The Stock Trends value approach looks to find trading opportunities derived from systematic screening and inference analysis. Many gold and real estate stocks have been highlighted recently.

|

Usually when analysts look at the stock market they use a framework that is either market-centric or value-centric. Sometimes these are classified as top-down or bottom-up approaches, and they apply to both fundamental and technical branches of analysis. A market-centric framework looks at the market as a whole, assesses sector strengths and drills down to find specific trading opportunities that fit the best-of-breed theme. A value-centric framework looks at individual securities, finds value (fundamental or technical) opportunities and indentifies sector themes that either support a trade or expose it as a special situation.

Stock Trends is aligned with the bottom-up approach. The screening process employed here is an attempt to isolate trend and momentum trading opportunities. Thematic discussions (which orthodox technicians sometimes cynically refer to as “bedtime stories”) may lend credence to a trade, and certainly they are great for editorial purposes, but a quantitative methodology is more concerned with the mathematical foundation of a trading model. The reasons for a trade are defined by the logic of the model, not its output.

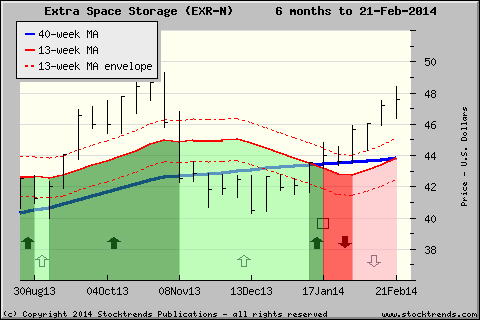

For instance, the current market conditions seem to suggest a rotation toward precious metals stocks. Our filter reports have highlighted some prominent gold plays. Other themes are evident as well, including a rotation to the real estate sector. But the trading models propagated here don’t take methodology beyond the value metric defined by the filter reports or the statistical inference model being introduced here. Patterns evident outside the models are, for lack of a better word, extraneous.

As an investor or an investment professional you may be concerned with context. Perhaps you even need to find your own rationale for a trade that colours beyond the algorithmic pale. This is a human need. It’s why the financial sector is so good at writing bedtime stories, why talking heads on business television sound so convincing when they present such refined tableaus of the economy, of market dynamics, of monetary and fiscal policy. Whether peddling feel good market positivism or the death stare of Dr. Gloom, analysts and commentators are gifted narrators and oracles. They give investors a sense of order in the midst of chaos.

However, as an algorithmic trader it is not necessary to strive to be all-knowing of market order – or even assume that any order exists. It is only necessary to understand the assumptions and methods of your model. In the case of the Stock Trends reports, as well as the inference model elaborated on again below, the output is based on a defined methodology and its implicit assumptions.

The task of a trader to translate the model’s output into a trade setup that executes a trading plan. The Stock Trends model trading strategies are examples, but there are other trade setups that can be employed using alternate plans. At some time we’ll start looking at trade setups that involve stock options, but it is important for investors new to this approach realize that the Stock Trends methodology is more about translating technical analysis into systematic trading.

Our bottom-up value approach (“value” in the world of technical analysis is based on market price and volume parameters, not financial parameters of fundamental analysis most often referred to as “value” by the broader investment business) derives regular weekly output. Let’s look at some of these reports and see how our inference model ranks the performance probabilities of the stocks in these reports.

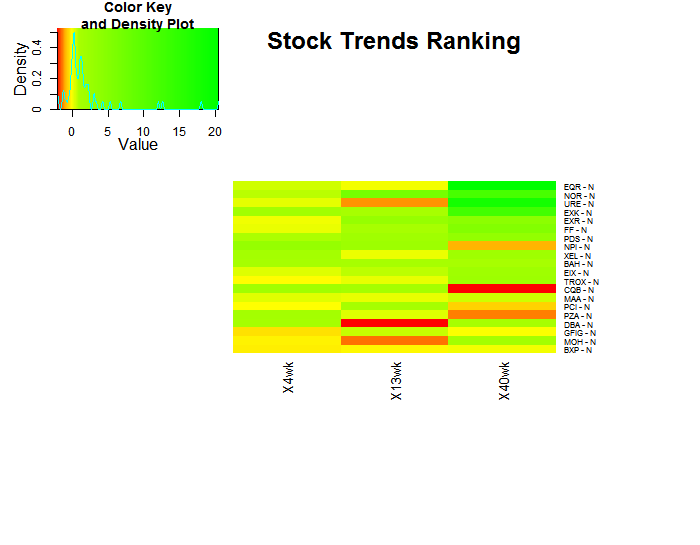

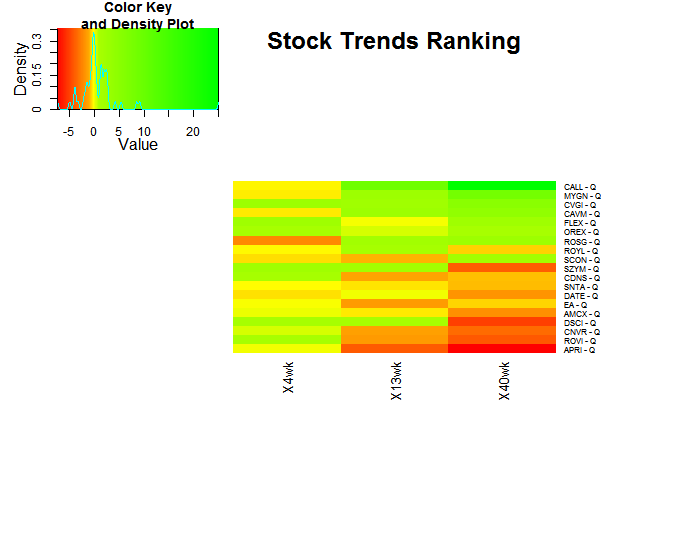

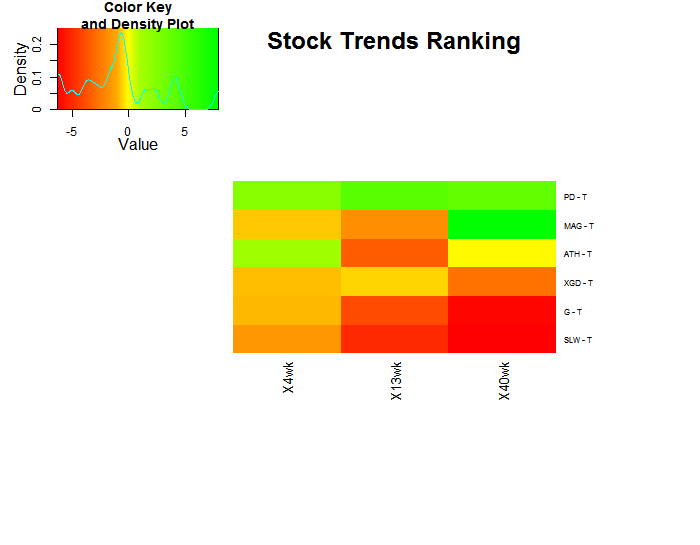

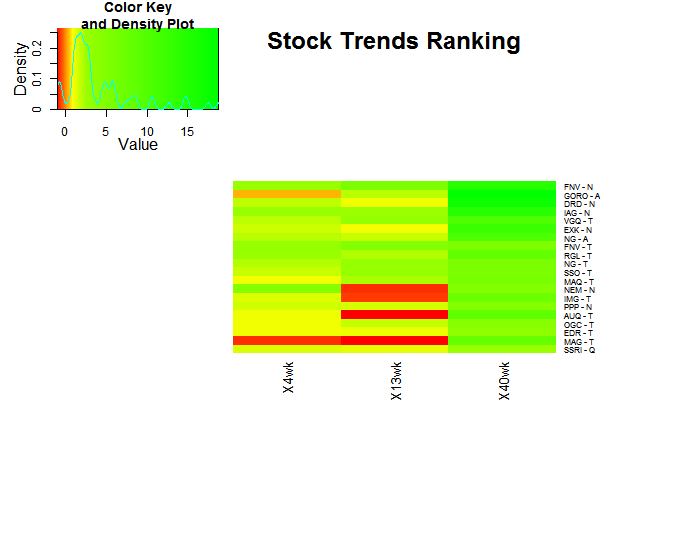

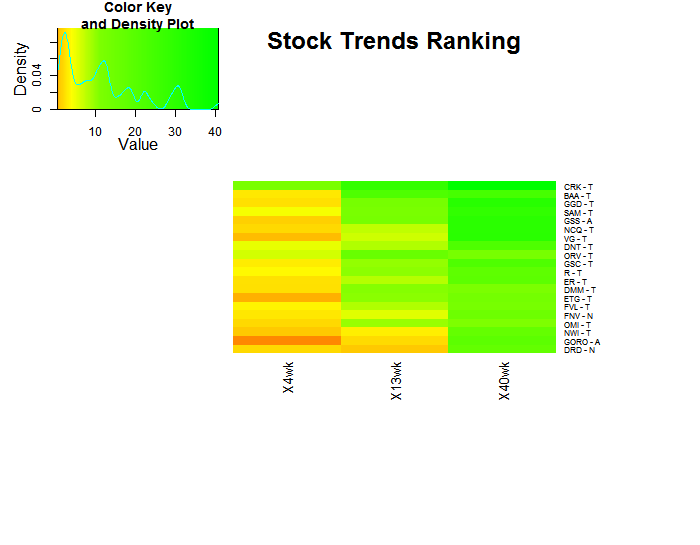

Below is a heatmap showing the current top Picks of the Week and gold stocks as ranked by the Stock Trends inference model (introduced in recent editorials). Of these filter groups - current Picks of the Week, and gold stocks - these stocks have the best probabilities of beating the expected returns of a randomly selected stock. We'll be moving toward creating new reports that detail these rankings for other groups, as well as reports that show over-all ranking derived from the inference model.

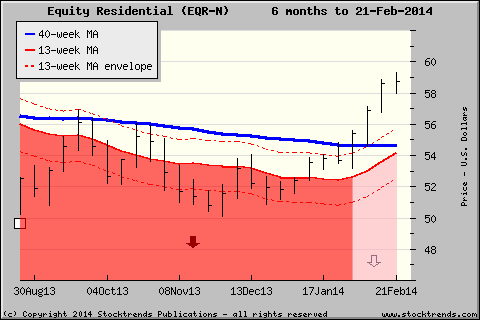

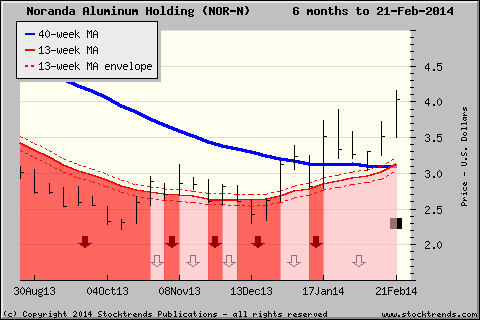

Picks of the WeekNYSE  2. Noranda Aluminum Holding (NOR-N)

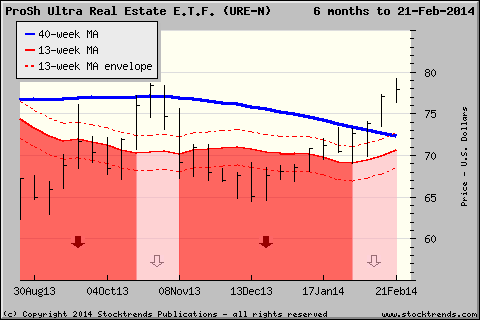

3. ProShares Ultra Real Estate E.T.F. (URE-N)

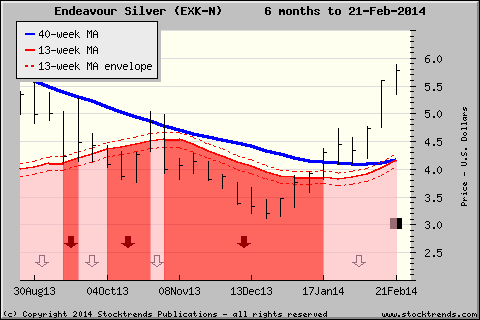

4. Endeavour Silver (EXK-N)

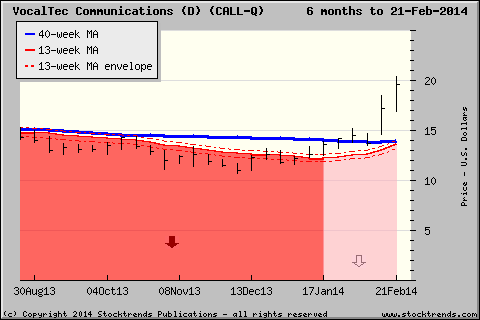

Nasdaq 1. VocalTec Communications (CALL-Q)

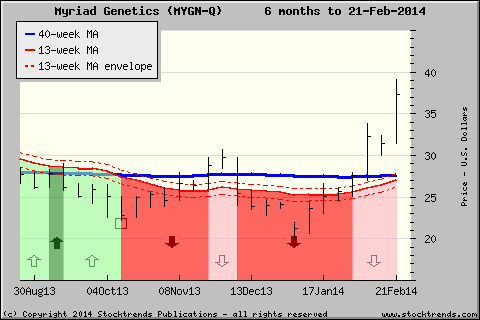

2. Myriad Genetics (MYGN-Q)

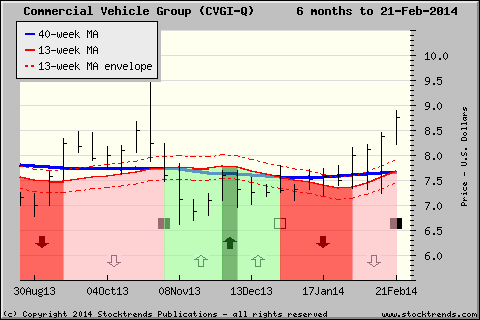

3. Commercial Vehicle Group (CVGI-Q)

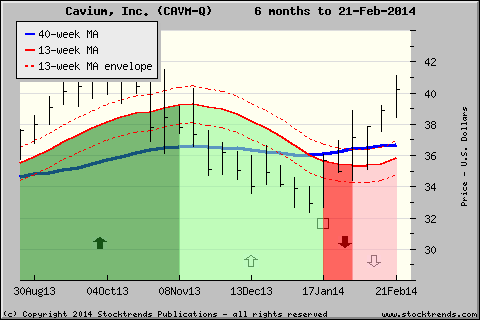

4. Cavium, Inc. (CAVM-N)

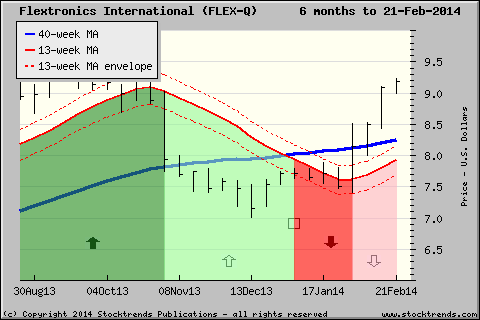

5. Flextronics International (FLEX-Q)

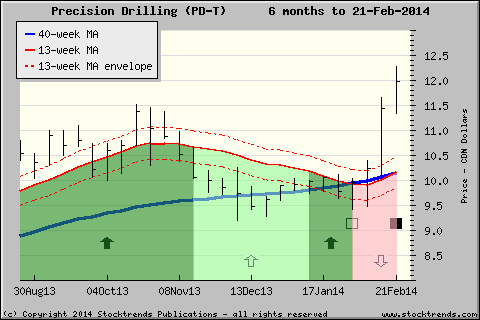

TSX 1. Precision Drilling (PD-T)

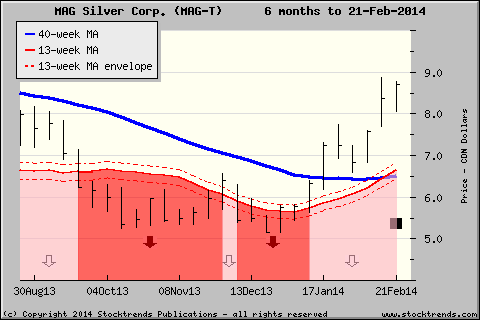

2. MAG Silver Corp. (MAG-T)

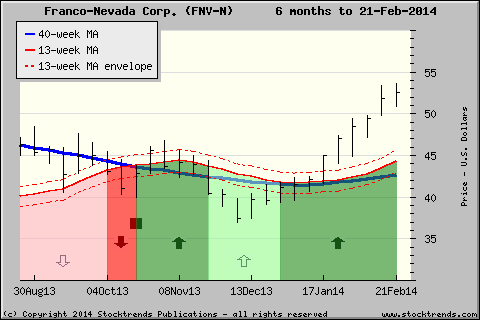

Top Gold stocks (price >= $2) 1. Franco-Nevada (FNV-N)

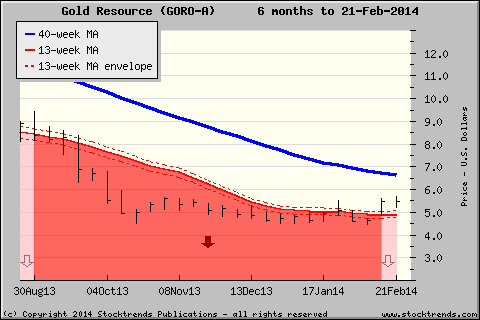

2. Gold Resource (GORO-A)

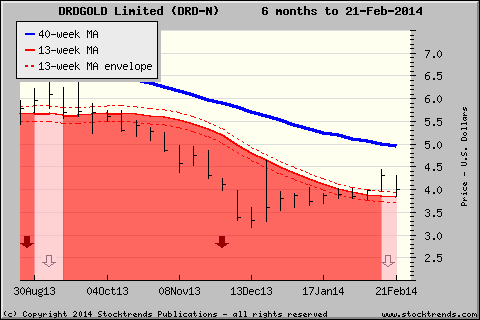

3. DRDGOLD Ltd. (DRD-N)

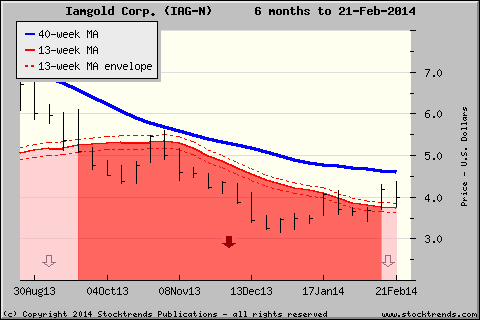

4. Iamgold Corp. (IAG-N)

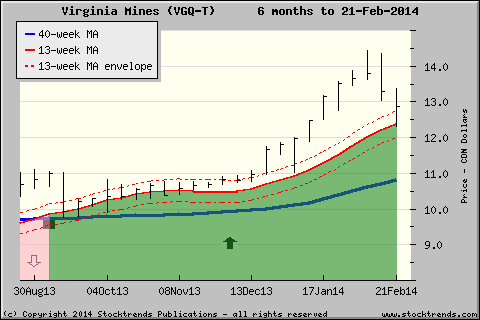

5. Virginia Mines (VGQ-T)

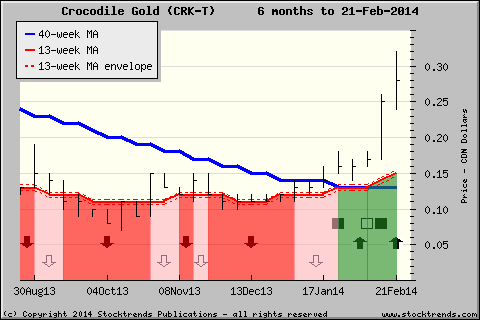

Gold stocks (all): 1. Crocodile Gold (CRK-T)

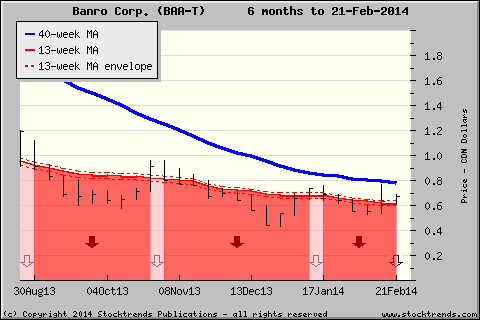

2. Banro Corp. (BAA-T)

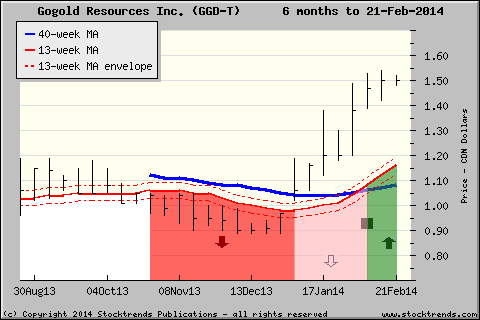

3. Gogold Resources (GGD-T)

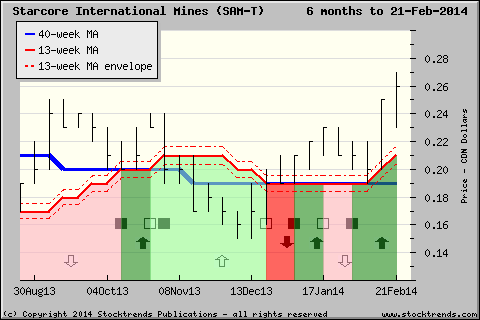

4. Starcore International Mines (SAM-T)

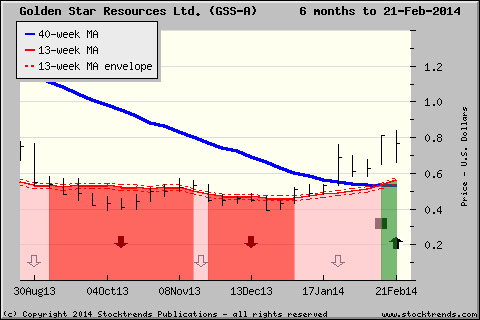

5. Golden Star Resources (GSS-A)

|

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.