Bullish investors looking to capture the rising fortunes of financial services stocks can trade the emerging trends of the group. Investment dealer Canaccord Financial fits the bill.

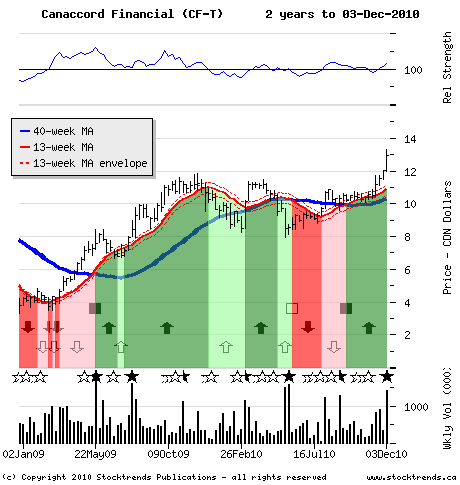

The Stock: Canaccord Financial Inc. (CF-T) Recent price: $12.95

The Trend

Whether propelled by bullish or bearish sentiment, investors are on the

move again. Although year-to-date trading activity on the Toronto Stock

Exchange in 2010 is below last year's tally of the same period,

November's trading volume and transactions are up significantly from the

activity of a year earlier. The total number of transactions on the

major North American exchanges in November was up 28 per cent from the

same November period of last year. Average daily volume on the platforms

of CME Group - where futures contracts on many important derivative

asset classes trade - was up 24 per cent in November from the previous

month.

Heightened market volatility spurred the revived trading, but a hopeful

investor class has responded by driving the stock market back to new

highs - both the S&P/TSX composite index and the Wilshire 5000 Total

Market index, the broadest measure of U.S. equities, eclipsed their

previous 2010 high-water marks last week.

Also reflecting the growing trading activity and bullish sentiment is

the performance of U.S. brokerage house stocks. The iShares Dow Jones

U.S. Broker-Dealers Index Fund, an exchange-traded fund that represents

the group, is a current Stock Trends pick, as are the stocks of TD

Ameritrade, E*Trade Financial, and optionsXpress Holdings. Both

optionsXpress and Interactive Brokers Group rallied to new highs on high

trading volume last week, as each company revealed the strength of their

balance sheets with special cash dividends for shareholders.

Investors see these improved conditions in the stocks of some

independent Canadian wealth management firms. Shares of Guardian Capital

Group rallied above trend and hit a new high last week, while

DundeeWealth Inc. traded heavily and begins December 58 per cent above

its summertime level.

High volume of trading characterized last week for the stocks of IGM

Financial and CI Financial, while shares of AGF Management and GMP

Capital Inc. have outperformed the S&P/TSX composite by 10 per cent in

the final quarter of 2010. Bullish investors looking to capture the

rising fortunes of these financial intermediaries can trade the emerging

trends of the group.

The Trade

Canada's largest independent investment dealer is Canaccord Financial.

Its stock rallied on high volume last week, hitting a new 52-week high

before closing the week below $13.

The company's announced ventures into expanding service in Asia - buying

China-based advisory firm Balloch Group and partnering with the

Export-Import Bank of China - lifted the stock, but these deals build

upon the growth strategy Canaccord staked its future on with its

acquisition of Genuity Capital Markets earlier this year.

Although its stock was a Stock Trends Bullish Crossover in September, an

indicator that would alert investors to an improving price trend, its

late-November rally off the 13-week moving average trend line to above

the $11.75 level was a good sign for investors looking for a more

positive signal before trading this bullish trend.

The Upside

Positive equity market conditions mark a technical objective above $16

for this trade, an advance of 25 per cent from the current share price.

An extended bull market will help fuel trading - and continued relative

price performance - for this and other wealth management and

broker-dealer stocks in the months ahead.

The Downside

A drop below $11.75 would be an early signal to exit this trade for

anxious short-term traders.

I want to thank you for posting such an excellent guide to technical analysis on the web. You have provided a great service to all of us novice investors.

I want to thank you for posting such an excellent guide to technical analysis on the web. You have provided a great service to all of us novice investors.