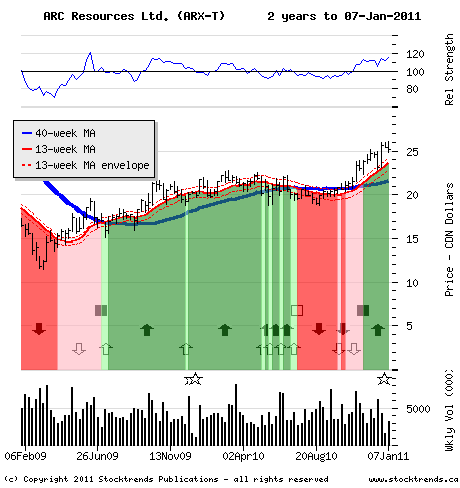

ARC Resources converted back to a corporate structure after years as an energy income trust. Will its blue chip status help it leave behind pre-conversion resistance levels?

The Stock: ARC Resources Ltd. (ARX-T) Recent price: $24.99

The Trend

With the arrival of 2011 there was the long-expected conversion of many

TSX-listed income trusts. More than 50 business income trusts completed

their switch to corporate status and began trading on the TSX as common

stocks last week.

Income trusts have certain capital restrictions that accompany the

tax-related income benefits of the asset, so the new common-share status

will deliver opportunities for market-timing investors looking for

capital gains. This slew of transformations may also offer investors a

fresh chance to capture bullish trends. Some of the newly converted

common stocks are in the energy sector, including well-known

large-capitalization entries such as Canadian Oil Sands, Penn West

Petroleum, and Enerplus Corp. Despite a recent pullback, the equity

price trend of the oil patch remains strongly bullish. The price of

crude oil slipped below $90 (U.S.) last week as the U.S. dollar lifted

with a revival of the flight-to-safety trade.

The Trade

From its initial public offering in 1996 until its completed conversion

last week, ARC Resources has established itself as a successful player

in the oil and gas sector, growing from its original $180-million

capitalization to its current $6.9-billion market cap as an income

trust. In late 2008 its units achieved membership in the S&P/TSX 60

index, and its stock will continue to attract institutional ownership as

a result of its blue-chip status. Of interest now, though, is how the

stock moves through price resistance levels established before the

recent conversion.

The stock has been in a Stock Trends Bullish category since

mid-November, after it rallied above the top end of a long-term trading

range. The stock subsequently dropped to the 13-week moving average

support line before rallying again to $26 before the Christmas holiday,

a level that now serves as a price resistance marker. The stock is again

retreating, trading below $25 in the Monday morning session. Technical

traders would expect support above $24, so the early weakness gives a

nice cue for a rally back to its 52-week high as the energy sector rebounds.

The Upside

Sector strength will guide this trade, with relatively firm crude oil

prices expected to elevate petroleum stocks in the quarter ahead.

Shareholders will be looking for fresh gains if the stock rallies out of

the current pullback and pushes decisively through the $26 level. When

ARC's units peaked above $30 in 2008 they were valued at 13 times

earnings. The stock now trades at 24 times forward earnings - an

indication of the changed valuations at work.

The Downside

The energy sector risk is that the North American recovery fizzles or

China's growth slows. ARC's shares would become Stock Trends Weak

Bullish at $23 - a fair trigger to exit the trade.

I am something of a momentum investor. I find Stock Trends useful as I can look at my portfolio as a “watch list” and quickly see where trends are declining in strength or reversing, so it is particularly useful as a tool in portfolio management regarding sales.

I am something of a momentum investor. I find Stock Trends useful as I can look at my portfolio as a “watch list” and quickly see where trends are declining in strength or reversing, so it is particularly useful as a tool in portfolio management regarding sales.