The Select Bullish Crossover Portfolio strategy stands at the intersection of systematic inference and market timing. Each position is chosen from the Stock Trends Inference Model’s Select list—names whose probability of outperforming the base random return is favorable across 4, 13, and 40 weeks. From this foundation, the portfolio then isolates Bullish Crossover (![]() ) signals, capturing securities that have transitioned from neutral or bearish states into confirmed upward momentum. In this editorial, we look at the NYSE Select Bullish Crossover Portfolio's current holdings and discover that some themes are revealed.

) signals, capturing securities that have transitioned from neutral or bearish states into confirmed upward momentum. In this editorial, we look at the NYSE Select Bullish Crossover Portfolio's current holdings and discover that some themes are revealed.

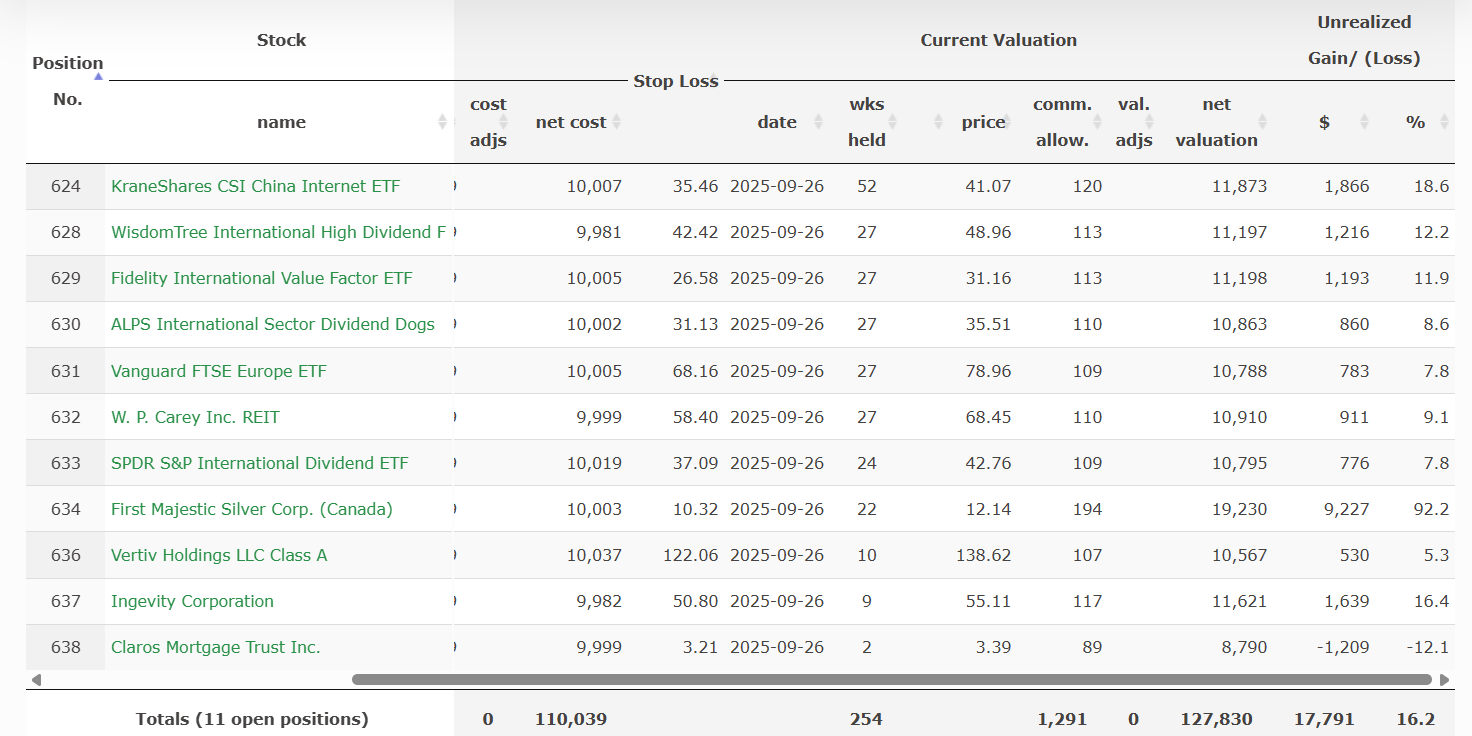

The current longer-term holdings of any Stock Trends Portfolio are, by definition, survivors. They represent stocks and ETFs that have adhered to the strategy parameters and have not yet triggered the exit rules. But what does a survey of the holdings of the NYSE Select Bullish Crossover Portfolio tell us? What emerges is a strategically diversified basket of bullish narratives, mapped to today’s macro regime:

- Hard Asset Resilience — precious metals as hedges in an inflation-tinged, geopolitically uncertain world.

- Yield & Income Stability — REITs and global dividend ETFs as rates ease and defensiveness returns.

- Global Value Rotation — factor/value exposures favored as investors seek earnings stability.

- China Recovery Trade — selective re-risking into China internet after prolonged turbulence.

- Cyclical & Secular Growth — industrials and AI/data-center infrastructure as twin engines.

Consistent with the Stock Trends Handbook and the ST-IM framework, this portfolio expresses the Stock Trends principle: probabilities, not speculation.

Selection Logic

Portfolio strategy details: NYSE — ST-IM Select Bullish Crossover.

- Minimum price: $2; Minimum weekly volume: 100,000 shares.

- Bullish Crossover Stock Trends indicator:

- ST-IM Select: lower bound of mean return confidence interval > base random mean at 4w, 13w, 40w.

- Names are then ranked by probability of exceeding the 13-week base random return (threshold ≥ 55%).

Current Holdings

| Symbol | Name | Trend | Trend Age (wks) | Major Trend Count (wks) | RSI | Notes |

|---|---|---|---|---|---|---|

| AG | First Majestic Silver Corp. | 18 | 23 | 141 | Precious metals hedge, strong momentum | |

| CMTG | Claros Mortgage Trust Inc. | 2 | 3 | 109 | Early bullish crossover in REITs | |

| DTH | WisdomTree International High Dividend ETF | 27 | 28 | 99 | Global yield play, stable trend | |

| DWX | SPDR S&P International Dividend ETF | 24 | 25 | 95 | Dividend exposure, lagging RSI | |

| FIVA | Fidelity International Value Factor ETF | 25 | 28 | 99 | Value tilt, aligned with global rotation | |

| IDOG | ALPS International Sector Dividend Dogs | 25 | 28 | 98 | Contrarian yield ETF | |

| KWEB | KraneShares CSI China Internet ETF | 22 | 53 | 111 | China rebound theme | |

| NGVT | Ingevity Corporation | 8 | 10 | 118 | Specialty chemicals, cyclical rebound | |

| VGK | Vanguard FTSE Europe ETF | 25 | 28 | 95 | Europe recovery trade | |

| VRT | Vertiv Holdings LLC Class A | 3 | 11 | 101 | AI/data center infrastructure | |

| WPC | W. P. Carey Inc. REIT | 24 | 28 | 101 | REIT with diversified income |

Theme-Based Commentary & Rationale

Hard Asset Resilience — First Majestic Silver Corp. (AG)

Signal: 18 weeks into a Bullish trend category (![]() ) with RSI 141 and positive relative momentum. Within the portfolio’s design, AG functions as a macro hedge and a momentum leader, consistent with the Handbook’s guidance on aligning trend confirmation with macro hedging.

) with RSI 141 and positive relative momentum. Within the portfolio’s design, AG functions as a macro hedge and a momentum leader, consistent with the Handbook’s guidance on aligning trend confirmation with macro hedging.

Yield & Income Stability — Claros Mortgage Trust (CMTG) & W. P. Carey (WPC)

CMTG is an early-phase Bullish trend (2 wks) with RSI 109; WPC is in a mature Bullish trend (24 wks) with RSI 101 and positive relative momentum. As expectations for rate relief grow, REITs’ risk-reward improves. The pairing provides both early momentum (CMTG) and seasoned trend stability (WPC).

Global Dividend Defensives — DTH (DTH), DWX (DWX), IDOG (IDOG), VGK (VGK)

All four are in mature Bullish trends (24–27 wks), offering income-tilted ballast and geographic diversification. DTH (RSI 99) and VGK (RSI 95, +) center the Europe/international yield theme, while IDOG (RSI 98, +) adds contrarian selection across sectors. DWX (RSI 95, –) lags on relative strength but remains trend-confirmed.

Global Value Rotation — FIVA (FIVA)

FIVA sits 25 weeks into its Bullish trend category with RSI 99 and positive relative momentum. As a systematic factor sleeve, it complements the ST-IM inference by emphasizing value and quality when earnings dispersion widens.

China Recovery Trade — KWEB (KWEB)

22 weeks into its strong Bullish trend with RSI 111 (– vs S&P). Despite relative chop, the trend confirmation and ST-IM Select status justify a measured allocation to the China internet rebound narrative.

Cyclical & Secular Growth — Ingevity (NGVT) & Vertiv Holdings (VRT)

NGVT is 8 weeks into its Bullish trend with RSI 118 (– vs S&P), a cyclical chemicals recovery story. VRT, 3 weeks into a Bullish trend (RSI 101, –), captures the secular AI/data-center build-out. Together they balance early momentum with structural growth exposure.

Conclusion

The Select Bullish Crossover Portfolio channels the weight of evidence: ST-IM probabilities, confirmed trend transitions, and macro-aligned themes. Mature dividend and international sleeves provide defensive ballast, while newer crossovers supply asymmetric upside. In line with the Stock Trends framework, we let quantified probabilities guide allocation and let trends validate it in real time.

Related items

- Stock Trends Mid-Quarter Review: How the Year-End 2025 Themes Are Performing in Q1 2026

- Stock Trends Year-End Analysis: Institutional Momentum, ST-IM Alpha, and the Road Into Q1 2026

- Understanding Our Assumptions — A Decade Later

- Trading Nvidia with the Stock Trends RSI +/– Pattern Analysis Model

- Navigating Market Turmoil in December 2025 – How Stock Trends Guides Investors

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!