Bullish investor sentiment - possibly even speculation about industry consolidation – will push price momentum for Chemtrade Logistics ahead.

|

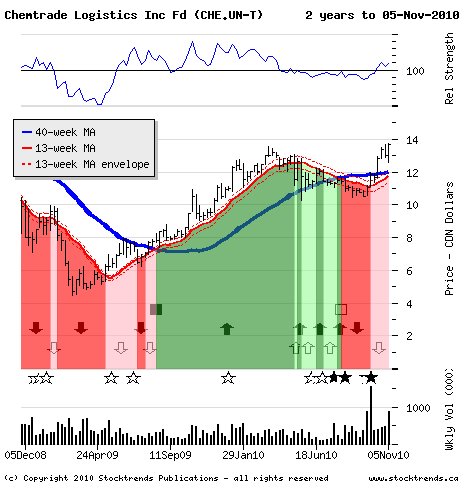

The Stock: Chemtrade Logistics Income Fund (CHE.UN-T) Recent price: $13.66 Trend: The market’s stampede toward commodity assets should not distract investors from another area of the materials sector that is being supported by green shoots of industrial demand: chemical stocks. While much of the run-up in mining stocks is attributable to monetary and fiscal drains on the U.S. dollar – capital is gravitating toward hard assets as the greenback slides – the recent performance of cyclical chemical stocks hints of sound fundamentals ahead for the global economy. These makers of resins, polymers, solvents, caustics, and a vast array of multi-syllable compounds that are the building blocks of our industrial economy are benefiting from broad global demand, low capital costs, and relatively weak natural gas prices. Emerging market industrial demand is fuelling export growth for chemical producers in an array of categories, and capital markets are providing blue chip borrowers with cheap money to fund their business. Dow Chemical Co. (DOW-N), for example, tapped the spigot of record low interest rates and an accommodative Fed last week to raise $2.5 billion from sales of debt securities. Shareholders with a stake in the chemical industry have been doing well this quarter, too. Along with Dow Chemical, a current Stock Trends Bullish Crossover stock, shares of E.I. du Pont Demours (DD-N), Celanese Corp. (CE-N), Westlake Chemical (WLK-N), PolyOne Corp. (POL-N) and Air Products & Chemical (APD-N) hit new 52-week highs last week. Also featured as a newly Stock Trends bullish diversified chemical play is Huntsman Corp. (HUN-N), while OMNOVA Solutions (OMN-N) and Koppers Holdings (KOP-N) are industry stocks attracting technical trading interest. The stock of Eastman Kodak (EMN-N), another familiar name in the category, hit new highs through October and is up 33 per cent since the end of August.

The Trade: Toronto-based Chemtrade Logistics is a leading North American supplier of sulphur products, as well as pulp chemicals. The fumes from these compounds may turn noses, but the recent unit performance of this income trust has a rosy bouquet. Sharing in the global chemical industry move, as well as recent forestry sector strength, Chemtrade unitholders are now up 29 per cent since trading picked up in late September - outperforming even the hot mining sector over the period. The autumn rally has returned the unit price back to its 2010 high above the $13.50 mark. Current yield on fund distributions is 8.8 per cent.

The Upside: Another positive move this week would signal a release of overhead resistance at the current level and point toward a further 15-30 per cent gain in the current sector strength. During bullish trending periods prior to the recession Chemtrade Logistic units traded at almost 30 times earnings, a considerable premium above the current price earnings ratio on forward earnings. Bullish investor sentiment - possibly even speculation about industry consolidation – will push price momentum ahead.

|

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!