The new Stock Trends RSI +/- analysis provides guidance on probable outcomes and expected returns in next week's trading.

Stock Trends Reports new Profile tab now also includes a pattern analysis of the RSI +/- indicator. This analysis looks to answer questions about a stock's volatility in particular price trends and how weekly price movement provides an indication of probable outcomes for the coming week.

The Stock Trends RSI +/- indicator is a simple binary marker of weekly price performance relative to the benchmark market index. If a stock (all North American trading issues and indexes covered by the Stock Trends analysis) outperforms the benchmark (the S&P 500 for U.S. stocks, the S&P/TSX Composite index for Canadian stocks) the stock is assigned a (+). If it underperforms, it is assigned a (-).

This binary notation of price performance can be a useful framework for an event sample space and inference model. From this we can derive probabilities of certain outcomes and estimate one week returns (%).

Binary events are always interesting. They provide a simple modeled sample space of possible outcomes. The most common example is the flipping of a coin. We know when we flip a fair coin that there is a 50% chance that the outcome will be heads, and an equal 50% chance the outcome will be tails. How does this kind of random event compare to the binary RSI +/- event?

Indeed, there is no surprise when the Stock Trends data reveals that almost all stocks have a near-50% chance of turning up an RSI +/- on any given week. But that is for a sample space that includes all the data. For instance, for IBM the Stock Trends weekly data shows that of the 1,800 weeks covered, 49.5% of observations show an RSI (+) as the weekly indicator. Although some stocks like INTC show a 51.6% probability of a (+) over their history, the mean value across all stocks tends to 50%.

A question derived from this random-like event becomes quite apparent: how does this probability change under different market characteristics? For example, if a stock is in a Stock Trends Bullish trend, what is the probability of an RSI (+) indicator? We can also ask what is the probability we will see an RSI (+) in the upcoming week if the previous week was also a (+) while the stock is in a Bullish trend?

Using the samples of the stock's data history that match certain patterns of market performance and underperformance we can also derive similar probability statements. Although this analysis operates under the assumption of randomness in market returns, we are looking at the pattern of past performance and estimate the probability of an outcome derived from the event sample space.

In short, like a gambler looking for evidence of an 'unfair' coin that can be capitalized on, we are looking for evidence of a pattern that provides us with better probabilities of a desired outcome than the base probability - which is 50%.

Introduced in last week's editorial, the Stock Trends Reports Profile section is the first element of the Stock Trends Inference Model - the implied population parameters and distribution of like Stock Trends indicator combinations. Also presented was a heatmap that ranks the estimated returns of stocks in an industry group. These elements of the inference model focus on homogeneous patterns across markets and estimates 4-week, 13-week, and 40-week returns for individual stocks. The RSI +/- pattern analysis differs by focusing on patterns with the stock itself, estimating returns based on these internal samples.

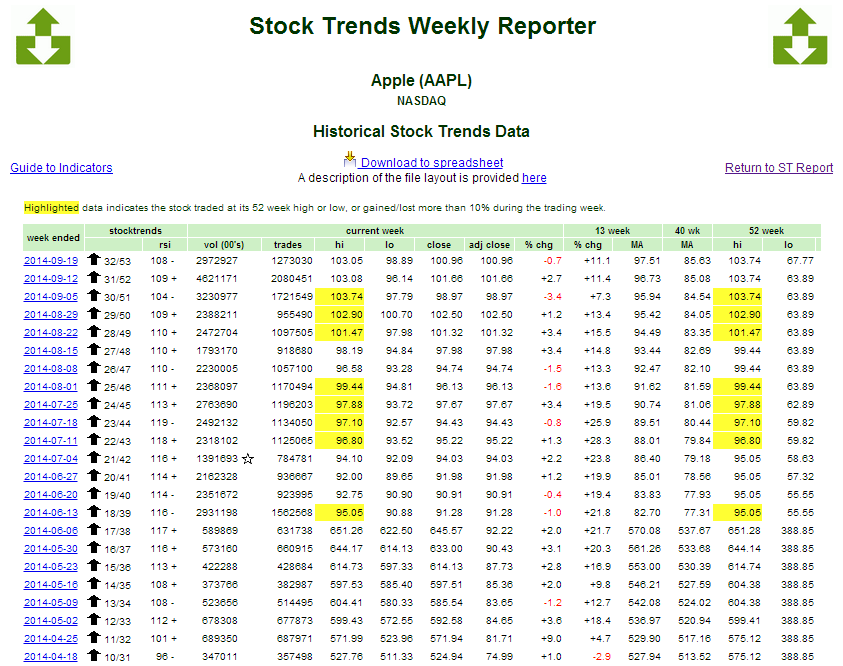

Last week AAPL was presented as an example, so we'll use it again for illustrating the RSI +/- pattern analysis. Below we can see the most recent history of the weekly Stock Trends indicators for AAPL.

The current RSI +/- indicator is (-). In this analysis two categorical variables - the Stock Trends trend indicator and the RSI +/- indicator - are inputs. The output is the returns, or percentage change in price, in the week following the observation. What kind of returns (%) do the data show after the observation of a particular pattern of RSI +/- indicators when a stock is labeled in a specific trend?

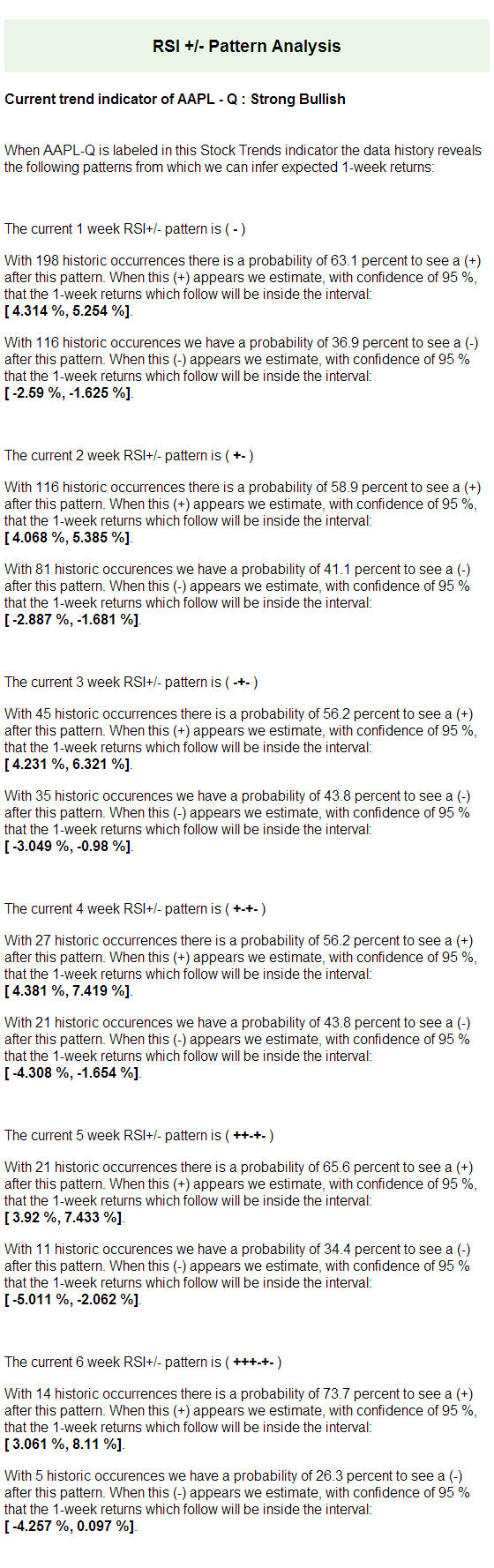

Here is the current RSI +/- pattern analysis of AAPL:

To repeat, only weeks of the AAPL data showing the same trend indicator as the current trend indicator (strong Bullish) of AAPL are evaluated. Here we are looking to find how the binary RSI +/- probabilities differs from the probabilities we already understand about the aggregate for this and most stocks - a near 50% chance of either a (+) or a (-).

Is the coin somehow biased in a particular trend? If so, to what degree? In this case, given the current RSI +/- patterns for AAPL, what does the data history tell us about how the stock performed subsequently to these patterns when the stock was in the same Bullish trend?

The length of the longest pattern of RSI +/- indicators for each stock analyzed depends on the data available. Here the longest pattern measured is 6-weeks long. However, practical usage of the analysis probably lends itself best to periods of three or four weeks.

In any event, the probabilities for binary outcomes as the pattern extends is of interest in evaluating the quality of the probabilities of the shorter term patterns. In the current AAPL example, the patterns all suggest that the current market underperformance indicated by the (-) will most probably be followed by a market outperformance (+).

Of course, with a given probability of market outperformance we would like to know the returns expectations. If AAPL does outperform the market next week, what is the expected change in price in the coming week? The analysis above defines intervals for the returns expectations for AAPL for each length of the pattern - here from one to six weeks.

This type of short-term price movement analysis can be used in tandem with the longer-term analysis provided by the Stock Trends Inference Model and detailed above the RSI +/- Pattern Analysis on the Profile tab of each Stock Trends Report. It can also be profitably used in short-term options trade setups, something Stock Trends will be able to advise about in the future.

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!