Looking for Google' shares to rally to the stock's all-time high? Now may be the time to catch the ride.

The Stock: Google Inc. (GOOG-Q) Recent price: $612.53 (U.S.)

The Trend

Three months ago, in the dog days of summer, this column suggested that

the technology sector was following a bearish trend and advised backing

away from or shorting big-capitalization tech stocks. However, the

sector rebounded with the rest of the market in September; the Nasdaq

100 index, representing blue-chip techs, galloped to a 17 per cent gain

in the past two months, hitting new 52-week highs this month. Of course,

a big contributor to that performance is Apple Inc. But developing

trends in other tech shares suggest it's time to take another swing at

the sector.

Global tech stocks have come to the fore again, with the Stock Trends

weekly trend filters recently plucking a number of tech names as

potential buy candidates, including Qualcomm, Cypress Semiconductor,

Logitech International, Xerox Corp., Alcatel-Lucent, and Sierra

Wireless, as well as technology-based exchange-traded funds such as the

Select Sector SPDR Technology. Rallying during the period, too, are

Amazon and eBay - both stocks reached new 52-week highs. Next to

precious metals stocks, tech equities are attracting the most bullish

investor interest in U.S. markets this quarter.

The Trade

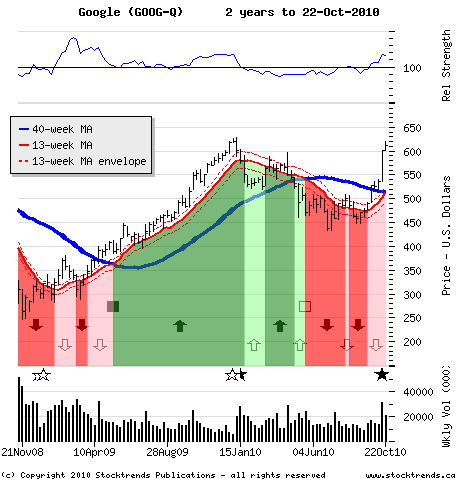

Google shares have rallied from the $450 level at the beginning of

September to a $600 stock again after strong earnings drove shares

higher earlier this month and primed investors for another bull trend

for this marquee stock. Google's stock has an impressive performance

history once a positive price trend has established itself. Last year's

bull trend raised Google's share price from below $400 back to a $630

peak before slipping early this year. An approaching Stock Trends

Bullish Crossover - a cue that a new long-term bullish trend is

commencing - as well as the opportunity to scale an important resistance

level at the 2010 high could once again open up the stock to a forceful

rally. Scaling the $630 mark should trigger more trading and would be a

good entry point.

The Upside

While the summer technology call would count as a bad slice into the

woods, an August, 2009, profile of Google in this column proved to be a

smashing drive down the centre of the fairway. A Stock Trends Bullish

Crossover stock at the time, Google's chart indicated that a move above

the $450 level would clear overhead resistance and signal a return to

plus-$500 valuations before the end of the third quarter of last year.

And so it came to be. The stock peaked near $630 at the beginning of

this year before sending sell signals as the stock abruptly dropped

below its intermediate-term trend line. A late February exit on that

bull trend around the $530 level would have been advised before Google's

shares were classified as Stock Trends Bearish in May. Replicating that

20 per cent market timing return would demand a rally to the stock's

all-time high at $747 - a price that aptly conjures up a jumbo jet.

Google bulls are waiting to see it soar again.

The Downside

Google's high share price excludes most retail investors from taking a

new, direct equity holding. Those that can will want to see the stock

stay above $600.

There is a lot to be gained from comparing trends of how individual stocks are doing within a sector, as well as how the sector is performing relative to the broad market.

There is a lot to be gained from comparing trends of how individual stocks are doing within a sector, as well as how the sector is performing relative to the broad market.