Stock Trends’ Unusually High Volume (![]() ) indicator flags stocks whose weekly trading volume is at least 200% of their 13-week average. In the October 31 weekly reports, only a small slice of the universe qualifies—making these signals rare and valuable. When high volume coincides with a bullish trend state (or a new Bullish Crossover), it can mark institutional footprints at the start of a multi-week advance.

) indicator flags stocks whose weekly trading volume is at least 200% of their 13-week average. In the October 31 weekly reports, only a small slice of the universe qualifies—making these signals rare and valuable. When high volume coincides with a bullish trend state (or a new Bullish Crossover), it can mark institutional footprints at the start of a multi-week advance.

How to Read the Signals (Quick Refresher)

- Bullish (

): Price is decisively above the 13- and 40-week moving averages.

): Price is decisively above the 13- and 40-week moving averages. - Weak Bullish (

): Temporary dip below the 13-week average while the long-term uptrend persists; may precede a Bearish Crossover but often reverts back to Bullish.

): Temporary dip below the 13-week average while the long-term uptrend persists; may precede a Bearish Crossover but often reverts back to Bullish. - Bullish Crossover (

): 13-week MA crosses above the 40-week MA—often the start of a major up-leg, especially if volume is high.

): 13-week MA crosses above the 40-week MA—often the start of a major up-leg, especially if volume is high.

STWR Unusually High Volume report

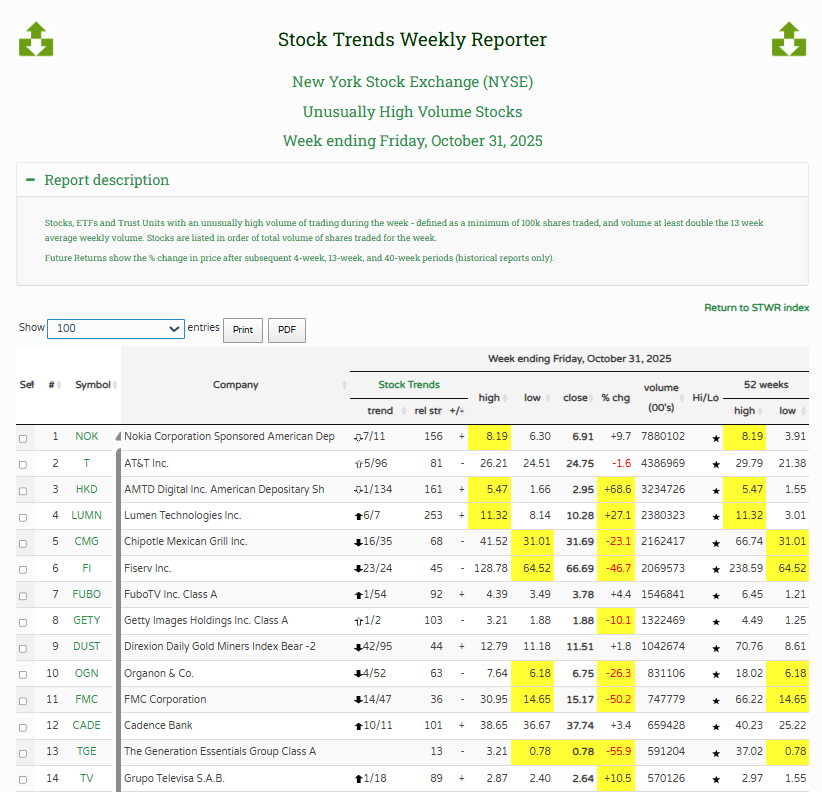

Subscribers to Stock Trends Weekly Reporter can review the Unusually High Volume filter report for each exchange to isolate stocks with significant changes in the weekly traded volume. Here is a snippet of this week's NYSE Usually High Volume report:

Select High-Volume ( ) Leaders & Why They’re Active

) Leaders & Why They’re Active

Semiconductors & Networking

- AXT Inc. (AXTI-Q) — Compound semiconductor wafer supplier with strong intermediate momentum. High volume aligns with renewed demand for specialty substrates used in 5G, LiDAR and AI hardware build-outs.

- Cambium Networks (CMBM-Q) — Wireless broadband equipment vendor showing heavy accumulation after product and ecosystem updates tied to enterprise connectivity. Elevated volume reflects institutional positioning for deployment cycles.

Biotechnology & Life Sciences

- Inhibrx Biosciences (INBX-Q) — High volume paired with a Bullish trend. Pipeline updates and partner visibility continue to draw interest.

- Cabaletta Bio (CABA-Q) — Early-stage gene-therapy name with unusual volume. Typical accumulation pattern ahead of program milestones; the recent Bullish Crossover followed by persistent volume is a powerful confirmation.

- Arcus Biosciences (RCUS-N) — Oncology developer with partner leverage. Heavy trading suggests institutions are extending timelines for immuno-oncology catalysts.

- BridgeBio Pharma (BBIO-Q) — Multi-asset rare-disease platform. Sustained high volume consistent with follow-through after positive program data and regulatory traction. The stock is listed in this week's Nasdaq Select stocks report, with Stock Trends Inference Model (ST-IM) Bullish forward return expectations and outperformance probabilities across the 4-week, 13-week, and 40-week periods ahead.

Communication Services

- Lumen Technologies (LUMN-N) — Fiber and enterprise networking operator. Elevated volume reflects restructuring-cycle expectations; The Stock Trends Inference Model (ST-IM) 13-week return expectation is 16.1% and the stock is included in this week's NYSE ST-IM Select stocks report.

Energy

- T1 Energy (TE-N) — High-volume rotation into cyclicals as energy pricing stabilizes. Monitor for rising 13-week return expectations to confirm trend persistence.

Other notable high-volume ( ) stocks in the current Nasdaq ST-IM Select stocks report:

) stocks in the current Nasdaq ST-IM Select stocks report:

Action Plan for Stock Trends Weekly Reporter Subscribers

- Open the Unusually High Volume filter report in the STWR filter reports (by exchange).

- Cross-check trend state: prioritize Bullish and Bullish Crossover names with high volume; track Weak Bullish names for return-to-Bullish entries.

- Layer in Bullish Crossover and Bullish Crossover Predictions filters. A stock that appears in both a crossover list and the high-volume list deserves immediate attention.

- Check Weak Bearish (

) stocks and weekly Picks of the Week reports for High Volume indicators. The Newly Weak Bearish report will also help isolate early reversals.

) stocks and weekly Picks of the Week reports for High Volume indicators. The Newly Weak Bearish report will also help isolate early reversals. - Check the weekly ST-IM Select stocks report for each exchange for high-volume stocks.

- Confirm with the individual Stock Trends Report pages (links above): review Trend Profile, Industry and Fundamentals tabs for alignment with your risk budget.

Note on interpretation: Weak Bullish trends often precede Bearish Crossovers, but they also frequently revert back to Bullish. Many recent Weak Bullish names in this dataset have rebounded to (Strong) Bullish—precisely where high-volume confirmation is most informative. Alternatively, Weak Bearish trends often precede Bullish Crossovers (that's why they are a major focus of Stock Trends reports like the Picks of the Week), but they can also revert to (Strong) Bearish.

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!

Hence, anyone who had followed the "Stock Trends" line should have sold their Bre-X shares and, with the windfall, paid for a lifetime subscription to The Globe and Mail and more. Talk about return on investment!