Depressed natural gas prices have been the norm for some time, but investors are warming up to natural gas stocks again. BNK Petroleum has some short-term upside worth playing.

The Stock: BNK Petroleum Inc. (

BKX) Recent price: $5.42

Trend: Political turmoil in the Middle East is again sending world oil markets on a speculative ride, with the price of crude jumping above $97 and threatening another spell of high gasoline prices ahead if unrest spreads in the OPEC sphere. Investors dipping into energy stocks should be strapped in for a rally, and ready for volatility that matches the bold headlines of a world in flux. However, for those interested in less drama in their energy investments, natural gas may be the way to go.

Natural gas investors have suffered a sector secular decline for some time now – over two years of weak and sliding prices with only brief intermittent periods of hopeful respite. Bounteous natural gas supplies have generally dampened the prospect of recovery. Of course, many have bet on the end of the commodity’s bearish trend, only to be disappointed in their timing. Natural gas prices are still depressed, with bearish commodity exchange traded funds like the Claymore Natural Gas ETF (

GAS) and Horizons BetaPro Winter-Term Natural Gas (

HUN) hardly sending technical trend traders any positive signals. Natural gas stocks, though, are plenty warm.

Large capitalization U.S. natural gas plays like El Paso Corp. (

EP), Chesapeake Energy (

CHK), and Williams Cos. (

WMB) are among a number of bullish trending components of the NYSE Arca Natural Gas Index, which is up almost 15 per cent in the past three months. More enticing for North American retail investors looking to add to their energy exposure a step removed from popular revolts in distant lands is the potential of junior gas stocks. The BMO Junior Gas Index ETF (

ZJN) - representing holdings of junior producers like Rosetta Resources (

ROSE), Celtic Explorations (

CLT), Paramount Resources (

POU), Birchcliff Energy (

BIR) and Fairborne Energy (

FEL), a current Stock Trends pick - has logged steady advances in recent weeks. Within the group are some bullish trending stocks that could provide ample returns for investors ready to go long natural gas equities.

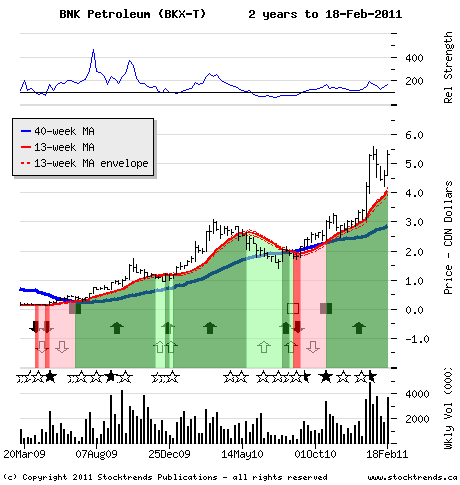

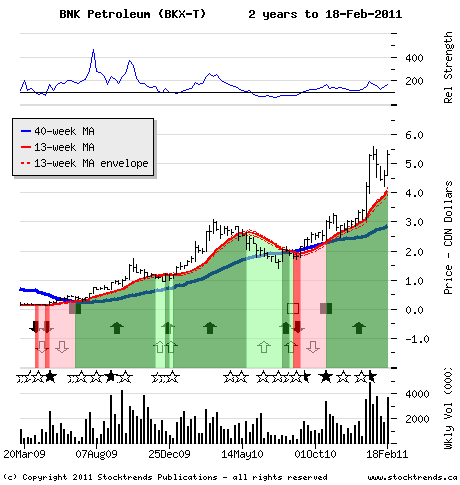

The Trade: TSX-listed BNK Petroleum is a natural gas play with shale basin assets in the United States and Eastern Europe. A Stock Trends Bullish Crossover breakout stock pick last October when the share price rallied to $3.00, this investment rewarded market timers over the following three months, peaking at $5.60 in January before retreating. The stock held this month above price support set earlier, and is now trading above the $5.30 tip of its initial January move. Look for stronger trading volume to elevate this investment toward another round of price momentum.

The Upside: Technical traders will be expecting this stock to best its highs of last month soon. Continued sector strength - and any whiff of improvement in the price of natural gas - should help BNK Petroleum shares continue to outperform the broad market, possibly adding a 40 to 50 per cent gain if momentum carries. The stock’s chart does not really guide that expectation, but statistical market analysis of the BNK’s current Stock Trends trend and momentum indicators gives us that upper-end, bullish objective for the next quarter.

The Downside: Another pullback to the $4.20 level will test this trade and send some anxious traders to the exit.

I want to thank you for posting such an excellent guide to technical analysis on the web. You have provided a great service to all of us novice investors.

I want to thank you for posting such an excellent guide to technical analysis on the web. You have provided a great service to all of us novice investors.