 weeks, while volume remains unremarkable. Such fresh categorized Bull trends with strong relative strength and low crowd participation are precisely what our methodology often seeks.

A travel industry riding a wave of demand

Our confidence in LIND is bolstered by broad industry data. Deloitte’s 2025 travel industry outlook notes that travel demand remains “strong” heading into 2025; U.S. travelers planned more and longer trips over the recent holiday season, with average spend rising and TSA throughput up 7% year over year. Deloitte highlights three drivers: travellers are reprioritising experiences post‑pandemic, remote work allows people to travel more often, and a greater share of Americans feel financially better off. These macro drivers support sustained growth in discretionary travel.

The cruise sector is experiencing a similar rebound. Precedence Research estimates the global cruise tourism market will grow from USD 5.47 billion in 2025 to nearly USD 9 billion by 2034, a 5.67% CAGR, driven by government initiatives such as e‑visa programs and investments in advanced technologies to improve passenger experience. The U.S. cruise market alone is projected to expand from USD 1.31 billion in 2024 to USD 2.31 billion by 2034, a 5.84% CAGR. North America already accounts for the largest share of the cruise market, benefiting from established brands and high disposable income. These statistics indicate that the cruise industry’s revenue base is set to widen over the next decade.

Expedition cruising momentum

Lindblad specialises in expedition cruises—small‑ship voyages to remote regions like Antarctica and the Galapagos. Recent data from the Expedition Cruise Network (ECN) underscores the strength of this niche. In its H1 2025 trends report, ECN notes that Antarctica remains the top expedition destination, followed by Svalbard, Greenland, Alaska and the Northwest Passage. Demand is also expanding to warm‑water regions, with a 60% increase in interest for Indonesia, the Pacific, the Amazon and Africa. The fastest‑growing demographics are travellers aged 46–55 and 56–65, and there is rising demand from solo travelers, luxury seekers and multi‑generational families. ECN reports that 67% of its members saw higher bookings in the first half of 2024 compared with 2023. CEO Akvile Marozaite describes the first half of 2025 as “extremely dynamic for the expedition cruise industry,” noting that travellers seek meaningful, transformative experiences. Such data suggests that expedition cruising is not just recovering—it is capturing new segments of travelers drawn to adventure and sustainability.

Industry peers and competitive positioning

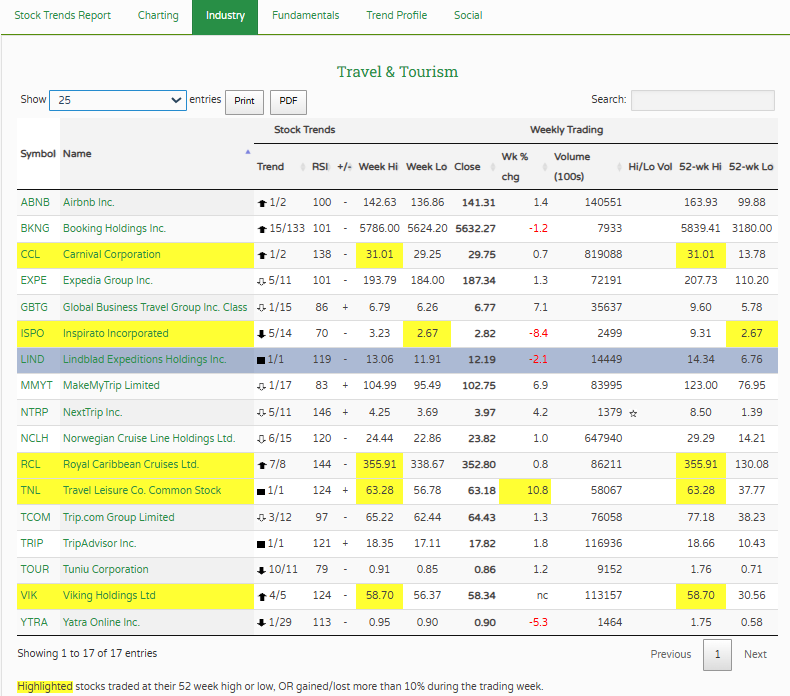

On the Stock Trends Report Industry tab, LIND is compared to travel & tourism peers such as Airbnb (ABNB), Booking Holdings (BKNG), Carnival Corporation (CCL) and Expedia Group (EXPE). While ABNB and BKNG have longer‑running bullish trends, LIND’s Bullish Crossover (![]() ) and RSI of 119 imply that it could be at the start of a catch‑up rally. The cruise industry’s projected expansion and expedition segment’s popularity mean that Lindblad has a tailwind that pure‑play online travel agencies may not share to the same degree.

) and RSI of 119 imply that it could be at the start of a catch‑up rally. The cruise industry’s projected expansion and expedition segment’s popularity mean that Lindblad has a tailwind that pure‑play online travel agencies may not share to the same degree.

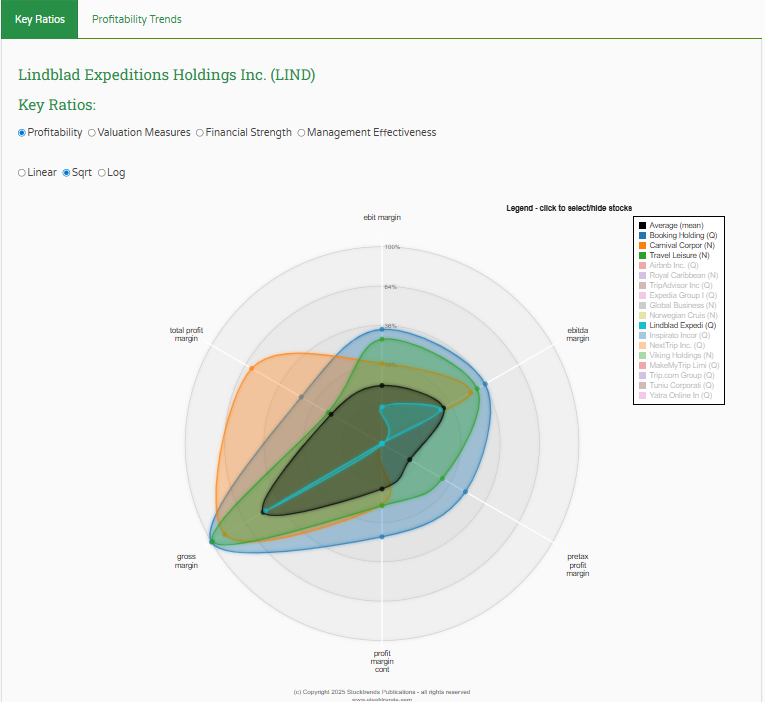

Fundamentals and profitability trends

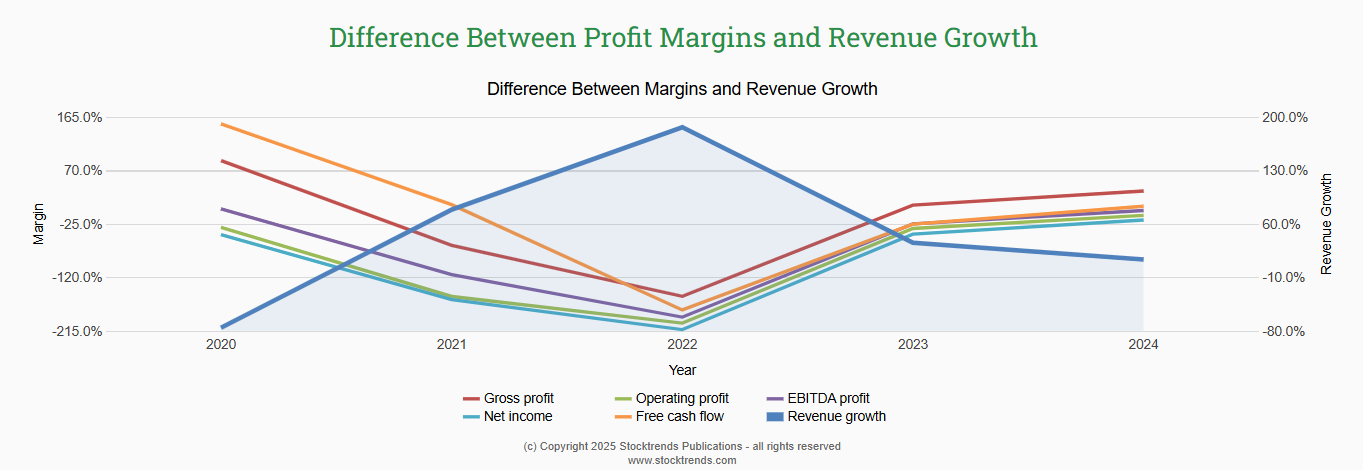

Our Fundamentals tab presents interactive charts comparing key ratios across the sector. LIND’s profitability metrics currently sit below the industry average due to high fixed costs. However, the Profitability Trends sub‑tab shows a sharp rebound in revenue growth post‑2020, rising profit margins and improving free cash flow in 2024. As cruise capacity increases and pricing power returns, we expect margins to drive the stock price higher in this bull trend. Moreover, the global cruise tourism report notes that operators are investing in smart technologies and sustainable fuels to reduce costs and environmental impact, which should support profitability.

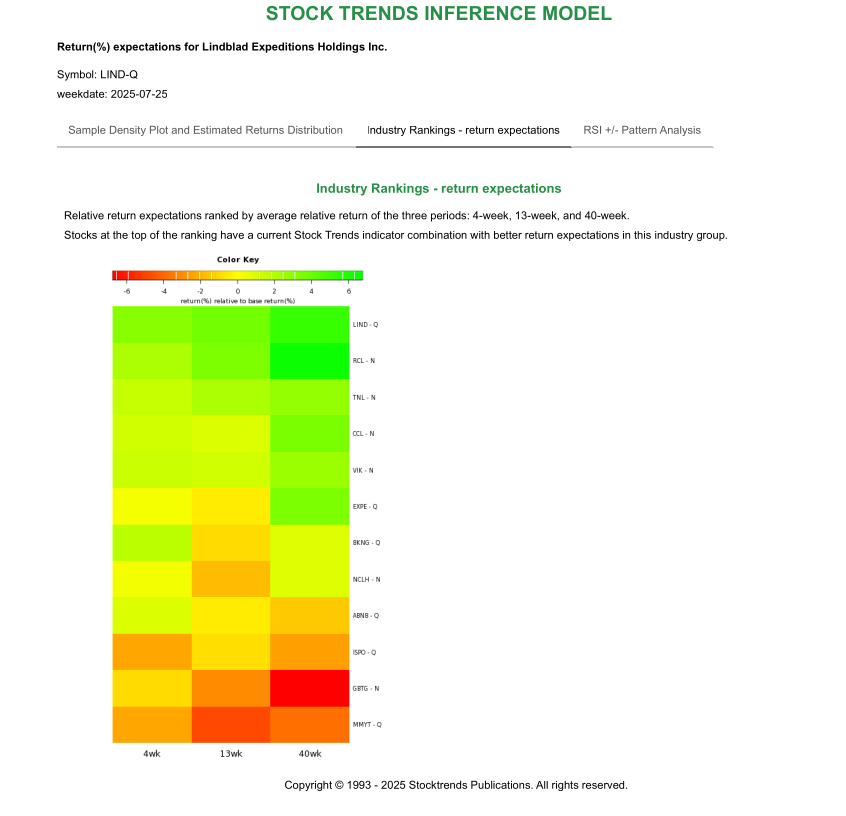

Quantifying upside with the Stock Trends Inference Model

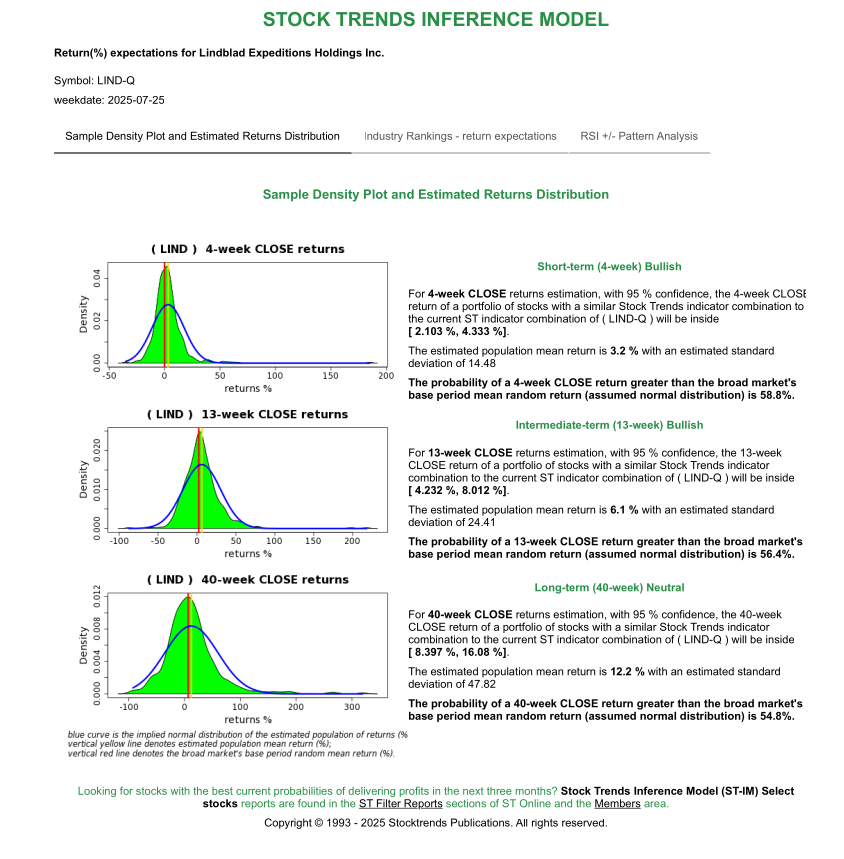

Our Trend Profile leverages the Stock Trends Inference Model (ST‑IM) to simulate future returns based on similar indicator combinations. For LIND, the ST‑IM projects a 4‑week mean return of 3.2% with a 58.8% probability of beating the market. The 13‑week forecast rises to 6.1% with a 56.4% probability. Even the 40‑week horizon shows a 12.2% mean return and a 54.8% probability of outperformance. These probabilities, coupled with the strong macro outlook, validate our decision to include LIND in the ST‑IM portfolio.

Travel’s renaissance meets disciplined analysis

A confluence of factors makes LIND a compelling opportunity today: a fresh Bullish Crossover and high relative strength, a growing expedition cruise market appealing to affluent and adventurous travelers, and a travel sector that continues to enjoy robust demand. Industry research highlights that the broader cruise market is expected to expand steadily over the next decade and that expedition cruises are attracting new demographics. By combining this industry research with our proprietary trend indicators and inference models, Stock Trends can deliver actionable insights to investors. As travel spending increases and expedition cruising gains momentum, LIND stands out as a quality stock aligned with these powerful currents.

Related items

- Stock Trends Mid-Quarter Review: How the Year-End 2025 Themes Are Performing in Q1 2026

- Stock Trends Year-End Analysis: Institutional Momentum, ST-IM Alpha, and the Road Into Q1 2026

- Understanding Our Assumptions — A Decade Later

- Trading Nvidia with the Stock Trends RSI +/– Pattern Analysis Model

- Navigating Market Turmoil in December 2025 – How Stock Trends Guides Investors

Thank you for your excellent work and kind approach to your customers.

Thank you for your excellent work and kind approach to your customers.