Last week’s rally on unusually high trading volume drove the stock above its May 2010 peak and delivers a trading opportunity for conservative investors coveting Sysco's dividend stream, currently yielding 3.2 percent.

The Stock: Sysco Corp. (SYY) Recent price: $32.36

Trend: Recent broad sector trend changes identified by aggregate stock market trend distributions now direct investors to pockets of relative performance in bullish trending health care, consumer, transportation, utilities and telecommunications stocks. Sector rotation from commodity momentum stocks to boring value and income stocks may continue to be a major theme of the coming summer months.

A measurement of equity trend distribution in Canada and the United States, ranging from blue chip heavy weights to small cap penny stocks, shows that investors are in an anxious mood with a bull market that is now two years old and counting. Over 20 per cent of stocks listed on the TSX, NYSE, NASDAQ, and Amex exchanges are in a Stock Trends Weak Bullish trend – a trend category that indicates a stock has dipped below trend line support. Added to the 28 per cent of stocks that are already in a bearish trend, the face of the stock market is a tad pale.

Commodity stocks are particularly vulnerable, with the sector indexes of materials, mining, and energy stocks all in Weak Bullish trends. Investors in these groups are now forced to make a decision: hang in for a bullish rebound in the commodity trade and a renewed, highly correlated, slide in the U.S. dollar or rotate toward relative strength in the dividend income streams of defensive sectors.

The technical analysis that is behind Stock Trends indicators does not offer guidance for evaluating the value or security of income stocks, but conservative investors should take interest in technical triggers for low-beta (low volatility) U.S. big cap income stocks in sectors like food products.

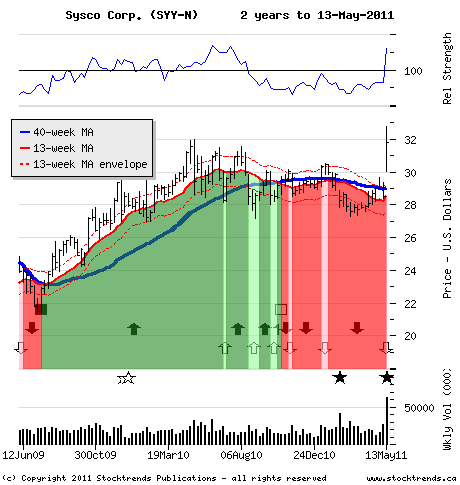

The Trade: Shares of Sysco Corp. broke out last week, and the stock is a current Stock Trends pick. Sysco is the largest food products distributor in North America, with annual revenues of (US)$40-billion. Its ubiquitous trucks supply foodservice companies – restaurants and institutions, big and small - that serve us our meals and do our dishes.

Until the current breakout, Sysco’s stock had been in a trading range over the previous 12 months, its long-term trend line largely flat during a period when the S&P 500 was trending positively. Last week’s rally on unusually high trading volume drove the stock above its May 2010 peak and delivers a trading opportunity for conservative investors coveting this dividend stream, currently yielding 3.2 percent.

The Upside: This trade assumes an abatement of the conditions that contribute to rising fuel costs and food inflation, both unfriendly to Sysco’s bottom line. For Canadian investors this also implies more favourable exchange rate factors for returns on U.S. dollar denominated equity prices and income streams. Technically, a revived bullish trend for this stock suggests modest 10 per cent advance from the current share price before resistance restrains the breakout.

The Downside: In another investor’s mind the inflation trade is still on the table, and the commodity bull ride is scheduled to return. If that is true this trade looks far less attractive. A drop back to the stock’s 40-week average price at $29 would reflect that reversion to materials and energy sector strength.

Thank you for your excellent work and kind approach to your customers.

Thank you for your excellent work and kind approach to your customers.