On September 17, 2025, the U.S. Federal Reserve delivered its first interest rate cut in nine months, lowering the federal funds rate by 25 basis points to a new target range of 4.00%–4.25%. This was a response to clear signs of a cooling labor market—slower job growth, shorter workweeks, and rising unemployment in several cohorts. Although inflation remains above the Fed’s 2% target, policymakers signaled that two more cuts are likely before the year’s end. This changing policy environment directly influences the Stock Trends signals observed in the week ending September 19.

When rates ease, financials often benefit from improved loan demand and margin stabilization, utilities gain as their long-dated cash flows become more valuable, and growth sectors like technology respond positively to lower discount rates on future earnings. Meanwhile, energy sectors split—traditional oil and gas pressured by demand concerns, while uranium and nuclear names benefit from secular policy and power-grid trends.

Financials & Utilities: Rate-Cut Beneficiaries

The most pronounced breadth is in Finance—635 common stocks in Strong Bullish. With the Fed now easing, banks and lenders are positioned for improved activity. Utilities also attract renewed interest as bond yields fall and data-center electricity demand rises.

Highlighted Stocks:

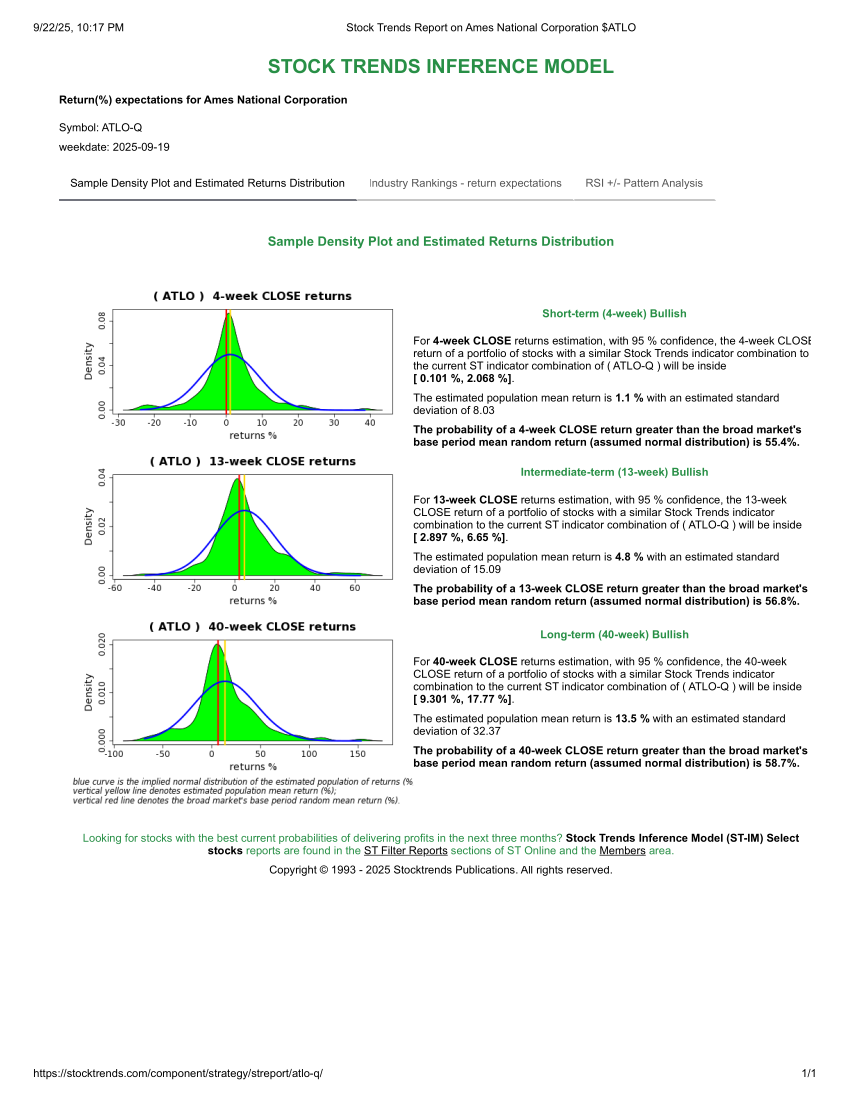

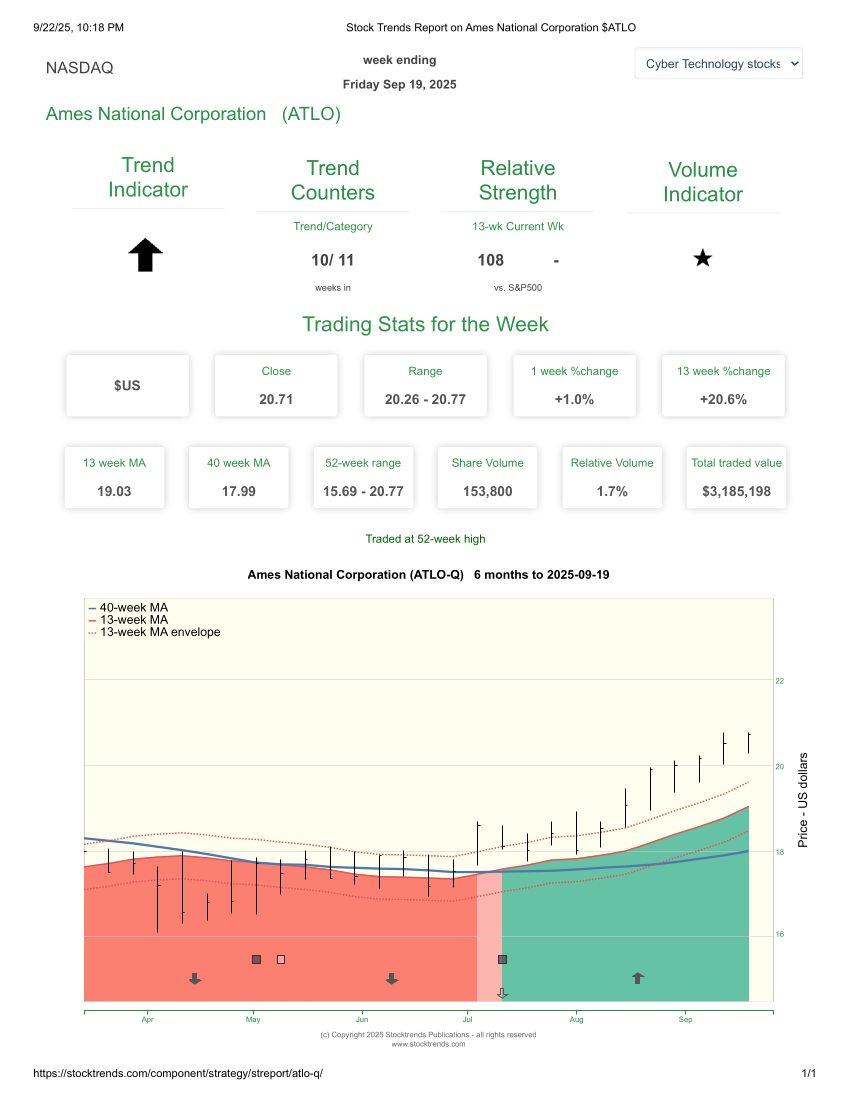

- Ames National Corp (ATLO-Q) — A regional bank in Iowa, this small-cap stock is tagged

with a 56.8% probability of 13-week outperformance ahead. RSI is rising, and the modeled forward 13-week returns are solid. As mortgage and agricultural lending conditions improve, ATLO exemplifies how rate cuts lift local lenders.

with a 56.8% probability of 13-week outperformance ahead. RSI is rising, and the modeled forward 13-week returns are solid. As mortgage and agricultural lending conditions improve, ATLO exemplifies how rate cuts lift local lenders. - Sentage Holdings (SNTG-Q) — A Nasdaq-listed Chinese financial services provider. Also

, ST-IM Select (56.2% probability of outperformance in the coming quarter). Though volatile, its probability edge reflects improving credit facilitation activity as Chinese policy also leans toward stimulus.

, ST-IM Select (56.2% probability of outperformance in the coming quarter). Though volatile, its probability edge reflects improving credit facilitation activity as Chinese policy also leans toward stimulus.

| Symbol | Company | Sector | Trend | RSI | Probability of outperformance - 13wk horizon | 13wk horizon return estimate | 40wk horizon return estimate |

|---|---|---|---|---|---|---|---|

| ATLO-Q | Ames National Corp | Finance | 108 | 56.8% | +4.8% | +13.5% | |

| SNTG-Q | Sentage Holdings | Finance | 181 | 56.2% | +11.0% | +25.8% |

Technology: Selectivity Required

Technology shows 297 Strong Bullish common stocks, but leadership is selective. The rate cut improves the outlook for growth names, but only a handful combine trend and probability alignment. Avoiding speculative names that lack ![]() designation helps focus on genuine leaders.

designation helps focus on genuine leaders.

Highlighted Stocks:

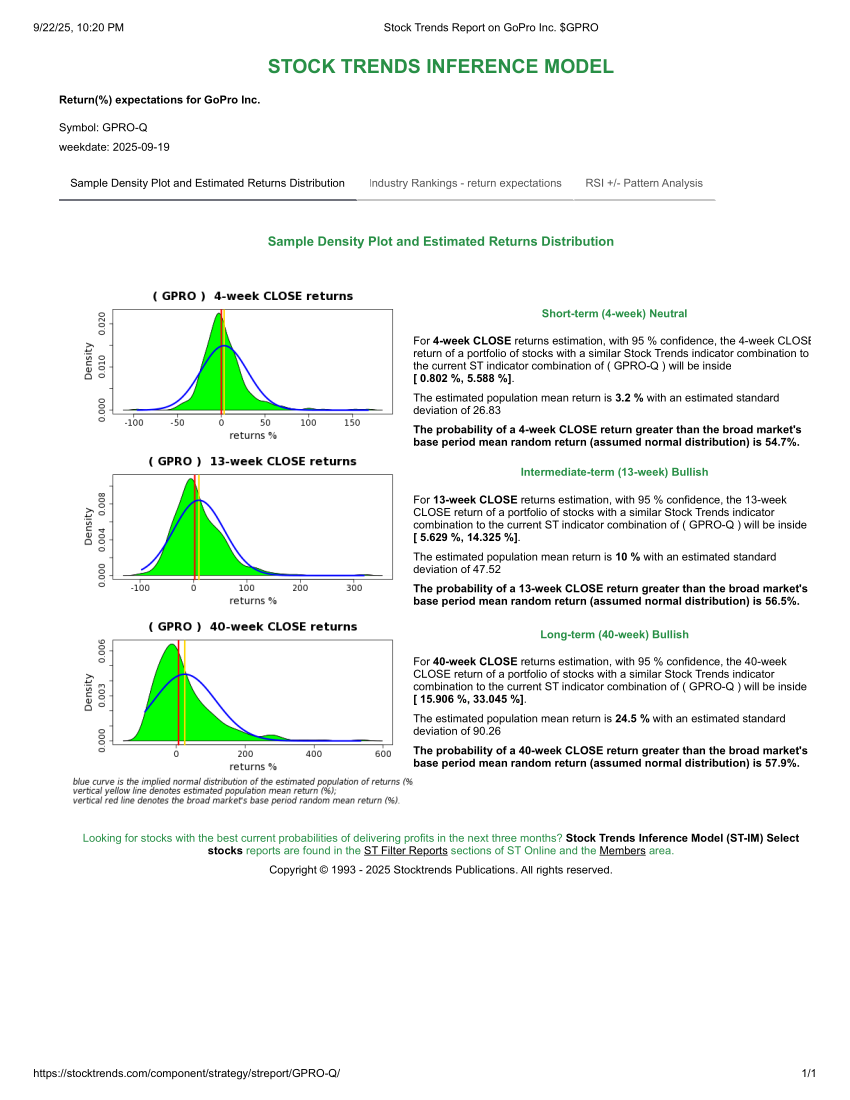

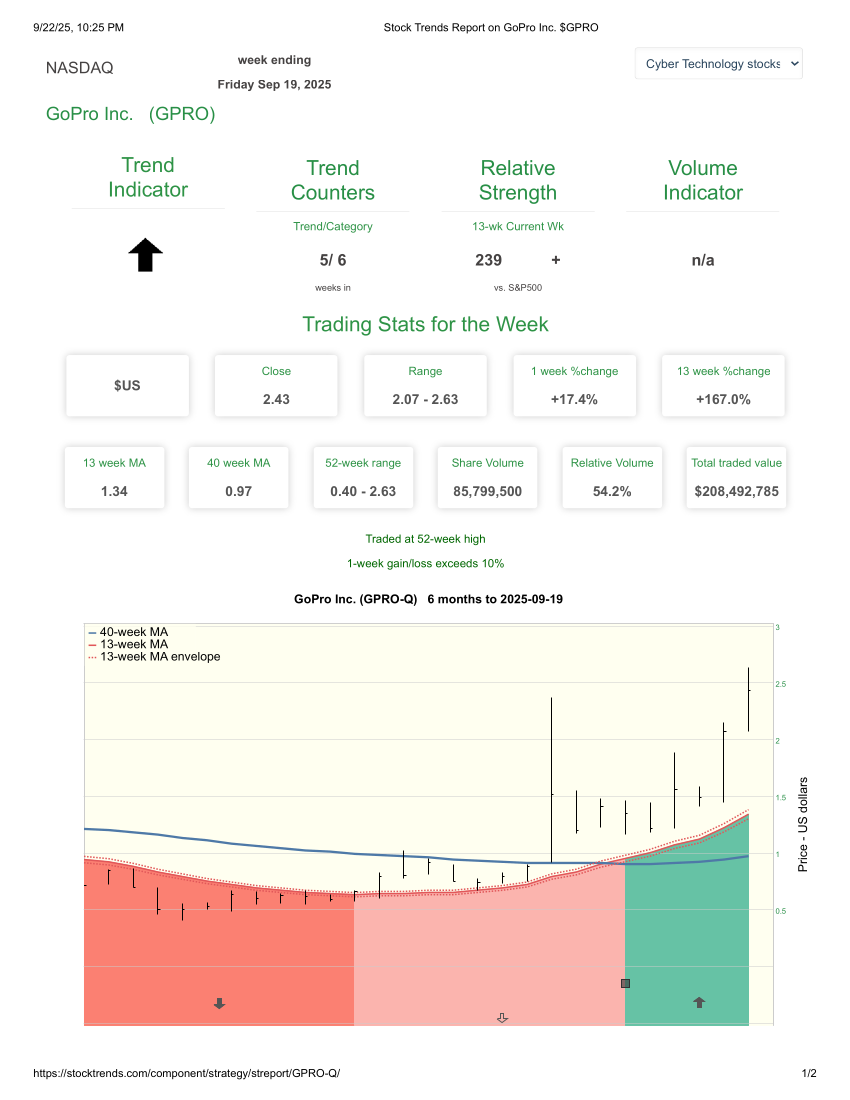

- GoPro (GPRO-Q) — Now running a subscription-anchored model, GoPro’s

trend, 56.7% probability of outperformance in the next quarter, and modeled double-digit forward returns confirm that restructuring is gaining traction.

trend, 56.7% probability of outperformance in the next quarter, and modeled double-digit forward returns confirm that restructuring is gaining traction. - Sony Group (SONY-N) — A diversified tech and media leader. The

trend and 56.1% probability of outperformance on the 13-week horizon reflect tailwinds from gaming and semiconductor demand. Strong yen movements may further bolster reported results.

trend and 56.1% probability of outperformance on the 13-week horizon reflect tailwinds from gaming and semiconductor demand. Strong yen movements may further bolster reported results.

| Symbol | Company | Sector | Trend | RSI | Probability of outperformance - 13wk horizon | 13wk horizon return estimate | 40wk horizon return estimate |

|---|---|---|---|---|---|---|---|

| GPRO-Q | GoPro Inc. | Technology | 239 | 56.7% | +10.2% | +24.5% | |

| SONY-N | Sony Group ADR | Technology | 106 | 56.1% | +6.1% | +10.3% |

Energy / Uranium: Divergent Performance, Nuclear in Focus

Energy is mixed. Oil stocks have faltered on weak demand forecasts, but uranium and nuclear remain strong. Governments are expanding nuclear capacity to meet both decarbonization goals and power demand from AI data centers.

Highlighted Stock:

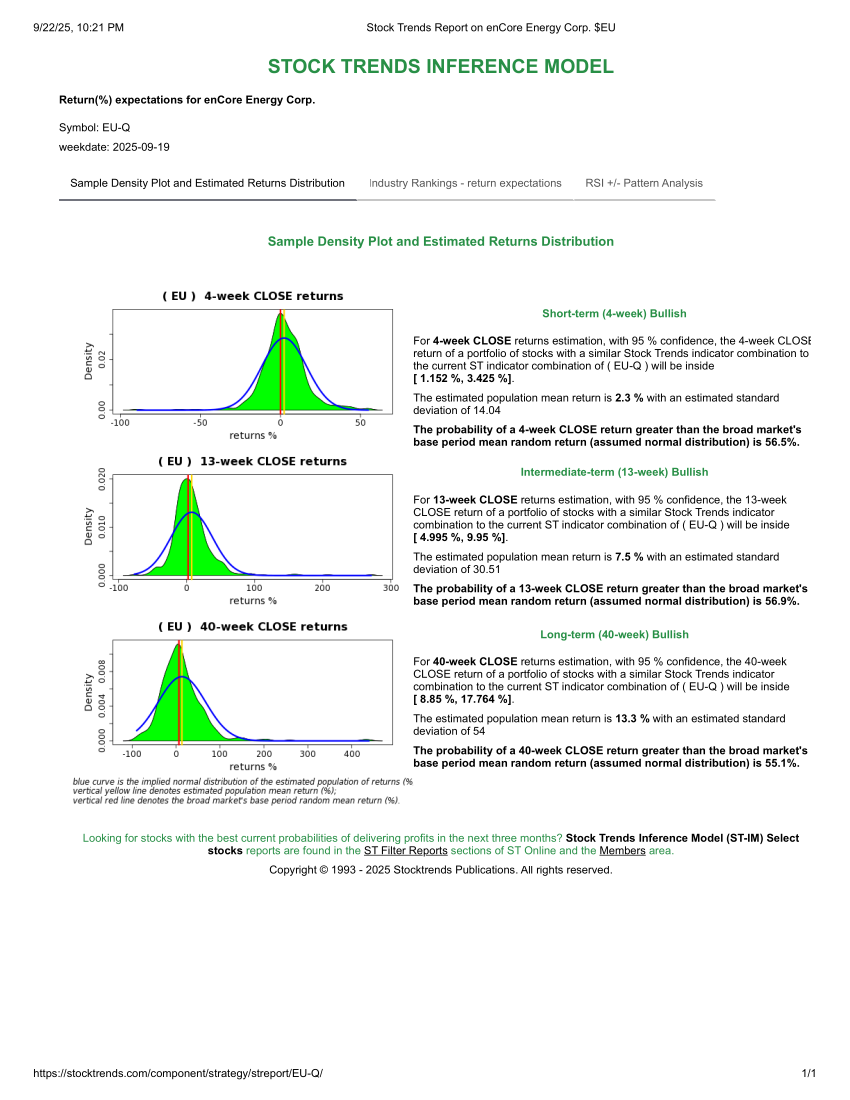

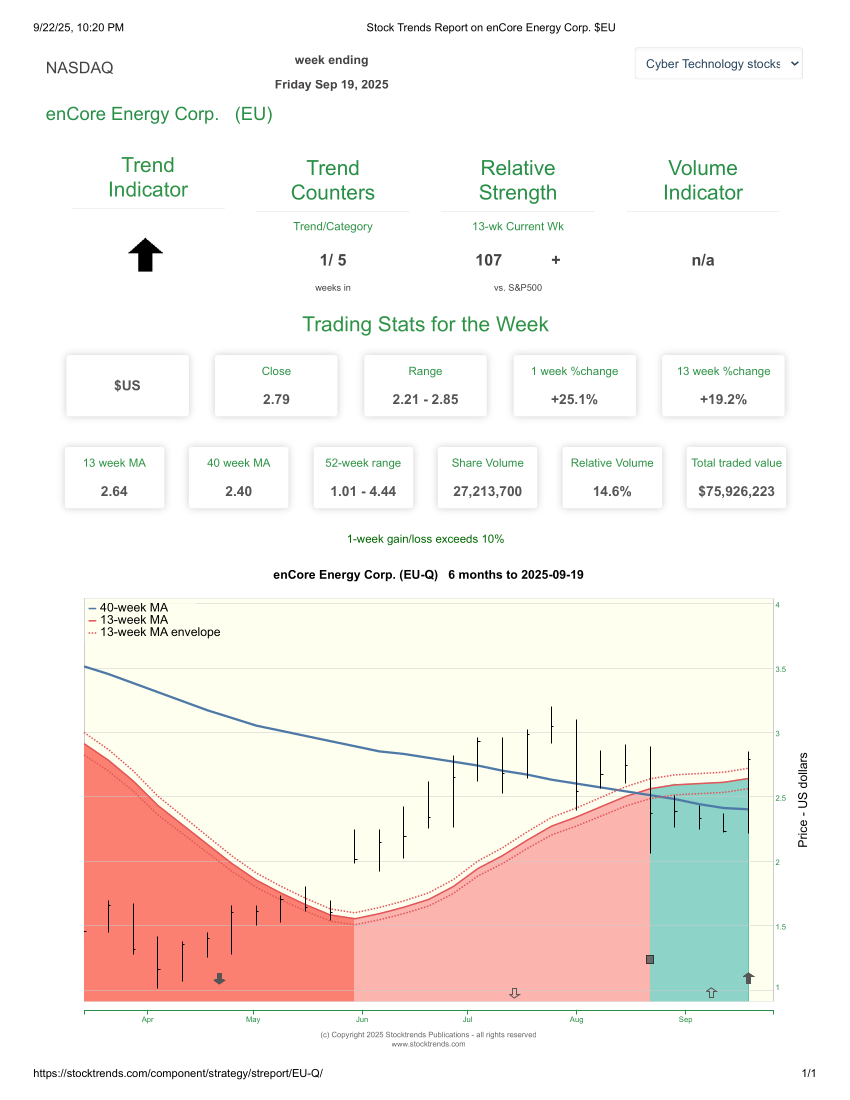

- enCore Energy (EU-Q) — A uranium producer, flagged

with a 56.9% probability of outperforming the benchmark in the coming quarter. Recent results showed improved uranium extraction rates and reduced costs. Despite short-term share price weakness, the macro case for nuclear strengthens its outlook.

with a 56.9% probability of outperforming the benchmark in the coming quarter. Recent results showed improved uranium extraction rates and reduced costs. Despite short-term share price weakness, the macro case for nuclear strengthens its outlook.

| Symbol | Company | Sector | Trend | RSI | Probability of outperformance - 13wk horizon | 13wk horizon return estimate | 40wk horizon return estimate |

|---|---|---|---|---|---|---|---|

| EU-Q | enCore Energy | Energy | 107 | 56.9% | +7.5% | +13.3% |

Investor Takeaways

The Fed’s September rate cut resets the playing field. The Stock Trends framework shows where investors can focus:

- Finance & Utilities — Immediate beneficiaries of easier money, with ATLO-Q and SNTG-Q showing aligned probability and trend strength.

- Technology — Selectivity is key. GPRO-Q and SONY-N combine the Strong Bullish trend with favorable ST-IM probabilities.

- Energy / Uranium — A narrower opportunity set, but EU-Q exemplifies how nuclear fits the secular and policy trend.

By filtering for ![]() trends, probability scores above 55, and confirming with RSI and volume signals, subscribers move from macro noise into actionable strategies. This disciplined approach is especially important in a changing interest-rate environment.

trends, probability scores above 55, and confirming with RSI and volume signals, subscribers move from macro noise into actionable strategies. This disciplined approach is especially important in a changing interest-rate environment.

Related items

- Stock Trends Mid-Quarter Review: How the Year-End 2025 Themes Are Performing in Q1 2026

- Stock Trends Year-End Analysis: Institutional Momentum, ST-IM Alpha, and the Road Into Q1 2026

- Understanding Our Assumptions — A Decade Later

- Trading Nvidia with the Stock Trends RSI +/– Pattern Analysis Model

- Navigating Market Turmoil in December 2025 – How Stock Trends Guides Investors

There is a lot to be gained from comparing trends of how individual stocks are doing within a sector, as well as how the sector is performing relative to the broad market.

There is a lot to be gained from comparing trends of how individual stocks are doing within a sector, as well as how the sector is performing relative to the broad market.