Many converted trusts strive to remain attractive to income investors, but they also garner new attention from investors more interested in capital gains.

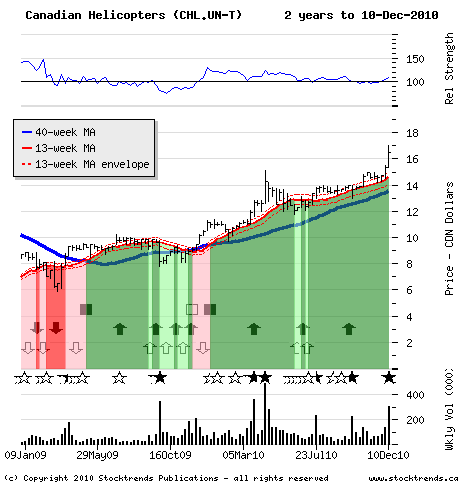

The Stock: Canadian Helicopters Income Fund (CHL.UN-T). Recent price $16.50

The Trend

With both the materials and energy sectors logging strong

gains in the final quarter of 2010, investors looking for more bounty in

the new year should be surveying related areas for opportunities. One

possibility is transportation stocks.

Improving economic vitality has been reflected in the relative strength

in recent weeks of shares in transportation firms and transport

equipment makers. The Dow Jones Transport index has been outperforming

the broad U.S. market.

North American railway and trucking stocks remain in solid bullish

trends, while transportation equipment stocks like Navistar

International (NAV-N), Wabash National (WNC-N), Greenbrier (GBX-N) and

Titan International (TWI-N) are also outpacing the broad stock market.

Airline and air services stocks have generated price momentum this

quarter, too.

The Trade

Canadian Helicopters Income Fund, which operates Canada's

largest helicopter transportation services company, is a deserving play

on the transport sector.

The company serves the resource sector and governments, as well as

emergency and military operations, while its training schools and

maintenance services provide additional revenue streams. Its military

contracts have helped the company weather the downturn ushered in by the

2008 market collapse and returned the units to a Stock Trends bullish

category at the beginning of this year.

More recently, the units' strong performance indicates that investors

are revaluing Canadian Helicopter for an impending reorganization. With

the Jan. 1, 2011, tax changes for income trusts fast approaching,

business income trusts are lined up at the conversion table. Last week

Canada Helicopters formally announced that it was joining the crowd and

converting to a corporate structure at year end.

Many converted trusts strive to remain attractive to income investors,

but they also garner new attention from investors more interested in

capital gains. Last week's action indicates that the market now sees

Canadian Helicopter as a stock with some upside. Units traded heavily

and are now 12 per cent above their opening price at the beginning of

December. Investors are anticipating continued price momentum as this

investment transforms.

The Upside

The change in corporate structure will shift the trading

multiples of Canadian Helicopter from its previous range as an

investment trust.

The unit price is now above $16 after clearing resistance at the spring

peak and should establish new highs in an improving economy.

The unit yield on distributions is 6.7 per cent. Because of the

corporate conversion, shareholders of the reorganized Canadian

Helicopters Group Inc. will be expecting trimmed yields and higher

price-to-earnings multiples ahead.

Where the stock peaks in the current bullish trend will reflect the new

balance between income investors and those keying in on the company's

growth prospects.

The firm now trades for almost eight times earnings. The stocks of

comparable U.S. air services fleet operators such as Bristow Group

(BRS-N) and PHI Inc. (PHIIK-Q) change hands for about 12 times forward

earnings.

The Downside

The $16 level is a likely short-term support area, but a

drop below $15 would be a reasonable sell trigger for this trade on a

bullish trend.

You have created and maintained an amazing, highly educational program and I am grateful for your part in getting our retirement funds to the good place they are.

You have created and maintained an amazing, highly educational program and I am grateful for your part in getting our retirement funds to the good place they are.