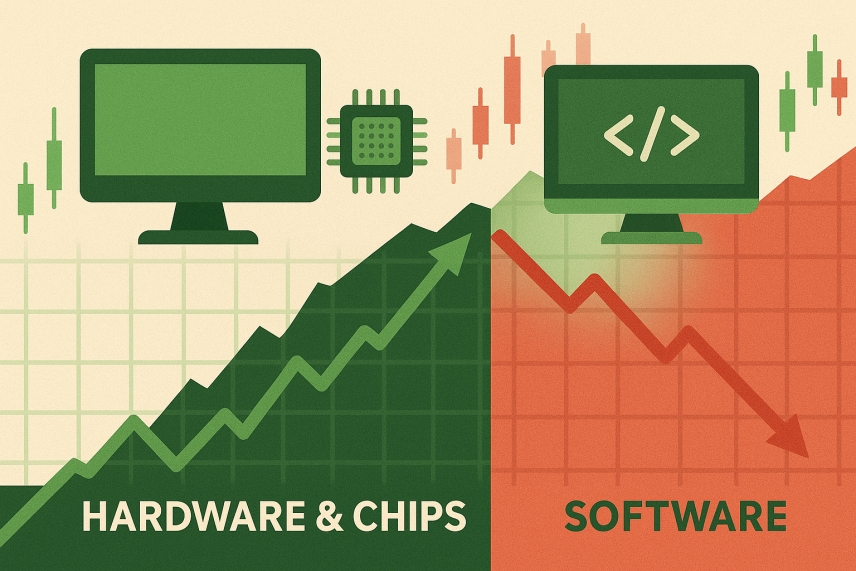

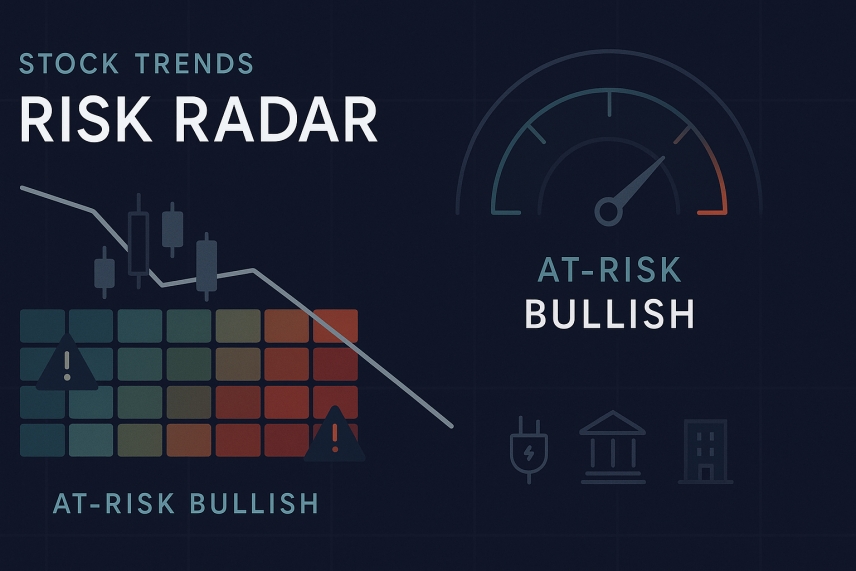

When the news broke that famed investor Michael Burry—whose 2008 “Big Short” foresight became legend—had placed large put options against Nvidia (NVDA) and Palantir (PLTR), the market reacted with a collective shudder. Within hours of the disclosure, technology shares that had led the 2025 rally wavered. Headlines proclaimed the “AI bubble” had met its doubter, and retail investors who had crowded into the artificial-intelligence narrative rushed to reassess. The initial pullback in high-beta technology stocks was swift, but not indiscriminate. Beneath the surface, the Stock Trends Weekly Reporter data from October 31 to November 7 revealed a precise rotation in trend strength—one that Stock Trends subscribers could see developing before it hit the newswires.

When the “Big Short” Turned Its Eye on Tech: Interpreting the Burry Shock Through Stock Trends Indicators

- Published in Stock Trends