The August 22, 2025 update of Stock Trends Weekly Reporter (STWR) shows that equity markets are being shaped by technologies that enable the next computing wave. Generative artificial intelligence, edge computing and ubiquitous connectivity are no longer abstract concepts – they are transforming demand for chips, satellites, and the physical real estate needed to house power-hungry data centers. To identify investable opportunities in this backdrop, we cross-checked the Stock Trends indicators (trend codes, trend counters, Relative Strength, and volume tags) with the Stock Trends Inference Model (ST-IM) probability scores using the most recent weekly dataset (week ending August 22, 2025) and the STWR Filter reports. Our objective was to find stocks whose short-term momentum is confirmed by longer-term return profiles, and to connect these signals to clear, real-world catalysts.

After screening the dataset for strongly bullish indicators (![]() codes with long trend counters), high relative strength, and ST-IM probabilities above 52 percent, three themes emerged:

codes with long trend counters), high relative strength, and ST-IM probabilities above 52 percent, three themes emerged:

- Semiconductor timing solutions and test equipment – stocks benefiting from generative-AI’s insatiable demand for specialized chips.

- Space-based broadband and satellite communications – a nascent industry deploying orbital networks to connect smartphones directly to space.

- Industrial real estate exposed to data centers – REITs that provide the warehouses and logistics infrastructure for AI-driven computing.

The sections below explain each theme, summarize the Stock Trends indicators for key stocks, and provide context from recent industry news.

Methodology

- Dataset screening: We loaded the August 22, 2025 universe file and filtered for stocks with a

trend (strong bullish trend). Additional filters required ST-IM probability (

trend (strong bullish trend). Additional filters required ST-IM probability (prob13wk) >= 52 %, relative strength (rsi) above 100, and a positive four-week return estimate based on the ST-IM (X4wk). - Indicator interpretation: The Stock Trends guide defines

as a strongly bullish trend,

as a strongly bullish trend,  as weakening bullish,

as weakening bullish,  as a bullish crossover and

as a bullish crossover and  as strongly bearish trend. The trend counter measures weeks in the current indicator, while

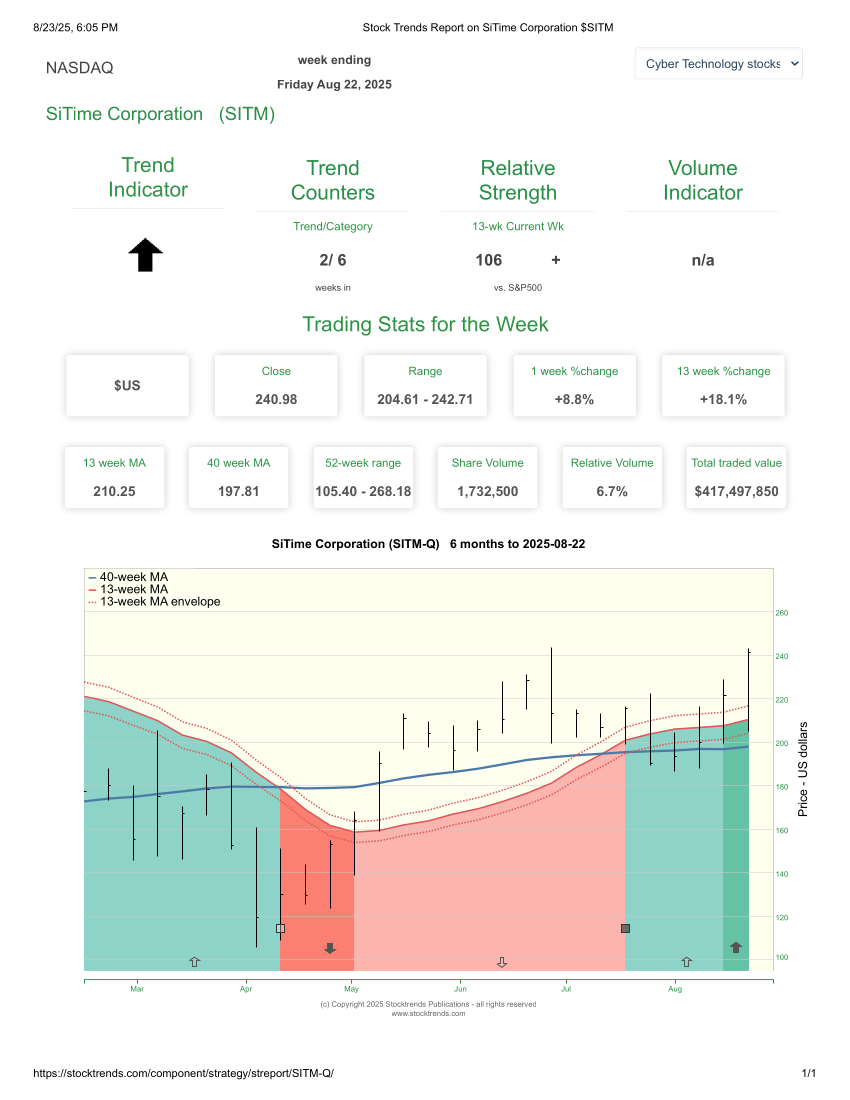

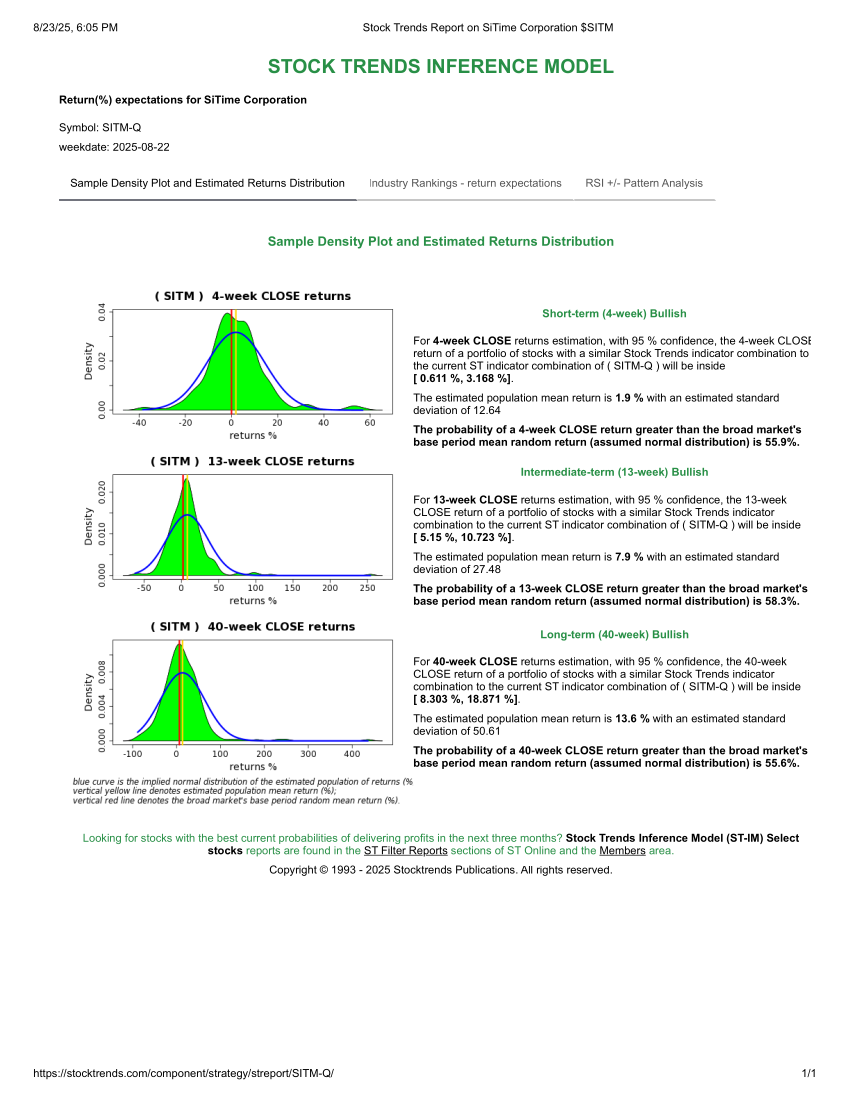

as strongly bearish trend. The trend counter measures weeks in the current indicator, while mt_cntcounts weeks in the underlying major trend (bullish or bearish). A relative strength value above 100 means the stock has outperformed the index over the past 13 weeks, and a “+” sign in thersi_updncolumn indicates relative strength improved in the current week. - Confirming ST-IM outputs: For each candidate, we visited the Stock Trends Report and its Trend Profile tab, which displays a sample density plot and estimated return distribution. For example, the SiTime (SITM-Q) Trend Profile shows that with 95 % confidence, a portfolio of stocks sharing SITM’s indicator profile is expected to deliver a 4-week return between approximately between 0.6 % and 3.2 %, with an estimated mean of about 1.9 % (short-term bullish). The dataset’s

prob13wkreports the probability that the stock will generate alpha and produce a positive return above the mean random base return of 2.19% over the next 13 weeks.

Theme 1 – Semiconductor Timing, Test and Control

Chip stocks surged in 2024–25 thanks to generative AI and data-center build-outs. Deloitte estimates that global semiconductor sales will reach US$697 billion in 2025, continuing the industry’s double-digit growth. A large part of this increase comes from generative AI chips; Deloitte notes that AI chips likely accounted for over 20% of total chip sales in 2024 and forecasts the market to exceed US$150 billion in 2025. Governments are also underwriting domestic manufacturing: on August 22, 2025, the U.S. government announced a US$8.9 billion investment in Intel to accelerate chip fabrication in Arizona.

Within STWR, several technology names from the semiconductor supply chain stand out. SiTime (SITM-Q) designs precision timing chips used in data-center and 5G equipment. Its ST-IM 13-week probability of 58.3 % of bettering its estimated 13-week return is 7.9 % - the highest among technology stocks in the current dataset. It trades in a strong bullish trend (![]() ), and relative strength (106) is improving. Aehr Test Systems (AEHR-Q) supplies test equipment for silicon carbide and semiconductor devices. Despite a slight downtick in relative strength (-), the shares remain firmly bullish with a probability of 55.4 % and an estimated 9.4 % gain in the 13 weeks ahead. Microchip Technology (MCHP-Q), a broad-line chip manufacturer, shows similar characteristics (see table below).

), and relative strength (106) is improving. Aehr Test Systems (AEHR-Q) supplies test equipment for silicon carbide and semiconductor devices. Despite a slight downtick in relative strength (-), the shares remain firmly bullish with a probability of 55.4 % and an estimated 9.4 % gain in the 13 weeks ahead. Microchip Technology (MCHP-Q), a broad-line chip manufacturer, shows similar characteristics (see table below).

| Symbol | Company/sector | ST trend | Trend counters | 13-wk return estimate | 40-wk return estimate | ST-IM 13-wk probability | Observation |

|---|---|---|---|---|---|---|---|

| SITM | SiTime – timing chips | 2 / 6 | 7.9 % | 13.6 % | 58.3 % | High-precision timing chips are critical for AI servers; ST-IM sees 4-wk mean return ˜ 1.9 % | |

| AEHR | Aehr Test Systems – semiconductor test | 4 / 5 | 9.4 % | 21.2 % | 55.4 % | Rising demand for silicon-carbide test gear; RSI elevated (184) but easing | |

| MCHP | Microchip Technology – mixed-signal chips | 2 / 7 | 6.0 % | 14.1 % | 56.1 % | Benefiting from industrial and automotive chip demand |

Why it matters: Generative-AI workloads require specialized timing, power-control and test solutions. Industry forecasts suggest that by 2028 the market for AI accelerator chips alone could reach US$500 billion. Companies like SiTime, Aehr and Microchip supply essential components to this ecosystem. The Stock Trends indicator framework confirms that these stocks are in the early stages of bullish cycles, while ST-IM probabilities above 55 % provide statistical confidence in their momentum.

Theme 2 – Satellite-based Connectivity

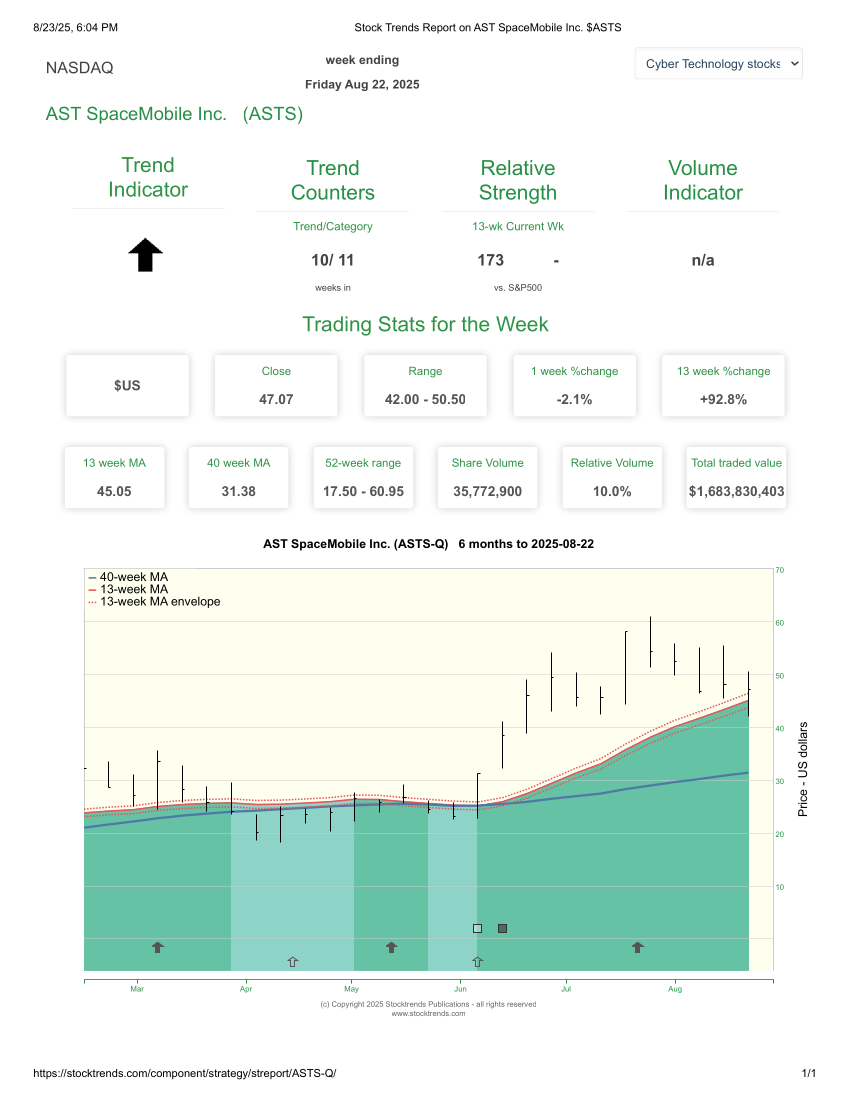

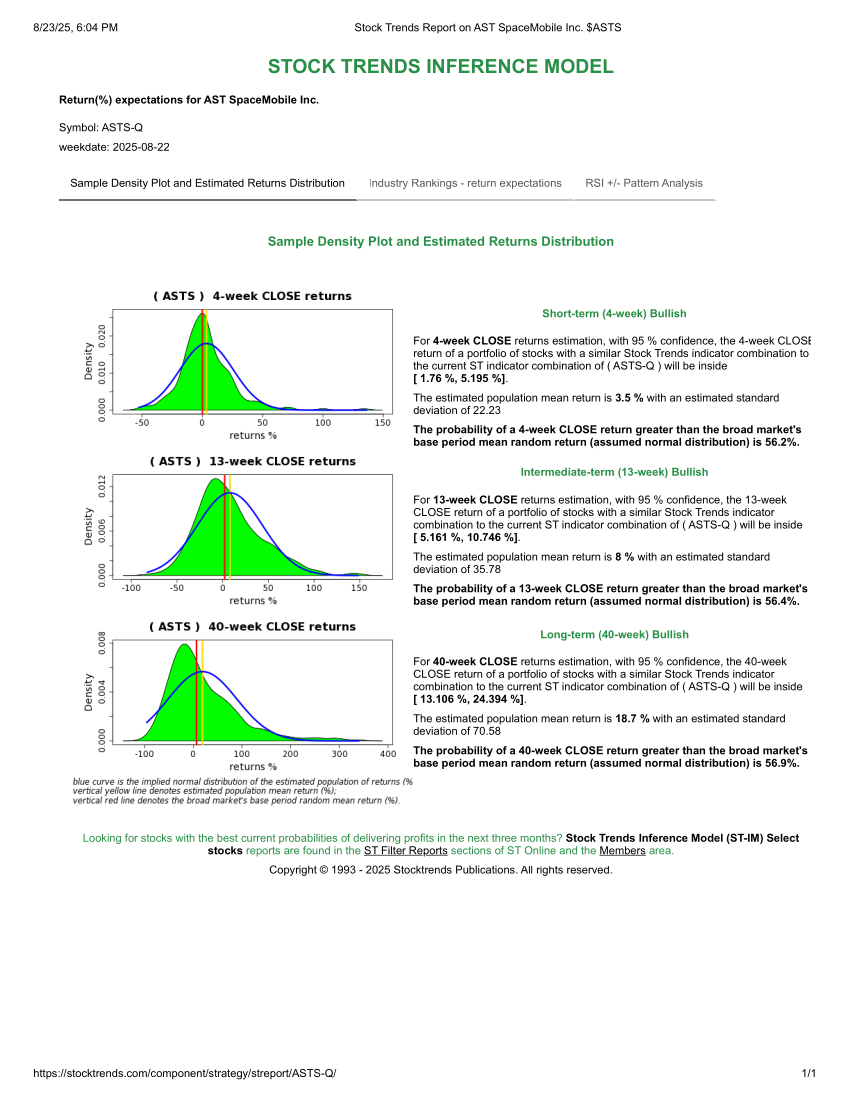

The race to deliver broadband directly from space is intensifying. According to an August 14, 2025 InvestorsObserver report, AST SpaceMobile (ASTS-Q) currently operates six satellites and plans to deploy 45–60 satellites by 2026. The company’s fully funded strategy includes launching satellites every one to two months and aims to offer continuous service in the United States, Europe, Japan and other markets. ASTS recently secured a US$43 million contract with the U.S. Space Development Agency, obtained priority S-band spectrum rights, and expects US$50–75 million in revenue during the second half of 2025. These milestones underscore the commercial viability of space-based cellular networks.

From a Stock Trends perspective, ASTS is firmly bullish. It has been in a ![]() trend for 10 weeks (major trend 11 weeks) and has an estimated 8 % return in the 13 weeks ahead. The ST-IM probability of 56.4 % suggests momentum could continue. Relative strength is high (173), although it slipped slightly in the most recent week (

trend for 10 weeks (major trend 11 weeks) and has an estimated 8 % return in the 13 weeks ahead. The ST-IM probability of 56.4 % suggests momentum could continue. Relative strength is high (173), although it slipped slightly in the most recent week (rsi_updn = –). The stock remains one of the top-ranked technology names in our screen.

| Symbol | Company/sector | ST trend | Trend counters | 13-wk return estimate | ST-IM 13-wk probability | Catalyst |

|---|---|---|---|---|---|---|

| ASTS | AST SpaceMobile – satellite connectivity | 10 / 11 | 8.0 % | 56.4 % | Deploying 45–60 satellites by 2026; new S-band spectrum rights support global broadband |

Why it matters: Satellite networks complement terrestrial 5G by providing coverage in underserved areas and enabling direct-to-device connectivity. As smartphone manufacturers integrate satellite modems, space-to-phone services could become a significant industry. ASTS’s aggressive rollout schedule and government contracts indicate growing confidence in the business model, while the Stock Trends signals highlight improving momentum.

Theme 3 – Logistics & Data-Center Real Estate

Artificial-intelligence workloads are also reshaping commercial real estate. Spending on U.S. data-center construction surpassed US$40 billion by June 2025, while spending on general office space fell to roughly US$44 billion. This is a dramatic reversal from 2021, when data-center construction was under US$10 billion and office spending exceeded US$65 billion. Analysts note that data centers now consume roughly 5 % of U.S. power, a share that could exceed 10 % by 2030. Cushman & Wakefield’s 2025 Global Data Center Market Comparison calls out AI and machine-learning workloads as key demand drivers and expects total capacity across regions to double over coming years. Developers are shifting projects toward suburban and rural sites with access to cheap power.

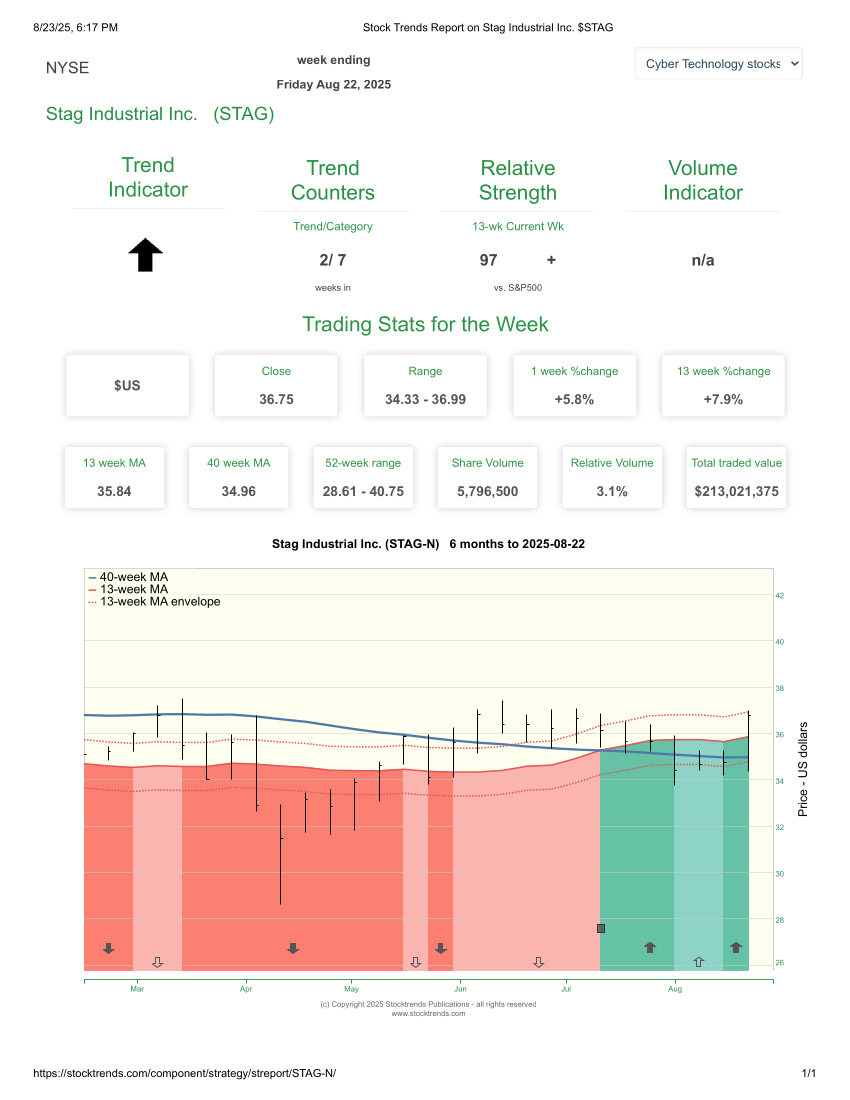

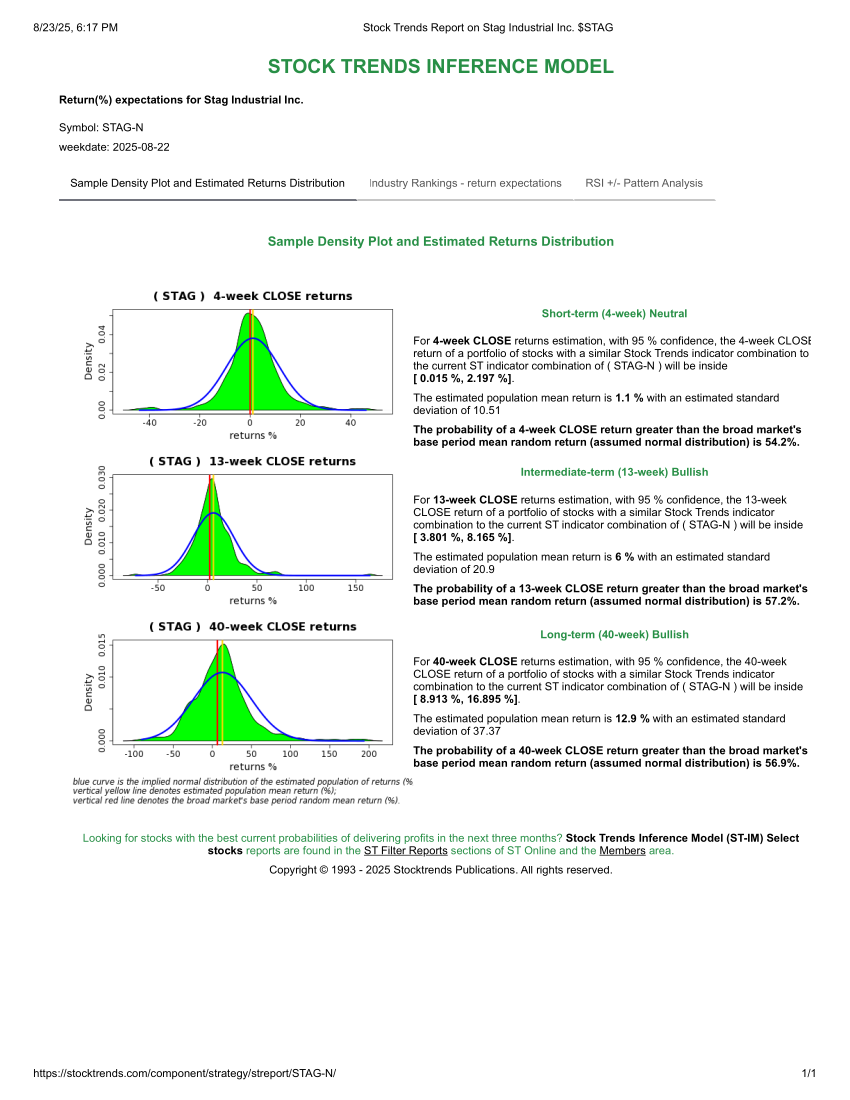

In this environment, industrial and logistics REITs exposed to data-center tenants stand to benefit. Within STWR the Stag Industrial (STAG-N) and Industrial Logistics Properties Trust (ILPT-Q) screen well. Both are in strong bullish trends, with ST-IM probabilities of 57.2 % and 52.7 %, respectively. STAG has only been in its current trend for two weeks (major trend seven weeks), suggesting an early-stage move, while ILPT has built a longer record with five weeks in its current trend and high relative strength (177). Their returns over the past 13 weeks (6.0 % and 4.7 %, respectively) reflect modest but improving momentum.

STAG Industrial stands as a compelling indirect play on the AI data-center boom. Its vast, high-quality logistics portfolio represents both a potential conversion opportunity and a supportive infrastructure layer for future AI data-center growth—indicating STAG as a meaningful real estate exposure to this high-growth trend. While ILPT doesn’t appear to be pivoting properties into data centers yet, its portfolio’s strategic structure and location embed it within the same infrastructure network that supports AI data-center expansion. This makes ILPT a meaningful indirect real estate exposure to the AI build-out theme, just like STAG.

| Symbol | Company/sector | ST trend | Trend counters | 13-wk return estimate | ST-IM 13-wk probability | Macro driver |

|---|---|---|---|---|---|---|

| STAG | Stag Industrial – industrial/logistics REIT | 2 / 7 | 6.0 % | 57.2 % | Data-center and warehouse demand rising; data-center spending now ~US$40 billion | |

| ILPT | Industrial Logistics Properties Trust – REIT | 5 / 6 | 4.7 % | 52.7 % | Logistics assets benefit as developers seek powered land outside city cores |

Why it matters: AI’s hunger for computing power is driving capital into data-center infrastructure. As hyperscalers and colocation providers expand, they need warehouses with robust power connections and access to fiber. Industrial REITs such as STAG and ILPT provide this real estate and are showing early bullish signals in the Stock Trends framework. The combination of secular demand and technical momentum makes the sector worth monitoring.

In addition to logistics‑oriented REITs like STAG Industrial and ILPT, the Stock Trends dataset shows how a handful of specialised real‑estate investment trusts focused on data‑centre and digital‑infrastructure assets are currently positioned. The analysis below covers American Tower (AMT), DigitalBridge Group (DBRG), Digital Realty Trust (DLR), Equinix (EQIX) and SBA Communications (SBAC). Each has exposure to the AI‑driven data‑centre boom, yet the Stock Trends indicators reveal diverging momentum: some are just entering bullish trends, while others remain in long bearish phases or show weakening signals.

| Symbol | Trend (weeks in trend / major trend) | 4‑wk return estimate | 13‑wk return estimate | 40‑wk return estimate | RSI | Observation |

|---|---|---|---|---|---|---|

| AMT | 0.06 % | 2.53 % | 5.24 % | 90 | Just entered a bullish trend; returns modest; RSI below 100. | |

| DBRG | 0.44 % | 1.99 % | 6.21 % | 92 | Early bullish trend; moderate returns; RSI still under 100. | |

| DLR | −0.66 % | −0.16 % | 5.91 % | 89 | Weakening bullish signal; negative short‑term returns; caution. | |

| EQIX | 1.53 % | 2.93 % | 6.37 % | 81 | Prolonged bearish trend; returns positive but momentum still weak. | |

| SBAC | 0.07 % | 2.91 % | 5.43 % | 88 | New bullish trend; modest gains; RSI under 100. |

Positioning for an AI future

Our analysis of the Stock Trends data and published STWR reports highlights how semiconductor suppliers, satellite-communication pioneers, and industrial REITs are positioned to benefit from the AI boom. Macro research underscores the strong tailwinds: semiconductor sales are on track for a record US$697 billion in 2025, generative-AI chips already account for more than 20 % of the market, the U.S. government is investing billions to expand domestic chip capacity, space-to-phone networks are rolling out dozens of satellites, and data-center construction is set to overtake office building spending.

While the Stock Trends indicator framework provides a systematic way to track trends and price momentum, the Stock Trends Inference Model helps quantify the probability that a trend will continue. In each of the highlighted names – SiTime, Aehr Test Systems, Microchip Technology, AST SpaceMobile, Stag Industrial, and ILPT – the ST-IM probability exceeds 52 %, indicating a statistically meaningful edge. Investors should still recognise that the semiconductor industry is cyclical and subject to policy risk, and that satellite and real-estate plays may face regulatory or funding hurdles. Nevertheless, the convergence of AI demand, communications innovation, and physical infrastructure investment suggests that these themes will remain central to market leadership in the coming quarters.

Stock Trends information is part of the base information I review before making a trade.

Stock Trends information is part of the base information I review before making a trade.