Trading U.S. securities implies foreign exchange rate risk. Canadian dollar hedged funds offer investors some protection of equity returns when exchange rates fluctuate.

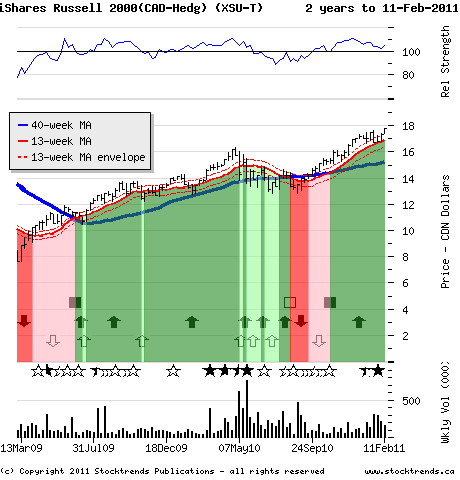

The Stock: iShares Russell 2000 Index Fund- CAD Hedged (XSU-T) Recent price: $17.80

The Trend

Canadian investors have enjoyed good returns during the current bull

market, with the domestic stock market outperforming U.S. stocks

throughout the period. However, the relative performance of U.S.

equities has improved enough that Canadians should consider expanding

their exposure south of the border. Of particular interest is the

small-capitalization sector, which has been eclipsing the performance of

the bigger stocks in the S&P 500 index since the end of the third

quarter last year.

The Russell 2000 index is the traditional benchmark for U.S. small-cap

stocks. It is up 14 per cent from three months ago, ahead of the

11-per-cent advance in the broader U.S. market. About 35 exchange-traded

funds offer various ways to play the U.S. small-cap sector. Last week,

all but two of these ETFs reached new 52-week highs, including the

heavily traded iShares Russell 2000 index fund as well as the

top-performing Vanguard Small Cap Growth fund, up 17 per cent in the

past three months.

Small-cap Canadian equities are also doing well, signalled by the TSX

Venture Exchange index outpacing the S&P/TSX composite index by 9 per

cent during the winter's stock market advance. However, small-cap stocks

on the Venture Exchange and the TSX are largely resource plays, so their

recent performance premium is largely a reflection of the speculative

strength of the commodity trade.

The Trade

The relative strength of the U.S. market may seem inviting to Canadian

investors, but currency risk is a real concern. A strong and rising

loonie eats away at the returns from U.S. stocks. But the iShares

Russell 2000 CAD Hedged index fund, traded on the Toronto Stock

Exchange, hedges its currency exposure and provides insurance against

the chance the loonie may continue to rise.

An example of the hedging advantage of this fund can be found when

comparing the performance of the unhedged Russell 2000 index against

this iShares fund. Over the past three months the Russell's

14.3-per-cent gain would have been partially offset by a 2.3-per-cent

rise in the Canadian dollar versus the greenback and resulted in a

12-per-cent return. In contrast, an investor in the Shares Russell 2000

index CAD Hedged fund would have retained a 13.1-per-cent gain.

The Upside

The Russell 2000 is just 4 per cent shy of its pre-recession high. Trend

investors can expect a bullish stock market to help blast through that

long-term overhang and will be anticipating a 10-per-cent gain from the

current level as the index moves along its current trend line.

The Downside

All the factors that threaten the U.S. stock market can doubly affect

small-cap stocks. A surging U.S. dollar also means bad news for this

trade, since Canadian-dollar-hedged instruments lag the unhedged index

when the loonie drops. This fund would turn Stock Trends Weak Bullish at

$16.50, a possible exit point for this trade if the market turns.

Stock Trends information is part of the base information I review before making a trade.

Stock Trends information is part of the base information I review before making a trade.