The Map of Stock Trends is a treemap that points investors toward large cap stocks the Stock Trends analysis favours. Investors get a unique and powerful look at the North American stock market.

The Stock Trends Inference Model is a quantitative approach to interpreting the categorical data that is the core value-added analysis presented here. The Stock Trends indicators are derived from base tenets of the market technician’s encyclopedia - a toolset designed to reduce a complex market dynamic to a categorical, and hierarchical framework. By evaluating the statistical significance of this framework we can apply meaningful algorithmic trading methods.

However, the first step is to understand the data and interpret the Stock Trends Inference Model results. Every week we sample 30-years of data to assign a probability for future returns on over 7,000 North American stocks. Using combinations of categorical data and making assumptions about the distribution of returns, we apply statistical inference methods to differentiate stocks (ETFs and income trusts, too) by the estimated returns in the coming periods (4-weeks, 13-weeks, and 40-weeks). You can see the result of that analysis in the Profile section of each Stock Trends Report.

I’ve already introduced the Stock Trends Inference Model in previous editorials. Subscribers to Stock Trends Weekly Reporter can interpret this information weekly, as well as review the reports on issues with the best expected returns. The Stock Trends ‘Select’ report, as well as the Top 4-wk/13-wk/40-wk returns expectations reports give users a new way to make the Stock Trends reports actionable.

However, these reports can be augmented by data visualizations. Graphical presentations of data are always useful in translating vast data points into more accessible interpretations. A good graph saves us time and points us in the right direction.

The Stock Trends Profile reports include heatmaps which help us compare returns expectations among industry group member stocks. Another useful display method for this data, especially when we want to broaden the use of the data hierarchy, is a treemap. A treemap is specifically designed for hierarchical data and is commonly used. A popular example in our equity analysis space is the

Map of the Market.

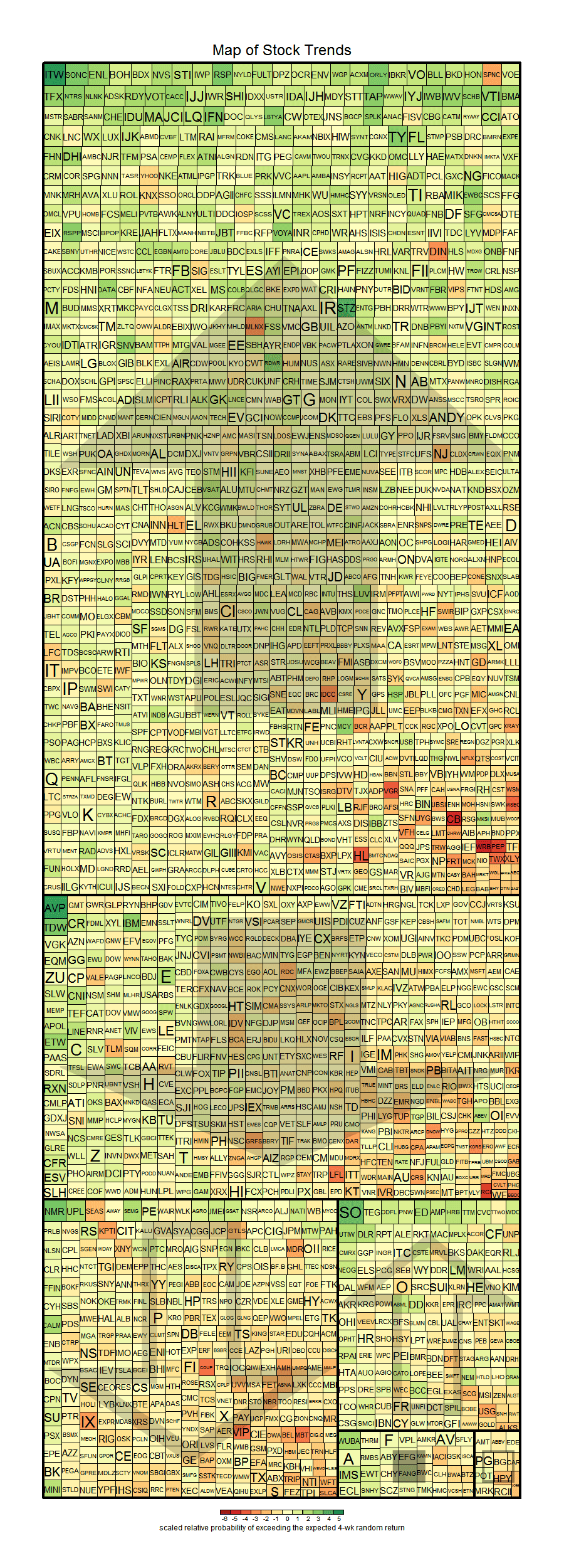

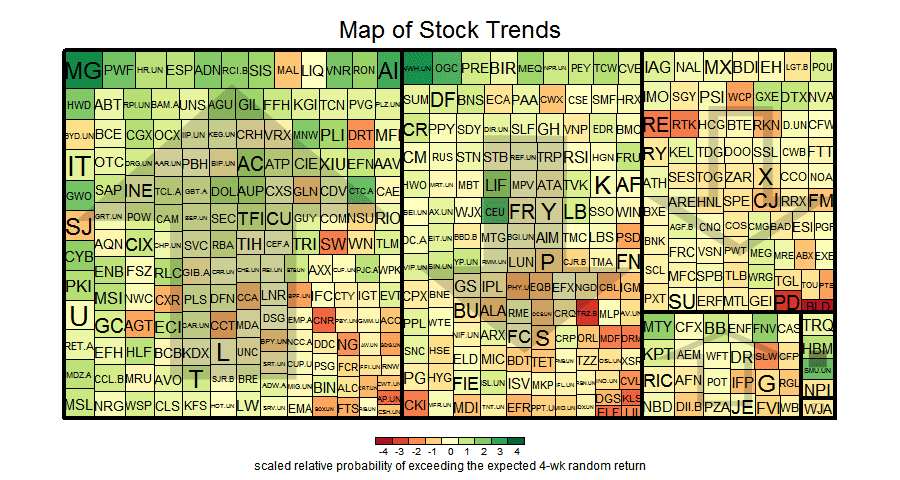

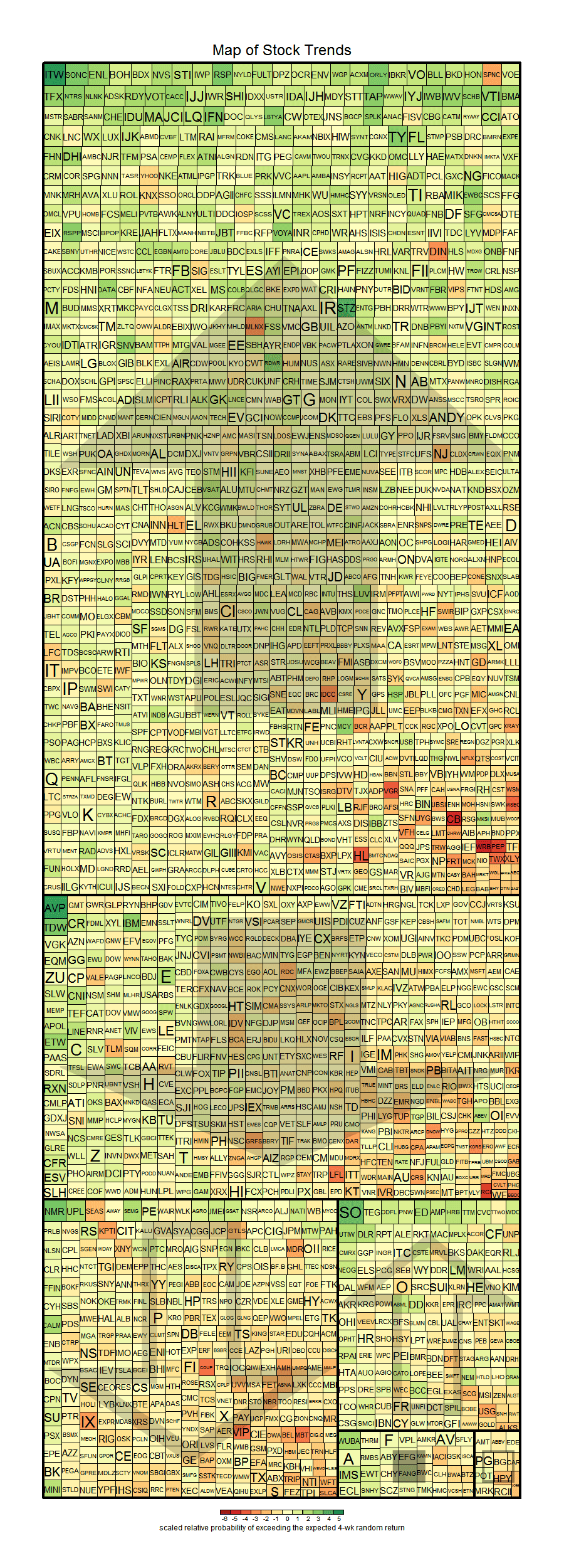

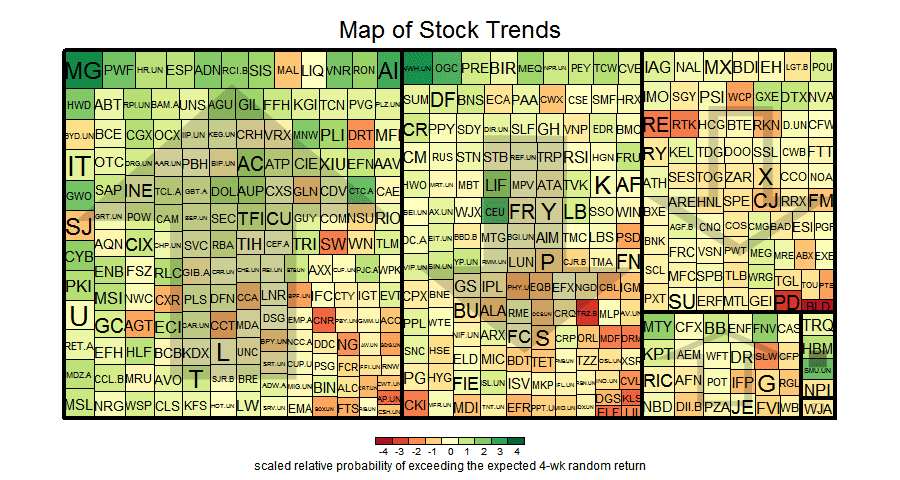

Today I am introducing a treemap of the Stock Trends Inference Model - the Map of Stock Trends. It takes the data results from the weekly analysis, sorting 4-week and 13-week returns expectations by trend category.

In the treemaps displayed below large capitalization stocks (U.S. stocks with a market cap greater than $1-billion, Canadian stocks with market cap greater than $500-million) are grouped by Stock Trends indicator (Bullish

, Weak Bullish

, Bearish

, Weak Bearish

, Bullish Crossover

, Bearish Crossover

). Each stock within these groups is visually differentiated in two ways: spatially by their relative probability of a return greater than the base 13-week mean random return (2.19%) , with larger cells (higher probabilities) sorted and displayed from the upper left quadrant and moving down to the lower right corner for the lower value. Secondly, the 4-week returns expectations are differentiated visually by color gradation, with darker green hues representing stocks with higher probabilities of exceeding the base average 4-week random return (0%) and darker red hues representing the stocks with the poorest probabiltity of a positive return in 4-weeks.

Dark green cells in the upper left of each trend category are stocks with the best statistical trend characteristics. Dark red cells in the lower right quadrant of each trend category are stocks with the worst statistical trend characteristics.

Below are the current Map of Stock Trends treemaps for the U.S. and Canadian stock markets. Each Stock Trends trend indicator category grouping is identified by the translucent indicators in the background of each box. In the future the treemap will be developed in an application that allows users to click on an individual cell and go directly to individual Stock Trends Reports, but for now the visualizations help direct us to the stocks with the most favourable current Stock Trends Reports.

U.S. stock exchanges - big cap stocks

Toronto Stock Exchange - big cap stocks

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!