A tech stock worth watching, Zarlink Semiconductor may be ready for a near-term rally.

The Stock: Zarlink Semiconductor Inc. (ZL) Recent price: $2.06 (company acquired by Microsemi Corporation in 2011 at $3.98)

Trend: Heightened market volatility puts even the most bullish investor on edge. The CBOE Volatility index (VIX-I) shot up almost 25 per cent last week, signalling rising premiums in the options market. Not surprisingly, as some sectors test their upward sloping trend lines active traders are looking for a little insurance. The technology sector, perhaps more than others, seems especially vulnerable now, with many big cap names dropping below trend in the wake of the Japanese disaster that has threatened global tech supply chains.

The S&P Technology index, NASDAQ 100 index, and the Philadelphia SOXX index have all turned Stock Trends Weak Bullish, an indicator of the drop below trend, after the market digested the implications of possible manufacturing disruptions in Asia. Elevated trading in the HOLDRS Semiconductors (SMH-N) reflected the recent selling pressure on stocks in this important group, with the healthy 2011 gains of the semiconductors now erased. This column advised a buy for the sector - the iShares Philadelphia SOX Semiconductor ETF (SOXX-Q) on its Stock Trends Bullish trend signal in November - but with the group’s retreat that trade is now testing market timing investors to pull the plug. However, other bullish-minded may see opportunity in the slide and buy on price weakness.

The Trade: Ottawa-based Zarlink Semiconductor is a small cap play in the sector that need not be lumped in with the supply issues currently afflicting major global semiconductor names. Shareholders know this, as the relatively thin trading last week indicates a willingness to sit tight amid broader market and sector volatility. The stocks of Zarlink’s competitors in the network communications space, like PMC-Sierra (PMCS-Q), Integrated Device (IDTI-Q), and Silicon Laboratories (SLAB-Q), took a bigger hit in the past two weeks.

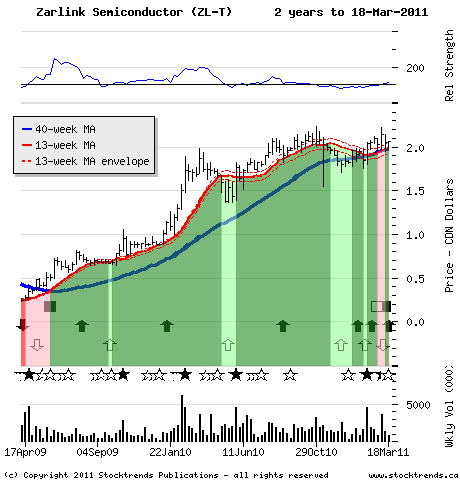

Zarlink’s shares have been holding near the established long-term trend line. A consolidation of the share price at this level, while the sector battles volatility, may serve up a near-term rally when the market cloud dissipates. The stock’s relative strength versus the market performance is improving, and shares have rallied on high volume after periods of weakness in the immediate period before the recent market recoil. A long bet on this semiconductor would go well with a sector rebound. Investors will be watching how Zarlink builds upon improved fundamentals presented in the previous quarter as the company nears its 2011 fiscal yearend at the end of March.

The Upside: Expectations here should not be too great, and readers should understand the risks and potential volatility generally associated with small cap stocks. Technical share price objectives range anywhere between $2.25, where near-term resistance is encountered, and $2.50 level shares maintained before the stock’s bear trend of 2007 took hold. Naturally, a calming of the tech sector ship will improve the prospect for Zarlink’s positive price trend.

The Downside: Should the share price retreat below $1.90, where Zarlink would be labelled as Stock Trends Weak Bullish, this trade will have proved disappointing. Anticipate the stock to remain above the long-term, 40-week average price of $1.99.

Published in Stock Trends