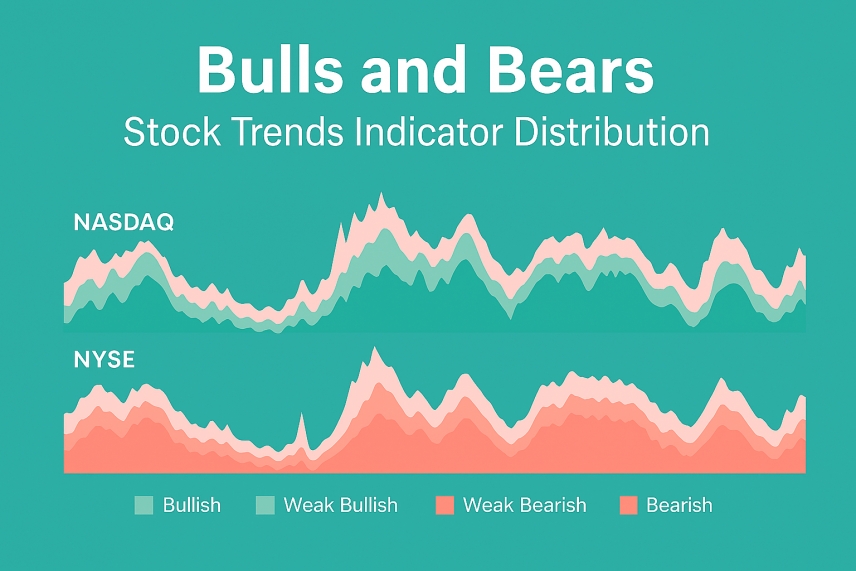

Each week, the Stock Trends system analyzes thousands of stocks from the NYSE, Nasdaq, NYSE American, and TSX exchanges, assigning a trend classification to each security based on its relationship to the 13-week and 40-week moving averages. This moving average study—a foundational method in technical analysis—provides insight into the primary and intermediate-term trends that drive investor sentiment and market momentum. The aggregated results of these trend classifications form the Stock Trends Indicator Distributions, offering a valuable snapshot of market health and trend direction across sectors and regions.

Stock Trends Indicator Distributions: A Historical Context and the Current Market Pulse

- Published in Stock Trends

Stock Trends analysis quantifies nicely the movement of individual stocks. I’ve found that if the technicals are out of synch with fundamental analysis, it is a wake-up call to make a decision. The Stock Trends Bull/Bear Ratio is useful in identifying major market bottoms and tops. It has always presented a good buying or selling opportunity.

Stock Trends analysis quantifies nicely the movement of individual stocks. I’ve found that if the technicals are out of synch with fundamental analysis, it is a wake-up call to make a decision. The Stock Trends Bull/Bear Ratio is useful in identifying major market bottoms and tops. It has always presented a good buying or selling opportunity.