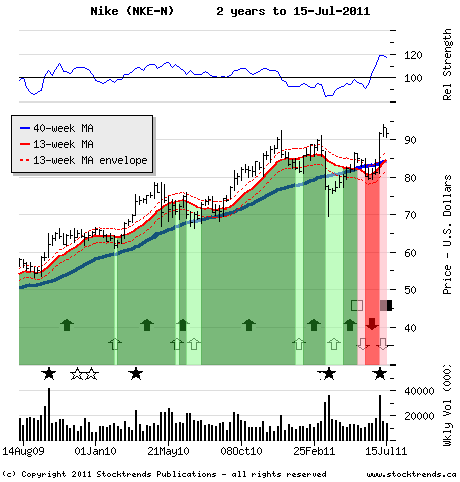

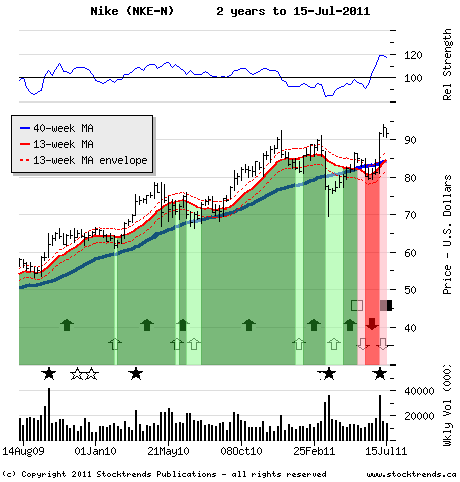

Nike’s shares have outperformed the S&P 500 for six straight weeks – all against a backdrop of consumer pessimism. The current Stock Trends Bullish Crossover presents a new opportunity to capture gains in a positive price trend for this stock.

The Stock: Nike Inc. (NKE) Recent price: $90.64

Trend: Worrisome U.S. economic metrics have been posted this summer – all confirming a disappointing economic recovery. Threatening fiscal uncertainty in Washington adds to the mix of high unemployment and a still-feeble housing market– the picture does not look good for the average American. Consumer confidence reflects the malaise: the most recent reading of the Thomson Reuters/University of Michigan index of consumer sentiment has dipped to its lowest level since March of 2009.

Consumer stocks would normally echo the gloom and doom represented by gauges of the prevailing consumer spending mood, but curiously they have maintained relative price performance over the past quarter. The three month performance of S&P Consumer Cyclical index is in positive territory, outpacing the broader S&P 500 index by 3 per cent and trailing only the leading sector performance of defensive health care and utilities stocks over the period. Investors are evidently more hopeful about the economic prospects than the consumers who ultimately feed this sector’s cash flow.

Multinational consumer stocks are even more upbeat. The SPDR S&P International Consumer Discretionary ETF (

IPD) is up 5 per cent since early April, with trading now picking up after a very thinly traded period in May and June. Automotive and media stocks have the largest weightings in this index fund, some of which have been reflecting more global growth confidence than U.S. angst. In recent weeks shares of Toyota Motor (

TM) and Honda Motor Corp. (

HMC) have advanced above their primary trend lines.

Investors need to recognize that the bearish trend signals flowing from Canadian stock market does not necessarily direct a complete move away from equities. The strength in consumer stocks indicates the market sees enough value in the sector to warrant a lot more confidence than American kitchen table conversations would indicate.

The Trade: An example of a large capitalization consumer stock that deserves some investor attention is Nike Inc. A current stock pick that has revived a long-term bullish trend in the midst of a very disappointing U.S. economic recovery, shares of this huge international brand have garnered rising price targets from analysts, including those at UBS and Citigroup.

Collapsing to a low of $76.53 in the spring, Nike’s stock has staged a July comeback on the upbeat guidance. Trend followers should like the conditions for further advances: the share price move this month took the stock to a 52-week high, past resistance that would have normally beat back a stock in danger of losing a battle with overhanging selling pressure. Indeed, Nike’s shares have outperformed the S&P 500 for six straight weeks – all against a backdrop of consumer pessimism. The current Stock Trends Bullish Crossover presents a new opportunity to capture gains in a positive price trend for this stock.

The Upside: This stock was originally a Stock Trends pick back in June of 2009 when the market emerged out of the recession. The renewal of Nike’s bullish trend presents an opportunity to trade this stocks relative strength, an outcome that will take this stock above $100 if investor optimism proves wiser than the consumer gloom. Certainly, this trade is predicated on continued relative price performance of consumer discretionary stocks.

The Downside: Absent a full stock market retreat, trend traders would be cutting losses if Nike shares pealed back below the trend line at $84.

I've followed your recommendations since reading your columns in the Globe & Mail, and finding they published Stock Trends arrows in their financial listings. I do find them a guide to the general market and what I should be avoiding for declining chart trends.

I've followed your recommendations since reading your columns in the Globe & Mail, and finding they published Stock Trends arrows in their financial listings. I do find them a guide to the general market and what I should be avoiding for declining chart trends.