The mixed performances on the oil patch instruct that there are selective opportunities for investors to add to their sector exposure. Delphi Energy may be ready to rally through resistane as the sector performance improves.

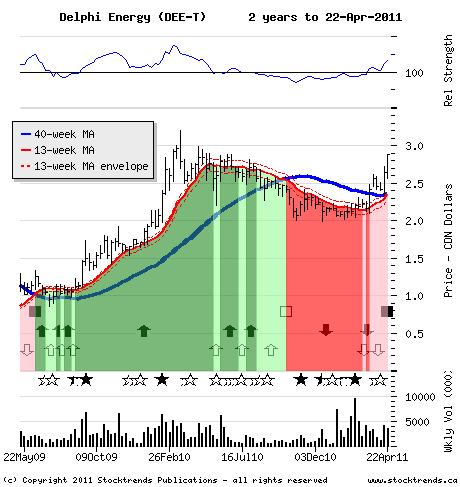

The Stock: Delphi Energy Corp. (DEE) Recent price: $2.82

Trend: The relative performance of energy stocks, so strong over the winter months, has been gradually falling off over the past six weeks. The S&P/TSX Energy index has dropped below its intermediate-term trend line, the 13-week moving average, and has failed to show group leadership even with the price of crude oil staying firm above $106 (U.S) and moving back above $112 in recent weeks. This performance drag, however, may reverse, providing an opportunity to pick up energy stocks as industry cash flow ripens in an unremitting inflation environment.

Weakness in big capitalization oil producer stocks is showing in the performance of Canadian Natural Resources (

CNQ), Talisman Energy (

TLM), Penn West Petroleum (

PWT), and slipping integrated oil stocks - all drags on the energy index in recent weeks. Notably, even the stock with the longest running bull trend in the sector, Celtic Exploration (

CLT), turned Stock Trends Weak Bullish last week. The drop in some oil producer stocks, though, is not reflected by others in the energy group - especially in hot field services stocks like Precision Drilling (

PD) and in producer stocks with promising natural gas assets.

The mixed performances on the oil patch instruct that there are selective opportunities for investors to add to their sector exposure. Like other areas of the commodity trade, investors going long oil producers have taken a bullish outlook based both on the fundamentals of petroleum supply and demand, as well as a belief in the continuation of the monetary drivers helping to inflate the price of oil and many other commodities. The strength of natural gas stocks like BNK Petroleum (

BKX), already profiled in this column, also continues to be a focus for market timing investors.

The Trade: A previously lagging small capitalization stock in the sector, Delphi Energy commenced a move above its bearish trend line in February and has rallied in recent weeks, becoming one of the better performing Western Canadian oil & natural gas stocks over the past three months. It is a current Stock Trends Bullish Crossover, a signal that can be used by market timing investors who demand more market evidence of a change in a stock’s primary price trend.

Last week’s move to a high of $2.89 brings shares to another helpful price resistance level dating from the second quarter of last year. Moves through levels like this will often release overhang – selling pressure – that retards advances, so Delphi Energy shareholders will be anticipating that the current price momentum will carry above $3.

The Upside: Although this stock has already rallied almost 40 per cent higher since January, the share price objective for its identified trend is another 20 per cent advance to previous bull trend valuations. As the company realizes improved projected cash flow above expected cost of operations, the result could be better.

The Downside: Investors entering this trade now can use the $2.35 level as an anchor for immediate support and an exit signal if the stock retreats below.

I've followed a number of Stock Trends picks, and the methodology is solid.

I've followed a number of Stock Trends picks, and the methodology is solid.