Gold bullion prices are still exhibiting a good long-term trend position, but gold producer stocks are not. A cautious time for investors in gold stocks like Eldorado Gold.

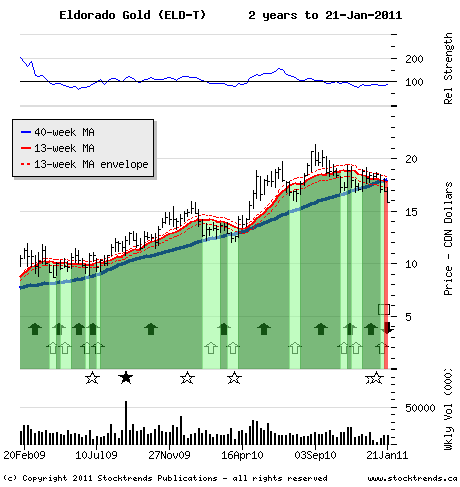

The Stock: Eldorado Gold Corp. (ELD-T) Recent price: $16.12

The Trend

Although the price of gold bullion is still above its long-term trend

line, a January retreat has contributed to a slide in the share prices

of gold producers.

The S&P/TSX Global Gold index turned Stock Trends Weak Bullish at the

beginning of the year as it dropped below trend line support, and many

large-capitalization gold stocks tumbled from their year-end share

prices. Gold stocks, which were stellar performers through much of last

year, are now a drag on the TSX.

Part of the story behind fizzling gold stocks is quite simple - the

monetary disorder that fuelled precious metal asset prices is, for the

moment, being overshadowed by earnings growth in productive assets.

The share prices of industrial enterprises reflect growing optimism

about the economy. Although it finished last week in the red with rest

of the U.S. stock market, the S&P industrial index previously hit a new

52-week high for eight consecutive weeks - an impressive string.

Add a strong technology sector, fired-up energy stocks, and a

strengthening financial sector and many stocks look positively enticing

for even the most skittish investor. Look no further than the

performance of financial and industrial conglomerate General Electric

Co. , which delivered a strong fourth-quarter earnings report card last

week - its share price above $20 (U.S.) for the first time since the

financial crisis.

Flip the coin on all this bullish good news for productive assets in the

global economy and you will find the scowling face of a gold investor.

Gold stocks have a place in most portfolios, but the current drop below

trend is a warning that the conditions that spurred the sector, starting

with the financial crisis of 2008, are giving way to the dynamics of a

much improved global economy.

More aggressive traders might be tempted to look for profits in gold's

decline by investing in a bear gold fund such as Horizons BetaPro Global

Gold Bear Plus ETF, but most investors should simply look to divert

capital to other sectors.

The Trade

Eldorado Gold is of particular interest in this column because it was

profiled as a buy in October, 2009. Eldorado's shares retreated to the

40-week moving average in November after peaking at $21.35 in the third

quarter of last year, but showed signs of trend line support in December.

However, the stock is now categorized as Stock Trends Bearish - the

first of the big-cap gold stocks in the blue-chip S&P/TSX 60 index to

close out a bullish trend this year. For those investors not already

cashed out of their position, any downward move in the stock price from

the current level should be a final straw. Eldorado's long-term chart

reminds us that $15.90 is an important support level, so further price

deterioration would be an exit signal for even the tardiest market timer.

The Upside

Because this column does not advise short sales, the positive outcome is

merely that a shareholder has taken profits on their Eldorado holding or

sold it and removed the risk of further declines in the stock.

The Downside

The share price may find support and rally back to the intermediate

trend line around $17.75. A more extreme outcome is that inflation

asserts itself and gold starts climbing again.

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.