The Stock Trends Inference Model is built around two central premises. These assumptions are crucial legs on which technical analysis stands.

|

The Stock Trends Inference Model is built around two central premises: (1) market conditions are non-specific to a particular security, and (2) market responses to market conditions are specific. These assumptions are crucial legs on which technical analysis stands. They state that price and volume patterns are homogeneous across markets – that a bull trend in one instrument is comparable to a bull trend in another, for instance – and that future price movements can be inferred or extrapolated from these patterns. Let’s better understand this analysis departure point. The first premise might strike you as more of a theoretical foundation than an empirical one. How can we really say that market conditions – however defined – are structurally consistent among all stocks? How can the market conditions, at one point in time, of a highly liquid financial stock like Bank of America (BAC-N), for instance, compare to that of a technology stock like EchoStar Corp. (SATS-Q) or an industrial stock like Illinois Tool Works (ITW-N) at other points in time?

Average daily trading volume of BAC is over 100 million shares, while average daily trading volume of ITW is about 2.1-million shares and SATS only trades about 250,000 shares a day. The market cap of BAC is $175-billion. The market cap of ITW and SATS is $35-billion and $4.5-billion, respectively. There are significant differences in the size of the market for these stocks, and even bigger differences if we looked at small cap stocks that could be grouped with BAC based on our definition of equivalent market conditions – that is, similar Stock Trends indicator combinations. And certainly these stocks are different beasts in terms of their industry categories. Are price trends and price momentum in these various markets comparable?

When we say that market conditions are non-specific to a particular security we mean that the price mechanism balancing demand and supply is analogous, even if the range and scope of factors influencing that balance differs. Technical analysis places priority on price and volume change factors as inputs influencing a market equilibrium. Investors respond to the market through various signals of price, market breadth, and trading intensity. These market conditions are dynamic, constantly shifting the balance of supply and demand to a new equilibrium.

So, if the shares of Bank of America have been trending positively for two years but the relative price momentum over the most recent three month period is market-neutral – as the current BAC Stock Trends Report infers - we can say something qualitative about the return expectations of investors in BAC. Investors key on past returns - their stability as well as trajectory. As the character of returns change – increased volatility and trading volume, or diminished price momentum, for example – the relative demand for and supply of a security changes. It matters less that the market for the security is the size of BAC or the size of SATS – the same relative responses determine the change in price. Shareowners who want to capture returns or limit losses sell. Investors who see more value buy.

Because the Stock Trends indicator combinations codify a market condition (by categorizing trend, quantifying the length of trend and relative price momentum) we can apply our assumption about the non-specificity of market conditions and group indicator combinations. It is from these samples of ‘like’ indicator combinations that we can apply statistical inference methods.

However, we are applying these inference methods on a statistic of the sample – that is, subsequent returns (changes in price). Here we are invoking our second premise – that market responses to market conditions are specific. The qualitative conditions of a market are assumed to be an input variable. The subsequent change in price is said to be a response variable. The measurement of that response is the key component of the Stock Trends Inference Model. We want to know which market conditions result in the best response – the best probabilities of higher returns.

This approach is quite different from the typical technical analysis you will find. Much of technical analysis has to do with time series analysis. In its most generic, simplest form you will recognize this as classical charting techniques. Indeed, trend and price support lines are tools used to extrapolate price trajectory. This is the form of technical analysis that presents opinions about price objectives. It is the technical analysis that prognosticates about where the market is headed.

The Stock Trends inference Model departs from this kind of conjecture. Instead, it is a quantitative apparatus that suggests responses to market conditions are random, but centered around categorized populations. The model employs the trend categories and market metrics (RSI, volume indicators, etc.) as inputs, but its output is a probability statement. Elements of charting go in…but what comes out is a probability distribution. A stock is ranked highly not because its chart characteristics suggest it will rally. It is ranked highly because its probabilities of beating the market are favourable.

Previous editorials have emphasized the randomness of results. Also highlighted is the generalized assumption of a normal distribution of returns, which is the inherent distribution of random data. Evidence of randomness seems to challenge our second premise. How can we infer future price movements with such evidence? Much of technical analysis does not address this question. Indeed, the answer to it has to come from a quantitative science. The Stock Trends Inference Model attempts to reconcile with randomness by assuming it implicitly. It does that by inferring a normal population distribution. From this distribution we can calculate statements of probability.

Ultimately, the goal of this analysis is to provide a new ranking system. The system will allow us to evaluate existing Stock Trends reports like the Picks of the Week, or the Newly Weak Bearish reports. New reports can also be generated. These will highlight select stocks and ETFs with the highest probability of generating returns that are better than those expected for randomly chosen stocks.

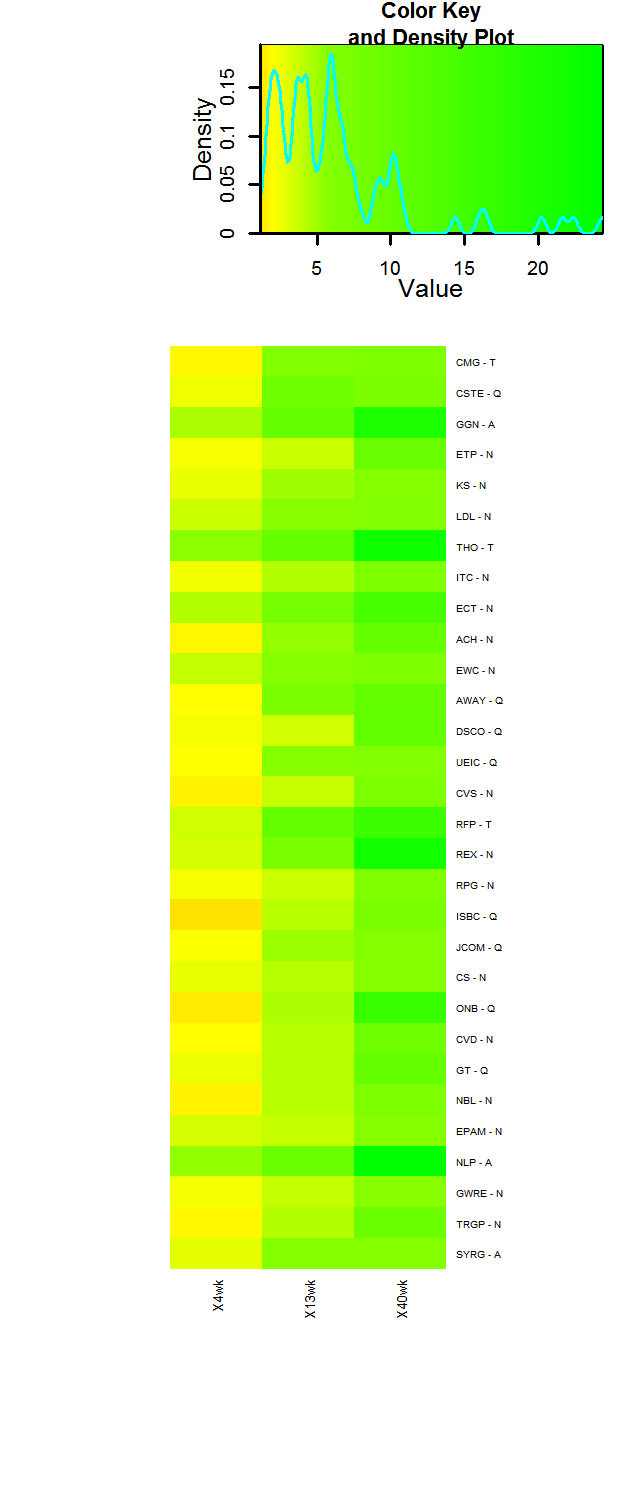

Below is a heatmap and associated table of the current top 30 ‘select’ stocks based on this ranking system. The colour coding shows us which have higher mean returns relative to the expected returns of randomly selected stocks for 4-week, 13-week, and 40-week periods. The scale of green intensifies as the mean return exceeds the period base return (4-week: 0%, 13-week: 2.19%, 40-week: 6.45%). Mean returns in the immediate area around the period base return are yellow, while mean returns below the period base returns intensify in redness as they sub-perform (this group is comprised of superior performers, so red codes will be largely absent).

To qualify for this select list the lower band of the 95% confidence interval of the population mean must exceed the mean returns of randomly selected stocks. Statistically this tells us that we are confident that there is only a 2.5% chance that the mean return of the inferred population is below the period base return. From this group we derive the normal probability distribution using the population mean and standard deviation, and then calculate the probability that a return will exceed the period base return. Stocks are ranked in descending order of the probability they will out-perform the 13-week base period return.

Stock Trends Inference ModelCurrent Select stocks

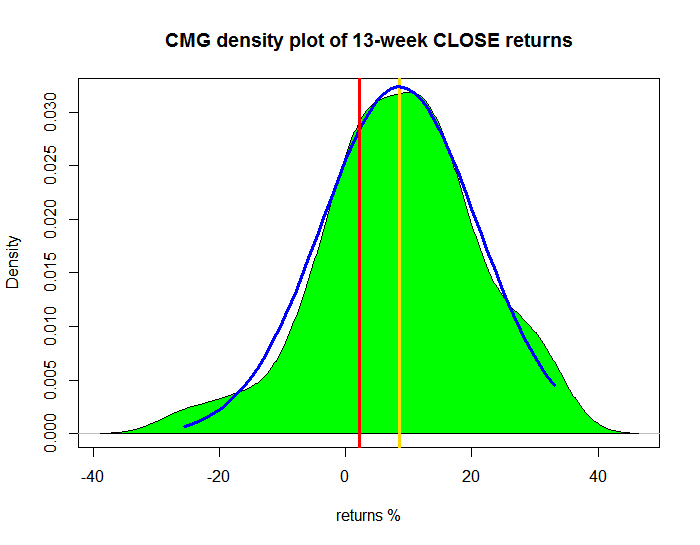

Below is the distribution curve of 13-week returns of stocks with similar Stock Trends indicator combinations to the current Stock Trends Report on Computer Modeling Group (CMG-T), the top stock in this select list. We can see how favourable the probabilities are for CMG to return above the base 13-week random return of 2.19%, represented by the red vertical line.

For 13-week returns distribution estimation, with 95 % confidence, the 13-wk mean return of the population of stocks with a similar Stock Trends indicator combination to CMG-T will be inside [ 5.59 %, 11.492 %]. Mean return 8.54% and standard deviation of 12.58 Assumed Normal Distribution:

|

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!