The Stock Trends inference model’s random benchmark looks at all returns possible. Universal returns are market agnostic – they are not framed by the boundaries of the moment. That is true randomness. We do not know what to expect. Anything is possible.

|

Behind all of the statistical modeling Stock Trends is gradually unveiling there is an attempt to break down the weekly data reports into probability distributions that give the trader an estimate of the odds of success. Success is measured in terms of relative performance against the expected returns of a randomly selected stock. This benchmark needs elaboration. The Stock Trends inference model defines the randomness of the market in a universal way - returns are not time specific. That means that we are referring to outcomes across all time frames, all markets, and all events. We are referring to a true population of returns.

This differs from the subjectively influenced range of outcomes that we see at any moment in time. For instance, at this moment in time the market might appear to present a certain bullish trend and typical analysis approaches build in expectations of price movement associated with aspects of the analysis (chart patterns, fundamental ratios, etc.). Those subjective evaluations of potential outcomes (whether the analysis reveals a highly bullish or highly bearish scenario) generally present only a subset of universal returns. These potential outcomes are rooted in expectations of the moment.

The Stock Trends inference model's random benchmark looks at all returns possible. Those returns are derived from every market type, including markets of ‘irrational exuberance’ as well as the gravest financial meltdown. Universal returns are market agnostic – they are not framed by the boundaries of the moment. That is true randomness. We do not know what to expect. Anything is possible.

When we look at large samples random returns match the long-term market expectations – basically 8 percent annually. Actually, the expected mean annual return of a randomly selected stock, across time, is about 8.6%. Taking period returns of approximately 500,000 random stocks from the Stock Trends 30-year weekly data, the estimated population parameters for the following periods are derived:

4-week mean return: -0.05%, standard deviation: 33.15

13-week mean return: 2.19%, standard deviation: 44.11

40-week mean return: 6.45%, standard deviation: 76.81

Obviously, the dispersion of results is quite wide. A random trade is as likely to be a double bagger as a money pit. Even more moderate ‘aggressive’ trading expectations are constrained by the same rules of the assumed normal distribution. Looking at the 40-week period for example, a random trade has a 48.1% chance of a return greater than 10%, but also has a 41.5% chance of a return less than -10%.

Assuming a normal distribution of returns for the population, we should be reminded that a binary implication of this is humbling for the trader. A trader’s odds of beating the mean return for any period are 1:2, or 50%. This is the situation most investors are in – they are at risk of entering the market at the worst of times or best of times depending on their investment life cycle, but will average out toward these mean values as we sample more and more trades over generations or multiple market cycles.

Most traders probably don’t think this way. Typically, they expect to be right and are trading because they believe they can do better than the market or that they are entering the market at an opportune time. After all, why trade if you can’t do better than an index fund or, alternatively, by not exposing to equity risk at all?

The Stock Trends inference model looks at trading as a kind of binary random outcome – heads to beat the market expected return, tails to do worse. Anyone who has experience in flipping coins knows that even a ‘fair’ coin can deliver an outcome – even lengthy series of outcomes - that seemingly defies the probabilities. A fair coin can deliver 10 consecutive heads (or tails) in the first 10 flips, for instance, 0.0977% of the time. More relevantly, over the span of 50 flips the probability of 10 consecutive heads (or tails) is 2% - certainly not impossible. This is known as a ‘run’, and every active trader has experience with both winning runs and losing runs. Every trading system will produce them.

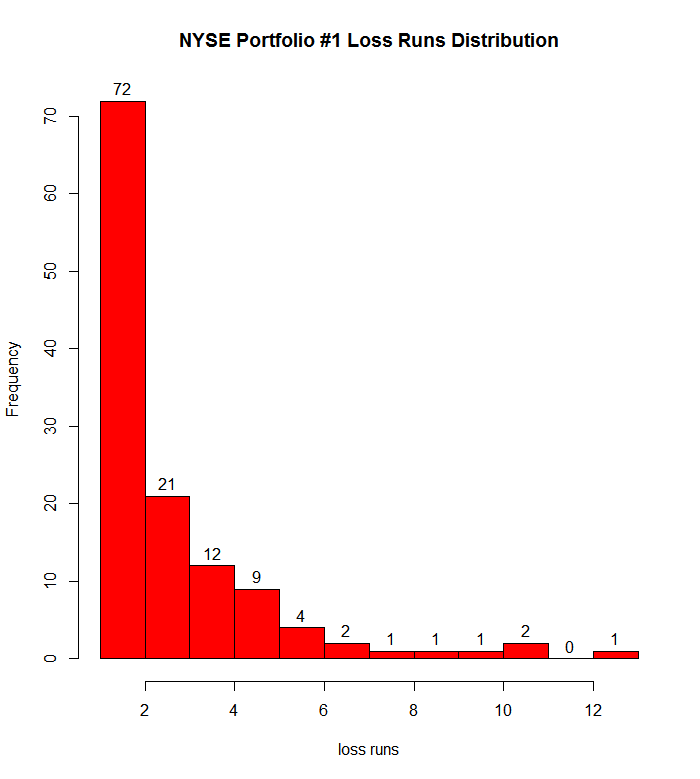

Let’s look at our own Stock Trends trading systems. This is a distribution of loss runs of the Stock Trends NYSE Portfolio #1 trading record:

In this trading record of 583 trades there are 4 loss runs of 10 or more (maximum loss run is 13). That would be our string of ‘tails’ on the flip of the coin. In the real world of trading that is also called a drawdown. It’s an ugly thing; and a painful one. But we can see how loss runs factor into every trading system - every active trader must try to limit them.

Limiting the extent of losses is the primary function of a money management system. Stock Trends model portfolio trading systems have a few elements of loss protection that are inherent. First, they use a method of position sizing. All trades are made with a specific dollar value. This is a topic of discussion on its own, and I have written about it in previous editorials, comparing fixed dollar trades against variable or random amounts. Another aspect of loss protection is in the exit strategies – the stop loss triggers and the indicator triggers. However, over-all trading results will markedly improve if loss runs can be minimized. That means improving your success ratio: the win/loss ratio.

The Stock Trends inference model is a quantitative method to improve an investor’s trade expectations in a world of randomness. We look for Stock Trends indicator combinations that represent our best chance of being on the right side of a coin toss.

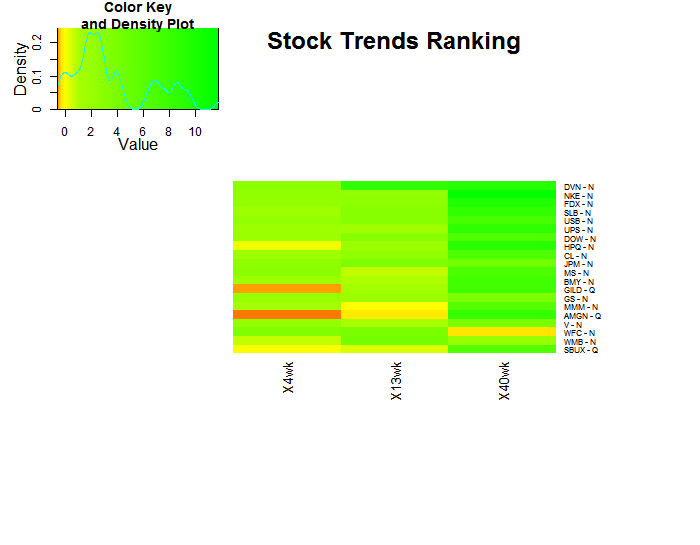

Here is a heatmap showing the current top ranked stocks of the S&P 100 index according to the Stock Trends inference model:

see Stock Trends editorial, Ranking expectations for an explanation of the ranking.

|

I very much like the systematic approach to analyzing stock data, it fits my approach.

I very much like the systematic approach to analyzing stock data, it fits my approach.