How can a statistical approach to the Stock Trends indicator combinations guide our trading? A trading strategy can be effectively constructed by assigning a probable outcome that is weighted as a directional trade and controlled for risk at defined levels. Although the success of any trading system hinges on prudent money management principles, positive trade expectations are crucial to long-term results. Confidence in a system builds off its ability to match expectations. Certain Stock Trends indicator combinations exhibit post-observation historical returns that imply improved trade expectations and generate risk profiles for statistically probable outcomes. This is a golden starting point for any trade.

From our core assumption that trend patterns are transferable across markets – namely the assumption that the Stock Trends trend indicator, the length of trend, relative price momentum indicators, and the unusual volume indicators as a ‘combination’ of variables can be grouped and evaluated for post-observation price performance – we test a posited correlation. Sometimes correlation can be specious – making improbable links between cause and effect. Sometimes we can mistakenly attribute stock price changes to variables that are not independent. In order to avoid these analysis failures it is important to review the variables we have grouped and understand why the Stock Trends indicator combinations represent discrete categories that can be measured for correlation with a subsequent outcome. (At a later date statistical tests for variable independence and correlation will be presented.)

When statisticians talk about correlation they are referring to a dependency. They are referring to an independent variable having an effect on an outcome. It does not mean causation. It does not necessarily mean that A caused B. It means that A somehow influenced a change in B. In our framework we are generally asserting that the changes in the price of a stock – its price trend, its longevity of trend, and the degree of price movement – have an effect on subsequent price movement. Also, we are stating that these variables are homogeneous across stocks – that the same influences of trend and price momentum affect subsequent price movement of every stock. Here we are implying that principles of mass psychology direct the market.

Consider the following: suppose the share price of a stock has been trending positively for many months, and has rallied again – out-pacing the broad market performance by over 25% in the most recent three month period. The share price is up over 100% since the beginning of its bullish trend. Obviously, existing shareholders have booked paper profits. However, these shareholders, regardless of which stock in question, have pressure to act on these returns - the pressure to respond to the accelerated interest in the stock that the market brings to bear.

The scale of interest may be different with every stock, but the underlying force to act remains: to sell or not? Of course, there are forces that balance the sell influence. The same forces that bring new buyers to the table make many current shareholders that much more confident that the share price is destined to ride even higher. Certainly, for blue chip stocks the forces of inertia, the tendency to ‘hold’, are considerable – institutional ownership and the emotional attachment to a company’s brand often mutes the market’s pull. But inevitably the force of the market – which is represented by changes in the share price – comes to bear. Eventually the market wins.

Do the Stock Trends indicator combinations categorize these psychological market moments?

Let’s have a look at the August 16th Stock Trends reports. If we rank the Stock Trends indicator combinations by the statistical analysis of returns introduced in previous editorials – focusing for now only on large cap North American stocks (many of which are institutional holdings) – the top-ranked statistical performing Stock Trends indicator combinations are currently sported by these stocks:

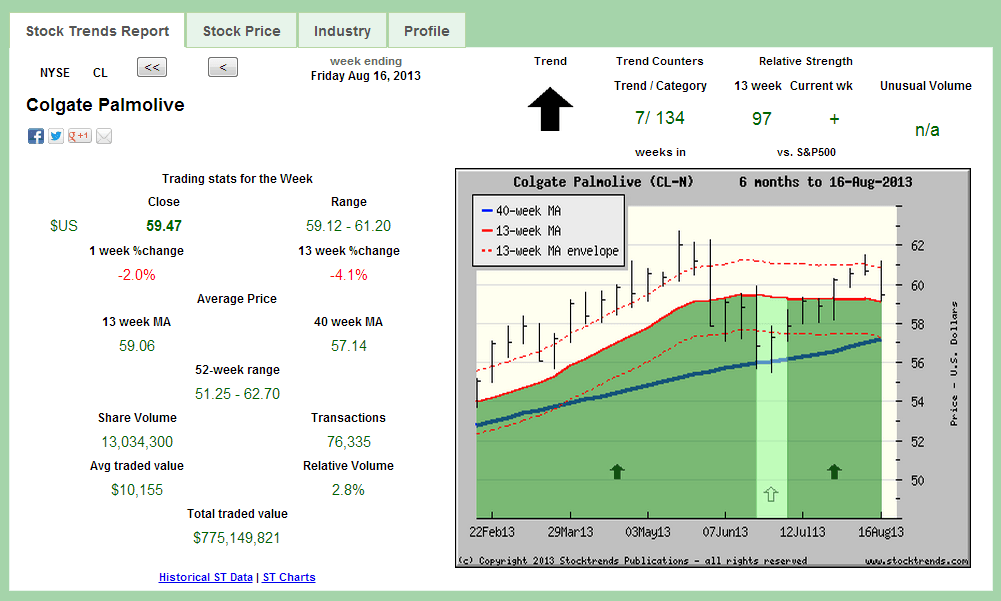

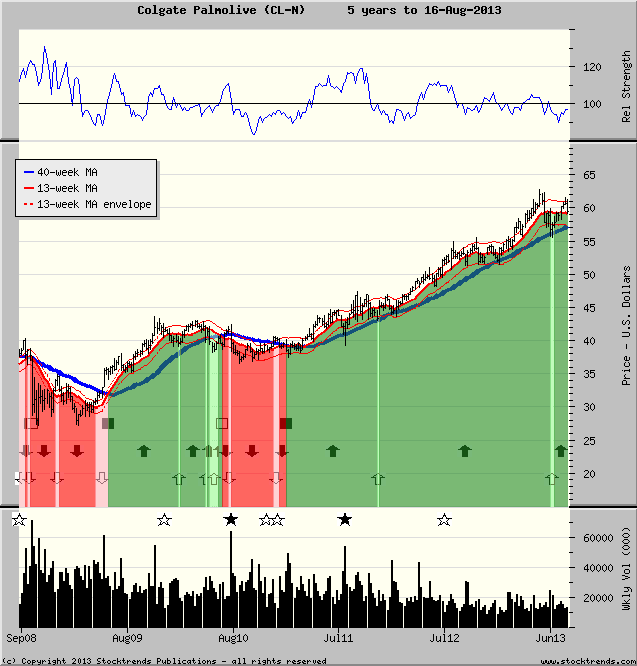

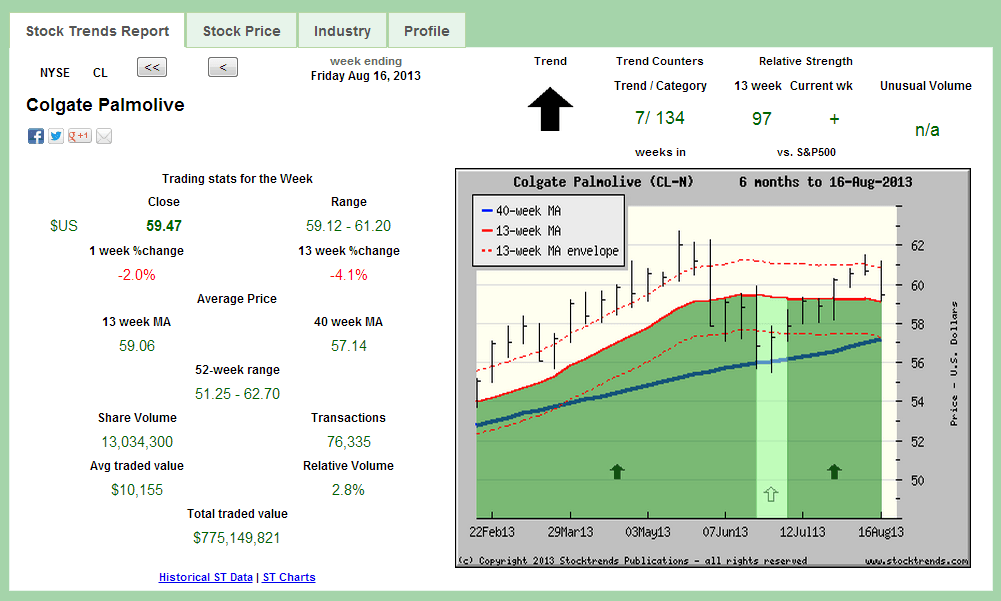

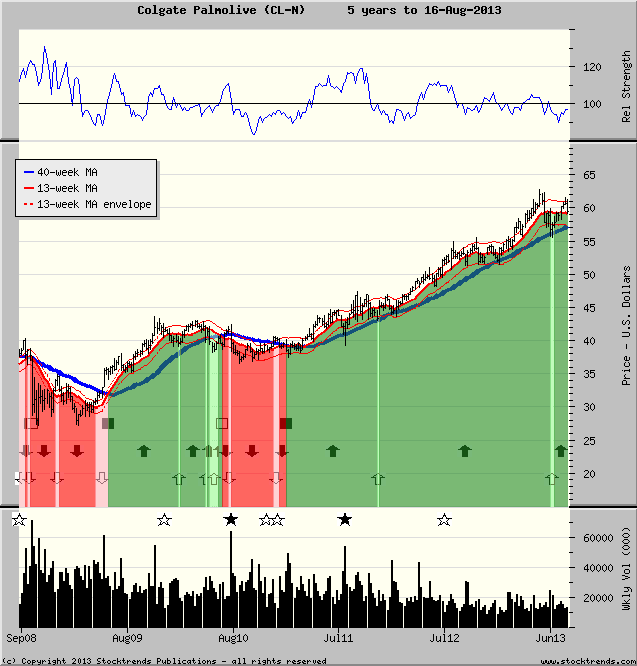

Among the top-ranked stocks is Colgate Palmolive (

CL-N). This familiar consumer staple stock has been categorized as Stock Trends bullish for 134 weeks, although it dropped to support along its primary trend line at the end of June and went Weak Bullish briefly. The stock is currently underperforming the market by 3% (RSI 97) but gained some ground in most recent weeks (RSI +). Although its chart shows a secondary trend line that is flat, the bullish long-term trend is entrenched and has not been compromised often (only two brief Weak Bullish periods). The market ‘buy’ forces are much stronger than the market forces to ‘sell’. The combination of Stock Trends indicators represented in CL’s Stock Trends Report encodes these chart (market) characteristics.

Our statistical analysis of previous instances of similar combinations (there are 42 similar observations in this sample) in the past directs us with some very positive results. What do these market characteristics indicate? Below is a statistical inference summary of the three post-observation time periods (4-week, 13-week, and 40-week).

For 4-week returns estimation, with 95 % confidence, the 4-week mean return of stocks with similar Stock Trends indicator combinations to CL will be inside [ 1.429 %, 4.968 ]. In other words, a basket of stocks similar to CL in terms of trend, trend length, price momentum and volume indicators would return between 1.4% and 5.0% at the end of the coming 4-week period.

Mean return 3.2% and standard deviation of 6.73

Normal Distribution

For 4wk CLOSE P(R> 10%)= 15.61

For 4wk CLOSE P(R< -10%)= 2.49

12.2% of sample returns are >10%

For 13-week returns estimation, with 95 % confidence, the 13-week mean return of stocks with similar Stock Trends indicator combinations to CL will be inside [5.275 %, 11.849 %]. In other words, a basket of stocks similar to CL in terms of trend, trend length, price momentum and volume indicators would return between 5.3% and 11.9% at the end of the coming 13-week period.

Mean return 8.56% and standard deviation of 12.5

Normal Distribution

For 13wk CLOSE P(R> 10%)=45.42

For 13wk CLOSE P(R< -10)=6.88

41.46% of sample returns are >10%

For 40-week returns estimation, with 95 % confidence, the 40-week mean return of stocks with similar Stock Trends indicator combinations to CL will be inside [9.137 %, 24.293 %]. In other words, a basket of stocks similar to CL in terms of trend, trend length, price momentum and volume indicators would return between 9.1% and 24.3% at the end of the coming 40-week period.

Mean return 16.71% and standard deviation of 27.69

Normal Distribution

For 40wk CLOSE P(R> 10)=59.58

For 40wk CLOSE P(R< -10)=16.73

57.89% of sample returns are >10%

The statistical inference of the population mean for stocks with these characteristics reveals above-market performance results for all three time frames. Focussing on the 13-week time frame, stocks that share similar indicator combinations to CL's current combination have a mean (average) return of 8.6%, and a confidence interval [5.275% to 11.849%] that is well above the interval exhibited by random results for the 13-week period (stocks randomly picked from the entire population, historically, of North American stocks have a mean between 2.1% and 2.3%).

If we assume a normal distribution of returns, the analysis also implies there is a 45.4 per cent chance that CL will have a return greater than 10% at the end of 13-weeks. Alternatively, CL has a 6.9% chance of dropping more than 10% in 13-weeks. Indeed, it is the estimation of the probability of an outcome that makes this inference model a foundation for an algorithmic trading strategy.

For now we’ll stick to trying to understand how the statistical inferences work, and how they respond to changing conditions. Let’s go back to the example stocks presented in the

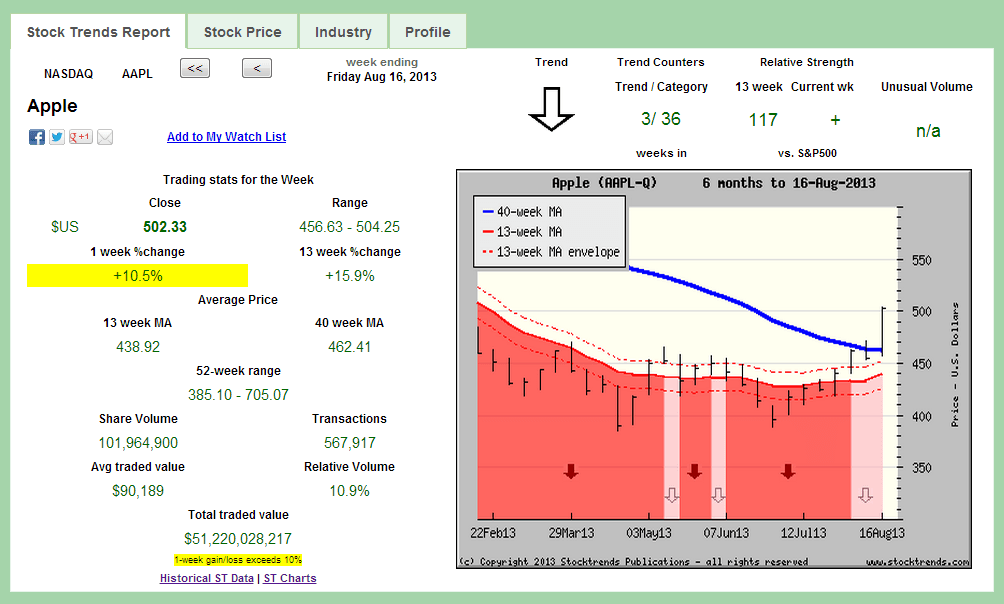

last editorial – Apple Inc. (

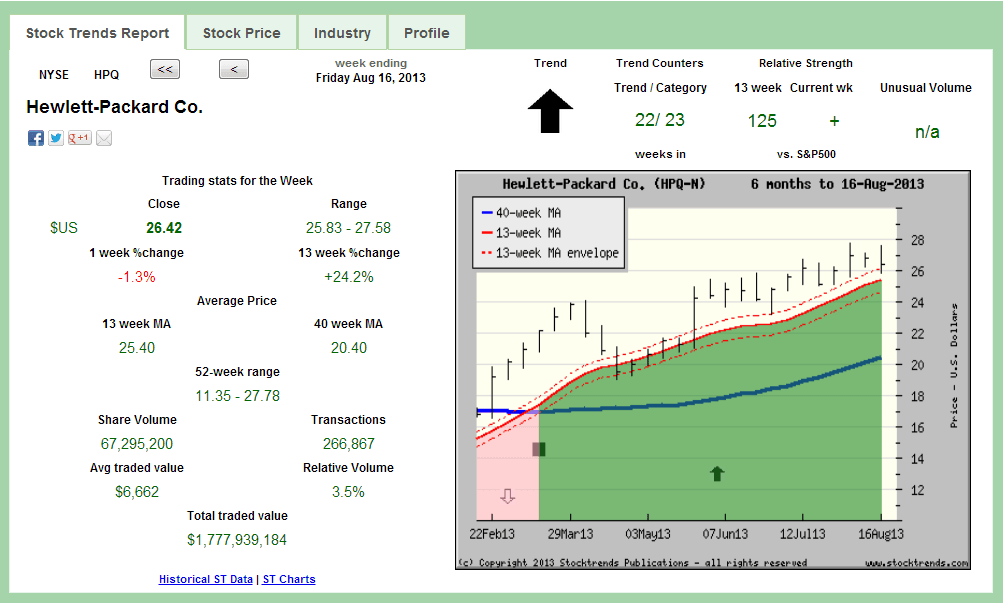

AAPL-Q) and Hewlett Packard (

HPQ-N). Since that editorial AAPL has rallied from $462.54 to above $500 and is now out-performing the market in the past 13-weeks by 17%. What are the new statistical inferences we can make from Apple’s current observation?

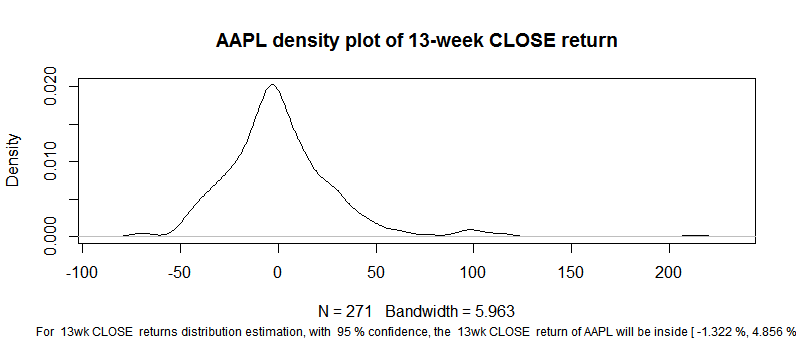

The mean of the population is now estimated to be between -1.3% and 4.9%, while at Aug 2 the interval was estimated to be inside 0.3% and 3.2%. The expected return of AAPL has improved, but not enough to change its relative performance expectations versus other big cap stocks. Returning to HPQ, here is its current ST Report and the returns that are inferred from this observation:

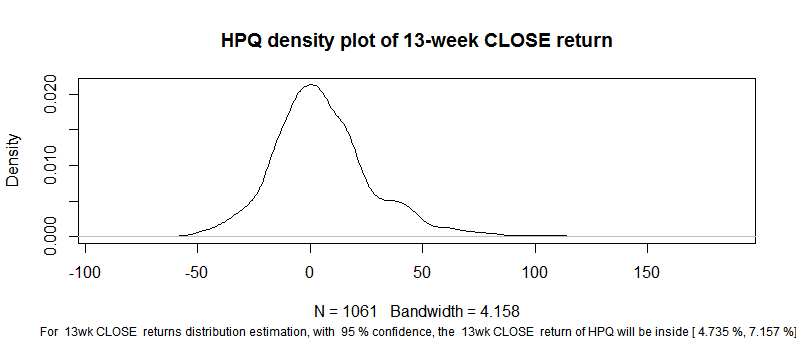

Here the statistical inference of the population mean for observations similar to HPQ continue to be higher than AAPL’s even though its share price has dropped marginally from $27 to $26.42. The analysis still supports a HPQ buy over an AAPL buy.

Are there characteristics of trend and momentum that show statistical evidence of future market out-performance? We would need more time periods of analysis to make any attempt at systematic filtering for optimal combinations, but the current data presented by large cap stocks supports a well-known adage: the trend is your friend. Most of the highest ranked statistical combinations involve rather lengthy, established trends.

Stock Trends will work toward making the analysis an important part of our weekly reports. For now, future editorials will commence a weekly selection of top and bottom ranked stocks as determined by the statistical inferences described here.

An admitted cynic, it's obviously very high praise when he says he likes StockTrends because of its "simplicity, utility, openness, [and] honesty," and in addition to having "no hidden agenda" is "understandably documented [and] historically verifiable." And, he adds, "It lets me see a lot of things without doing a lot of work." Globe and Mail

An admitted cynic, it's obviously very high praise when he says he likes StockTrends because of its "simplicity, utility, openness, [and] honesty," and in addition to having "no hidden agenda" is "understandably documented [and] historically verifiable." And, he adds, "It lets me see a lot of things without doing a lot of work." Globe and Mail