Food processing stocks are doing well despite rising input prices. Kellogg is a familiar name at the breakfast table and in investor portfolios.

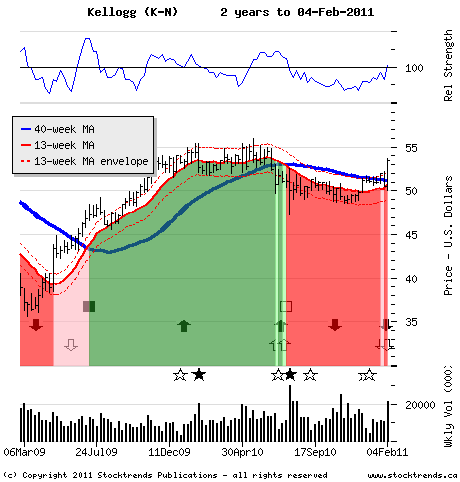

The Stock: Kellogg Co. (K-N) Recent price: $53.42*

The Trend

Major spells of food inflation can spur social unrest. They also affect

the valuations of companies in the global food industry.

Casual dining restaurants are among the companies that feel the squeeze

from rising agricultural prices. When consumers last confronted rising

food costs three years ago, dining stocks such as Ruth's Hospitality

Group, Ruby Tuesday, Chipotle Mexican Grill, Texas Roadhouse and units

of Keg Royalties Income Fund struggled. Although last week saw a rise in

many U.S. restaurant stocks, the trend since late 2010 has been

deteriorating.

Stocks of major food processors are a different story. Some of these

producers have commodity hedging programs and more room to pass along

higher input costs. Consider the surprisingly strong results of meat

producer Tyson Foods, announced late last week. Its shares are

categorized as newly Stock Trends Bullish and are a current stock pick.

The Trade

In 2007 and 2008, commodity price inflation was acute. The U.S. consumer

price index for cereals and bakery products rose about 15 per cent, but

the stock of Kellogg Co., the world's largest cereal maker, outperformed

the broader stock market during most of the period. Its shares have been

struggling since last May because of competition and product recalls,

but the recently announced fourth-quarter earnings suggest a corner has

been turned.

Kellogg's stock advanced 5.8 per cent last week, and turned to Stock

Trends Weak Bearish - an indicator that points to a move above trend

line resistance. While consumers may be faced with higher prices for

their granola, Corn Pops and Pop Tarts, shareholders should be

encouraged by improved revenue expectations. The company plans more

product price increases in 2011, on the order of 3 to 4 per cent.

Trend-following investors will like the stock's aggressive move above

$52, with trading volume in the stock last week lifting 60 per cent

higher than its weekly average of the past two quarters.

The Upside

Although the current rally may only lead to the stock regaining its 2010

high of $56, shareholders can anticipate market outperformance over a

longer period. Recent analyst upgrades also suggest this trade can offer

more.

The Downside

The 40-week moving average trend line sits near the $51 mark. A drop

below that level suggests it's time to exit this trade.

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.