The stock market exhibits undeniable aspects of randomness. If trading is like a toss of the coin, let's find a 'special' coin...

|

All reports and trading strategies in Stock Trends Weekly Reporter are derived from standard techniques of technical analysis. They are offered based on the premise that the indicators and chart patterns represented alert to possible trade events – either buying or selling. But because trading and investment advice is really a statement about future price movement - an uncertain domain – it should be framed as a probability statement. The Stock Trends inference model I am developing is an attempt to do that. By looking at the results of past indicator combinations and assembling a sample space from which to estimate probable outcomes relative to probable outcomes of randomly selected stocks the model looks for a small edge in particular trend and price momentum situations. Put simply: if a trade is a toss of the coin, let’s find a 'special' coin. First we must clarify that statements of probable outcomes enumerated here are not asserting what the actual outcome will be. That is unknown. The market could experience a massive correction, something that is in the realm of possible outcomes. Any individual stock could rally significantly… or drop precipitously. This analysis is not attempting to predict the price path of a stock. It is instead asserting that, assuming a particular distribution of the population of a sample space, a particular Stock Trends indicator combination signals a higher probability of a return greater than the one we would expect, on average, with a random stock selection. We’re playing to beat the monkey.

Ranking estimated means

In this week’s Stock Trends Picks of the Week reports (across all exchanges covered) there are 52 stocks highlighted. They include U.S. healthcare stocks like Eli Lilly & Co. (LLY-N) and AMN Healthcare Services Inc. (AHS-N), technology stocks like Digimarc Corp. (DMRC-Q), CommTouch Software (CTCH-Q), as well as precious metals stocks like Silver Standard Resources (SSO-T) and Agnico Eagle Mines (AEM-T) on the TSX. All of the stocks are selected based on a filter that looks for certain combinations of Stock Trends indicators, as well as share price and trading volume requirements.

The Picks of the Week report is designed as a weekly screening tool, helping investors locate stocks and exchange traded funds that might be signaling a good entry point. Generally, good practice is to look for additional confirmation, either technical or fundamental, in assessing the selections. The Stock Trends inference model allows us to evaluate these picks in terms of the statistical performance of grouped indicator combinations. Which stocks give us our best chance for a positive outcome?

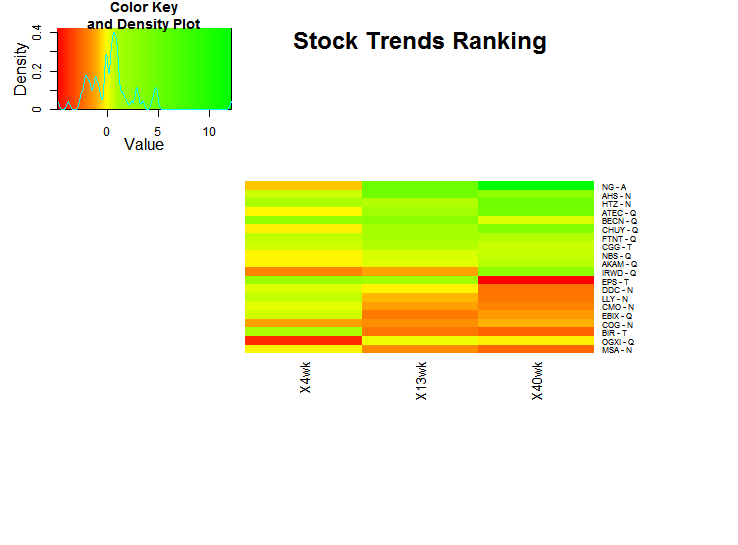

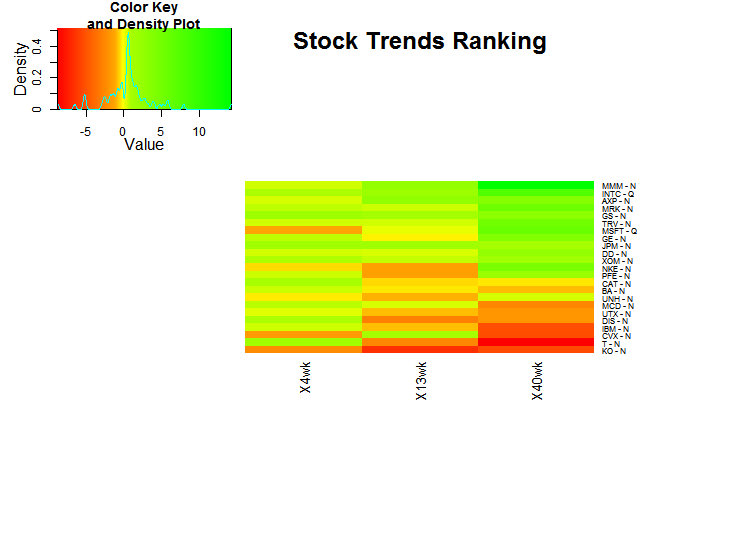

The following heatmap graph ranks the current top Picks of the Week selections based on the inference analysis. Each stock is evaluated to see how much its expected mean return is above the expected mean return of randomly selected stocks. The stocks are then ranked by the average mean return across all three periods (the “mean of means”).

The colour scheme for the heatmap is set to the market base for random returns. Values that are greater than the expected mean return of randomly selected stocks have progressively darker green boxes; values that are less than the expected mean return of randomly selected stocks have progressively darker red boxes. Values hovering near the expected mean of randomly selected stocks are yellow. The color key legend gives us this representation. It also shows a density distribution of the “mean of the means” returns.

This analysis points us toward stocks that have the best record of indicating higher probabilities of positive returns throughout a 40-week period. At the top of the list – among this week’s Picks of the Week stocks – is NovaGold Resources (NG-A), AMN Healthcare Services (AHS-N), Hertz Global Holdings (HTZ-N), and Alphatec Holdings (ATEC-Q).

A breakdown of the analysis – what does it tells us?

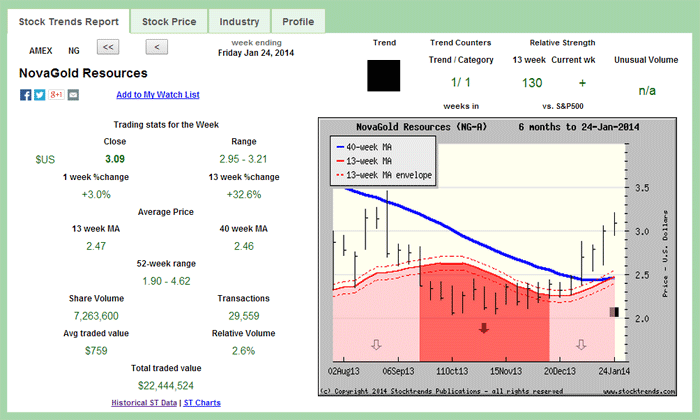

Let's have a look at NovoGold Resources. Currently, it has a Bullish Crossover (

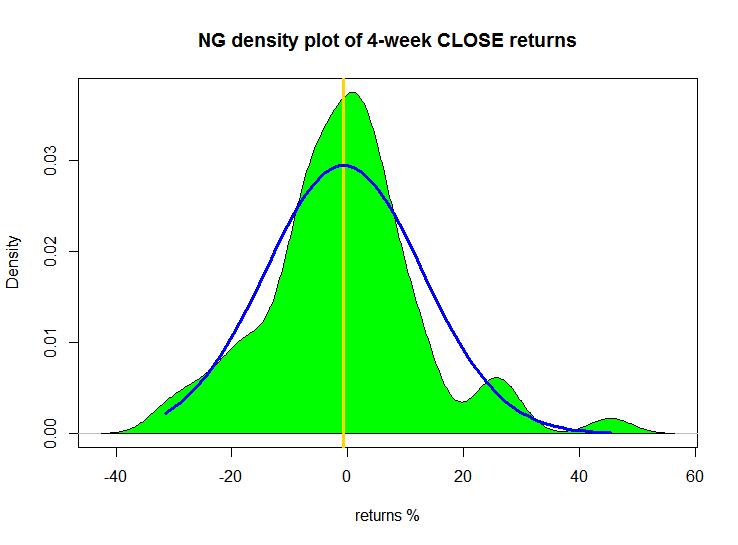

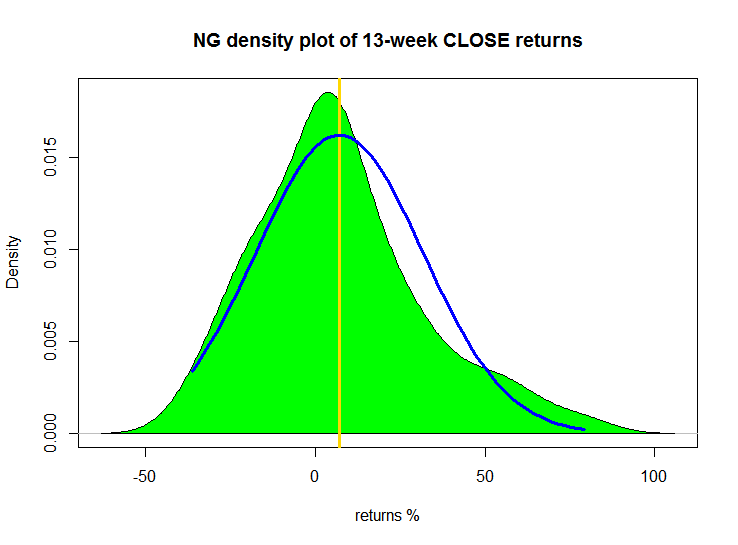

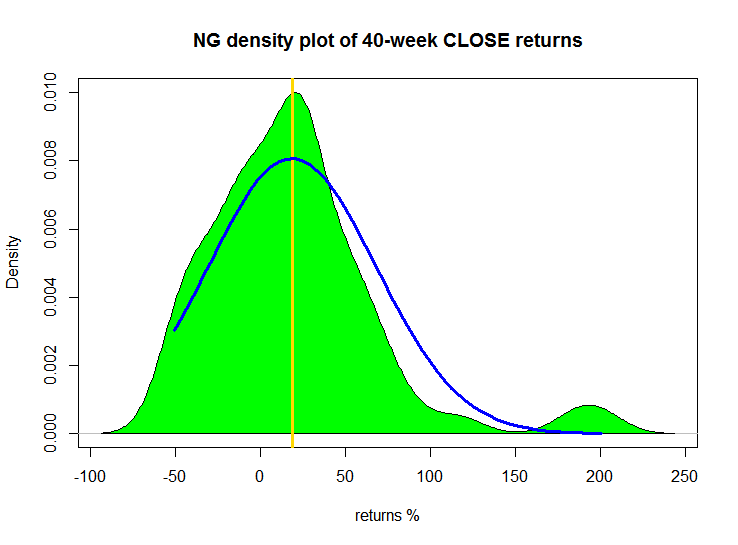

NovaGold’s current Stock Trends indicator combinations (*see note) generate the following distributions of returns for 4-week, 13-week, and 40-week periods:

The returns distribution of stocks that shared a similar Stock Trends indicator combination to NG (as described in last week’s editorial) tells us that the stock will perform relative to the expected random mean return are as follows:

There is a 48.1% probability that NG will return better than the expected mean return of randomly selected stocks at the end of the coming 4-week period.

There is a 57.9% probability that NG will return better than the expected mean return of randomly selected stocks at the end of the coming 13-week period.

There is a 59.7% probability that NG will return better than the expected mean return of randomly selected stocks at the end of the coming 40-week period.

This analysis suggests that while NG’s shorter-term expectations are not that positive; the longer-term expectations are quite positive.

The components of the Dow Jones Industrials give us another representation of this analysis. Here not all 30 stocks currently have indicator combinations with large enough sample sizes for our inference model. This week there are 23 DJI stocks to compare.

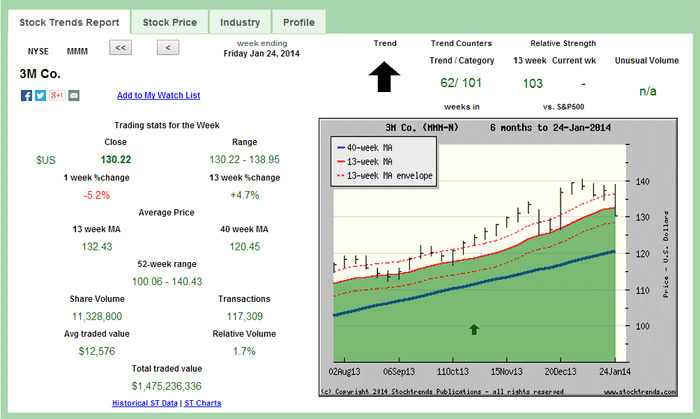

The returns distribution of stocks that shared a similar Stock Trends indicator combination to MMM tells us that the probabilities that the stock will perform relative to the expected random mean return are as follows:

There is a 52.5% probability that MMM will return better than the expected mean return of randomly selected stocks at the end of the coming 4-week period.

There is a 56.2% probability that MMM will return better than the expected mean return of randomly selected stocks at the end of the coming 13-week period.

There is a 65.95% probability that MMM will return better than the expected mean return of randomly selected stocks at the end of the coming 40-week period.

The analysis tells us that 3M Co. stock is a good bet. The stock is now in its 101st week of a Stock Trends Bullish trend and looks to continue along its path. At the very least, you would, on average, be better off buying MMM than buying a random stock.

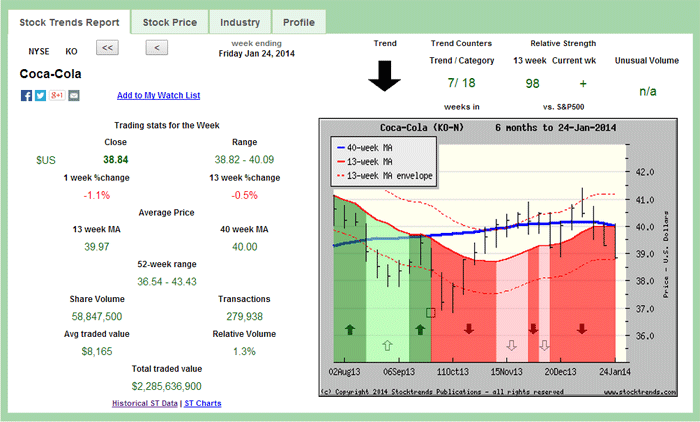

At the bottom of the Dow Jones Industrials in terms of current expectations is Coca-Cola.

The returns distribution of stocks that shared a similar Stock Trends indicator combination to KO tells us that the probabilities that the stock will perform relative to the expected random mean return are as follows:

There is a 42.6% probability that KO will return better than the expected mean return of randomly selected stocks at the end of the coming 4-week period.

There is a 38.4% probability that KO will return better than the expected mean return of randomly selected stocks at the end of the coming 13-week period.

There is a 43.4% probability that KO will return better than the expected mean return of randomly selected stocks at the end of the coming 40-week period.

Here the analysis tells us that Coca-Cola’s stock is not a good bet. You would be better off to buy a random stock.

[note: for Bullish Crossover and Bearish Crossover stocks the trend counter criteria reverts to the previous week's counters. In that manner the length of the previous trend category is the pertinent comparison. This adjustment is made for queries on all Crossover combinations because the trend counters are set to 1 for Crossovers.]

|

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!