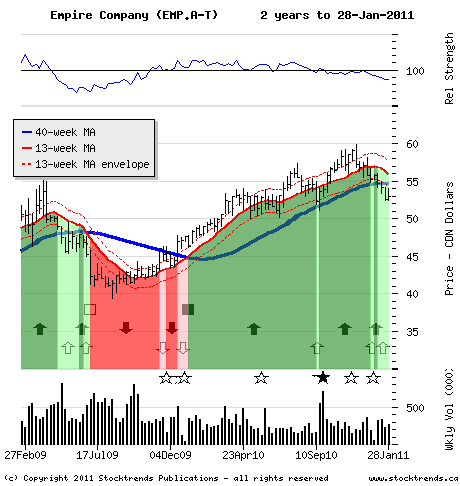

It's time to check-out at Empire Company.

The Stock: Empire Co. Ltd. (EMP.A-T) Recent price: $53

The Trend

The entry of U.S. retailers into the Canadian marketplace is exciting

news for consumers, but it also puts pressure on domestic retail stocks.

Target Corp.'s long-anticipated move north of the border has already

squeezed the share prices of Canadian Tire, down 7 per cent in

January, and Reitmans (Canada), which dropped 5 per cent last month.

Target stores won't open for a while, but investors know the

implications for the market share, profits and share prices of domestic

retailers.

Meanwhile,Wal-Mart Canada's plan to build more superstores has shaken

shareholders of Canadian food stores.

Loblaw Cos. Ltd. is feeling the tremors, as is Metro Inc., which has

seen its shares fall almost 10 per cent from their peak three months

ago. Investors should take note: The expiration date of last year's

grocery store bull trend has passed.

The Trade

Most of these Stock Trends columns focus on buying opportunities, but

some times it is possible to feature stocks that are pointing investors

to the exit. Empire Co., operator of Sobeys and other food retail

banners, was profiled as a "buy" here at the end of 2009 when it was in

the early stages of a new bullish trend. Its stock moved from the $46

level to eventually peak just a penny shy of $60 in late November.

However, since hitting its 52-week high Empire's stock has

underperformed the broader TSX market for all but one week. Since the

New Year, it has been in the Stock Trends Weak Bullish category,

indicating that trend-following shareholders should be ready for checkout.

The Upside

The immediate downside risk is a slip to the $50 level, a possible price

support level. But the relative weakness of food store stocks may well

persist for a longer period. Rotating to bullish trending sectors will

deliver better results.

The Downside

Although market timers like to celebrate their success, there are almost

always lost profits on the table. Those willing to risk waiting to sell

on strength might wait on a rally in the short-term, perhaps sending the

stock back above the $56 area, to regain some of the value lost since

November.

I am fascinated with your service and methodology - it is very impressive. [...] Over the years I have concluded that there are many ways to approach stock investing, but once one has chosen a path, one is better off sticking to it.

I am fascinated with your service and methodology - it is very impressive. [...] Over the years I have concluded that there are many ways to approach stock investing, but once one has chosen a path, one is better off sticking to it.