Expect Ferrari's stock (RACE) to continue to perform well thanks to strong product pricing and company profitability. A new generation of new economy wealth - especially crypto wealth - bodes well for the Ferrari demographic. Technical trend analysis indicates a short-term opportunity to enter a trade for new long-term positions.

Key Points

- In 2Q’21, Ferrari shipped 2,685 cars, an increase of 93% year on year compared to 2Q’20.

- Net profit for 2Q’21 increased from € 9.43 million to € 206.09 million compared with 2Q’20.

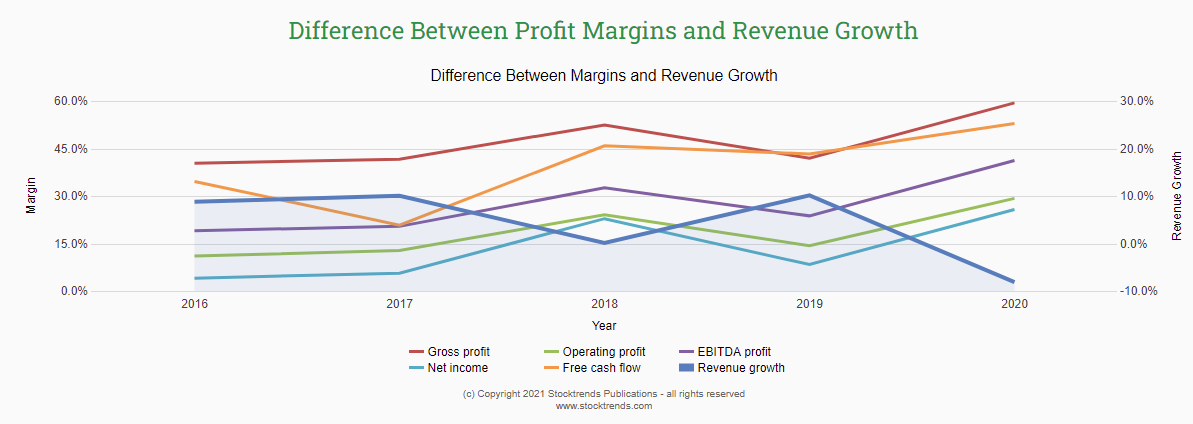

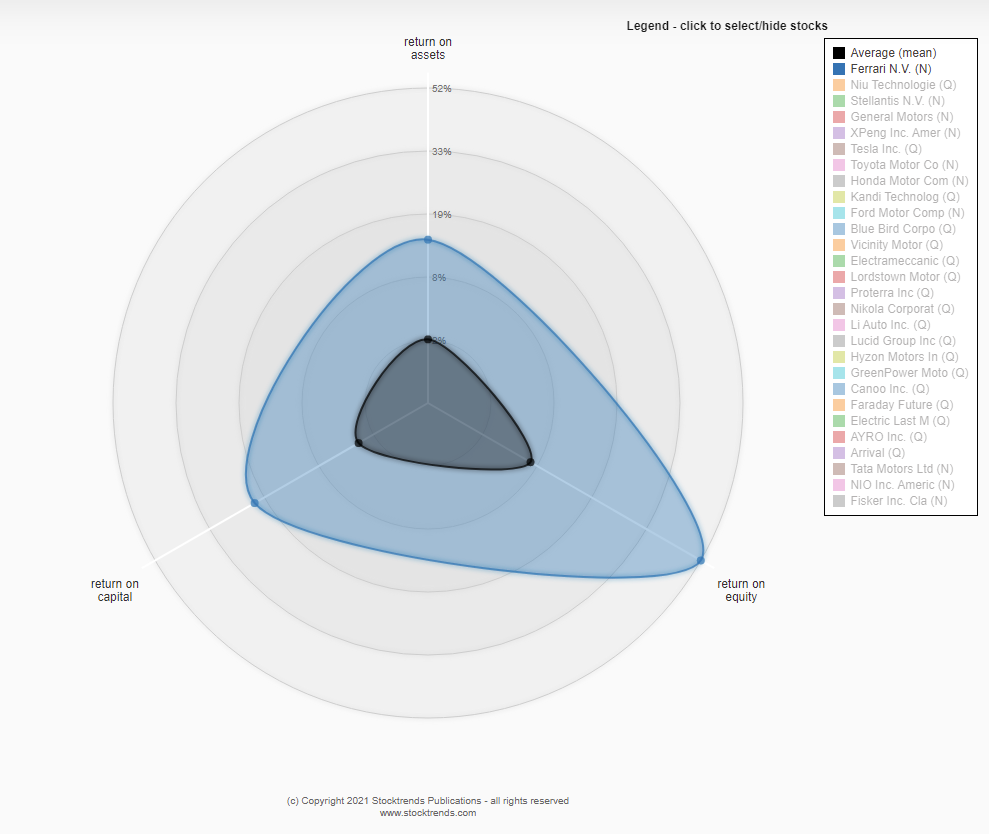

- Ferrari’s return on assets is around 15%, return on capital 21% and return on equity 53%, significantly above the industry average and highlighting management effectiveness of the Ferrari company in maximizing shareholder value.

- The company is busy working on new car models, with the 296 GTB being open for orders, and due to its V6 Hybrid, orders from younger customers are flowing in.

- Ferrari has teamed up with Sir Jony Ive, the British-American designer who defined the look of Apple gadgets, to develop the first Ferrari electric supercar.

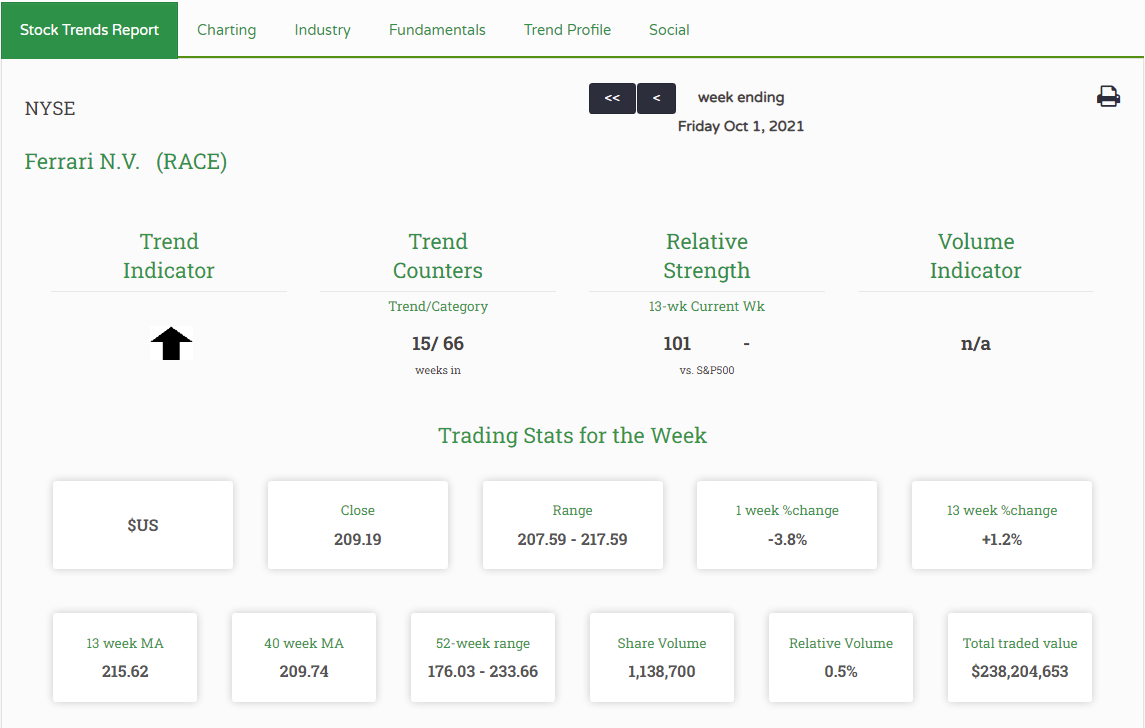

- Stock Trends statistical trend analysis indicates a good entry point for investors.

Crypto founder Richard Heart flexes his Ferrari Roma on social media. His digital asset HEX is the best performing crypto of 2020 and 2021 - creating incredible new wealth among its investors, many of whom aspire to own Ferraris and other luxury sports cars.

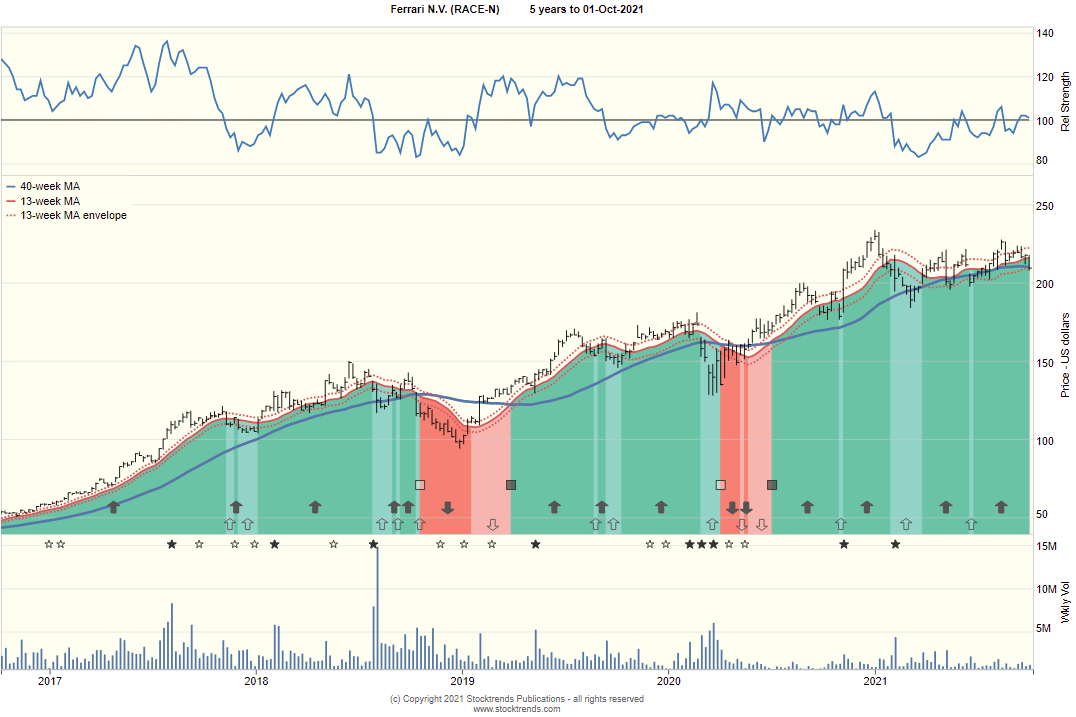

On the New York Stock Exchange, the company's stock has seen tremendous volatility in recent months, reaching highs of US$ 233.66 and lows of US$196. This price volatility may provide investors with a greater opportunity to buy RACE at a lower price.

Company Background

Company Background

Ferrari NV designs and manufactures sports cars. The Company offers new and used vehicles, warranty programs, financial services, and maintenance, as well as brand-enhancing watches, apparel, earphones, caps, and other accessories. Ferrari markets its products and brand worldwide. The COVID-19 pandemic, which prompted a seven-week production and delivery stoppage in the first half of 2020, had a negative impact on the company's costs as a proportion of net revenues, EBIT, and EBIT margin for the three months ended June 30, 2020.

The start of the 2020 Formula One World Championship season was pushed back from March to July, and there were only 17 Grand Prix races in total, five fewer than initially planned. In addition, most of the races, including Paddock Club and Paddock Guests, were held without the presence of the general audience. Due to a decline in sponsorships and resulting in reduced commercial earnings from partners and holders of Formula 1's commercial rights, these conditions had a negative impact on financial performance in the first half of 2020 (as well as the remainder of 2020).

All those challenges made Ferrari N.V. seem like a weak investment. However, during the recent two quarters the company’s EBIT margins increased and net profit margins stabilized.

Period |

Q3 2020 |

Q4 2020 |

Q1 2021 |

Q2 2021 |

| Revenue (€ Millions) | 888 | 1,069 | 1,011 | 1,035 |

| Number of cars shipped | 2,313 | 2,679 | 2,771 | 2,685 |

| EBIT Margins (%) | 25% | 23% | 26% | 26% |

| Net profit Margins (%) | 19% | 25% | 20% | 20% |

For the fiscal year 2021, the company expects net revenue of €4.3 Billion, an increase of 23% compared with fiscal year 2020. Ferrari expects its EBITDA to rise 33.7%-34.9% year over year in 2021, and adjusted EBIT margin to stay between 22.6%-23.7%. The basis for increased guidance is the resumption of normal operations, with the core business being sustained by positive mix and volume factors, and the company's ability to manage overall COVID-19 challenges they're facing.

Q2 2021 revenue increased led by:

- a €431 million increase in cars and spare parts,

- a €25 million increase in engines, and

- a €8 million increase in sponsorship, commercial, and brand licensing.

Q2 2021 EBIT increase was primarily attributable to the combined effects of:

- positive volume impact of €144 million and product mix impact of €113 million,

- an increase in research and development & selling, general and administrative costs of €17 million,

- positive contribution of €36 million mainly due to Formula 1 racing activities from brand-related and other supporting activities,

- negative foreign currency exchange impact of €25 million

Growth Prospective

As order books at Lamborghini, Ferrari, and Rolls-Royce burst with demand from the world's wealthy, the global recovery from the Coronavirus pandemic is restoring luxury carmakers' sales to never-before-seen heights. With three new models unveiled during the quarter, Ferrari saw record intake across all models and geographic regions. The company announced the appointment of Benedetto Vigna as its Chief Executive Officer on June 9 2021 and believes his deep understanding of the technologies driving much of the change in the industry, and his proven innovation, leadership, and business-building skills will further strengthen Ferrari and its unique story of passion and performance in the exciting era ahead.

To build its first electric supercar Ferrari has teamed up with Sir Jony Ive, the British-American designer who defined the minimalist look of Apple gadgets. Sir Ive will help Ferrari build upon its iconic brand with the new technology and design driving the company’s product offering to consumer demand for low emission, high-performance status vehicles. It expects to launch its first electric supercar in 2025.

The new Ferrari limited-edition V12 model is the ultimate expression of Ferrari’s concept of an extreme front-engine Berlinetta, honing the characteristics of the critically acclaimed 812 Superfast to a level never seen before.

Ferrari N.V. also appointed Charlie Turner to the newly created position of Chief Content Officer. Charlie joins Ferrari from his current role as Editorial Director for BBC Top Gear, where over the past decade he has overseen the growth and success of one of the largest global communities dedicated to the enjoyment of every aspect of cars and motoring. Expect Ferrari brand cultivation to even further elevate the company’s products among the global wealthy.

Ferrari N.V. has also announced that it has signed a multi-year cooperation arrangement with Richard Mille, which will see the Haute Horlogerie brand become the Prancing Horse's sponsor and licensee, another indicator of the tremendous value of the Ferrari brand represented by its very familiar emblem.

Conclusion

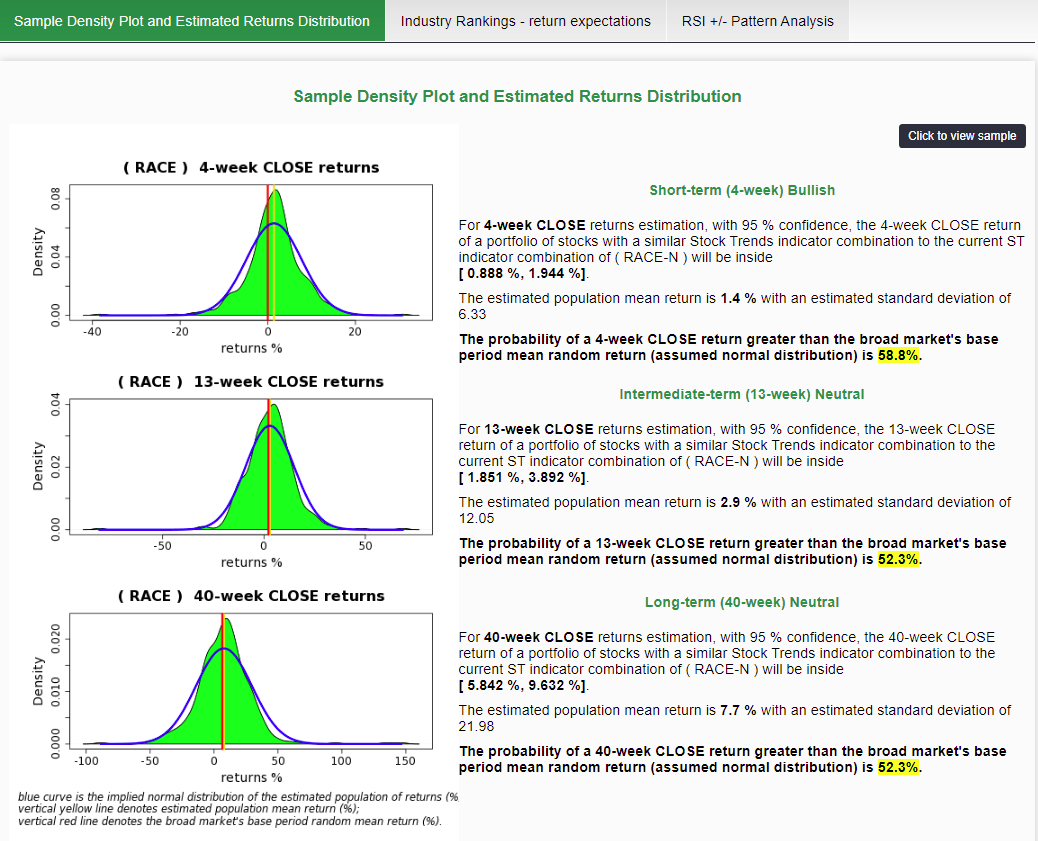

As we all know Ferrari is a global luxury car brand that commands considerable pricing power. Its company financials are thriving, considering revenue and profitability margins. Ferrari's share price is currently in a Stock Trends Bullish trend, although it has been unable to regain its all-time high attained at the end of 2020. The Stock Trends Inference Model predicts short-term market outperformance in the next month, but 13-week and 40-week return expectations are more market neutral.

In a nutshell, if you want to own Ferrari stock, you must be patient and have a long-term view of the company's growth potential. The Ferrari brand is impeccable and their products have consistent appeal to the expanding demographics of global wealth. External risks to the global economy have shown that that company revenue is not immune to downturns, but Ferrari has shown its ability to maintain its profitability.

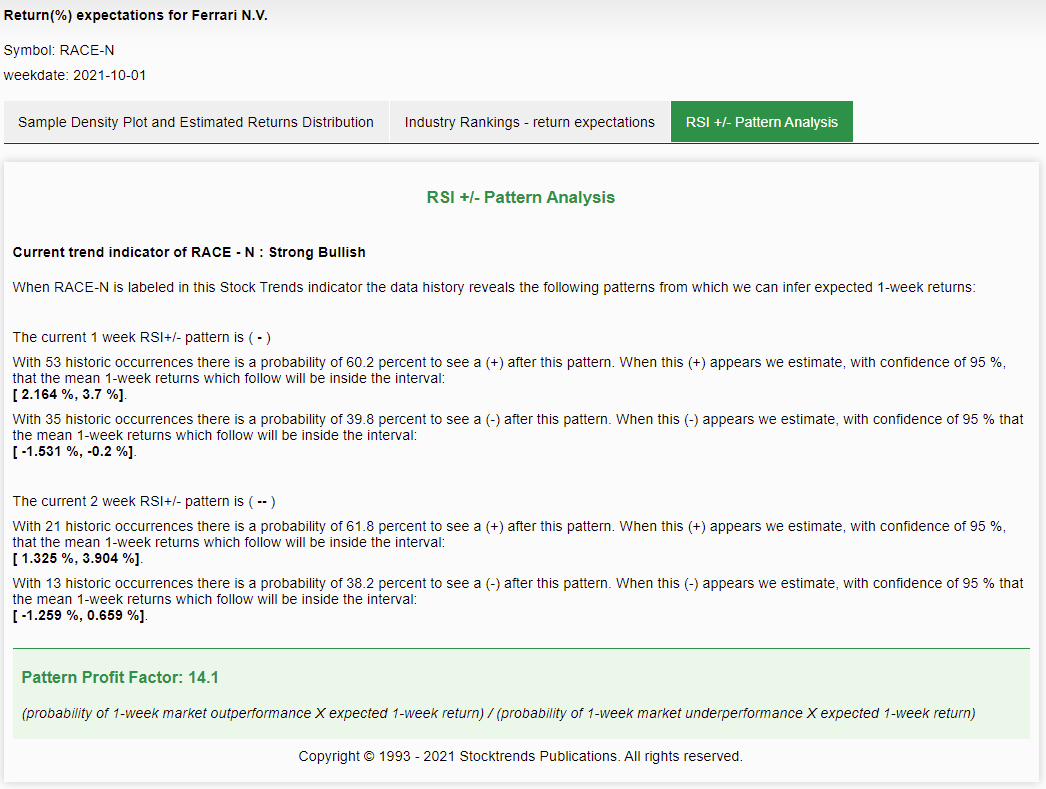

Investors looking to add Ferrari to their portfolio could view the current price ($209) as a good entry point as it has dipped to the primary trend line. Stock Trends’ statistical analysis of Ferrari’s share price trend indicates a move back to the stock’s upper range near $222 as its consolidation persists into Q4. The current Stock Trends RSI Pattern Analysis Model for RACE confirms that now is a good entry point with a higher probability of market outperformance in the coming week and a Proft Factor of 14.1.

A long-term outlook should help weather market risks as the Ferrari brand and its ability to maintain profitability will help extend its bullish primary trend. The company maintains the industry gold standard in terms of return on capital and return on equity. Ferrari’s return on capital is 21% while the industry average is 3%. Its return on equity is 52% while the industry average is 7%.

Quality investments are not independent of timing considerations for investors. Sometimes market conditions create an opportunity to enter into a trade more favorably for even long-term time horizons. Ferrari is a good example of this. Its Bullish price trend and the high standard of its brand and profitability signal quite favorably. RACE is a stock that will deliver ROI in style.

Sources:

1. New Ferrari limited-edition V12: the countdown has begun

https://corporate.ferrari.com/en/new-ferrari-limited-edition-v12-countdown-has-begun

2. Ferrari appoints Charlie Turner as Chief Content Officer

https://corporate.ferrari.com/en/ferrari-appoints-charlie-turner-chief-content-officer

3. Ferrari and Richard Mille sign a partnership contract

https://corporate.ferrari.com/en/ferrari-and-richard-mille-sign-partnership-contract

4. Ferrari appoints Benedetto Vigna as Chief Executive Officer

https://corporate.ferrari.com/en/ferrari-appoints-benedetto-vigna-chief-executive-officer

5. iPhone designer to help Ferrari create first electric supercar

https://finance.yahoo.com/news/iphone-designer-help-ferrari-create-065954660.html

Related items

- Understanding Our Assumptions — A Decade Later

- Navigating Market Turmoil in December 2025 – How Stock Trends Guides Investors

- TJX at New Highs — A Case Study in Long-Run Trend Persistence and Momentum Rotation

- Positioning for Opportunity: Trade Detente and Stock Trends Momentum

- Technology Sector Split: Hardware & Chips vs. Software – A Deep Dive with Stock Trends

I very much like the systematic approach to analyzing stock data, it fits my approach.

I very much like the systematic approach to analyzing stock data, it fits my approach.