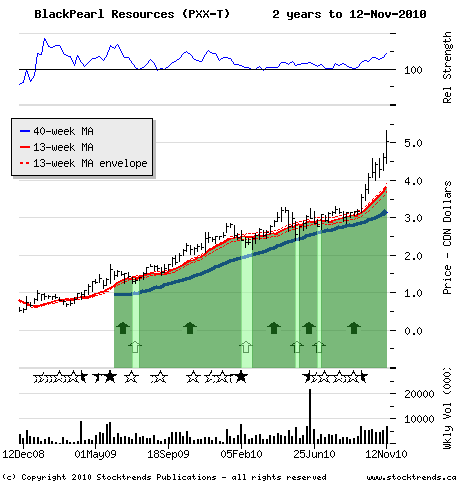

Look for a continuation in BlackPearl Resource's bullish trend.

|

The Stock: BlackPearl Resources Inc. (PXX-T) Recent price: $5.00

Trend: Oil producer and driller stocks have been great performers since the beginning of September, and their immediate outlook will continue to reflect the movement of crude oil prices. After trading above $80 in October and leaping above its second quarter high this month, the price of crude oil has pulled back in recent sessions and now trades below $84. Canadian equity investors will be focused on this crucial commodity over the next period, looking for a resumption of the energy sector’s autumn rally.

While a World Energy Outlook report released recently by the International Energy Agency points to a long-term trend toward even higher energy prices, a more immediate influence on crude oil and petroleum producer equity prices is a frail U.S. dollar. The link between the performance of the dollar and crude oil should provide technical traders with an opportunity to ride price momentum in energy sector stocks.

Last week’s rebound in the greenback, sparked by Euro-zone concerns, returned the U.S. Dollar index to its October resistance level - a mark from which the greenback will be expected to retreat along its downtrend. Energy sector investors anticipating commodity inflation to persist – despite this recent setback, the CRB index of commodity prices is up 12 per cent in the past three months – can add to their weightings in the oil patch as the dollar slips again and the price of crude oil regains the plus-$85 level.

High-cost heavy oil and tar sands producers would be a good play in an environment where $100 crude possibly looms. When consumers last battled sky-rocketing energy prices Canada’s unconventional oil reserves attracted heightened investor interest and big cap producers with sizable oil sands reserves shined. Suncor Energy (SU-T) and Canadian Natural Resources (CNQ-T) were notable sector out-performers in 2008 when crude peaked above $140.

A number of oil sands income trusts are now developing positive short-term price signals, including Canadian Oil Sands Trust (COS.UN-T), Oil Sands Sector Fund (OSF.UN-T), and the Oil Sands & Energy Mega-Projects Trust (OSM.UN-T), which closed above its October high last week. Also showing the group’s strength is the Claymore Oil Sands Sector exchange traded fund (CLO-T), up 17 per cent since the end of August. That move is in parallel with the advancing price of crude oil, and better than the 15 per cent gain by the broader energy sector. Shares of Canadian Natural Resources are up 24 per cent over the period, too.

The Trade: One of the best current energy sector performers is BlackPearl Resources, a constituent of the Claymore Oil Sands Sector ETF. The stock of this heavy oil producer is up 60 per cent since breaking out at the end of September, hitting an all-time high and advancing another 10 per cent in a week of trading that ended with the energy group down. That kind of performance would normally put the stock at risk of a retreat on profit-taking, but momentum traders are not likely to give up on this one yet. The company announced a new $50-million equity financing this week, another sign of the market’s appetite for its stock. Look for the share price to hold at the current level, but resume a bullish trend with a return to rising crude prices and continued capital flows toward unconventional oil reserves.

The Upside: This is new territory for BlackPearl’s stock, so there is little on the stock chart to guide investors. However, given the length of the bullish price trend and relative price performance, an historical comparison of one-month returns on similar momentum stocks suggests shares could extend toward $6 by yearend.

The Downside: A lot can go wrong with a momentum play, too. A trade exit might be advised if the stock retreats below $4.25.

|

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!

Just thought I'd call to thank you, Skot. Stock Trends Weekly Reporter helped pay for my daughter's education!