Stock Trends Weekly Reporter highlights two powerful themes this week: Leadership Momentum — stocks in entrenched Bullish states with sustained outperformance — and Volume-Validated Bullish — stocks in Bullish categories attracting unusual accumulation. Together, these lists showcase the names that momentum metrics are backing, and where retail traders can align with strength.

Leadership Momentum ( )

)

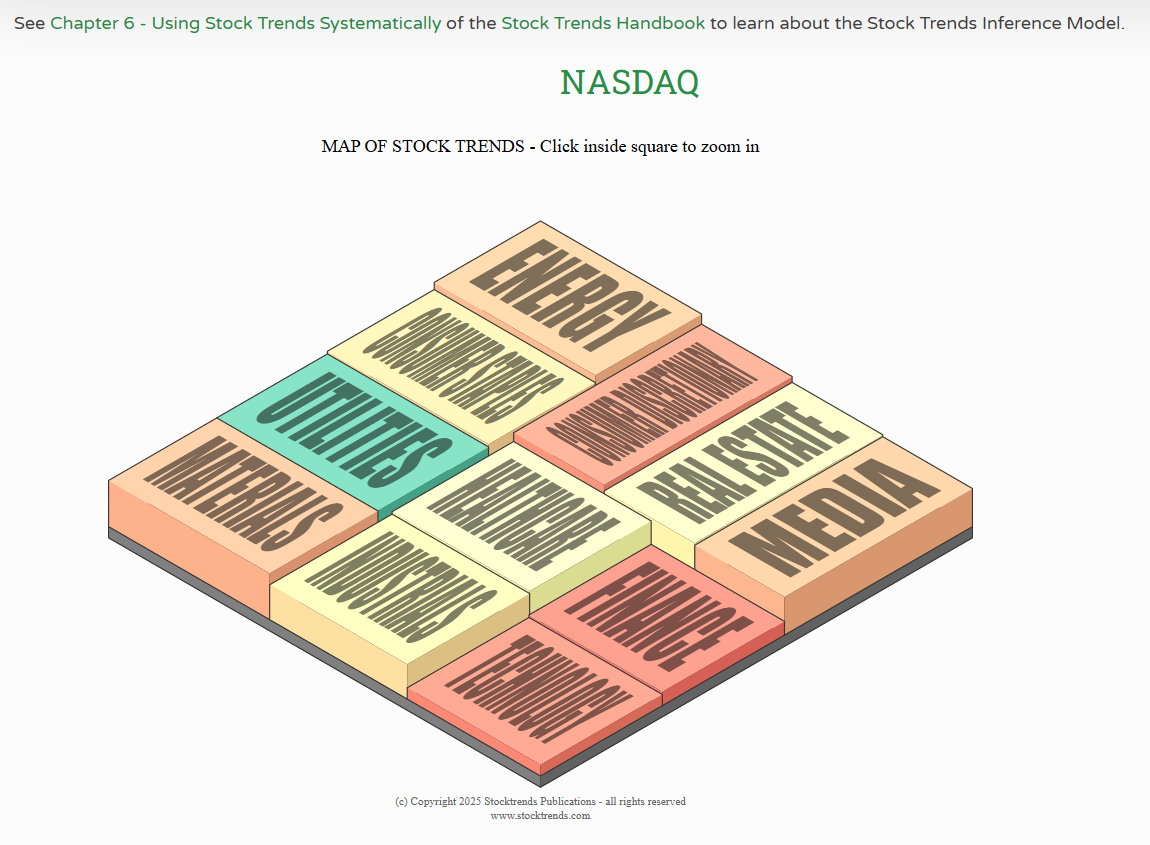

These attractive stocks have established Bullish (![]() ) classifications, multiple weeks in trend, and strong relative strength. They can typically appear in ST-IM Select stocks of the Week, Top Trending, Unusually High Volume, and Oldest Bullish Stock Trends Weekly Reporter filter reports, and often serve as core Stock Trends Portfolio positions. STWR subscribers can also access the Map of Stock Trends for each exchange. It allows users to drill down into each sector's trend makeup. The stocks selected here are supported by Bullish forward return estimates generated by the Stock Trends Inference Model.

) classifications, multiple weeks in trend, and strong relative strength. They can typically appear in ST-IM Select stocks of the Week, Top Trending, Unusually High Volume, and Oldest Bullish Stock Trends Weekly Reporter filter reports, and often serve as core Stock Trends Portfolio positions. STWR subscribers can also access the Map of Stock Trends for each exchange. It allows users to drill down into each sector's trend makeup. The stocks selected here are supported by Bullish forward return estimates generated by the Stock Trends Inference Model.

| Symbol | Name | Trend | Weeks | Major Wks | RSI | Vol Tag | Rel Vol |

|---|---|---|---|---|---|---|---|

| RAPP-Q | Rapport Therapeutics | 4 | 5 | 216+ | 9.2% | ||

| HOWL-Q | Werewolf Therapeutics | 3 | 4 | 189+ | |

22.6% | |

| LITE-Q | Lumentum Holdings | 11 | 12 | 158- | 28.1% | ||

| AMRC-N | Ameresco | 4 | 5 | 213+ | 7.8% | ||

| TLS-Q | Telos Corp. | 5 | 6 | 211+ | 5.9% | ||

| SIF-A | SIFCO Industries | 10 | 11 | 195+ | 1.6% |

Insights: Ameresco’s outsized RSI marks it as one of the clearest renewable leaders. Rapport and Werewolf are biotech momentum names, with Rapport boosted by strong Phase 2a results. Lumentum demonstrates resilience despite financing, while TLS combines federal cybersecurity contracts with clear sponsorship. SIFCO shows how small industrials can quietly lead during industrial recovery.

Volume-Validated Bullish ( )

)

These names carry Bullish classifications and unusual volume tags, showing heavy accumulation. They often represent early stages of bigger leadership runs. These stocks are also supported by Bullish Stock Trends Inference Model forward returns estimates found in their Stock Trends Report Trend Profiles dashboards.

| Symbol | Name | Trend | Weeks | Major Wks | RSI | Vol Tag | Rel Vol |

|---|---|---|---|---|---|---|---|

| TLS-Q | Telos Corp. | 5 | 6 | 211+ | 5.9% | ||

| ORKA-Q | Oruka Therapeutics | 4 | 5 | 127- | 6.5% | ||

| TOYO-Q | Toyo Solar | 15 | 16 | 151+ | 0.7% | ||

| FLNC-Q | Fluence Energy | 1 | 2 | 180+ | 31.6% | ||

| PLUG-Q | Plug Power | 1 | 2 | 190+ | 84.9% |

Insights: Oruka’s $180m financing and trial progress draw attention, validated by heavy volume. Toyo Solar’s new 4GW capacity expansion gives a strong narrative to back its building Bullish ![]() status. Fluence Energy’s Polish battery project, Plug Power’s record green hydrogen output - both highlighted as Newly Bullish (

status. Fluence Energy’s Polish battery project, Plug Power’s record green hydrogen output - both highlighted as Newly Bullish (![]() ) stocks in the previous week's reports - are supported by heavy market participation this week, classic signs of accumulation. Together, this group reflects the growing sponsorship flowing into renewables, energy storage, biotech, and metals.

) stocks in the previous week's reports - are supported by heavy market participation this week, classic signs of accumulation. Together, this group reflects the growing sponsorship flowing into renewables, energy storage, biotech, and metals.

Conclusion

Leadership Momentum stocks show the market’s conviction: biotech breakthroughs, renewable infrastructure, and inflation hedges. Volume-Validated Bullish names often reveal where institutions are quietly accumulating early positions. For investors, the playbook is clear: respect category signals (![]() ), monitor ST-IM edge, and use volume as confirmation. With peer fundamentals layered in (available under the Fundamentals tab of each Stock Trends Report page), these names offer a roadmap for disciplined participation in Fall 2025.

), monitor ST-IM edge, and use volume as confirmation. With peer fundamentals layered in (available under the Fundamentals tab of each Stock Trends Report page), these names offer a roadmap for disciplined participation in Fall 2025.

Related items

- TJX at New Highs — A Case Study in Long-Run Trend Persistence and Momentum Rotation

- Stock Trends: The Human Side of Market Trends

- Money management and trading psychology: building a resilient trading plan that integrates with the Stock Trends decision-tree framework

- Stock Trends Insights: Market Breadth Across Sectors and Exchanges

- Stock Trends Insights: Bullish Momentum in Consumer Discretionary and Healthcare