King Coal shows strength on emerging-market demand.

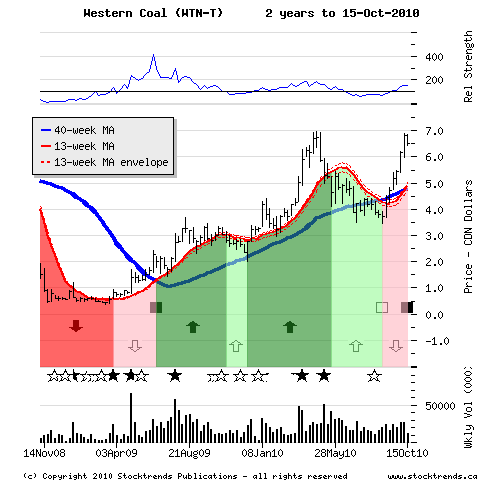

The Stock: Western Coal Corp. (WTN-T) Recent price: $6.50

The Trend

Gains by commodity stocks since the end of August have been

considerable, and the number of stocks in resource industries with new

bullish price trends has surged. The S&P/TSX Metal Mining index is up 33

per cent in the period and the sector has been a major reason the

Toronto market has climbed back above its first-quarter peak. But

non-base metal mining stocks have put up stellar autumn performances,

too - including uranium mining shares after a strong move last week. Not

lost in the broader mining rally, though, is the resurgence of many coal

stocks.

Market Vector Coal ETF and the Powershares Global Coal Portfolio have

fired up 29-per-cent gains during this most recent commodity rally.

Component stocks in these funds represent different aspects of the coal

industry, but coal miners are the main polish on the group. The coal

market's fundamentals are correlated with Chinese economic prospects in

particular, and the growth of developing markets in general, so the

bullish trends of coal mining stocks relates a positive sentiment from

investors about the global economy.

Improved fundamentals for the U.S. coal industry are showing in the

stocks of its major producers. Although finishing last week on a soft

note, shares of Peabody Energy have advanced in prime technical form,

trading a string of six straight weeks of higher highs and higher lows.

A similar recent rally in CONSOL Energy and even better performances

over the past 13 weeks by the stocks of Alpha Natural Resources, Arch

Coal, and International Coal Group suggests the group will finish 2010

above the resistance that capped industry share prices over the past year.

Canadian coal stocks have shared the upbeat tempo. Integrated miner Teck

Resources, a current Stock Trends Bullish Crossover stock, announced a

new 10-year deal with Canadian Pacific Railway to ship coal from its

mines to West Coast terminals, a positive indicator of the company's

demand for coal transport capacity. Shares of Grande Cache Coal hit a

road bump last week, but are still outperforming the broad Toronto

market by 20 per cent over the past three months. The stock of Cline

Mining Corp. is also holding on to its big September gains. And surely

enjoying the glow of the coal fire is Westshore Terminals Income Fund,

operating Canada's busiest coal export facility. Its units have been

trending positively since the second quarter of 2009 and continue to

notch all-time highs.

The Trade

Western Coal shareholders appreciate the improved conditions. The stock

has recovered from a huge setback after shares collapsed from an April

high of $6.97, dropping below their previous bullish trend line to

eventually find support at the $3.50 level. The mid-year dip is coming

full circle, though, as the stock is approaching its first-quarter peak

again. The crossover of the 13-week moving average above the 40-week

moving average is a Stock Trends signal to review this stock for an

intermediate-term trade, but a move to a new 52-week high would be a

good trade trigger. Shares dropped to $6.23 early this week, so patience

might be in order.

The Upside

If the industry momentum helps carry this stock through the final months

of the year, a move above $7 should deliver a further 15-per-cent gain

ahead.

The Downside

An emerging-market shiver could cool down coal stocks. A drop below

$5.50 would be an early signal that this trend trade has derailed.

There is a lot to be gained from comparing trends of how individual stocks are doing within a sector, as well as how the sector is performing relative to the broad market.

There is a lot to be gained from comparing trends of how individual stocks are doing within a sector, as well as how the sector is performing relative to the broad market.