At the heart of Stock Trends is a conviction: market data is not noise, but information. For more than three decades, the Stock Trends framework has given investors a disciplined way to interpret market cycles, trend signals, and momentum patterns. The Stock Trends Inference Model (ST-IM) is the natural extension of this approach, embedding rigorous statistical reasoning into the reports available for every listed stock and ETF.

As outlined in Chapter 6 of the Stock Trends Handbook, ST-IM is designed to answer a key question investors continually face: What is the probability that a stock or ETF will outperform the market benchmark over the coming weeks? The answer is never certain—but it can be inferred systematically.

Why the Central Limit Theorem matters

One of the most powerful results in statistics, the Central Limit Theorem (CLT), tells us that when we take averages of sufficiently large samples—even if the underlying data is skewed—the distribution of those averages approaches a normal (bell-curve) distribution. The ST-IM analysis takes samples of composite Stock Trends indicator groupings, matching trends, relative momentum, and volume statistics to measure subsequent returns (price changes).

Investment returns are well known to be skewed and fat-tailed. A few dramatic gains or losses can distort short-term distributions. Yet, as the Stock Trends database demonstrates, when returns are aggregated over time, they begin to approximate normal distributions. This is precisely why ST-IM employs the normal distribution: it is a statistically sound approximation for inferring probabilities of outperformance over multi-week horizons.

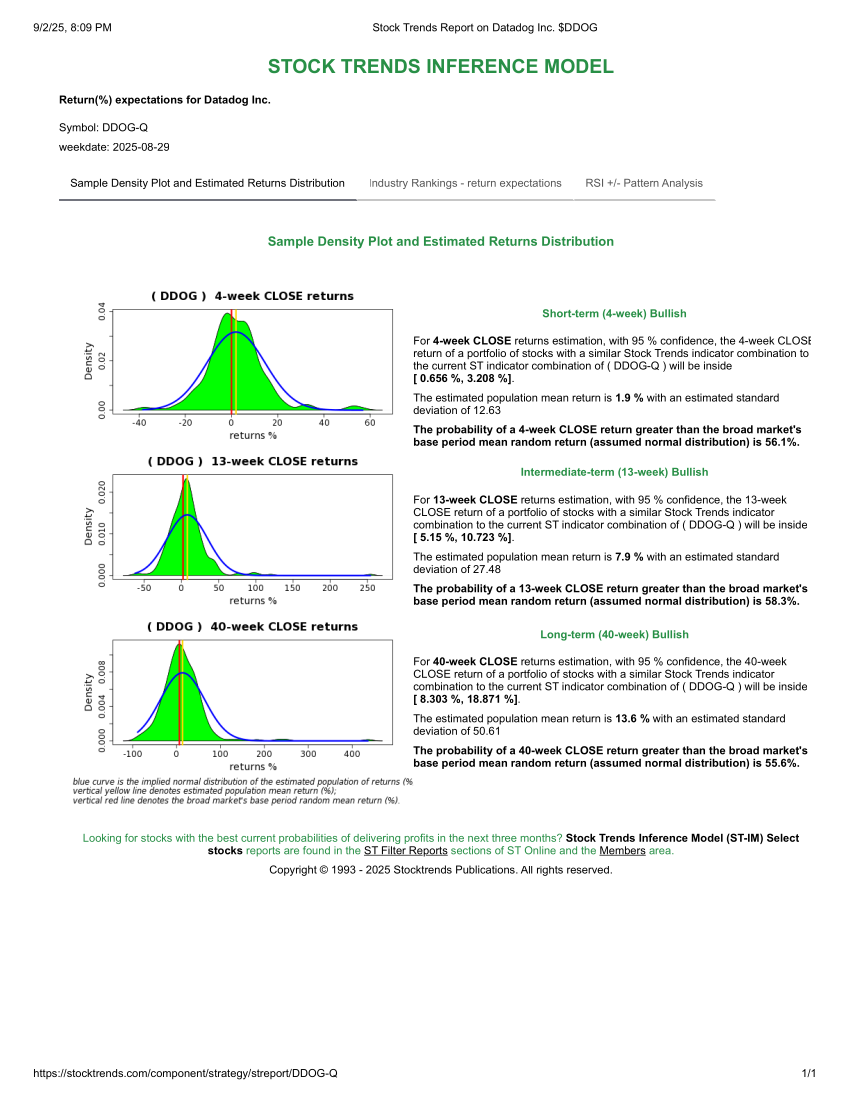

Here is a current example of the ST-IM analysis - the Bullish interpretation of future return estimates for DataDog Inc. (DDOG-Q). This analysis is presented under the Trend Profile section of every Stock Trends Report page.

Stock Trends Weekly Reporter also helps investors filter for the best and worst returns expectations over the 4-week/13-week/40-week horizons, and find the stocks with the best probabilities of outperforming the market over the periods.

From Modern Portfolio Theory to Stock Trends

Modern Portfolio Theory (MPT) rests on the same statistical foundation. By modeling returns with a finite mean and variance, MPT makes the risk–reward trade-off (mean vs. variance) actionable. ST-IM does not replicate MPT, but it leverages the same principle: normal-based inference makes probabilities actionable. Where MPT produces an efficient frontier for portfolios, ST-IM applies inference directly to the Stock Trends trend indicators, yielding probabilistic estimates of future performance for individual stocks and ETFs.

Beyond normality: acknowledging market realities

No investor should mistake the population of returns as truly normal. Markets exhibit volatility clustering, regime shifts, skewness, and fat tails. Post-modern finance tools—such as t-distributions, GARCH models, and extreme value theory—address these realities.

The strength of ST-IM is its practicality and clarity: a consistent, transparent, and interpretable probability measure for thousands of securities, week after week. For many investment decisions, this clarity is more useful than model complexity.

The unique value of Stock Trends Inference Reports

- Coverage: Probability-based interpretation for every listed stock and ETF.

- Discipline: A systematic bridge from trend indicators to forward-looking probabilities.

- Perspective: A framework grounded in empirical observation and well-established statistical theory.

No other site presents this breadth of statistical trend analysis with an inference model integrated across the full North American stock market universe. ST-IM translates the Stock Trends methodology—trend categories, RSI +/- patterns, and momentum context—into actionable probabilities that fit directly into weekly decision-making.

Conclusion

The Stock Trends Inference Model, first introduced over a decade ago, is more than an added feature—it is the statistical backbone that elevates the Stock Trends service. By linking the principles of the CLT and MPT to the weekly signals in the Stock Trends database, ST-IM gives investors something rare: a systematic, probabilistic view of market opportunity.

That is why ST-IM Reports deserve a central place in every Stock Trends user’s toolkit. They embody the core mission of Stock Trends—to help investors navigate market cycles with discipline, probability, and perspective that no other service provides.

Related items

- Stock Trends Mid-Quarter Review: How the Year-End 2025 Themes Are Performing in Q1 2026

- Stock Trends Year-End Analysis: Institutional Momentum, ST-IM Alpha, and the Road Into Q1 2026

- Understanding Our Assumptions — A Decade Later

- Trading Nvidia with the Stock Trends RSI +/– Pattern Analysis Model

- Navigating Market Turmoil in December 2025 – How Stock Trends Guides Investors

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.