Shareholders of ATCO should be happy about the stock’s current push to new 52 week highs – the stock rallying from $58 to above $63 in May’s trading - and can expect more advances in the months ahead.

The Stock: ATCO Ltd. (ACO.X) Recent price: $63.20

Trend: Defensive stocks are looking buff again. Health care, consumer staples, utilities stocks – all are showing predictable strength as market volatility tests investor confidence. A correction in precious metals and energy stocks stands to hit Canadian investors who are often heavily weighted in the nation’s resource assets, so sector rotation toward more stable assets will be a common theme unless the inflation trade re-ignites.

Evidence of the appeal of consumer non-discretionary and health care stocks abound. The S&P Healthcare index and S&P Consumer Non-Cyclical index rank among the top three-month performers of the ten major U.S. sector groups, with a number of constituent stocks currently hitting trends alerts. Recent share price trends of Pepsico (

PEP) and Johnson & Johnson (

JNJ) typify the spring march of blue chip names in these traditionally defensive areas. Canadian reflections of this strength can be found in the stocks of cheese maker Saputo (

SAP) and pharmacy benefits management provider SXC Health Solutions (

SXC) – both frequent flyers in the 52-week high club recently.

Investors should not forget about utilities stocks, though. Interest rate sensitive stocks tend to suffer in an environment where rates are rising, or expected to rise. However, utilities stocks are performing solidly and have now achieved positive price performance against the broader market. Duke Energy (

DUK) is among many U.S. utilities stocks hitting new highs amid recent market gyrations. Expect dividends in this group to attract even more investors if the market trend foundation continues to weaken. The number of North American stocks categorized as Stock Trends Bullish has dropped from 63 per cent to 52 percent over the past month, a sign for risk adverse investors to hold dear trustworthy streams of income.

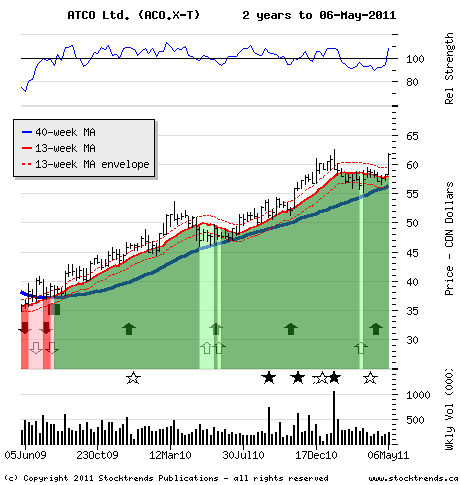

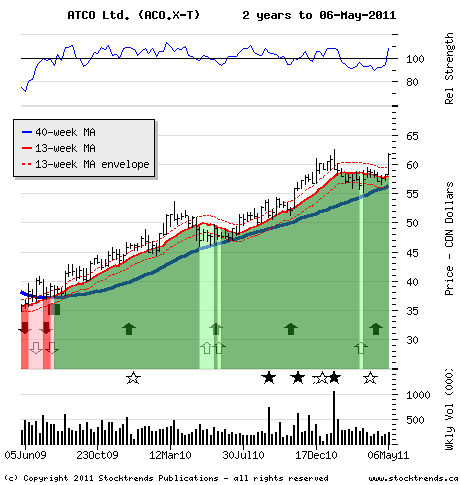

The Trade: The fired up stock of ATCO Ltd. illustrates the thematic rotation toward more exposure in the utilities sector. ATCO is a conglomerate with extensive operations in power generation, transmission, and storage, as well as industrial construction and logistics services. Canadian Utilities Ltd. (

CU) is part of the ATCO group of companies – an enterprise with $10-billion in combined assets. Shareholders of ATCO should be happy about the stock’s current push to new 52 week highs – the stock rallying from $58 to above $63 in May’s trading - and can expect more advances in the months ahead.

The Upside: This bullish trending stock is looking good to return soon to the $65 mark it peaked at in late 2007. A more timely entry on the current rally off the trend line would have been in March when the stock quickly returned to a Stock Trends Bullish category after a brief drop to Stock Trends Weak Bullish, but multiples on this stock stretched to the 2007 level suggest setting a further 20 per cent advance as a trend objective.

The Downside: A retreat to the trend line, currently at $59, should be a secure support level. A serious drop below tells of changed market conditions, but should not remove the average investor. This is a trade for stability against the downside risk in other sectors.

I am just writing to tell you of my appreciation of your service! It makes so much sense to me. You seem to be an oasis of stability and sensibility in a stockmarket jungle.

I am just writing to tell you of my appreciation of your service! It makes so much sense to me. You seem to be an oasis of stability and sensibility in a stockmarket jungle.