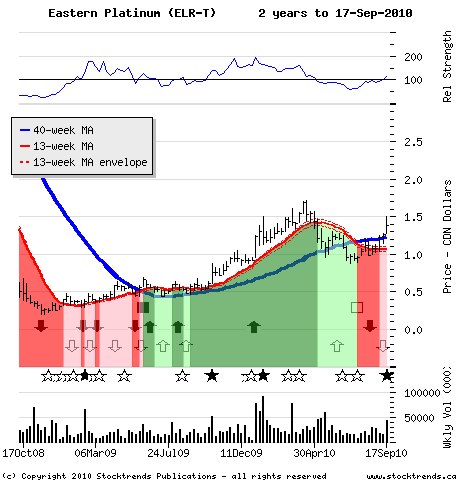

Gold is not the only shiny play. Check out Eastern Platinum Ltd.

The Stock: Eastern Platinum Ltd. (ELR-T) Recent price : $1.38

The Trend

Although the metal mining sector was the big mover on the TSX last week,

junior precious metal stocks were hot items, many surging amid high

volume of trading as gold bullion continued its third-quarter advance.

Breakout stocks in the group included CGA Mining Ltd. and Gabriel

Resources, which rallied on news that the Romanian government is

pressing ahead with its environmental review of the company's

long-stalled project in Transylvania - a gold mine that would be

Europe's largest. Plays like these tend to get the market's speculative

juices percolating.

More generally, though, small-cap gold stocks are helping revive the

Toronto market. The BMO Junior Gold Index exchange-traded fund, trading

on the TSX since the beginning of this year, is outperforming the

S&P/TSX Composite index by 14 per cent in the past three months and has

hit new highs for the past five weeks. The S&P/TSX Venture composite

index's performance in recent weeks also reflects the small-cap mining

strength. It is up 11 per cent already this month.

Investors interested in trading lively junior precious metals stocks

don't have to be focused on gold, or silver for that matter. Platinum is

an oft-overlooked segment of the category among the broader investing

public. However, the metal's important industrial applications -

specifically in the automotive industry as an agent for catalytic

converters - along with its known appeal in jewellery make miners of

this mineral plenty precious.

Like gold bullion, platinum prices are picking up. The E-TRACS UBS Long

Platinum ETN and ETFS Physical Platinum Shares advanced 5 per cent last

week. While gold and silver prices are tapping new nominal highs, some

analysts have pegged platinum for bigger price gains ahead if global

economic metrics trend positively. Although platinum does not have the

monetary cachet of gold, investors should stay tuned to the metal and

its miners.

The Trade

Among the rallying small-cap platinum stocks is Eastern Platinum, a

Vancouver-based producer of platinum group metals with significant

assets in South African mines. It has surged over 30 per cent in

September and traded heavily last week. Although trend analysis of

volatile penny stocks can be a fool's game, retail investors should

evaluate chart patterns of these breakout situations. The stock's

aggressive move to $1.50 last week sent it up against resistance that

chopped back shares in its January rally. Shares slipped on Friday to

close lower, but traders will be looking for the stock to move through

$1.50 quickly if it is to challenge the spring high. Speculative

investors can use this cue as an entry signal.

The Upside

The price of platinum is well off its March, 2008, peak - it would have

to add another 30 per cent to reach the $2,200 (U.S.) an ounce mark it

hit then - but the metal's recent eclipse of $1,600 takes it above a

trading range ceiling. A fuelling of precious metals buying amid growing

monetary concerns should help the mineral rally further this quarter and

drive Eastern Platinum shares through the next resistance level at $1.70

(Canadian). A 70-per-cent gain to the $2.35 level would be the hopeful

objective for shareholders long this platinum play.

The Downside

Assumed in this trade is a risk of volatility, and a substantial loss.

An exit stands at the base of the current rally, the intermediate-term

average share price of $1.08 - 20-per-cent below the current price.

Stock Trends Weekly Reporter is an easy way to pick up equities that represent an upward trend.

Stock Trends Weekly Reporter is an easy way to pick up equities that represent an upward trend.