The S&P 500 index's 4.1% recovery last week may be heartening, but fading investor sentiment should keep investors on high alert.

Investors are always looking for the door. Even when returns are abundant and investor sentiment is wildly bullish, shareholders know that plump investment accounts are but paper profits - only real when the trigger is pulled and equity is once again cash. The degree to which investors look more nervously to the exit is proportional to the degree to which their equity positions are compromised. How we measure that compromise helps us identify critical shifts in investor sentiment and recognize high-risk market periods.

Stock Trends is by design a categorical reporting framework that gives us a measure of aggregate investor sentiment and a metric for determining when market participants are feeling the squeeze and most ready to dash for the cash. The Stock Trends Bull/Bear Ratio is now serving notice that the exit doors are wide open.

Most market analysts look at benchmark indexes of price level, pointing to areas of support and resistance to anticipate market rallies and corrections. Certainly, the 6% drop in the S&P 500 index from the market high in September sounded alarm bells. But we have had corrections of 5% and more multiple times during the bull market run since 2009. Can we expect this is just another typical and expected correction that will soon be subdued? Price level analysis can conjecture about that, but a measure of market breadth is the best barometer of how sentiment has truly shifted.

The Stock Trends Bull/Bear Ratio measures the distribution of Stock Trends trend categories and tells us something quite simple: are the majority of stocks trending positively or negatively? Are the diversified holdings of investors buoyed by a rising tide or sinking in aggregate?

The Stock Trends trend indicators categorize individual trends by the conditions of a simple moving average study. The base categories - Bullish or Bearish - are determined by the relationship of the 13-week and 40-week moving averages of price. If the 13-week average price is above the 40-week average price the stock is categorized as Bullish. If it is below the stock is categorized as Bearish. This is a factual reporting of past price performance.

The price smoothing aspect of average prices gives us a clearer idea of trends, and although these longer-term time parameters are lagging in nature, they do make it possible to characterize long-term price movement. It is this long-term price movement that most shifts the balance of investor sentiment and creates heightened periods of anxiety about equities.

Stock Trends tabulates the Bull/Bear Ratio for individual North American exchanges. The New York Stock Exchange Bull/Bear Ratio has been plummeting since August, and is now at 1.07. The Nasdaq Bull/Bear Ratio dropped below 1.0 in June and is now at 0.66. When we look at the composite of both major exchanges - some 5,660 common stocks that currently have Stock Trends trend indicators - we get a good look at the trend breadth of the U.S. stock market.

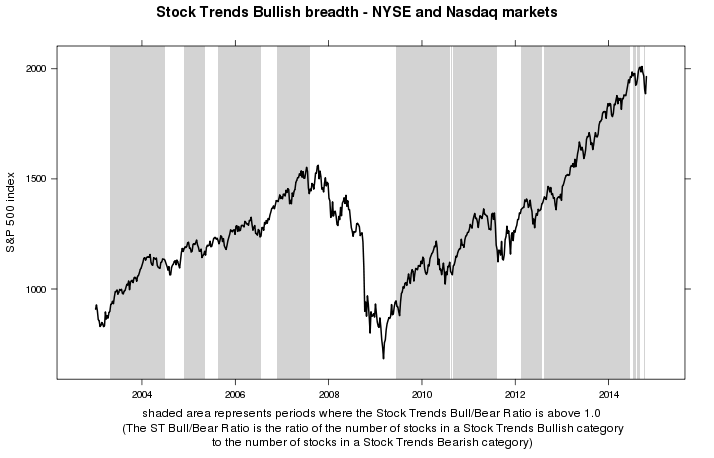

The graph below highlights periods where the Stock Trends Bull/Bear Ratio for the combined Big Board and Nasdaq exchanges has been rated as 'Bullish'. These shaded areas tell us when investor sentiment provides more fertile ground for market rallies and rebounds. There will be times when the S&P 500 index rallies without broader market support , like in late 2006, but these can represent divergences between large cap and small cap performances. Generally, a strong bullish investor sentiment is characterized across the stock market. The Stock Trends Bull/Bear Ratio gives us that representation of market breadth.

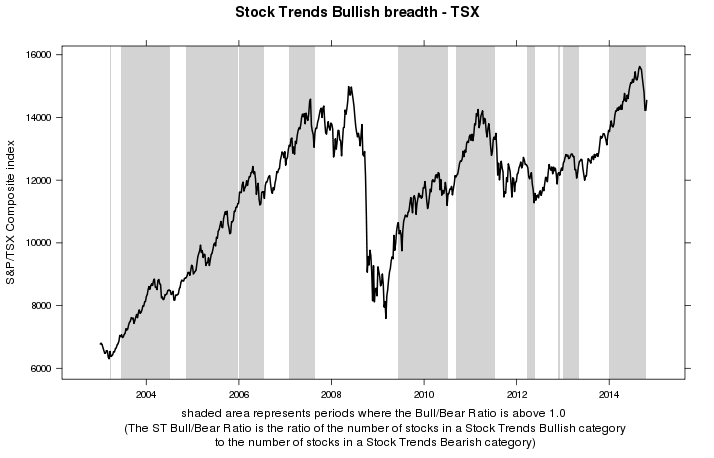

Where are we at now? The U.S. market Bull/Bear Ratio has been flirting with a Bearish investor sentiment reading since the market top in the summer, and has now dropped to 0.7. Canadian investors sentiment has also dipped into Bearish territory - the Stock Trends TSX Bull/Bear Ratio fell below 1.0 this week (now at 0.85).

Investors should take note that this aggregate North American trend condition makes the market vulnerable to a crash as investors increasingly weigh in about making an exit. The S&P 500 index's 4.1% recovery last week may be heartening, but fading investor sentiment should keep investors on high alert.

You have created and maintained an amazing, highly educational program and I am grateful for your part in getting our retirement funds to the good place they are.

You have created and maintained an amazing, highly educational program and I am grateful for your part in getting our retirement funds to the good place they are.