Apple's stock retreated today. It's Relative Strength indicator told us to be ready.

|

Let’s be clear: there is nothing prescient in talking down Apples Inc’s shares – an assertion that confidently stands even after the stock’s tumble today. Yet, the market is always full of prognosticators who peddle the ‘overbought’ terminology and eagerly anticipate a bubble bursting. For sure, AAPL has an extraordinary record as a momentum stock – especially for such a large cap creature. It has delivered powerful price trends and impressive returns for shareholders repeatedly. Naturally, the market has been anticipating an end to the stock’s current ascent. And the chorus of the skittish has been loud for some time. Many of these naysayers are analysts and investors who get especially cautious at the first sign of a good time. They are the type of people who leave a party early and make their way home to comfortable and predictable lives. They rest their heads on soft pillows while more vital party animals carry on with laughter and adventure into the wee hours of the morning. Sometimes this prudence is just plain pragmatic – the kind of risk management that leads to long and secure lives. But other times, this rational risk aversion leads to significant opportunity costs.

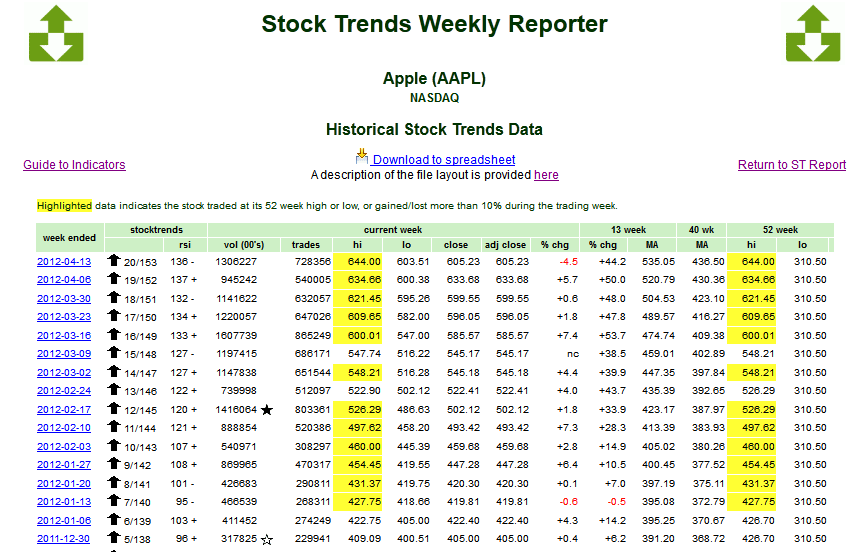

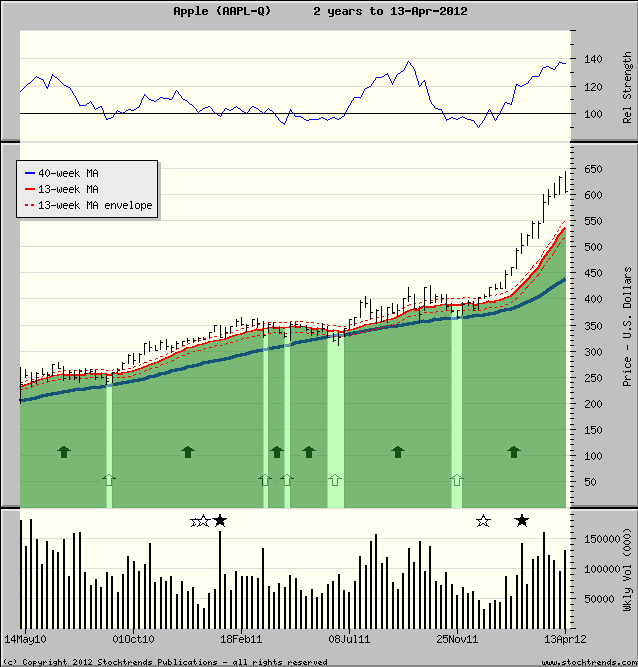

Take two months ago when AAPL tapped the $500 level. Then the nervous Nellies said the stock would run out of gas, that a retreat was imminent and highly probable. But here the Stock Trends Relative Strength indicator told us something different. As shared in the editorial of that moment (Apple has speed and stamina, February 17), we knew that the Relative Strength of AAPL was not in the zone where we should be overly concerned about a pullback or diminishing price momentum. The Stock Trends RSI sported by AAPL at the time (122) was well below the level of statistical concern. And so it was hardly surprising that Apple’s share price left the $500 marker in the dust as it launched ever more stridently to the $600 level.

But invariably, the naysayers will eventually be right. There must be a retreat. Stock Trends followers who kept on eye on AAPL’s Relative Strength Indicator would have started to make a warning call a month later after the March 16 Stock Trends reports. Then Apple’s RSI reached 133 as the share price hit the $600 mark. As pointed out in the February article about Apple’s RSI, the RSI tipping 136 would signal increased probability of a pullback. That RSI mark was scaled on April 6, so smart Apple investors would have set up a derivative options trade setup to plan for this increased risk. The stock’s 4.2% drop to $579 today will have played well for that astute trading.

|

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!