Investors are preparing for even worse news ahead. Bonds are rallying, with yields now dipping into unchartered territory. Underlying inflation expectations have pushed even U.S. long bonds into negative real rates of returns. Not surprisingly, TIPs are attracting broad interest.

|

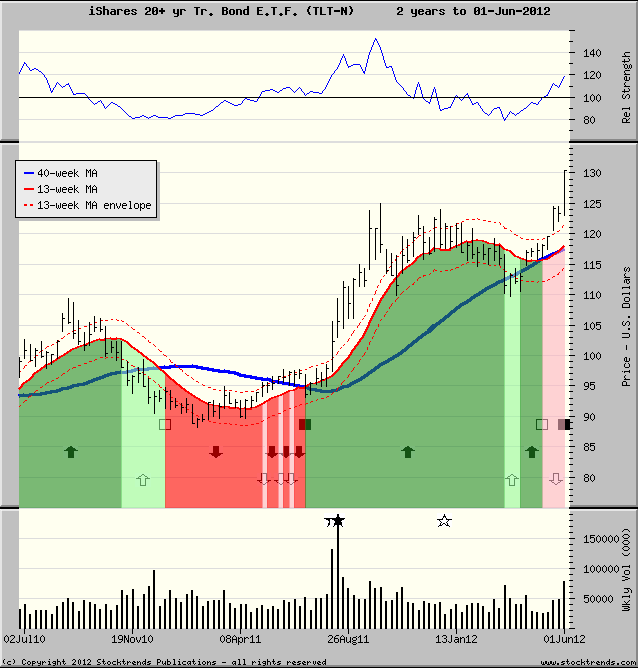

With May’s stock market tumble another summer is being introduced with a scramble for safe haven investments. Although gold and gold stocks are benefiting, principal among the alternatives are bonds and bond funds. Bond prices are being pushed higher, sending yields – which move inversely to price - south. The current yield on 10-year U.S. Treasury note is 1.47 per cent – the benchmark’s lowest level ever. Long bond prices are being driven by expanding demand, too. The yield on the 20-year Treasury is 2.13 per cent, making the yield curve increasingly flatter and indicating real interest rates (yields discounted by inflation expectations) are negative across the board – from short-duration Treasury Bills all the way up to long bonds. Investors are basically paying to put their money in these securities. That’s the price of safety. Heavier trading volume in bond funds has fueled a strong rally in this group and momentum indicators point to even more of a push toward bond exposure this summer. The iShares 20+ year Treasury Bond ETF (TLT) traded double its average weekly volume last week, hitting a new high. It closed Friday at $130.36 – up 10 per cent in three short weeks. Last week’s move took the floor out of long bond yields, which are now well below the rates at the end of 2008 – although real 20-year yields in the depths of the recession never went below 1.99 per cent – a lot better than the current -0.03 per cent real yield.

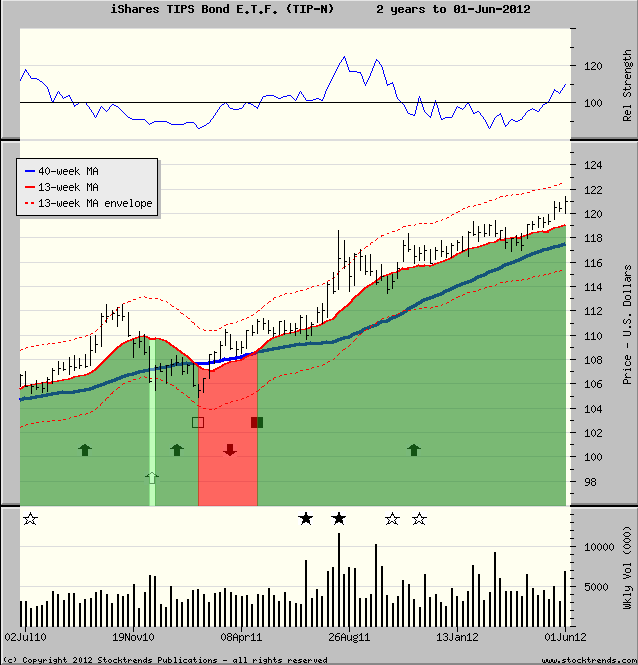

With negative real interest rates investors have been looking for some cover. Most inflation-protected U.S. bond ETFs have out-performed the slumping S&P 500 by 10 per cent over the past three months. All have been categorized as Stock Trends Bullish for over a year. The iShares TIPS Bond ETF (TIP) is the most actively traded, with trading volume up 50 per cent last week. The best performer, mirroring the long bond rally, was the PIMCO US 15+year TIPS ETF (LTPZ). It has advanced 10 per cent so far in the second quarter. With monetary stimulus almost reliably on the table again these instruments will remain popular until the U.S. elections clarify whether fiscal policy solutions lay ahead. Until then, the positive trend in bond prices will be accompanied by demand for inflation-protection.

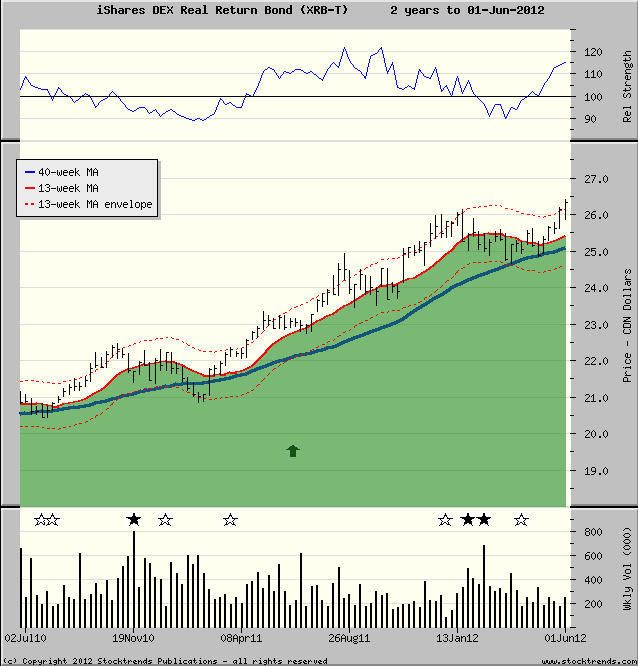

Canadians are not immune to this ominous picture of stagflation, so real return bonds are an attractive investment – and have been since the spring of 2009. Both the BMO Real Return Bond Index ETF (ZRR) and the iShares DEX Real Return Bond Index Fund (XRB) have hit new highs in each of the past two weeks and are outperforming the broad equity market by 15 per cent over the past three months.

The iShares DEX Real Return Bond ETF has proven to be an attractive investment for some time, and was profiled in a Stock Trends column in April of 2011. The fund moved through the previous high reached early in January, and like many bond funds has rising relative strength against the backdrop of sinking equities.

How low can U.S. and Canadian bond yields go? That is a question about to be answered, since an economic slowdown is forcing a U.S. monetary policy response relatively soon. The Canadian long-term real return bond yield closed May at 0.34 per cent and will likely plumb along with U.S. bonds. While stocks are in a downdraft – the Stock Trends TSX Bull/Bear Ratio now shows there are more bearish trending stocks than bullish ones – the flight to safety will continue to be a strong theme in the third quarter.

|

An admitted cynic, it's obviously very high praise when he says he likes StockTrends because of its "simplicity, utility, openness, [and] honesty," and in addition to having "no hidden agenda" is "understandably documented [and] historically verifiable." And, he adds, "It lets me see a lot of things without doing a lot of work." Globe and Mail

An admitted cynic, it's obviously very high praise when he says he likes StockTrends because of its "simplicity, utility, openness, [and] honesty," and in addition to having "no hidden agenda" is "understandably documented [and] historically verifiable." And, he adds, "It lets me see a lot of things without doing a lot of work." Globe and Mail