Stock Trends Weekly Reporter (STWR) Bullish Crossover and Top Trending reports direct us in this review toward infrastructure and travel stocks. The Bullish Crossover report identifies stocks whose short-term average price has just crossed above the long-term average price; the Top Trending report requires a price above US$5, weekly volume over 100k, an RSI above 100, and a positive 4- and 13-week rate of change. These filters helped surface stocks showing both early and established technical momentum. Each Stock Trends Report page provides additional context.

Understanding the Stock Trends indicators

Stock Trends employs an algorithmic classification system to label stocks with trend, momentum, and unusual volume indicators. The indicator compares the 13-week and 40-week moving averages and looks for breakouts around a 3 % envelope. A Bullish Crossover (![]() ) occurs when the 13-week moving average moves above the 40-week average, signalling the beginning of an uptrend. A strong Bullish signal (

) occurs when the 13-week moving average moves above the 40-week average, signalling the beginning of an uptrend. A strong Bullish signal (![]() ) reflects sustained upward momentum, while a Weak Bullish (

) reflects sustained upward momentum, while a Weak Bullish (![]() ) flag warns that the price has dipped below the 13-week moving-average envelope. Likewise, Bearish Crossover (

) flag warns that the price has dipped below the 13-week moving-average envelope. Likewise, Bearish Crossover (![]() ) and Bearish (

) and Bearish (![]() ) signals mark deteriorating trends, while a Weak Bearish (

) signals mark deteriorating trends, while a Weak Bearish (![]() ) trend indicates a gathering trend reversal amid price momentum. The relative strength indicator (RSI) measures how a stock’s 13-week performance compares with the benchmark market index (S&P 500 Index, or the S&P/TSX Index for TSX stocks); values above 100 mean the stock is outperforming the index.

) trend indicates a gathering trend reversal amid price momentum. The relative strength indicator (RSI) measures how a stock’s 13-week performance compares with the benchmark market index (S&P 500 Index, or the S&P/TSX Index for TSX stocks); values above 100 mean the stock is outperforming the index.

Industrial & Infrastructure momentum

United Rentals Inc. (URI-N)

United Rentals is the largest equipment-rental company in North America. The STWR Bullish Crossover report for the week ending July 25, 2025 reveals URI as a Bullish Crossover. The stock gained 10.1 % during the week and is up 40.5 % over 13 weeks; its 13-week RSI of 121 indicates outperformance versus the S&P 500, and there was no unusual volume tag. According to the company’s second-quarter results released this past week, total revenue reached US$3.943 billion, net income was US$622 million, and adjusted EBITDA was US$1.810 billion. Management raised the full-year revenue and earnings guidance and increased planned share repurchases by US$400 million, citing strong growth in both general rentals and the higher-margin specialty division. The Stock Trends Bullish Crossover combined with rising earnings and capital returns, suggests a supportive technical and fundamental backdrop.

Woodside Energy Group (WDS-N)

Woodside operates LNG and oil projects in Australia and the United States. Its STWR indicator also flipped to a Bullish Crossover during the week ending 25 July 2025, with a 1-week price gain of 8.8 % and a 13-week gain of 32.9 %. The RSI of 115 is comfortably above 100, signalling superior performance versus the S&P 500. Woodside’s second-quarter report, released in the past week, emphasised operational strength: quarterly production rose to 50.1 million barrels of oil equivalent (MMboe), up 2 % from the prior quarter, and the realised LNG price averaged US$62 per boe. The company updated its full-year production guidance to 188 – 195 MMboe and reduced its unit cost range to US$8.0 – $8.5 per boe. Management highlighted progress on major projects such as Scarborough (86 % complete) and the Trion oil project (35 % complete), and the sell-down of a 40 % stake in the Louisiana LNG project, which brought in US$1.9 billion. These fundamental tailwinds support the new bullish signal in the Stock Trends report.

Powering the future: next-generation semiconductors

Navitas Semiconductor (NVTS-Q)

Navitas, a developer of gallium-nitride (GaN) and silicon-carbide (SiC) power chips, appears on the STWR Top Trending list with a Bullish indicator. The stock has been in this category for six weeks (with seven weeks in the broader bullish category) and logged a 29.5 % weekly gain; its 13-week return exceeds 328 %, and its RSI is an eye-popping 371, signifying dramatic outperformance. Investor enthusiasm is driven by a pipeline of design wins across electric vehicles, AI data-centres and renewable energy; the company launched the first production-ready bidirectional GaN integrated circuit, which simplifies power conversion and can cut cost, size and power loss by 30 % or more ]. Its GaNSafe platform has achieved automotive-grade qualification and secured more than 40 EV design wins. Navitas is also expanding into AI data-centre power platforms, with over 40 design wins at major Asian original-design manufacturers. Cost-cutting has reduced operating expenses from US$19.9 million in Q4 2024 to US$17.2 million in Q1 2025, leaving the company debt-free and targeting positive EBITDA in 2026. Despite modest current revenues and a high valuation, the combination of Stock Trends momentum and a compelling technology roadmap makes NVTS a stock to watch.

Travel & leisure resurgence

Travel + Leisure Co. (TNL-N)

The parent company of the Wyndham timeshare business and Travel + Leisure magazine also registered a Bullish Crossover in the latest STWR data. TNL’s one-week price gain was 10.8 %, and its 13-week return stood at 43.5 % with an RSI of 124. An early-stage trend counter (1/1) suggests the stock has just begun its upward move. A recent article noted that Travel + Leisure stock has outperformed the consumer discretionary sector, and that vacation-ownership sales exceeded forecasts in Q2 2025. The company’s shares jumped about 7 % following its earnings release last week, and it offers a 3.6 % dividend yield. The STWR crossover highlight coincides with a fundamental uptick in travel demand and improving investor sentiment toward timeshare and leisure stocks.

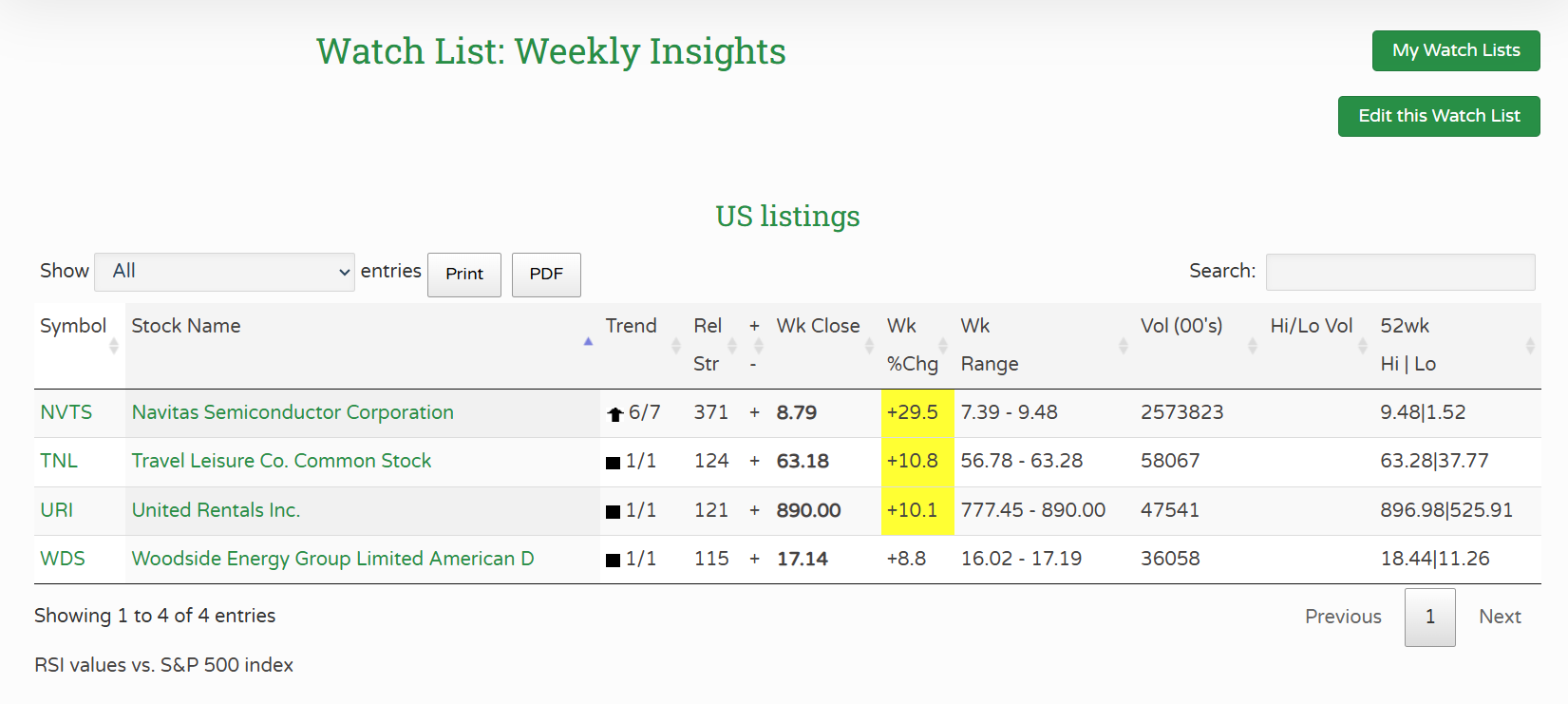

Stock Trends dashboard

The table below summarises the key Stock Trends metrics for the featured stocks. The trend counters show how many weeks each stock has been in its current indicator and broader bullish category, while the relative strength values compare 13-week performance to the S&P 500.

| Symbol | ST indicator | Trend counters (indicator/major) | 1-week change (%) | 13-week change (%) | RSI (vs S&P 500) | Price (USD) |

|---|---|---|---|---|---|---|

| URI | Bullish Crossover ( |

1 / 1 | +10.1 | +40.5 | 121 | 890.00 |

| WDS | Bullish Crossover ( |

1 / 1 | +8.8 | +32.9 | 115 | 17.14 |

| NVTS | Strongly Bullish ( |

6 / 7 | +29.5 | +328.8 | 371 | 8.79 |

| TNL | Bullish Crossover ( |

1 / 1 | +10.8 | +43.5 | 124 | 63.18 |

Stock Trends Weekly Reporter for the week ending 25 Jul 2025.

Conclusion

The Stock Trends Weekly Reporter highlights emerging momentum across very different corners of the market. United Rentals and Woodside Energy show fresh Bullish Crossovers backed by rising earnings and constructive industry fundamentals such as infrastructure spending and global LNG demand. Navitas Semiconductor offers a more speculative but potentially transformational opportunity; its technology leadership in GaN/SiC power devices and early design wins have driven triple-digit gains, and the Stock Trends model confirms sustained momentum. Finally, Travel + Leisure Co. captures the rebound in travel and discretionary spending, pairing a new bullish signal with strong recent earnings and an attractive dividend.

By combining Stock Trends’ disciplined technical framework with fundamental research, investors can identify themes early and evaluate whether momentum is supported by real-world catalysts. The current STWR data suggest that infrastructure, energy transition, and leisure travel remain areas where technical strength aligns with industry tailwinds. As always, momentum should be weighed against valuation and risk; for example, Navitas’ lofty price-to-sales ratio and United Rentals’ cyclical exposure warrant caution. Nevertheless, these signals provide a useful starting point for deeper due diligence.

I very much like the systematic approach to analyzing stock data, it fits my approach.

I very much like the systematic approach to analyzing stock data, it fits my approach.