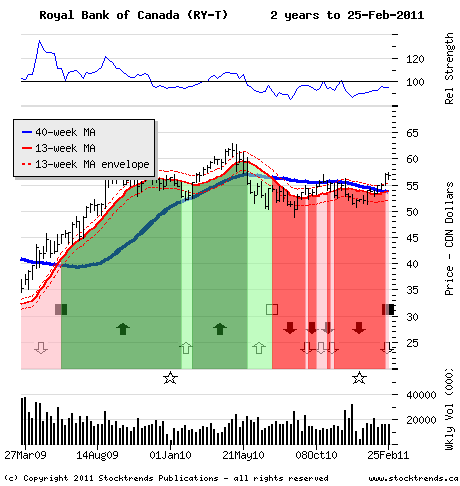

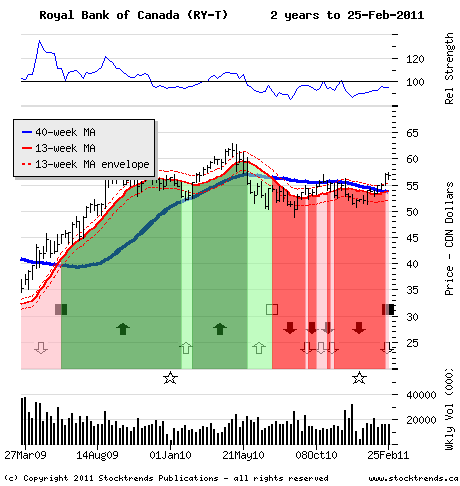

A healthier economy brings back the shine for bank stocks. Look for shares of Royal Bank to gain traction.

A healthier economy brings back the shine for bank stocks. Look for shares of Royal Bank to gain traction.

$19.95

Monthly subscription plan to Stock Trends Weekly Reporter - pay your monthly subscription fees by having them automatically charged (PayPal only). Free 7-day trial period. Subscribers may cancel before the end of any subscription month.

$199.00

1 Year Prepaid subscription to Stock Trends Weekly Reporter. Save 16% off monthly rate!

$299.00

2 Year Prepaid subscription to Stock Trends Weekly Reporter. Save 37% off monthly rate!

$399.00

3 Year Prepaid subscription to Stock Trends Weekly Reporter. Save 44% off monthly rate!

Halfway through Q1 2026, the question is no longer theoretical: Did the year-end institutional momentum and ST-IM Alpha themes actually guide investors effectively? With the updated February 13, 2026 Stock Trends dataset now in hand, we can measure the outcome directly — not against headlines, but against trend structure, relative strength, and momentum persistence. The short answer: the framework largely held — but leadership rotated exactly where the model suggested it might.

Halfway through Q1 2026, the question is no longer theoretical: Did the year-end institutional momentum and ST-IM Alpha themes actually guide investors effectively? With the updated February 13, 2026 Stock Trends dataset now in hand, we can measure the outcome directly — not against headlines, but against trend structure, relative strength, and momentum persistence. The short answer: the framework largely held — but leadership rotated exactly where the model suggested it might.  As 2025 comes to a close, investors naturally ask whether the strongest trends visible at year-end represent durable opportunity—or merely seasonal noise. The Stock Trends framework addresses this question not by forecasting headlines, but by examining how trend structure, momentum and participation, and ST-IM forward opportunity align across different classes of capital. This year-end outlook integrates three complementary lenses that Stock Trends users can carry directly into Q1 2026: Large-cap institutional momentum — where capital can deploy at scale Top Trending momentum leadership — where price discovery is happening fastest Stock Trends Inference Model (ST-IM) — where forward return expectations and risk dispersion suggest true alpha opportunity

As 2025 comes to a close, investors naturally ask whether the strongest trends visible at year-end represent durable opportunity—or merely seasonal noise. The Stock Trends framework addresses this question not by forecasting headlines, but by examining how trend structure, momentum and participation, and ST-IM forward opportunity align across different classes of capital. This year-end outlook integrates three complementary lenses that Stock Trends users can carry directly into Q1 2026: Large-cap institutional momentum — where capital can deploy at scale Top Trending momentum leadership — where price discovery is happening fastest Stock Trends Inference Model (ST-IM) — where forward return expectations and risk dispersion suggest true alpha opportunity  The final trading week of the year is often dismissed as inconsequential. Liquidity thins, participation narrows, and many investors assume that meaningful signals will wait until January. Yet history shows that year-end positioning—especially in hard assets—often reveals more about institutional conviction than about seasonal noise. The Stock Trends framework does not speculate on holiday effects. It classifies what is happening beneath the surface. As holiday trading unfolds, the precious metals complex offers a clear case study in why disciplined trend analysis matters most when markets appear quiet. Earlier this month, we examined silver’s resurgence and the discipline required to participate without emotion. Today’s update allows us to ask a more important question: Has silver leadership expanded into a broader precious-metals regime, or is this still a narrow trade vulnerable to reversal?

The final trading week of the year is often dismissed as inconsequential. Liquidity thins, participation narrows, and many investors assume that meaningful signals will wait until January. Yet history shows that year-end positioning—especially in hard assets—often reveals more about institutional conviction than about seasonal noise. The Stock Trends framework does not speculate on holiday effects. It classifies what is happening beneath the surface. As holiday trading unfolds, the precious metals complex offers a clear case study in why disciplined trend analysis matters most when markets appear quiet. Earlier this month, we examined silver’s resurgence and the discipline required to participate without emotion. Today’s update allows us to ask a more important question: Has silver leadership expanded into a broader precious-metals regime, or is this still a narrow trade vulnerable to reversal?  In markets where headline indexes appear steady but leadership narrows beneath the surface, the Stock Trends framework tends to guide investors toward a specific class of opportunity: durable trends supported by durable business structure. This week’s universe reinforces that late-cycle character—Bullish classifications remain dominant overall, yet momentum leadership is increasingly selective. It is in this environment that a largely ignored cohort deserves fresh attention: hospital consumables. These are the unglamorous, repeat-use products embedded deep within clinical workflows—dialysis supplies, catheters, blood collection systems, sterilization kits, and procedure disposables. They rarely make headlines, but they often exhibit the same technical signature Stock Trends users learn to respect: persistent trend behavior with corrections that are more often time-based than destructive.

In markets where headline indexes appear steady but leadership narrows beneath the surface, the Stock Trends framework tends to guide investors toward a specific class of opportunity: durable trends supported by durable business structure. This week’s universe reinforces that late-cycle character—Bullish classifications remain dominant overall, yet momentum leadership is increasingly selective. It is in this environment that a largely ignored cohort deserves fresh attention: hospital consumables. These are the unglamorous, repeat-use products embedded deep within clinical workflows—dialysis supplies, catheters, blood collection systems, sterilization kits, and procedure disposables. They rarely make headlines, but they often exhibit the same technical signature Stock Trends users learn to respect: persistent trend behavior with corrections that are more often time-based than destructive. $19.95/Month

Monthly subscription plan to Stock Trends Weekly Reporter - pay your monthly subscription fees by having them automatically charged (PayPal only). Free 7-day trial period. Subscribers may cancel before the end of any subscription month.

$199/Year

1 Year Prepaid subscription to Stock Trends Weekly Reporter. Save 16% off monthly rate!

$299/2 Years

2 Year Prepaid subscription to Stock Trends Weekly Reporter. Save 37% off monthly rate!

$399/3 Years

3 Year Prepaid subscription to Stock Trends Weekly Reporter. Save 44% off monthly rate!