An aspect of the Stock Trends statistical inference trading model is worthy of elaboration: the end-of-period measurement of returns. Returns are always expressed as a function of time, where time and its increments can be sliced and diced in a multitude of ways. But with each period of time, unless it is a period of extreme brevity, there are numerous market prices that mark transactions. Intra-period returns are variable with those prices.

I have chosen 4-week, 13-week and 40-week end-of-period returns as the statistic of measurement in our Stock Trends inference model. These, of course, are based on closing prices for each period. But what about all those prices in between? The path of a market price from a starting point to an ending point – notated as t and t+1 – is usually far from linear. This price variability is hard to overstate. Take a look at the high and the low price for any stock quotation. Trades at opposite ends of the price bar can result in entirely different returns, depending on the trade time frame.

Here’s a statistical look at the powerful effect of price variability: comparing the returns distribution of a Stock Trends indicator combination with returns measured not only by the period closing price, but also by period highs and period lows. In addition, we can compare another arbitrary price that approximates the return of other investors who traded the stock over the periods – the average price of the stock as defined by the average price of the intra-period weekly closing prices. We will see that there is always a range of returns possible with any trade, and depending on which returns we statistically measure those returns project quite different outcomes.

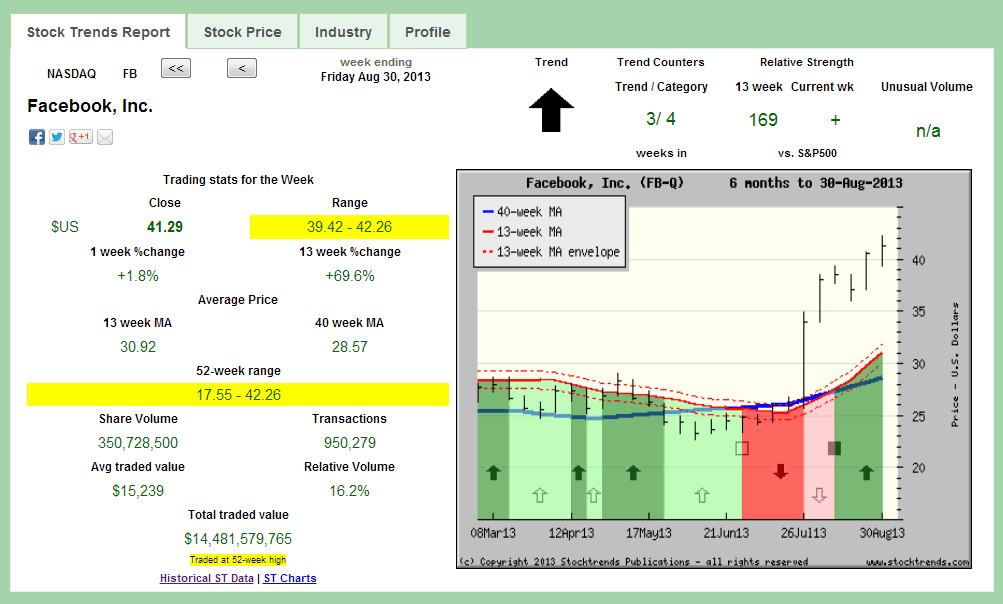

To illustrate this deviation of mean returns we’ll look at the statistical inference of the population mean of returns found in the stocks that share the same Stock Trends indicator combinations as Facebook, Inc. (

FB-Q) at August 30.

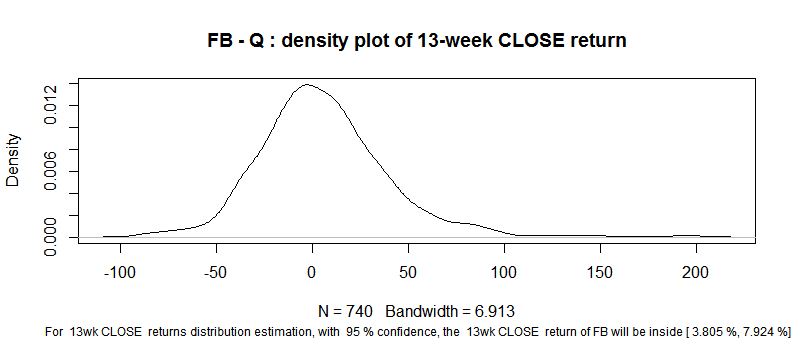

Focusing on the 13-week period ahead, the Stock Trends statistical inference model generates the following estimation of returns:

For 13wk CLOSE mean (average) returns estimation, with 95 % confidence, the 13wk CLOSE mean return of stocks with similar Stock Trends indicator combinations to FB’s will be inside [ 3.805 %, 7.924 %].

Mean return 5.86 and standard deviation of 34.01

Normal Distribution

For 13wk CLOSE P(R> 10)=45.16% probability that FB will return above 10%

For 13wk CLOSE P(R< -10)=32.05% probability that FB will return below -10%

40.27% of sample returns are >10%

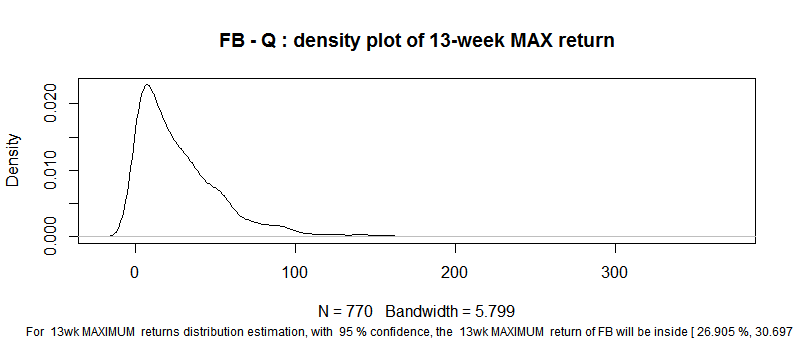

For 13wk MAXIMUM mean returns distribution estimation, with 95 % confidence, the 13wk MAXIMUM mean return of stocks with similar Stock Trends indicator combinations to FB will be inside [ 26.905 %, 30.697 %].

Mean return 28.8 and standard deviation of 31.95

Normal Distribution

For 13wk MAXIMUM P(R> 10)=72.19% probability that FB will return above 10%

68.96% of sample returns are >10%

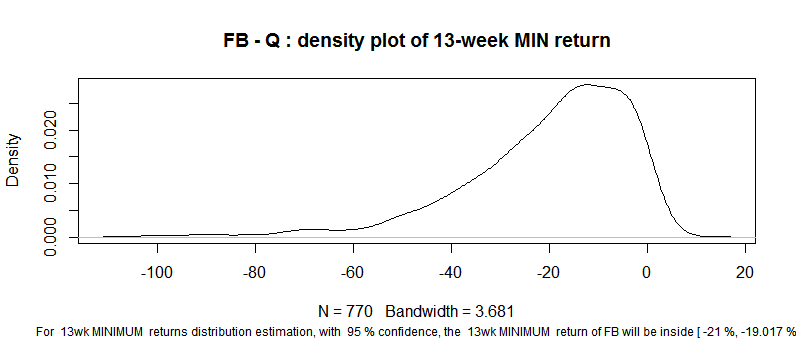

For 13wk MINIMUM mean returns distribution estimation, with 95 % confidence, the 13wk MINIMUM mean return of stocks with similar Stock Trends indicator combinations as FB will be inside [ -21 %, -19.017 %].

Mean return -20.01 and standard deviation of 16.71

Normal Distribution

For 13wk MINIMUM P(R< -10)=72.54% probability that FB will return less than -10%

31.04% of sample returns are >-10%

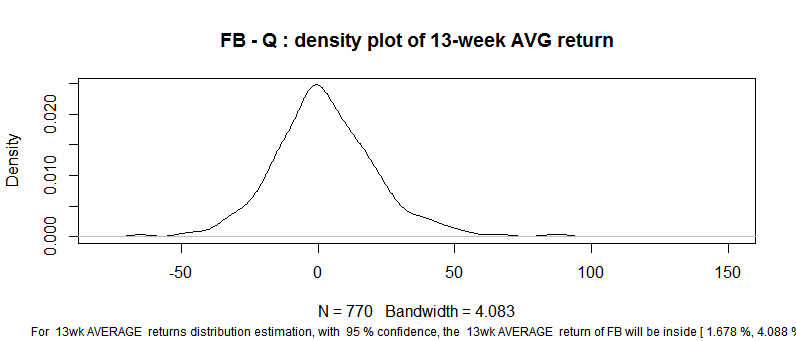

For 13wk AVERAGE mean returns distribution estimation, with 95 % confidence, the 13wk AVERAGE mean return of stocks with similar Stock Trends indicator combinations as FB will be inside [ 1.678 %, 4.088 %].

Mean return 2.88 and standard deviation of 20.3

Normal Distribution

For 13wk AVG P(R> 10)=36.29% probability that FB will return above 10%

Normal Distribution

For 13wk AVG P(R< -10)=26.28% probability that FB will return below -10%

30.65% of sample returns are >10%

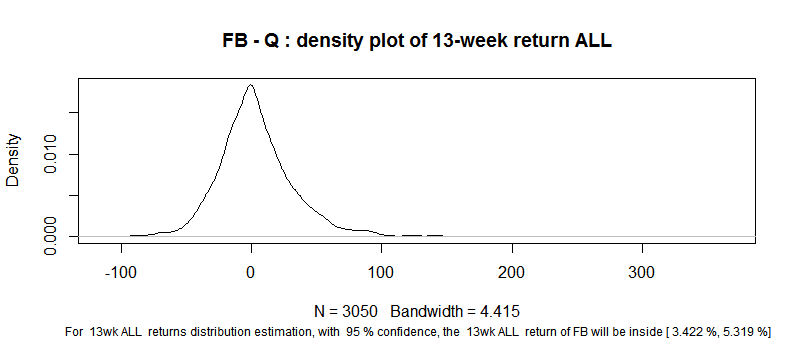

For 13wk ALL mean returns distribution estimation, with 95 % confidence, the 13wk ALL mean return of stocks with the same indicator Stock Trends combination as FB will be inside [ 3.422 %, 5.319 %].

Mean return 4.37 and standard deviation of 31.83

Normal Distribution

For 13wk ALL P(R> 10)=42.98% probability that FB will return above 10%

For 13wk ALL P(R< -10)=32.58% probability that FB will return below -10%

34.92% of sample returns are >10%

The range of mean returns is quite large, making it clear that a trade’s returns depend on the type of trader. In this example, the mean return of traders who stuck with the trade until the end-of-period (13-weeks) exceeds the mean return of the population of traders that exited the trade at variable prices through the period, represented by the “All prices mean return”.

We looked at this variation of returns for two reasons: First, it’s important to identify the type of returns the Stock Trends inference model is measuring – end-of-period returns. During the periods Stock Trends measures – whether the 4-week period, the 13-week period, or the 40-week period – there is intra-period variability of prices that result in variable returns. The second reason for defining these variable returns is to show how the end-of-period returns rank against intra-period returns. Our analysis focuses on end-of-period returns because it is much easier to compare with other trading or investment models, but also because end-of-period returns compare favourably to aggregate intra-period returns.

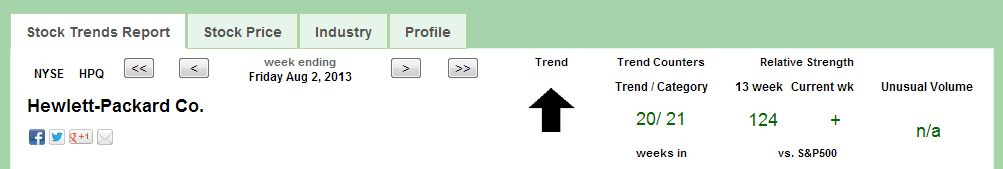

On that point, we can return to the fate of Hewlett Packard (

HPQ) and Apple Inc (

AAPL), featured in recent editorials outlining the Stock Trends inference model. Since the last editorial HPQ’s share price plummeted from $26.42 to the $22 level, while AAPL dropped marginally from $502.33 to sub-$500. Our model had presented a probable outcome for HPQ that exceeded that of AAPL. How does the model explain the actual results?

First of all, let’s make sure we are talking about the same returns. The Stocks Trends indicator combination for HPQ four weeks ago (August 2) was:

The 4-week end-of period mean returns for stocks with similar Stock Trends indicator combinations to HPQ at August 2 (4-weeks ago) was expressed as a confidence interval between 0.8% and 1.9%. Further, a normal distribution of returns around this interval indicated that there was a 17.4% chance that HPQ would drop 10% or more below the August 2nd share price 4-weeks later. Indeed, the share price did close out August down 17% (coincidentally the same value as the probability). In short, there is always a chance that a stock will perform outside an expected range. In this case, HPQ closed the 4-week period outside its expected range. Traders must learn how to quantify this risk and protect against it.

Stock Trends analysis quantifies nicely the movement of individual stocks. I’ve found that if the technicals are out of synch with fundamental analysis, it is a wake-up call to make a decision. The Stock Trends Bull/Bear Ratio is useful in identifying major market bottoms and tops. It has always presented a good buying or selling opportunity.

Stock Trends analysis quantifies nicely the movement of individual stocks. I’ve found that if the technicals are out of synch with fundamental analysis, it is a wake-up call to make a decision. The Stock Trends Bull/Bear Ratio is useful in identifying major market bottoms and tops. It has always presented a good buying or selling opportunity.