Wondering which U.S. sectors and industry groups are signalling the best opportunities for returns in the period ahead?

|

Wondering which U.S. sectors and industry groups are signalling the best opportunities for returns in the period ahead? The Stock Trends Inference Model presents a quantitative look at period returns for individual stocks, and from those return expectations the sector and industry group average return expectations can be measured.

Recall that the Stock Trends Inference Model estimates the returns expectations for a stock, ETF or income trust given its current Stock Trends indicators. It does this by sampling for similar combinations of Stock Trends indicators over the past 30-years and measures post-observation price performance. From these samples statistical inference methodology is applied to estimate population mean and standard deviation parameters.

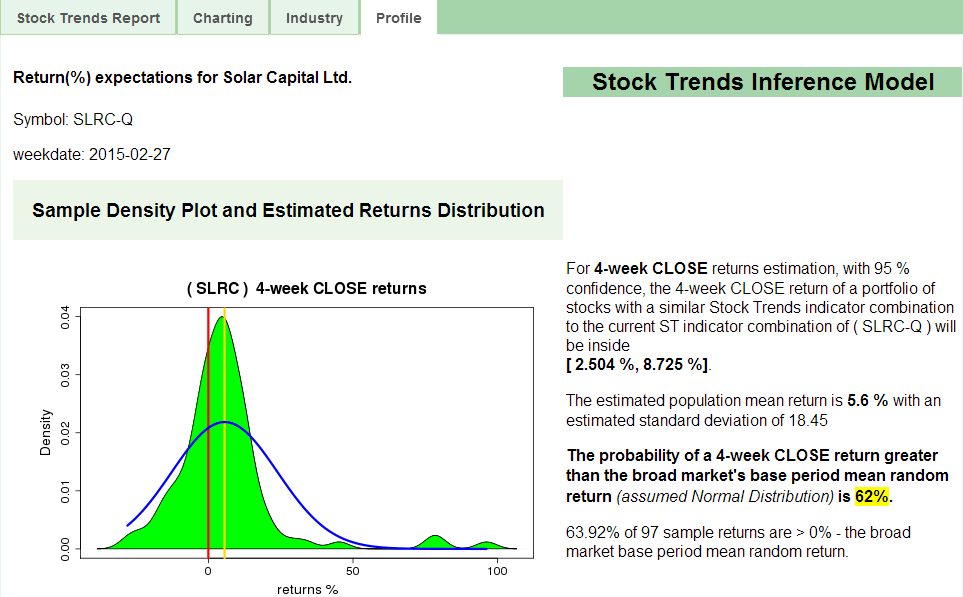

Every week over 6,000 issues have a Stock Trends indicator combination that has a minimum of 50 similar combinations in the data history, and you can find the resultant probability analysis in the Profile tab of these individual Stock Trends Reports. For instance, the current Stock Trends Profile of Solar Capital Ltd. (SLRC) shows that the expected 4-week return will be 5.6% and that the probability of a return greater than the base 4-week return expectation (which is 0%) is 62%. Our base expectation is that a stock has a 50% chance of a positive return in a 4-week period, so SLRC has a better chance of performing well, and is the top Nasdaq ST-IM Select stock this week.

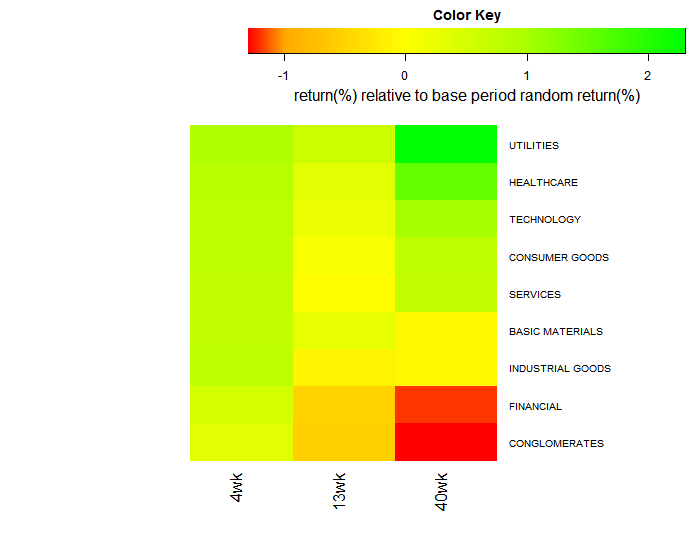

The current week reports on 6,261 listings that have ST-IM returns estimations for 4-week, 13-week, and 40-week periods ahead. Breaking down those listings by sector and industry group gives us a better understanding of market timing trade opportunities. The heatmaps below rank sectors and industry groups by mean relative expectations over the three different time periods.

U.S sectors - ranking of return(%) expectations

Currently, the top returns expectations are found in utilities, healthcare, and technology sectors. Conglomerates, Financials, and Industrial sectors have the worst returns expectations.

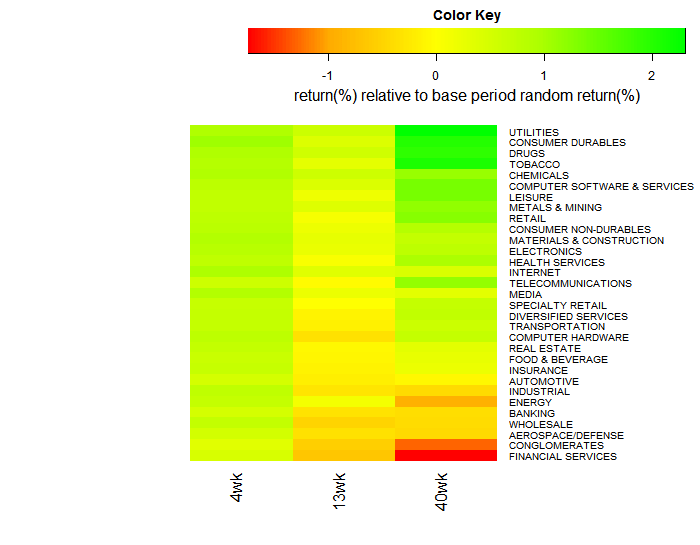

Each sector breaks down into industry groups. The following heatmap shows how the returns expectations for these groups rank.

U.S industry groups - ranking of return(%) expectations

The industry groups with the best returns expectations, as averaged over the three periods, include utilities, consumer durables, and drug stocks. Financial services, conglomerates, and aerospace/defense stocks have the worst returns expectations.

The weekly Stock Trends ST-IM Select report shows the issues (stocks, ETFs, income units) with the best returns expectations over 13-weeks where the returns expectations are better than the base period returns expectations in all three periods (4-week, 13-week, and 40-week). [For rankings of return expectations within each period see the reports Top 4-week returns(%) expectations, Top 13-week returns(%) expectations, Top 40-week returns(%) expectations in the ST Filters reports section.]

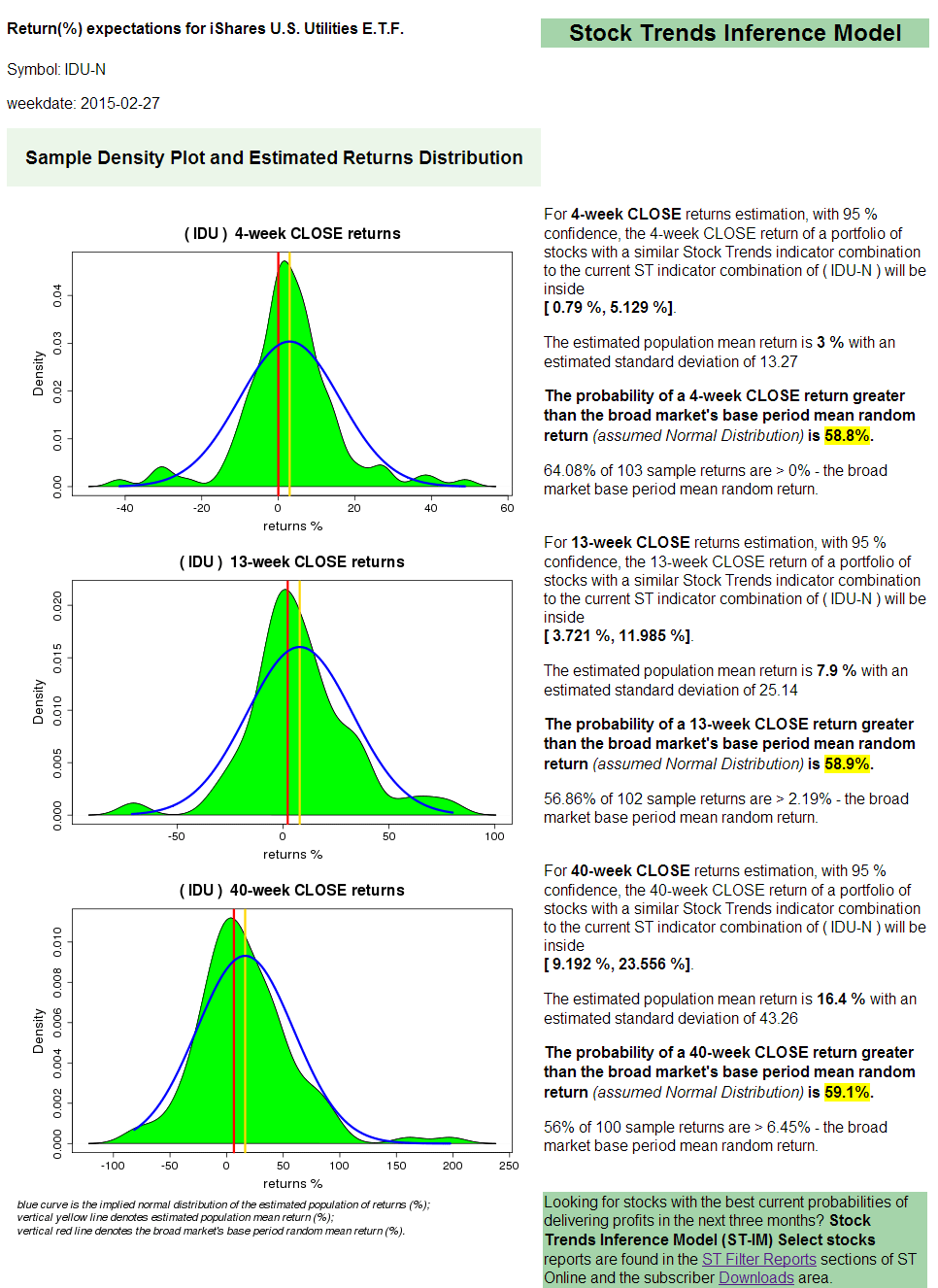

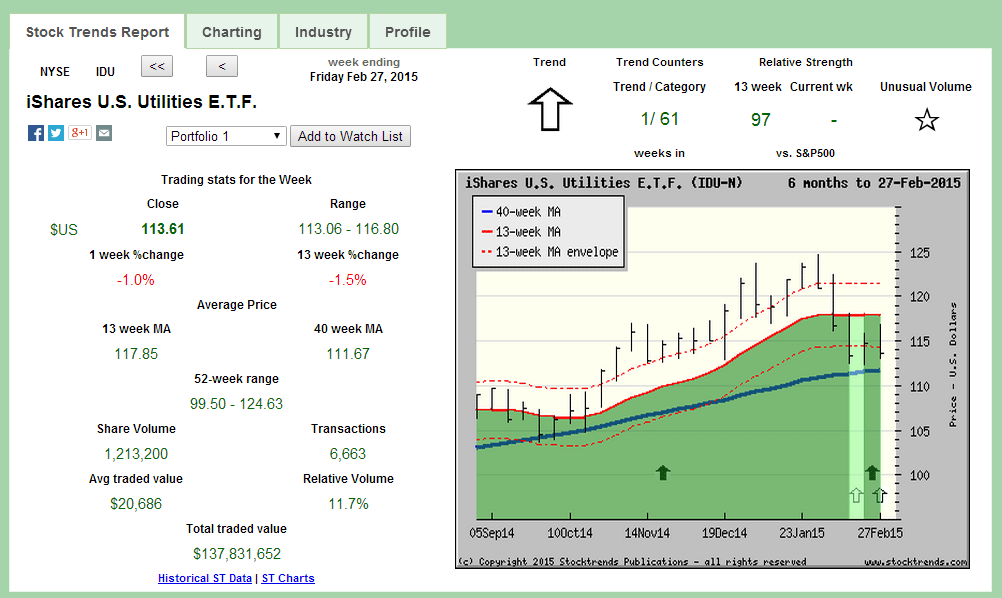

Among the top ranked issues in the February 27th NYSE ST-IM report is the iShares U.S. Utilities ETF (IDU). Here Profile report shows that IDU has a 59% probability of beating the base period random return for each of the three periods. Recall that a stock chosen at random has a 50% chance of beating the broad market’s base period random return (i.e. a 0% return over 4-weeks, a 2.19% return over 13-weeks, and a 6.45% return over 40-weeks). With the given assumption of randomness in market returns, a 59% probability of beating a random return constitutes an appreciable edge.

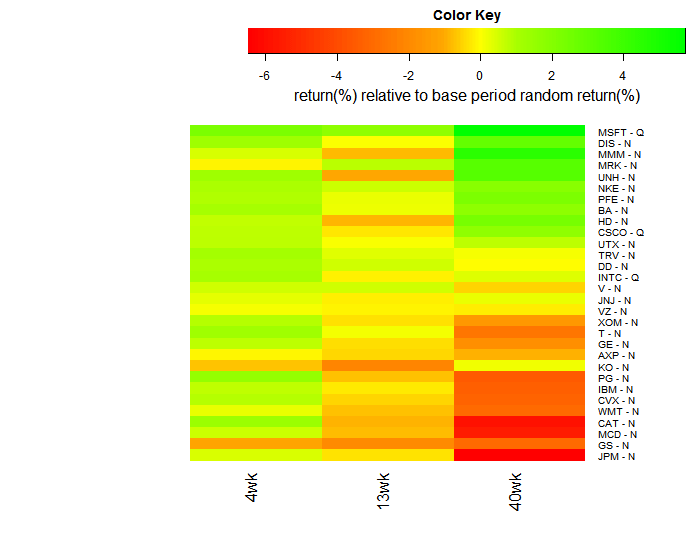

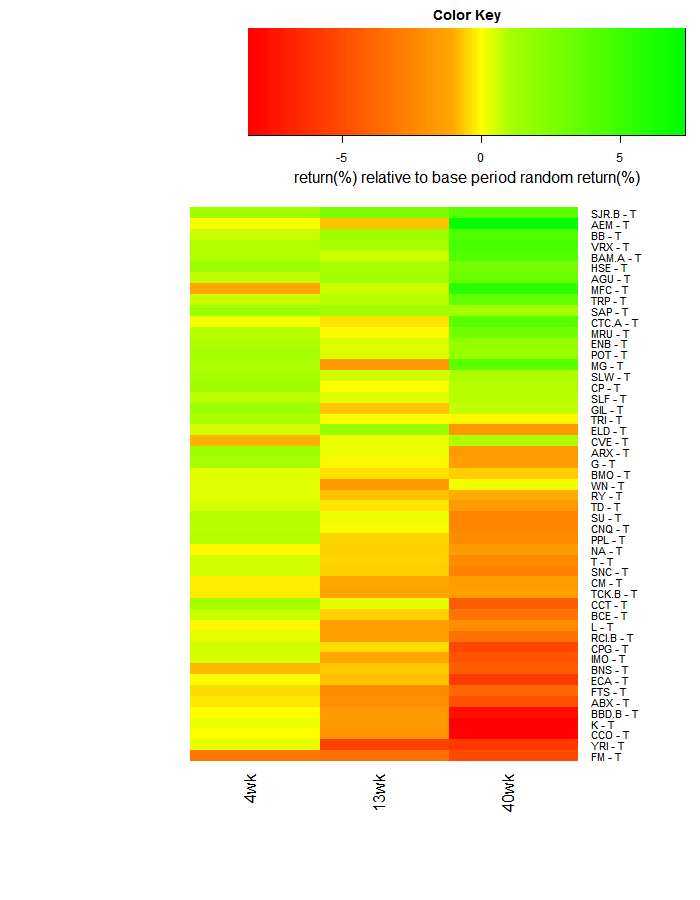

The heatmaps below rank the current returns expectations of large cap stocks represented in the Dow Jones Industrials index and the S&P/TSX 60 index. Microsoft (MSFT), Disney (DIS) and 3-M (MMM) top the DJI rankings, while Shaw Communications (SJR.B), Agnico Eagle Mines (AEM), and Blackberry (BB) have the best blue chip Canadian stocks return expectations. You can view the Profile report of each of these and all stocks on the Stock Trends Report page.

Dow Jones Industrials stocks - ranking of return(%) expectations

S&P/TSX 60 stocks - ranking of return(%) expectations

|

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.

I use Stock Trends to help direct my stock picks. Also, following the advice of Stock Trends I have religiously used stop-loss orders and have avoided hanging on to losing stocks for emotional reasons.