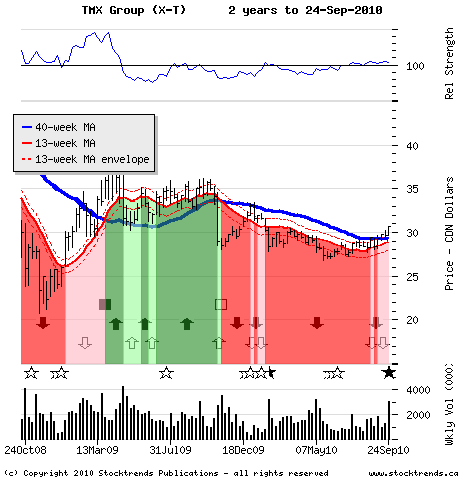

The bullish commodity sector suggests more upside for TMX Group.

The Stock:TMX Group Inc. (X-T) Recent Price:$30.70

The Trend

The kids are back at school - and so are investors. Although the S&P/TSX

composite index is only marginally above its level of three weeks ago,

trading activity on the Toronto exchange has elevated dramatically.

Weekly TSX trading volume has risen 44 per cent above the average weekly

volume of the third quarter prior to Sept. 1. And during the month there

has been a big increase in the number of stocks with high weekly trading

volume relative to those with low trading volume - four times the ratio

of the summer period. But while the volume of stocks traded has gone up,

the number of weekly transactions over the recent period is up only 11

per cent from the third-quarter average. Apparently, active investors

are in a trading mood and intent on doubling down.

Driving the heightened interest are metal mining and precious metals

stocks. The S&P/TSX Mining index is outperforming the broad market by 20

per cent in the past three months, while precious metals stocks are

powering ahead as the price of gold scales to new nominal highs. Trading

volume in these sectors is up about 70 per cent from summer levels as

momentum traders pile into both junior and blue chip mining stocks.

Mining stocks are attracting the speculative crowd, pushing price

performance gains in the small and mid-cap miners higher than that of

the big sisters in the group. The S&P/TSX Small Cap index has

outperformed the broader market in each of the past three weeks, while

the S&P/TSX 60 index has underperformed the S&P/TSX composite index in

the same periods - a comparison reflecting the preference for junior

mining stocks in September.

This uptick in trading volume and bullish price moves in commodities may

mean an Indian summer ahead for more than just the shareholders of these

resource sectors. Financial intermediaries taking trading orders have

plenty of reason to be glad that investors are more aggressive.

Independent Canadian wealth management firms are few, but their share

prices are reflecting the market buoyancy. Shares of Canaccord Financial

Inc., largely benefiting from its merger with Genuity Capital Markets

but also indicating improved stock market sentiment, are Stock Trends

Bullish. GMP Capital's stock jumped 10 per cent last week, while Jovian

Capital surged 12 per cent. Shares of DundeeWealth are also showing

recent improvement. A continuation of the September market rally in the

mining sector puts a shine on these financial services stocks, too.

The Trade

When the Canadian equity market gets lively TMX Group merrily sits at

the cash register. Operating the Toronto Stock Exchange and the Montreal

Exchange, as well as the Canadian Venture Exchange, TMX's top line

revenue feeds off improved investor sentiment and trading activity. Not

surprisingly, shares of TMX Group are rallying. The stock turned Stock

Trends Weak Bearish - a signal that its price has moved above its

bearish trend - at the beginning of the month and is a current stock

pick. Trading volume spiked last week as shares added another 4 per cent

to the recent rally off its now positively trending intermediate-term

trend line. Much of last week's trading volume tended toward bigger

players - average traded value of the stock was about three times its

third-quarter average. The stock's solid finish above $30 on Friday is

another positive signal for trend followers interested in going long TMX.

The Upside

Bullish commodity investors should give TMX added lift in the final

months of 2010. A 10-per-cent gain to above the stock's January peak

would be the objective on this trade, but a more bullish interpretation

of the Canadian equity market might make a trip to its October, 2009,

high near $36 the rewarding result.

The Downside

Market timing shareholders should make room for a retreat in the stock

price. A drop below trend line support at $29 can mark an early exit.

I want to thank you for posting such an excellent guide to technical analysis on the web. You have provided a great service to all of us novice investors.

I want to thank you for posting such an excellent guide to technical analysis on the web. You have provided a great service to all of us novice investors.