The S&P 500 index is a size factor-based index that is not a good benchmark for measuring alpha (market intelligence). Naive portfolios generated by random sampling provide a better alpha benchmark.

The growth of passive investing has a lot to do with investors migrating to lower cost investment vehicles, but implicit in the migration to passive frameworks is a presumably lower risk metric. Investors want to be exposed to equities but don’t want to take risks beyond those inherent in the benchmark indexes they are investing in. Additionally, index investors are opting out of the risks of active management because the returns generated have recently not kept pace with the index benchmarks. But indexes are not what investors should be using as benchmarks. They don’t represent a truly passive approach to the market. The only truly passive approach to the markets is one that employs random portfolio construction.

Why random portfolios? Because all indexes are systematically biased by their factor premises. The prevalent index factor is size (market capitalization) but other factor frameworks include sector, industry, value, growth, momentum, and smart beta. Each of these index frameworks employs a systematic weighting of components based on predetermined valuation that aims to minimize variability of returns based on defined factors.

Take a look at the S&P 500 index. It’s the most traded index in the world - through ETFs like SPY - but more importantly is the primary benchmark for U.S. equities. The performance S&P 500 index guides investors in terms of relative performance of actively managed funds and ultimately is the most broadly used compensation metric of the asset management industry. The fees investors pay these managers and, ultimately, the employment, compensation and rewards these fees fuel depend on the structure of the index.

The S&P 500 index is first and foremost a members club. Stocks are included in the index by decision of a committee. Yes, constituent stocks must meet certain primary criteria - market capitalization (float adjusted weightings), liquidity, domicile, public float, sector classification, financial viability, and length of time publicly traded and stock exchange - but the criteria is set by a member board. And it’s set with a certain purpose in mind: the index is a gauge of large cap U.S. equities.

So we know that the SPX is a factor-based measure of U.S. equities - it tells us about the price movement of large-cap stocks. That should surprise few people. Implicit in this size factor is the fact that the SPX accounts for about 80% of the entire capitalization of the U.S. stock market. That’s a good chunk of the assets invested in this market.

However, the size factor weighting of the SPX is problematic when it comes to fulfilling the index’s role as a benchmark. The size bias distorts the benchmark performance and concentrates on the largest companies, often adding additional risk in those constituents because many are in the same sector or industry. In fact, the current weighting of the SPX shows that about 28% of the index weighting is in technology stocks. Further, the top 4 stocks by weight in the index are Apple, Microsoft, Amazon, and Facebook. The S&P 500 index has a decidedly tech bias at this time, a considerable sector risk for a benchmark index that is ostensibly supposed to track the overall performance of U.S. equities.

That may be a reasonably correct weighting of big cap U.S. equities, however it’s not a correct benchmark measure of alpha. Alpha is the intelligence that extracts investment returns above the market performance. A portfolio of stocks constructed with a size bias only tells us about the performance of the bias. It does not represent the performance of a naive portfolio - a portfolio of stocks that has no factor bias. A naive portfolio would not have a selection criteria that restricts to a subset of a given universe of stocks. It would be a portfolio derived from a set of randomly selected stocks.

Random portfolio returns give us an estimate of the returns that are built into the broad market. Irrespective of factors that deliver alpha, a measure of random portfolio returns tells us the returns a given market generates without having any specific intelligence about how to generate those returns. They are the returns that would be generated by an untrained monkey.

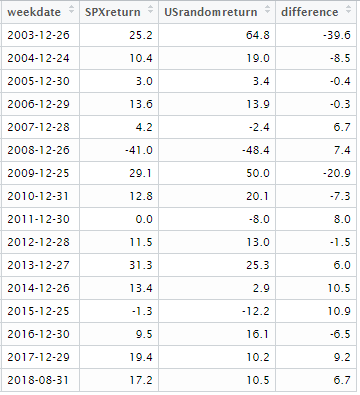

What have been the random portfolio returns of the U.S. equity market? How do they compare to the returns of the S&P 500 index? Below is an annual comparison of 52-week returns (%) of the market cap index and the mean (average) return (%) of randomly selected portfolios. The last column shows the differences in returns (%) between the market cap index (SPX) and the random portfolios.

The random portfolio returns are the mean return (%) of 1,000 randomly selected portfolios of 100 common stocks selected at the beginning of the return period. That would be equivalent to 1,000 different monkeys picking a 100 stock portfolio, then taking the average return of those 1,000 portfolios after the 52-week period. The universe of stocks from which these random portfolios are selected includes all NYSE/Nasdaq listed common stocks that have traded for at least 40-weeks trading at a price above $2 and weekly trading volume above 100,000 shares. That would be a universe of about 3,900 stocks.

Annual returns (%) - SPX and random portfolios

This summary tells us that the S&P 500 index has only out-performed the random portfolios in 7 of the last 15 years (2003-2017) and that the sum of the differences in return is -26.3%. The monkey would have outperformed the S&P 500 index over the period by a significant amount. However, we can also see that much of this outperformance comes in 2003 and 2009, both years where the overall market enjoyed exceptional returns after a bear market. Clearly, those were periods where the size bias of the S&P 500 index excluded it from returns that were delivered elsewhere in the market (small cap stocks, growth stocks, momentum stocks, etc.).

Presently, the S&P 500 index is providing excess returns above the benchmark represented by random portfolios. On the surface that tells us that portfolios weighted toward large cap - specifically large cap technology stocks - are outperforming the market. They will until they don’t. Investors should be aware of where their returns are coming from and where their risk is situated. The S&P 500 index is not a passive index. It is not market agnostic.

I have had the good fortune to be reasonably successful and enjoy the investment process. Your process would be recommended for both experts and those who are new to investing.

I have had the good fortune to be reasonably successful and enjoy the investment process. Your process would be recommended for both experts and those who are new to investing.